Annual Financial Statements 2008 of Bank Austria

Annual Financial Statements 2008 of Bank Austria

Annual Financial Statements 2008 of Bank Austria

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Pr<strong>of</strong>itability, value creation<br />

and resources<br />

The key indicators and performance data for <strong>2008</strong> reflect the unusual<br />

situation in the MIB business segment, which leads to high percentage<br />

shares for the commercial banking business segments and our<br />

two core markets in a long-term comparison. Moreover, when comparing<br />

the three <strong>Austria</strong>n customer business segments with the CEE<br />

business segment, one should note that the weaker trend became<br />

increasingly discernible in <strong>Austria</strong> from quarter to quarter, while the<br />

CEE countries started to be strongly affected by the deterioration in<br />

the market environment only towards the end <strong>of</strong> the reporting period.<br />

If these factors are taken into account, the most recent key indicators<br />

confirm that <strong>Bank</strong> <strong>Austria</strong>, as an <strong>Austria</strong>n bank and the sub-holding<br />

company for CEE operations, is continuing its performance along its<br />

strategic lines under the current exceptional circumstances: in<br />

<strong>Austria</strong>, the bank is maintaining its leading market position and<br />

pr<strong>of</strong>itability levels while employing its resources sparingly; in Central<br />

and Eastern Europe, <strong>Bank</strong> <strong>Austria</strong> is taking advantage <strong>of</strong> the region’s<br />

continued, disproportionately strong growth.<br />

In <strong>Austria</strong> (three customer business segments), business volume expanded<br />

at a moderate pace typically seen in a mature market (RWA:<br />

+ 4 %), while revenues contracted as a result <strong>of</strong> the tighter margins<br />

referred to above and <strong>of</strong> the currently discernible shift to business reflected<br />

in the balance sheet. In CEE, revenue growth fell only slightly<br />

short <strong>of</strong> the strong external and internal volume growth <strong>of</strong> 45 %. Marginal<br />

Economic Value Added (mEVA) measures value creation beyond<br />

the cost <strong>of</strong> capital (net operating pr<strong>of</strong>it after tax less minimum return<br />

required by the market on equity capital employed, excluding goodwill<br />

impairment). In <strong>2008</strong>, <strong>Bank</strong> <strong>Austria</strong> generated an mEVA <strong>of</strong> € 1,091 m,<br />

a figure which was only 14 % lower than in the previous year. The<br />

contribution from the Markets & Investment <strong>Bank</strong>ing Division was<br />

negative, at – € 345 m; this business segment recorded a negative<br />

performance while the capitalisation <strong>of</strong> UniCredit CAIB increased the<br />

equity capital employed in the segment. The CEE business segment’s<br />

contribution to mEVA rose by 35 % to € 783 m in <strong>2008</strong>. In the three<br />

business segments <strong>of</strong> <strong>Austria</strong>n customer business (Retail, PB&AM<br />

and Corporates), value creation beyond the cost <strong>of</strong> capital was a<br />

combined € 316 m, down by 12 % from the previous year.<br />

We increased the capital allocated to our banking subsidiaries in CEE<br />

by an additional 34 % to safeguard our growth prospects in the region<br />

in line with our strategy. The capital is intended for the acquisitions<br />

mentioned above, and for supporting organic growth. Risk-weighted<br />

assets (average RWA) <strong>of</strong> the CEE business segment rose by 45 % in<br />

<strong>2008</strong>, indicating that capital employment improved. The two newly<br />

added banking subsidiaries in Kazakhstan and Ukraine made positive<br />

contributions to mEVA already in the first year <strong>of</strong> their integration,<br />

despite the particularly difficult local environment. RARORAC, risk-adjusted<br />

return on risk-adjusted capital, was 12.5 % in CEE, lower than<br />

in the very good year 2007 (14.7 %) but still significantly higher than<br />

the 2006 level (pro-forma figure: 10.2 %).<br />

Equity capital employed in <strong>Austria</strong>n customer business rose by 5 %<br />

and risk-weighted assets (RWA) increased by 4 %. RARORAC was<br />

10.7 %, also significantly better than in 2006, also as a result <strong>of</strong> the<br />

turnaround in the Retail Division since then. While the RARORAC<br />

figures for <strong>Austria</strong>n customer business and CEE do not differ by a<br />

wide margin, there is a significant gap in absolute terms <strong>of</strong> marginal<br />

Economic Value Added.<br />

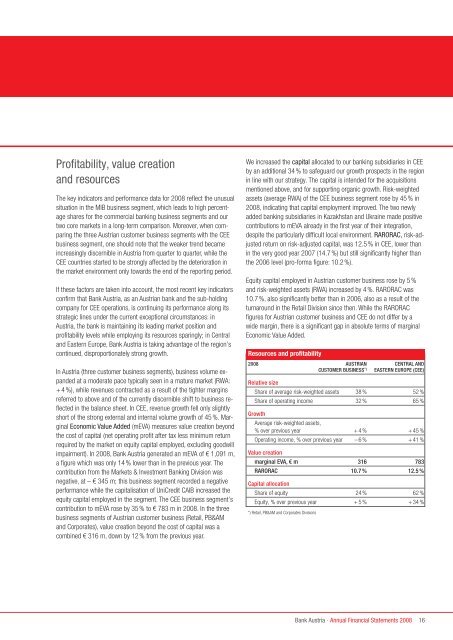

Resources and pr<strong>of</strong>itability<br />

<strong>2008</strong> AUSTRIAN CENTRAL AND<br />

CUSTOMER BUSINESS *) EASTERN EUROPE (CEE)<br />

Relative size<br />

Share <strong>of</strong> average risk-weighted assets 38 % 52 %<br />

Share <strong>of</strong> operating income 32 % 65 %<br />

Growth<br />

Average risk-weighted assets,<br />

% over previous year + 4 % + 45 %<br />

Operating income, % over previous year – 6 % + 41 %<br />

Value creation<br />

marginal EVA, € m 316 783<br />

RARORAC 10.7 % 12.5 %<br />

Capital allocation<br />

Share <strong>of</strong> equity 24 % 62 %<br />

Equity, % over previous year + 5 % + 34 %<br />

*) Retail, PB&AM and Corporates Divisions<br />

<strong>Bank</strong> <strong>Austria</strong> · <strong>Annual</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2008</strong><br />

16