Your Card, Your Health Brochure - Premera Blue Cross

Your Card, Your Health Brochure - Premera Blue Cross

Your Card, Your Health Brochure - Premera Blue Cross

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

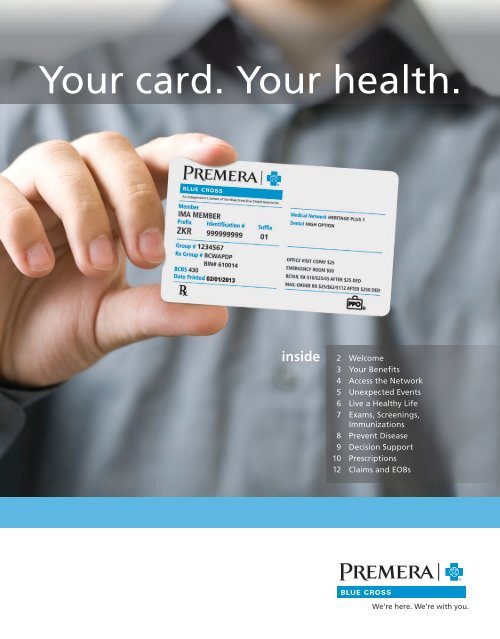

<strong>Your</strong> card. <strong>Your</strong> health.inside2 Welcome3 <strong>Your</strong> Benefits4 Access the Network5 Unexpected Events6 Live a <strong>Health</strong>y Life7 Exams, Screenings,Immunizations8 Prevent Disease9 Decision Support10 Prescriptions12 Claims and EOBs

Welcome!We understand that you’re the one who makes decisions about your lifestyle,preventive care, and treatment. We’re here to help you.We are a healthcare support system that works with you, your employer and the medical professionalsyou see for treatment. As your health plan, we serve you by providing financial coverage—plus awide range of services to help you maintain or improve your everyday health and get the greatestvalue when you need care.This guide will show you highlights of the many ways you can use your health plan to your advantage.Always carry your card with you and present it to doctors, pharmacists, and other providers whenyou seek care.premera.comRegister now! *<strong>Premera</strong>.com makes it easy to take controlof your health. In just a few clicks you havepersonalized information about your healthspending, benefits and personal health.secure • personalized • available 24/7.* If your company has not previously registered with <strong>Premera</strong>, individualinformation setup and activation may take up to three weeks.<strong>Premera</strong> MobileScan this code to download our free app.Available for Windows Phone, Android, iPhone,iPad and Kindle Fire.Need a new card, or other help?Log in at premera.com to order a new cardor call our Customer Service Team at 800-722-1471between 8 a.m. – 5 p.m., Monday – Friday.Note: The sample card here and on thecover may not match what appears onyour card, as benefits differ by plan.

Get the right care in the event ofan accident or unexpected illness.<strong>Your</strong> plan provides coverage for unexpected health events. Here are our suggestions tohelp you get the right care while avoiding unnecessary out-of-pocket costs.Should I call a nurse, seek urgent care or go to the ER?Sometimes it’s hard to know which to choose, but there’s a big difference in time and money. If your conditionis not life-threatening, you can either call our FREE and CONFIDENTIAL 24-Hour NurseLine or visit an urgentcare facility. If your condition is life-threatening, you should call 911 or go to the emergency room immediately.Here are some criteria to help you decide:NOT SURE WHAT TO DO?NON-LIFE THREATENINGLIFE THREATENINGCall the FREE 24-Hour NurseLineat 800-841-8343 to speak to aregistered nurse who will ask theright questions, listen to yourconcerns, and help you determinewhere and when to seek treatment.Urgent care facilities provide quick,convenient care for health needs thataren’t life threatening but can’t waituntil the next day or longer. They areopen outside of regular business hoursand are less expensive than emergencyroom care.Examples of conditions that canbe dealt with in an urgent carefacility include:• ear infections• low fever or mild flu symptoms• minor rashes, cuts, bites and sprains.Call 911 or go to the emergencyroom if you are in severe pain oryour condition is endangeringyour life.Examples of medicalemergencies include:• suspected heart attacks• suspected strokes• broken bones.<strong>Premera</strong>MobileNON-LIFE THREATENING: URGENT CARETo find an urgent care facility near you, search “Find a Doctor” at premera.com or<strong>Premera</strong> Mobile or call 800-722-1471.Download <strong>Premera</strong> Mobile5

