HeritageSelect Envoy $5000 Deductible - Premera Blue Cross

HeritageSelect Envoy $5000 Deductible - Premera Blue Cross

HeritageSelect Envoy $5000 Deductible - Premera Blue Cross

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

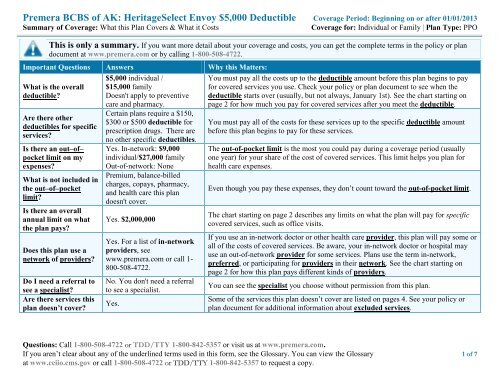

<strong>Premera</strong> BCBS of AK: <strong>HeritageSelect</strong> <strong>Envoy</strong> $5,000 <strong>Deductible</strong> Coverage Period: Beginning on or after 01/01/2013Summary of Coverage: What this Plan Covers & What it CostsCoverage for: Individual or Family | Plan Type: PPOThis is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plandocument at www.premera.com or by calling 1-800-508-4722.Important Questions Answers Why this Matters:What is the overalldeductible?Are there otherdeductibles for specificservices?Is there an out–of–pocket limit on myexpenses?What is not included inthe out–of–pocketlimit?Is there an overallannual limit on whatthe plan pays?Does this plan use anetwork of providers?Do I need a referral tosee a specialist?Are there services thisplan doesn’t cover?$5,000 individual /$15,000 familyDoesn't apply to preventivecare and pharmacy.Certain plans require a $150,$300 or $500 deductible forprescription drugs. There areno other specific deductibles.Yes. In-network: $9,000individual/$27,000 familyOut-of-network: NonePremium, balance-billedcharges, copays, pharmacy,and health care this plandoesn't cover.Yes. $2,000,000Yes. For a list of in-networkproviders, seewww.premera.com or call 1-800-508-4722.No. You don't need a referralto see a specialist.Yes.You must pay all the costs up to the deductible amount before this plan begins to payfor covered services you use. Check your policy or plan document to see when thedeductible starts over (usually, but not always, January 1st). See the chart starting onpage 2 for how much you pay for covered services after you meet the deductible.You must pay all of the costs for these services up to the specific deductible amountbefore this plan begins to pay for these services.The out-of-pocket limit is the most you could pay during a coverage period (usuallyone year) for your share of the cost of covered services. This limit helps you plan forhealth care expenses.Even though you pay these expenses, they don’t count toward the out-of-pocket limit.The chart starting on page 2 describes any limits on what the plan will pay for specificcovered services, such as office visits.If you use an in-network doctor or other health care provider, this plan will pay some orall of the costs of covered services. Be aware, your in-network doctor or hospital mayuse an out-of-network provider for some services. Plans use the term in-network,preferred, or participating for providers in their network. See the chart starting onpage 2 for how this plan pays different kinds of providers.You can see the specialist you choose without permission from this plan.Some of the services this plan doesn’t cover are listed on pages 4. See your policy orplan document for additional information about excluded services.Questions: Call 1-800-508-4722 or TDD/TTY 1-800-842-5357 or visit us at www.premera.com.If you aren’t clear about any of the underlined terms used in this form, see the Glossary. You can view the Glossary 1 of 7at www.cciio.cms.gov or call 1-800-508-4722 or TDD/TTY 1-800-842-5357 to request a copy.

