Annual report - Viscofan

Annual report - Viscofan

Annual report - Viscofan

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

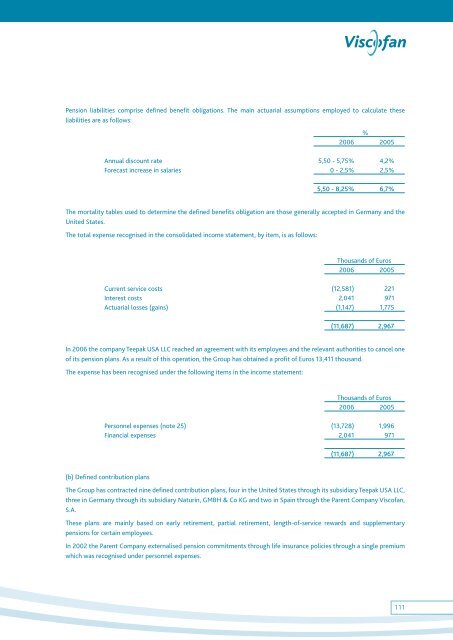

Pension liabilities comprise defined benefit obligations. The main actuarial assumptions employed to calculate theseliabilities are as follows:%2006 2005<strong>Annual</strong> discount rate 5,50 - 5,75% 4,2%Forecast increase in salaries 0 - 2,5% 2,5%5,50 - 8,25% 6,7%The mortality tables used to determine the defined benefits obligation are those generally accepted in Germany and theUnited States.The total expense recognised in the consolidated income statement, by item, is as follows:Thousands of Euros2006 2005Current service costs (12,581) 221Interest costs 2,041 971Actuarial losses (gains) (1,147) 1,775(11,687) 2,967In 2006 the company Teepak USA LLC reached an agreement with its employees and the relevant authorities to cancel oneof its pension plans. As a result of this operation, the Group has obtained a profit of Euros 13,411 thousand.The expense has been recognised under the following items in the income statement:Thousands of Euros2006 2005Personnel expenses (note 25) (13,728) 1,996Financial expenses 2,041 971(11,687) 2,967(b) Defined contribution plansThe Group has contracted nine defined contribution plans, four in the United States through its subsidiary Teepak USA LLC,three in Germany through its subsidiary Naturin, GMBH & Co KG and two in Spain through the Parent Company <strong>Viscofan</strong>,S.A.These plans are mainly based on early retirement, partial retirement, length-of-service rewards and supplementarypensions for certain employees.In 2002 the Parent Company externalised pension commitments through life insurance policies through a single premiumwhich was recognised under personnel expenses.111