Annual Financial Statements 2008 of Bank Austria

Annual Financial Statements 2008 of Bank Austria

Annual Financial Statements 2008 of Bank Austria

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

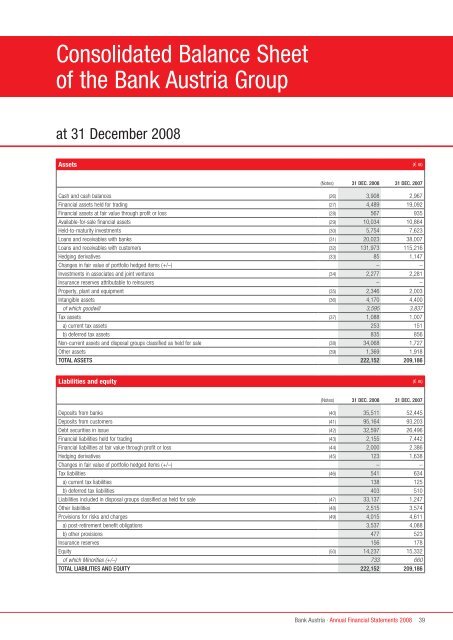

Consolidated Balance Sheet<br />

<strong>of</strong> the <strong>Bank</strong> <strong>Austria</strong> Group<br />

at 31 December <strong>2008</strong><br />

Assets (€ m)<br />

(Notes) 31 Dec. <strong>2008</strong> 31 Dec. 2007<br />

Cash and cash balances (26) 3,908 2,967<br />

<strong>Financial</strong> assets held for trading (27) 4,489 19,092<br />

<strong>Financial</strong> assets at fair value through pr<strong>of</strong>it or loss (28) 567 935<br />

Available-for-sale financial assets (29) 10,034 10,864<br />

Held-to-maturity investments (30) 5,754 7,623<br />

Loans and receivables with banks (31) 20,023 38,007<br />

Loans and receivables with customers (32) 131,973 115,216<br />

Hedging derivatives (33) 85 1,147<br />

Changes in fair value <strong>of</strong> portfolio hedged items (+/–) – –<br />

Investments in associates and joint ventures (34) 2,277 2,281<br />

Insurance reserves attributable to reinsurers – –<br />

Property, plant and equipment (35) 2,346 2,003<br />

Intangible assets (36) 4,170 4,400<br />

<strong>of</strong> which goodwill 3,595 3,837<br />

Tax assets (37) 1,088 1,007<br />

a) current tax assets 253 151<br />

b) deferred tax assets 835 856<br />

Non-current assets and disposal groups classified as held for sale (38) 34,068 1,727<br />

Other assets (39) 1,369 1,918<br />

tOtal assets 222,152 209,186<br />

Liabilities and equity (€ m)<br />

(Notes) 31 Dec. <strong>2008</strong> 31 Dec. 2007<br />

Deposits from banks (40) 35,511 52,445<br />

Deposits from customers (41) 95,164 93,203<br />

Debt securities in issue (42) 32,597 26,496<br />

<strong>Financial</strong> liabilities held for trading (43) 2,155 7,442<br />

<strong>Financial</strong> liabilities at fair value through pr<strong>of</strong>it or loss (44) 2,000 2,386<br />

Hedging derivatives (45) 123 1,638<br />

Changes in fair value <strong>of</strong> portfolio hedged items (+/–) – –<br />

Tax liabilities (46) 541 634<br />

a) current tax liabilities 138 125<br />

b) deferred tax liabilities 403 510<br />

Liabilities included in disposal groups classified as held for sale (47) 33,137 1,247<br />

Other liabilities (48) 2,515 3,574<br />

Provisions for risks and charges (49) 4,015 4,611<br />

a) post-retirement benefit obligations 3,537 4,088<br />

b) other provisions 477 523<br />

Insurance reserves 156 178<br />

Equity (50) 14,237 15,332<br />

<strong>of</strong> which Minorities (+/–) 733 660<br />

tOtal liabilities aND equity 222,152 209,186<br />

<strong>Bank</strong> <strong>Austria</strong> · <strong>Annual</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2008</strong><br />

39