HeritageSelect Envoy $5000 Deductible - Premera Blue Cross

HeritageSelect Envoy $5000 Deductible - Premera Blue Cross

HeritageSelect Envoy $5000 Deductible - Premera Blue Cross

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

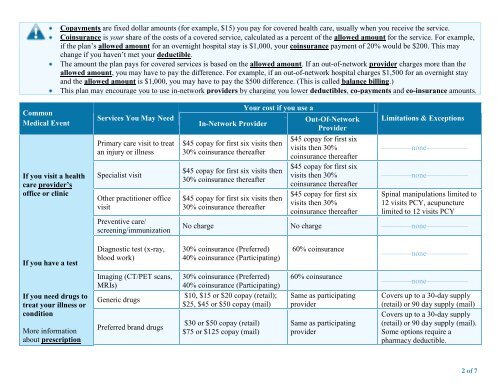

Copayments are fixed dollar amounts (for example, $15) you pay for covered health care, usually when you receive the service.Coinsurance is your share of the costs of a covered service, calculated as a percent of the allowed amount for the service. For example,if the plan’s allowed amount for an overnight hospital stay is $1,000, your coinsurance payment of 20% would be $200. This maychange if you haven’t met your deductible.The amount the plan pays for covered services is based on the allowed amount. If an out-of-network provider charges more than theallowed amount, you may have to pay the difference. For example, if an out-of-network hospital charges $1,500 for an overnight stayand the allowed amount is $1,000, you may have to pay the $500 difference. (This is called balance billing.)This plan may encourage you to use in-network providers by charging you lower deductibles, co-payments and co-insurance amounts.CommonMedical EventIf you visit a healthcare provider’soffice or clinicServices You May NeedPrimary care visit to treatan injury or illnessSpecialist visitOther practitioner officevisitPreventive care/screening/immunizationIn-Network ProviderYour cost if you use a$45 copay for first six visits then30% coinsurance thereafter$45 copay for first six visits then30% coinsurance thereafter$45 copay for first six visits then30% coinsurance thereafterOut-Of-NetworkProvider$45 copay for first sixvisits then 30%coinsurance thereafter$45 copay for first sixvisits then 30%coinsurance thereafter$45 copay for first sixvisits then 30%coinsurance thereafterLimitations & Exceptions––––––––none–––––––––––––––––––none–––––––––––Spinal manipulations limited to12 visits PCY, acupuncturelimited to 12 visits PCYNo charge No charge ––––––––none–––––––––––If you have a testDiagnostic test (x-ray,blood work)30% coinsurance (Preferred)40% coinsurance (Participating)60% coinsurance––––––––none–––––––––––If you need drugs totreat your illness orconditionMore informationabout prescriptionImaging (CT/PET scans,MRIs)Generic drugsPreferred brand drugs30% coinsurance (Preferred)40% coinsurance (Participating)$10, $15 or $20 copay (retail);$25, $45 or $50 copay (mail)$30 or $50 copay (retail)$75 or $125 copay (mail)60% coinsuranceSame as participatingproviderSame as participatingprovider––––––––none–––––––––––Covers up to a 30-day supply(retail) or 90 day supply (mail)Covers up to a 30-day supply(retail) or 90 day supply (mail).Some options require apharmacy deductible.2 of 7