Live a healthy life.We want our members to take advantage of the best defenses against disease—healthyliving, prevention, early detection, and immunization. That’s why many of our plansinclude benefits that cover the costs of preventive care.Take advantage of preventive exams and screeningsMost <strong>Premera</strong> <strong>Blue</strong> <strong>Cross</strong> plans cover preventive screenings and immunizations in full, with little orno coinsurance. So take advantage of these benefits that can prevent illness and disease, especially whenthey cost you little or nothing out-of-pocket.Check your benefits online at premera.com to see what is covered. As the saying goes, an ounce ofprevention is worth a pound of cure. This is true not just for children, who need many immunizations againstpreventable diseases, but also for adults. Routine adult exams and screenings can play a crucial role in earlydetection and prevention.THREE THINGS TO REMEMBER1 2 3Be INFORMEDCheck your benefitsonline to find out whatis covered.Get SCREENEDSet a regular schedulefor routine exams andscreening tests.Get VACCINATEDDon’t overlookyour scheduledvaccinations.6

Exams and screeningsMany routine tests are covered by your health plan, from newborn exams and vaccinations tophysicals needed for work or school. The following schedule for routine check-ups will help you with therecommended screenings and exams:AGEWHEN TO GET A CHECK-UP0–24 months In the first 2–7 days and at months 2, 4, 6, 9, 12, 15, 18 and 243–6 years Every year7–18 years Every 2 years19–64 years Every 1-3 years65+ years AnnuallyImmunizationsVaccines offer protection from illness and disease. The U.S. Centers for Disease Control and Prevention(CDC) and the Advisory Committee on Immunization Practices issue recommendations for vaccinations thatwill protect you from diseases such as Hepatitis B, pneumonia, and chicken pox. Children and Adolescentsshould receive a range of vaccinations and follow-up doses from birth to age 18. Adults age 19 and olderneed some additional follow-up doses, and should follow the CDC’s recommendations regarding annual flushots.IMMUNIZATIONSVisit us at premera.com/immunizations to get recommendations, and check withyour doctor to make sure your family’s immunizations are current.7

Prevent disease.Lifestyle choices are at the root of many chronic illnesses, withtobacco use topping the list, followed by a lack of physical activityand poor nutrition. The more you know, the more power you haveto make healthy choices. Preventive screenings are a great way tospot changes that may mean a change in your health.<strong>Your</strong> doctor can help you get up-to-date with thesetests and screenings:TEST/SCREENING IDEAL WHEN TO GET TESTEDBlood pressure 120/80 Every 1–3 years for adults 18 and olderBlood glucoselevel (fasting)

Make informed decisions.Our online tools can help you understand your medicalconcerns, have more effective conversations with yourdoctor, and make informed healthcare choices.Manage My AccountUse this section to check out your health planbenefits, view the status of your claims or downloada needed form.The Spending Activity Report generates snapshotsof your overall spending. It also shows how much yousaved through your health plan.Stay <strong>Health</strong>yThis section can help you understand more aboutyour health and how to take care of it.Take the <strong>Health</strong> Assessments to find out your real“health age” and learn what you need to makesmart healthful choices.The Symptom Evaluator helps you figure out whatyour symptom may be and what to do about it.Access our Medical Library to find an extensivecollection of health-related videos, photos anddetailed explanations written by physicians aboutcommon health problems and concerns.Use the <strong>Health</strong> Trackers to lead your health in theright direction. Includes:• Trackers to observe your health over time• The 12-week <strong>Health</strong>y Living program to practicelifestyle habits that improve your health• Calculators to learn more about your healthand find out the cost of a procedure, lab testor doctor visitMY ACCOUNTRegister and log in at premera.com to use these and other online tools to help you get themost value from your health plan.9