Copayments are fixed dollar amounts (for example, $15) you pay for covered health care, usually when you receive the service.Coinsurance is your share of the costs of a covered service, calculated as a percent of the allowed amount for the service. For example,if the plan’s allowed amount for an overnight hospital stay is $1,000, your coinsurance payment of 20% would be $200. This maychange if you haven’t met your deductible.The amount the plan pays for covered services is based on the allowed amount. If an out-of-network provider charges more than theallowed amount, you may have to pay the difference. For example, if an out-of-network hospital charges $1,500 for an overnight stayand the allowed amount is $1,000, you may have to pay the $500 difference. (This is called balance billing.)This plan may encourage you to use in-network providers by charging you lower deductibles, co-payments and co-insurance amounts.CommonMedical EventIf you visit a healthcare provider’soffice or clinicServices You May NeedPrimary care visit to treatan injury or illnessSpecialist visitOther practitioner officevisitPreventive care/screening/immunizationIn-Network ProviderYour cost if you use a$45 copay for first six visits then30% coinsurance thereafter$45 copay for first six visits then30% coinsurance thereafter$45 copay for first six visits then30% coinsurance thereafterOut-Of-NetworkProvider$45 copay for first sixvisits then 30%coinsurance thereafter$45 copay for first sixvisits then 30%coinsurance thereafter$45 copay for first sixvisits then 30%coinsurance thereafterLimitations & Exceptions––––––––none–––––––––––––––––––none–––––––––––Spinal manipulations limited to12 visits PCY, acupuncturelimited to 12 visits PCYNo charge No charge ––––––––none–––––––––––If you have a testDiagnostic test (x-ray,blood work)30% coinsurance (Preferred)40% coinsurance (Participating)60% coinsurance––––––––none–––––––––––If you need drugs totreat your illness orconditionMore informationabout prescriptionImaging (CT/PET scans,MRIs)Generic drugsPreferred brand drugs30% coinsurance (Preferred)40% coinsurance (Participating)$10, $15 or $20 copay (retail);$25, $45 or $50 copay (mail)$30 or $50 copay (retail)$75 or $125 copay (mail)60% coinsuranceSame as participatingproviderSame as participatingprovider––––––––none–––––––––––Covers up to a 30-day supply(retail) or 90 day supply (mail)Covers up to a 30-day supply(retail) or 90 day supply (mail).Some options require apharmacy deductible.2 of 7

CommonMedical Eventdrug coverage isavailable atwww.premera.com.If you haveoutpatient surgeryIf you needimmediate medicalattentionIf you have ahospital stayIf you have mentalhealth, behavioralhealth, or substanceabuse needsIf you are pregnantServices You May NeedNon-preferred branddrugsIn-Network Provider$30, $50 copay or 50%coinsurance (retail)$75, $125 or 70% coinsurance(mail)Your cost if you use aOut-Of-NetworkProviderSame as participatingproviderSpecialty drugs 30% coinsurance Not coveredFacility fee (e.g.,ambulatory surgerycenter)30% coinsurance (Preferred)40% coinsurance (Participating)Limitations & ExceptionsCovers up to a 30-day supply(retail) or 90 day supply (mail).Some options require apharmacy deductible.Limited to 30 day supply.Some options require apharmacy deductible.60% coinsurance ––––––––none–––––––––––Physician/surgeon fees 30% coinsurance 30% coinsurance ––––––––none–––––––––––Emergency room $100 copay then 30%$100 copay then 30%servicescoinsurancecoinsurance––––––––none–––––––––––Emergency medical $100 copay then 30%$100 copay then 30%transportationcoinsurancecoinsuranceNo copay for 2-50 groupsUrgent care$45 copay for first six$45 copay for first six visits thenvisits then 30%30% coinsurance thereaftercoinsurance thereafter––––––––none–––––––––––Facility fee (e.g., hospital 30% coinsurance (Preferred)60% coinsurance ––––––––none–––––––––––room)40% coinsurance (Participating)Physician/surgeon fee 30% coinsurance 30% coinsurance ––––––––none–––––––––––Mental/Behavioral healthOptional benefit for 2-5030% coinsurance 30% coinsuranceoutpatient servicesgroupsMental/Behavioral healthOptional benefit for 2-5030% coinsurance 60% coinsuranceinpatient servicesgroupsSubstance use disorderOptional benefit for 2-5030% coinsurance 30% coinsuranceoutpatient servicesgroupsSubstance use disorderOptional benefit for 2-5030% coinsurance 60% coinsuranceinpatient servicesgroupsPrenatal and postnatal30% coinsurance 30% coinsurance ––––––––none–––––––––––care3 of 7

