Annual Financial Statements 2008 of Bank Austria

Annual Financial Statements 2008 of Bank Austria

Annual Financial Statements 2008 of Bank Austria

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

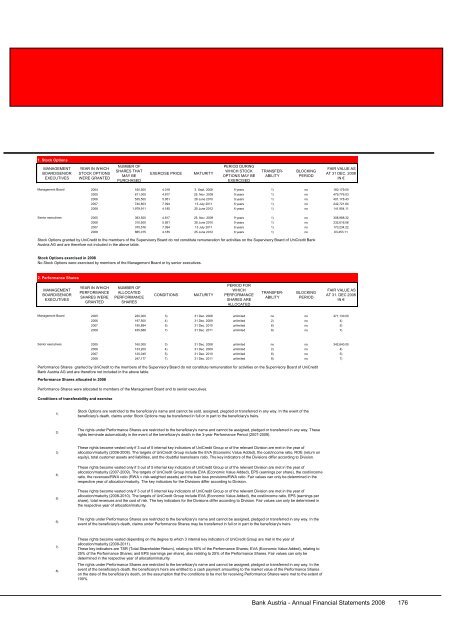

1. Stock Options<br />

MANAGEMENT<br />

BOARD/SENIOR<br />

EXECUTIVES<br />

YEAR IN WHICH<br />

STOCK OPTIONS<br />

WERE GRANTED<br />

NUMBER OF<br />

SHARES THAT<br />

MAY BE<br />

PURCHASED<br />

EXERCISE PRICE MATURITY<br />

PERIOD DURING<br />

WHICH STOCK<br />

OPTIONS MAY BE<br />

EXERCISED<br />

TRANSFER-<br />

ABILITY<br />

BLOCKING<br />

PERIOD<br />

FAIR VALUE AS<br />

AT 31 DEC. <strong>2008</strong><br />

IN €<br />

Management Board 2004 160,500 4.018 3. Sept. <strong>2008</strong> 9 years 1) no 160,179.00<br />

2005 611,000 4.817 25. Nov. 2009 9 years 1) no 479,776.03<br />

2006 535,500 5.951 28 June 2010 9 years 1) no 401,178.43<br />

2007 740,803 7.094 13 July 2011 6 years 1) no 242,721.64<br />

<strong>2008</strong> 1,979,911 4.185 25 June 2012 6 years 1) no 141,954.11<br />

Senior executives 2005 393,500 4.817 25. Nov. 2009 9 years 1) no 308,988.32<br />

MANAGEMENT<br />

BOARD/SENIOR<br />

EXECUTIVES<br />

2006 310,500 5.951 28 June 2010 9 years 1) no 232,616.06<br />

2007 375,576 7.094 13 July 2011 6 years 1) no 170,234.22<br />

<strong>2008</strong> 885,015 4.185 25 June 2012 6 years 1) no 63,453.11<br />

Stock Options granted by UniCredit to the members <strong>of</strong> the Supervisory Board do not constitute remuneration for activities on the Supervisory Board <strong>of</strong> UniCredit <strong>Bank</strong><br />

<strong>Austria</strong> AG and are therefore not included in the above table.<br />

Stock Options exercised in <strong>2008</strong><br />

No Stock Options were exercised by members <strong>of</strong> the Management Board or by senior executives.<br />

2. Performance Shares<br />

YEAR IN WHICH<br />

PERFORMANCE<br />

SHARES WERE<br />

GRANTED<br />

NUMBER OF<br />

ALLOCATED<br />

PERFORMANCE<br />

SHARES<br />

CONDITIONS MATURITY<br />

PERIOD FOR<br />

WHICH<br />

PERFORMANCE<br />

SHARES ARE<br />

ALLOCATED<br />

TRANSFER-<br />

ABILITY<br />

BLOCKING<br />

PERIOD<br />

FAIR VALUE AS<br />

AT 31. DEC <strong>2008</strong><br />

IN €<br />

Management Board 2005 220,000 3) 31 Dec. <strong>2008</strong> unlimited no no 471,130.00<br />

2006 197,500 4) 31 Dec. 2009 unlimited 2) no 4)<br />

2007 190,894 5) 31 Dec. 2010 unlimited 6) no 5)<br />

<strong>2008</strong> 435,688 7) 31 Dec. 2011 unlimited 8) no 7)<br />

Senior executives 2005 160,000 3) 31 Dec. <strong>2008</strong> unlimited no no 342,640.00<br />