When you see a provider in the <strong>Premera</strong> <strong>Blue</strong> <strong>Cross</strong> network, the providersends the bill directly to us for payment. This is your claim, of which youmight pay nothing or a portion, depending on your covered services,deductible, and coinsurance.Definition of Terms123456789Service/product—The type of service/product youreceived from your provider.Dates of service—The date(s) you received service.Amount billed—The full amount billed by yourprovider to your health plan.<strong>Premera</strong> network discount—The amount yousave by using a provider that belongs to a <strong>Premera</strong>network. <strong>Premera</strong> negotiates lower rates with itsin-network providers to help you save money. Thisamount may not be itemized and may only show inthe Totals row of the Claim Detail.Amount paid by your health plan—The portion of the charges eligible for benefitsminus your copay, deductible, coinsurance, networkdiscount and amount paid by another source up tothe billed amount.Amount paid by another source—Examples of other sources include: a healthfunding account, other health insurance,automobile insurance, homeowners’ insurance,disability insurance, etc. This amount may not beitemized and may only show in the Totals row of theClaim Detail.<strong>Your</strong> plan discounts & payments—This sectiondetails the amounts that you do not need to pay.Copay—A set amount you pay for certain coveredservices such as office visits or prescriptions. Copaysare usually paid at the time of service.Deductible—<strong>Your</strong> deductible is the amount youneed to pay each year for covered services beforeyour plan starts paying benefits.1011121314Coinsurance—A percentage of covered expensesthat you pay after you meet your deductible.Amount not covered—The portion of the amountbilled that was not covered or eligible for paymentunder your plan. Examples include charges forservices or products that are not covered by yourplan, duplicate claims that are not your responsibility,amount related to not getting a prior authorizationfor service, and any charges submitted that are abovethe maximum amount your plan pays for out-ofnetworkcare.<strong>Your</strong> total responsibility—This section details theportion of the bill that is your responsibility to pay.This amount might include your copay, deductible,coinsurance, any amount over the maximumreimbursable charge, or products/services not coveredby your plan. If you received payment intended for aprovider, it is your responsibility to pay the provider.Claim notes—When present, these notes providegeneral information about the claim and may alsoprovide specific explanation of activity that occurredin the Amount Not Covered, Amount Paid byAnother Source, and Amount Paid By <strong>Your</strong> <strong>Health</strong>Plan fields. For example, if the claim was deniedbecause your provider submitted the same claimtwice, a note would tell you that we denied the claimas a duplicate.Benefit Booklet Information—If applicable,contains information about why portions of a claimwere denied.ELECTRONIC EOBSign up to receive your EOB electronically when you register and log in at premera.com.That’s one less piece of paper you’ll have to file away.13

Get the answers you need.We believe that the better you understand your health plan, the more you will benefit from it.This information will help you navigate the claims process.Filing a claim with anout-of-network providerWhen you see a provider or use a pharmacyoutside the network, you have to submit theclaim yourself after paying for the service up front.(In-network providers submit the claim for you.)To file a claim:1. Complete a claim form. Download one fromthe “Forms” section on premera.com, orcall 800-722-1471.2. Attach an itemized bill from the provider for thecovered service.3. Make a copy for your records.4. Mail your claim to the address on the claim form.Claim InquiriesIf you would like a review of your processed claim,just call Customer Service at 800-722-1471. You mustmake your request within 180 days after you receiveyour EOB. You can also submit a request in writing.Include a copy of the EOB in question and any otherdocumentation that may support your inquiry. Makesure that you send in this request within 180 days ofreceiving the EOB. Send your request to:<strong>Premera</strong> <strong>Blue</strong> <strong>Cross</strong>PO Box 91059Seattle, WA 98111Once we receive your request, we’ll send you moredetails about the review process.Questions? Call customerservice at 800-722-1471.They’re ready to help you! Customer Service staffis available 8 a.m. to 5 p.m., Monday through Friday,Pacific Time. Whenever you call, please have yourID card handy.LEARN ABOUT YOUR COVERAGEAccess your benefit booklet online when you log into your secure member account at premera.com14

Member DiscountsSave money on health andwellness products and servicesnot covered by your health plan.Fitness Clubs and Gyms • Diet, Nutritionand Supplements • Vision Care Supplies •Alternative Care Services • Newborn Servicesand Products • Hearing Aids and ScreeningsThank youfor being a <strong>Premera</strong> <strong>Blue</strong> <strong>Cross</strong> member.We’re here. We’re with you.Learn more atpremera.com/discounts

<strong>Premera</strong> MobileThe answer is right in your pocket.With the free <strong>Premera</strong> mobile app you caneasily find a doctor along with maps, drivingdirections and you can even use the app as proofof coverage. Plus, it offers one-touch connectionto our 24-Hour NurseLine and Customer Service.Available to registered <strong>Premera</strong> members withAndroid, iPhone or Windows mobile phones.Note about cover: The sample member ID card on the cover may not match what appears on your card, as benefits differ by plan.Please note that this booklet is not a contract. For more information about the full terms and conditionsof your health plan, including benefits, limitations and exclusions, please see your Benefit Booklet.<strong>Premera</strong> <strong>Blue</strong> <strong>Cross</strong> is an Independent Licensee of the <strong>Blue</strong> <strong>Cross</strong> <strong>Blue</strong> Shield Association012346 (12-2012)