CommonMedical EventServices You May NeedIn-Network ProviderYour cost if you use aOut-Of-NetworkProviderLimitations & ExceptionsDelivery and all inpatientservices30% coinsurance (Preferred)40% coinsurance (Participating)60% coinsurance––––––––none–––––––––––If you need helprecovering or haveother special healthneedsIf your child needsdental or eye careHome health care 30% coinsurance 30% coinsurance Limited to 130 visits PCYRehabilitation servicesOutpatient: 30% coinsuranceInpatient: 30% coinsurance(Preferred)40% coinsurance(Participating)Outpatient: 30%coinsuranceInpatient: 60%coinsuranceLimited to 45 outpatient visitsPCY, limited to 30 inpatientdays PCYHabilitation servicesSkilled nursing careDurable medicalequipmentOutpatient: 30% coinsuranceInpatient: 30% coinsurance(Preferred)40% coinsurance(Participating)30% coinsurance (Preferred)40% coinsurance (Participating)Outpatient: 30%coinsuranceInpatient: 60%coinsurance30% coinsuranceAutism unlimited up to age 21;Over age 21 rehab will apply tothe rehab limits andneurodevelopmental therapynot coveredLimited to 60 days PCY30% coinsurance 30% coinsurance ––––––––none–––––––––––Hospice service 30% coinsurance 30% coinsuranceLimited to 10 inpatient days,240 respite hours - 6 monthoverall benefit limitEye exam Not covered Not covered Plan option availableGlasses Not covered Not covered Plan option availableDental check-up Not covered Not covered ––––––––none–––––––––––Excluded Services & Other Covered Services:4 of 7

Services Your Plan Does NOT Cover (This isn’t a complete list. Check your policy or plan document for other excluded services.)Bariatric surgeryCosmetic surgeryDental care (Adult)Dental care (Child)Hearing aidsInfertility treatmentLong-term carePrivate-duty nursingRoutine eye care (Adult)(plan option available)Routine eye care (Child)(plan option available)Routine foot careWeight loss programsOther Covered Services (This isn’t a complete list. Check your policy or plan document for other covered services and your costs for theseservices.)AcupunctureChiropractic care (or other spinalmanipulations)Habilitation servicesNon-emergency care when traveling outsidethe U.S.Your Rights to Continue Coverage:If you lose coverage under the plan, then, depending upon the circumstances, Federal and State laws may provide protections that allow you to keephealth coverage. Any such rights may be limited in duration and will require you to pay a premium, which may be significantly higher than thepremium you pay while covered under the plan. Other limitations on your rights to continue coverage may also apply.For more information on your rights to continue coverage, contact the plan at 1-800-508-4722. You may also contact your state insurancedepartment, the U.S. Department of Labor, Employee Benefits Security Administration at 1-866-444-3272 or www.dol.gov/ebsa, or the U.S.Department of Health and Human Services at 1-877-267-2323 x61565 or www.cciio.cms.gov.Your Grievance and Appeals Rights:If you have a complaint or are dissatisfied with a denial of coverage for claims under your plan, you may be able to appeal or file a grievance. Forquestions about your rights, this notice, or assistance, you can contact: <strong>Premera</strong> <strong>Blue</strong> <strong>Cross</strong> <strong>Blue</strong> Shield of Alaska Customer Service at 1-800-508-4722, or you can contact the U.S. Department of Labor’s Employee Benefits Security Administration at 1-866-444-EBSA (3272) orwww.dol/gov/ebsa/healthreform. In addition, you may contact the Alaska Division of Insurance at 907-269-7900 or 1-800-467-8725.Language Access Services:Spanish (Español): Para obtener asistencia en Español, llame al 1-800-508-4722.Tagalog (Tagalog): Kung kailangan ninyo ang tulong sa Tagalog tumawag sa 1-800-508-4722.Chinese ( 中 文 ): 如 果 需 要 中 文 的 帮 助 , 请 拨 打 这 个 号 码 1-800-508-4722.Navajo (Dine): Dinek'ehgo shika at'ohwol ninisingo, kwiijigo holne' 1-800-508-4722.–––––––––––––––––––To see examples of how this plan might cover costs for a sample medical situation, see the next page.––––––––––––––––––5 of 7

