Annual Financial Statements 2008 of Bank Austria

Annual Financial Statements 2008 of Bank Austria

Annual Financial Statements 2008 of Bank Austria

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Consolidated <strong>Financial</strong> <strong>Statements</strong>: Management Report <strong>of</strong> the Group<br />

Management Report <strong>2008</strong> (cONTINUED)<br />

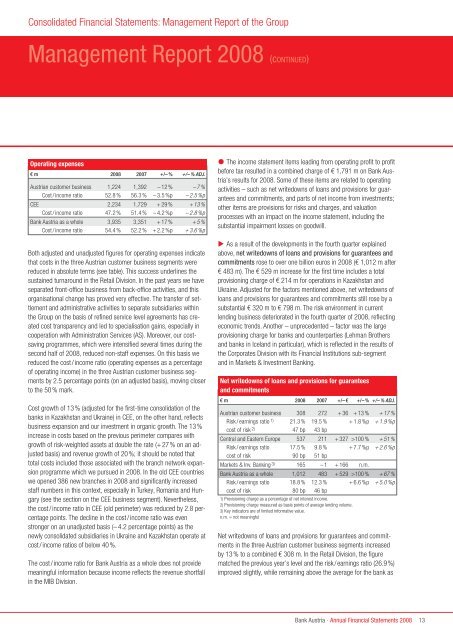

Operating expenses<br />

€ m <strong>2008</strong> 2007 +/– % +/– % ADJ.<br />

<strong>Austria</strong>n customer business 1,224 1,392 – 12 % – 7 %<br />

Cost / income ratio 52.8 % 56.3 % – 3.5 %p – 2.5 %p<br />

CEE 2,234 1,729 + 29 % + 13 %<br />

Cost / income ratio 47.2 % 51.4 % – 4.2 %p – 2.8 %p<br />

<strong>Bank</strong> <strong>Austria</strong> as a whole 3,935 3,351 + 17 % + 5 %<br />

Cost / income ratio 54.4 % 52.2 % + 2.2 %p + 3.6 %p<br />

Both adjusted and unadjusted figures for operating expenses indicate<br />

that costs in the three <strong>Austria</strong>n customer business segments were<br />

reduced in absolute terms (see table). This success underlines the<br />

sustained turnaround in the Retail Division. In the past years we have<br />

separated front-<strong>of</strong>fice business from back-<strong>of</strong>fice activities, and this<br />

organisational change has proved very effective. The transfer <strong>of</strong> settlement<br />

and administrative activities to separate subsidiaries within<br />

the Group on the basis <strong>of</strong> refined service level agreements has created<br />

cost transparency and led to specialisation gains, especially in<br />

cooperation with Administration Services (AS). Moreover, our costsaving<br />

programmes, which were intensified several times during the<br />

second half <strong>of</strong> <strong>2008</strong>, reduced non-staff expenses. On this basis we<br />

reduced the cost / income ratio (operating expenses as a percentage<br />

<strong>of</strong> operating income) in the three <strong>Austria</strong>n customer business segments<br />

by 2.5 percentage points (on an adjusted basis), moving closer<br />

to the 50 % mark.<br />

Cost growth <strong>of</strong> 13 % (adjusted for the first-time consolidation <strong>of</strong> the<br />

banks in Kazakhstan and Ukraine) in CEE, on the other hand, reflects<br />

business expansion and our investment in organic growth. The 13 %<br />

increase in costs based on the previous perimeter compares with<br />

growth <strong>of</strong> risk-weighted assets at double the rate (+ 27 % on an adjusted<br />

basis) and revenue growth <strong>of</strong> 20 %; it should be noted that<br />

total costs included those associated with the branch network expansion<br />

programme which we pursued in <strong>2008</strong>. In the old CEE countries<br />

we opened 386 new branches in <strong>2008</strong> and significantly increased<br />

staff numbers in this context, especially in Turkey, Romania and Hungary<br />

(see the section on the CEE business segment). Nevertheless,<br />

the cost / income ratio in CEE (old perimeter) was reduced by 2.8 percentage<br />