1)<br />

2)<br />

3)<br />

4)<br />

5)<br />

6)<br />

7)<br />

8)<br />

2006 133,200 4) 31 Dec. 2009 unlimited 2) no 4)<br />

2007 120,045 5) 31 Dec. 2010 unlimited 6) no 5)<br />

<strong>2008</strong> 247,177 7) 31 Dec. 2011 unlimited 8) no 7)<br />

Performance Shares granted by UniCredit to the members <strong>of</strong> the Supervisory Board do not constitute remuneration for activities on the Supervisory Board <strong>of</strong> UniCredit<br />

<strong>Bank</strong> <strong>Austria</strong> AG and are therefore not included in the above table.<br />

Performance Shares allocated in <strong>2008</strong><br />

Performance Shares were allocated to members <strong>of</strong> the Management Board and to senior executives.<br />

Conditions <strong>of</strong> transferability and exercise<br />

Stock Options are restricted to the beneficiary's name and cannot be sold, assigned, plegded or transferred in any way. In the event <strong>of</strong> the<br />

beneficiary's death, claims under Stock Options may be transferred in full or in part to the beneficiary's heirs.<br />

The rights under Performance Shares are restricted to the beneficiary's name and cannot be assigned, pledged or transferred in any way. These<br />

rights terminate automatically in the event <strong>of</strong> the beneficiary's death in the 3-year Performance Period (2007-2009).<br />

These rights become vested only if 3 out <strong>of</strong> 5 internal key indicators <strong>of</strong> UniCredit Group or <strong>of</strong> the relevant Division are met in the year <strong>of</strong><br />

allocation/maturity (2006-<strong>2008</strong>). The targets <strong>of</strong> UniCredit Group include the EVA (Economic Value Added), the cost/income ratio, ROE (return on<br />

equity), total customer assets and liabilities, and the doubtful loans/loans ratio. The key indicators <strong>of</strong> the Divisions differ according to Division.<br />

These rights become vested only if 3 out <strong>of</strong> 5 internal key indicators <strong>of</strong> UniCredit Group or <strong>of</strong> the relevant Division are met in the year <strong>of</strong><br />

allocation/maturity (2007-2009). The targets <strong>of</strong> UniCredit Group include EVA (Economic Value Added), EPS (earnings per share), the cost/income<br />

ratio, the revenues/RWA ratio (RWA = risk-weighted assets) and the loan loss provisions/RWA ratio. Fair values can only be determined in the<br />

respective year <strong>of</strong> allocation/maturity. The key indicators for the Divisions differ according to Division.<br />

These rights become vested only if 3 out <strong>of</strong> 5 internal key indicators <strong>of</strong> UniCredit Group or <strong>of</strong> the relevant Division are met in the year <strong>of</strong><br />

allocation/maturity (<strong>2008</strong>-2010). The targets <strong>of</strong> UniCredit Group include EVA (Economic Value Added), the cost/income ratio, EPS (earnings per<br />

share), total revenues and the cost <strong>of</strong> risk. The key indicators for the Divisions differ according to Division. Fair values can only be determined in<br />

the respective year <strong>of</strong> allocation/maturity.<br />

The rights under Performance Shares are restricted to the beneficiary's name and cannot be assigned, pledged or transferred in any way. In the<br />

event <strong>of</strong> the beneficiary's death, claims under Performance Shares may be transferred in full or in part to the beneficiary's heirs.<br />

These rights become vested depending on the degree to which 3 internal key indicators <strong>of</strong> UniCredit Group are met in the year <strong>of</strong><br />

allocation/maturity (2009-2011).<br />

These key indicators are TSR (Total Shareholder Return), relating to 50% <strong>of</strong> the Performance Shares; EVA (Economic Value Added), relating to<br />

25% <strong>of</strong> the Performance Shares; and EPS (earnings per share), also relating to 25% <strong>of</strong> the Performance Shares. Fair values can only be<br />

determined in the respective year <strong>of</strong> allocation/maturity.<br />

The rights under Performance Shares are restricted to the beneficiary's name and cannot be assigned, pledged or transferred in any way. In the<br />

event <strong>of</strong> the beneficiary's death, the beneficiary's heirs are entitled to a cash payment amounting to the market value <strong>of</strong> the Performance Shares<br />

on the date <strong>of</strong> the beneficiary's death, on the assumption that the conditions to be met for receiving Performance Shares were met to the extent <strong>of</strong><br />

100%.<br />

<strong>Bank</strong> <strong>Austria</strong> - <strong>Annual</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2008</strong> 176