.About these CoverageExamples:These examples show how this plan mightcover medical care in given situations. Usethese examples to see, in general, how muchfinancial protection a sample patient might getif they are covered under different plans.This isnot a costestimator.Don’t use these examples toestimate your actual costsunder this plan. The actualcare you receive will bedifferent from theseexamples, and the cost ofthat care will also bedifferent.See the next page forimportant information aboutthese examples.Having a baby(normal delivery)• Amount owed to providers: $7,540• Plan pays: $1,640• Patient pays: $5,900Sample care costs:Hospital charges (mother) $2,700Routine obstetric care $2,100Hospital charges (baby) $900Anesthesia $900Laboratory tests $500Prescriptions $200Radiology $200Vaccines, other preventive $40Total $7,540Patient pays:<strong>Deductible</strong>s $5,000Copays $0Coinsurance $700Limits or exclusions $200Total $5,900Managing type 2 diabetes(routine maintenance ofa well-controlled condition)• Amount owed to providers: $5,400• Plan pays $600• Patient pays $4,800Sample care costs:Prescriptions $2,900Medical Equipment and Supplies $1,300Office Visits and Procedures $700Education $300Laboratory tests $100Vaccines, other preventive $100Total $5,400Patient pays:<strong>Deductible</strong>s $1,400Copays $500Coinsurance $0Limits or exclusions $2,900Total $4,8006 of 7

Questions and answers about the Coverage Examples:What are some of the assumptionsbehind the Coverage Examples?Costs don’t include premiums.Sample care costs are based on nationalaverages supplied by the U.S.Department of Health and HumanServices, and aren’t specific to aparticular geographic area or healthplan.The patient’s condition was not anexcluded or preexisting condition.All services and treatments started andended in the same coverage period.There are no other medical expenses forany member covered under this plan.Out-of-pocket expenses are based onlyon treating the condition in theexample.The patient received all care from innetworkproviders. If the patient hadreceived care from out-of-networkproviders, costs would have beenhigher.What does a Coverage Exampleshow?For each treatment situation, the CoverageExample helps you see how deductibles,copayments, and coinsurance can add up.It also helps you see what expenses might beleft up to you to pay because the service ortreatment isn’t covered or payment islimited.Does the Coverage Example predictmy own care needs? No. Treatments shown are justexamples. The care you would receive forthis condition could be different based onyour doctor’s advice, your age, howserious your condition is, and many otherfactors.Does the Coverage Example predictmy future expenses? No. Coverage Examples are not costestimators. You can’t use the examples toestimate costs for an actual condition.They are for comparative purposes only.Your own costs will be differentdepending on the care you receive, theprices your providers charge, and thereimbursement your health plan allows.Can I use Coverage Examples tocompare plans?Yes. When you look at the Summary ofBenefits and Coverage for other plans,you’ll find the same Coverage Examples.When you compare plans, check the“Patient Pays” box in each example. Thesmaller that number, the more coveragethe plan provides.Are there other costs I shouldconsider when comparing plans?Yes. An important cost is the premiumyou pay. Generally, the lower yourpremium, the more you’ll pay in out-ofpocketcosts, such as copayments,deductibles, and coinsurance. Youshould also consider contributions toaccounts such as health savings accounts(HSAs), flexible spending arrangements(FSAs) or health reimbursement accounts(HRAs) that help you pay out-of-pocketexpenses.Questions: Call 1-800-508-4722 or visit us at www.premera.com.If you aren’t clear about any of the underlined terms used in this form, see the Glossary. You can view the Glossary 7 of 7at www.cciio.cms.gov or call 1-800-508-4722 to request a copy. 025681 (02-2013)