Your Card, Your Health Brochure - Premera Blue Cross

Your Card, Your Health Brochure - Premera Blue Cross

Your Card, Your Health Brochure - Premera Blue Cross

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

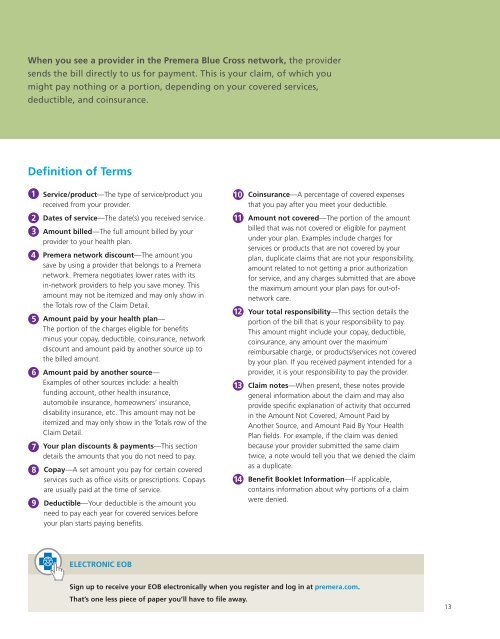

When you see a provider in the <strong>Premera</strong> <strong>Blue</strong> <strong>Cross</strong> network, the providersends the bill directly to us for payment. This is your claim, of which youmight pay nothing or a portion, depending on your covered services,deductible, and coinsurance.Definition of Terms123456789Service/product—The type of service/product youreceived from your provider.Dates of service—The date(s) you received service.Amount billed—The full amount billed by yourprovider to your health plan.<strong>Premera</strong> network discount—The amount yousave by using a provider that belongs to a <strong>Premera</strong>network. <strong>Premera</strong> negotiates lower rates with itsin-network providers to help you save money. Thisamount may not be itemized and may only show inthe Totals row of the Claim Detail.Amount paid by your health plan—The portion of the charges eligible for benefitsminus your copay, deductible, coinsurance, networkdiscount and amount paid by another source up tothe billed amount.Amount paid by another source—Examples of other sources include: a healthfunding account, other health insurance,automobile insurance, homeowners’ insurance,disability insurance, etc. This amount may not beitemized and may only show in the Totals row of theClaim Detail.<strong>Your</strong> plan discounts & payments—This sectiondetails the amounts that you do not need to pay.Copay—A set amount you pay for certain coveredservices such as office visits or prescriptions. Copaysare usually paid at the time of service.Deductible—<strong>Your</strong> deductible is the amount youneed to pay each year for covered services beforeyour plan starts paying benefits.1011121314Coinsurance—A percentage of covered expensesthat you pay after you meet your deductible.Amount not covered—The portion of the amountbilled that was not covered or eligible for paymentunder your plan. Examples include charges forservices or products that are not covered by yourplan, duplicate claims that are not your responsibility,amount related to not getting a prior authorizationfor service, and any charges submitted that are abovethe maximum amount your plan pays for out-ofnetworkcare.<strong>Your</strong> total responsibility—This section details theportion of the bill that is your responsibility to pay.This amount might include your copay, deductible,coinsurance, any amount over the maximumreimbursable charge, or products/services not coveredby your plan. If you received payment intended for aprovider, it is your responsibility to pay the provider.Claim notes—When present, these notes providegeneral information about the claim and may alsoprovide specific explanation of activity that occurredin the Amount Not Covered, Amount Paid byAnother Source, and Amount Paid By <strong>Your</strong> <strong>Health</strong>Plan fields. For example, if the claim was deniedbecause your provider submitted the same claimtwice, a note would tell you that we denied the claimas a duplicate.Benefit Booklet Information—If applicable,contains information about why portions of a claimwere denied.ELECTRONIC EOBSign up to receive your EOB electronically when you register and log in at premera.com.That’s one less piece of paper you’ll have to file away.13