points. The decline in the cost / income ratio was even<br />

stronger on an unadjusted basis (– 4.2 percentage points) as the<br />

newly consolidated subsidiaries in Ukraine and Kazakhstan operate at<br />

cost / income ratios <strong>of</strong> below 40 %.<br />

The cost / income ratio for <strong>Bank</strong> <strong>Austria</strong> as a whole does not provide<br />

meaningful information because income reflects the revenue shortfall<br />

in the MIB Division.<br />

� The income statement items leading from operating pr<strong>of</strong>it to pr<strong>of</strong>it<br />

before tax resulted in a combined charge <strong>of</strong> € 1,791 m on <strong>Bank</strong> <strong>Austria</strong>’s<br />

results for <strong>2008</strong>. Some <strong>of</strong> these items are related to operating<br />

activities – such as net writedowns <strong>of</strong> loans and provisions for guarantees<br />

and commitments, and parts <strong>of</strong> net income from investments;<br />

other items are provisions for risks and charges, and valuation<br />

processes with an impact on the income statement, including the<br />

substantial impairment losses on goodwill.<br />

� As a result <strong>of</strong> the developments in the fourth quarter explained<br />

above, net writedowns <strong>of</strong> loans and provisions for guarantees and<br />

commitments rose to over one billion euros in <strong>2008</strong> (€ 1,012 m after<br />

€ 483 m). The € 529 m increase for the first time includes a total<br />

provisioning charge <strong>of</strong> € 214 m for operations in Kazakhstan and<br />

Ukraine. Adjusted for the factors mentioned above, net writedowns <strong>of</strong><br />

loans and provisions for guarantees and commitments still rose by a<br />

substantial € 320 m to € 798 m. The risk environment in current<br />

lending business deteriorated in the fourth quarter <strong>of</strong> <strong>2008</strong>, reflecting<br />

economic trends. Another – unprecedented – factor was the large<br />

provisioning charge for banks and counterparties (Lehman Brothers<br />

and banks in Iceland in particular), which is reflected in the results <strong>of</strong><br />

the Corporates Division with its <strong>Financial</strong> Institutions sub-segment<br />

and in Markets & Investment <strong>Bank</strong>ing.<br />

Net writedowns <strong>of</strong> loans and provisions for guarantees<br />

and commitments<br />

€ m <strong>2008</strong> 2007 +/– € +/– % +/– % ADJ.<br />

<strong>Austria</strong>n customer business 308 272 + 36 + 13 % + 17 %<br />

Risk / earnings ratio 1) 21.3 % 19.5 % + 1.8 %p + 1.9 %p<br />

cost <strong>of</strong> risk 2) 47 bp 43 bp<br />

Central and Eastern Europe 537 211 + 327 >100 % + 51 %<br />

Risk / earnings ratio 17.5 % 9.8 % + 7.7 %p + 2.6 %p<br />

cost <strong>of</strong> risk 90 bp 51 bp<br />

Markets & Inv. <strong>Bank</strong>ing 3) 165 – 1 + 166 n.m.<br />

<strong>Bank</strong> <strong>Austria</strong> as a whole 1,012 483 + 529 >100 % + 67 %<br />

Risk / earnings ratio 18.8 % 12.3 % + 6.6 %p + 5.0 %p<br />

cost <strong>of</strong> risk 80 bp 46 bp<br />

1) Provisioning charge as a percentage <strong>of</strong> net interest income.<br />

2) Provisioning charge measured as basis points <strong>of</strong> average lending volume.<br />

3) Key indicators are <strong>of</strong> limited informative value.<br />

n.m. = not meaningful<br />

Net writedowns <strong>of</strong> loans and provisions for guarantees and commitments<br />

in the three <strong>Austria</strong>n customer business segments increased<br />

by 13 % to a combined € 308 m. In the Retail Division, the figure<br />

matched the previous year’s level and the risk / earnings ratio (26.9%)<br />

improved slightly, while remaining above the average for the bank as<br />

<strong>Bank</strong> <strong>Austria</strong> · <strong>Annual</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2008</strong><br />

13