Annual report - Viscofan

Annual report - Viscofan

Annual report - Viscofan

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

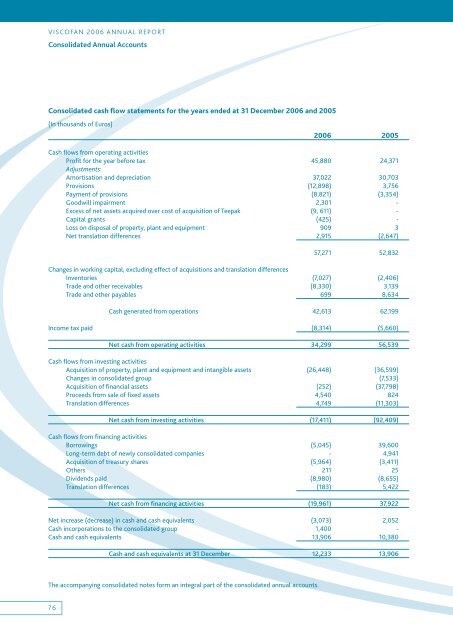

VISCOFAN 2006 ANNUAL REPORTConsolidated <strong>Annual</strong> AccountsConsolidated cash flow statements for the years ended at 31 December 2006 and 2005(In thousands of Euros)2006 2005Cash flows from operating activitiesProfit for the year before tax 45,880 24,371Adjustments:Amortisation and depreciation 37,022 30,703Provisions (12,898) 3,756Payment of provisions (8,821) (3,354)Goodwill impairment 2,301 -Excess of net assets acquired over cost of acquisition of Teepak (9, 611) -Capital grants (425) -Loss on disposal of property, plant and equipment 909 3Net translation differences 2,915 (2,647)57,271 52,832Changes in working capital, excluding effect of acquisitions and translation differencesInventories (7,027) (2,406)Trade and other receivables (8,330) 3,139Trade and other payables 699 8,634Cash generated from operations 42,613 62,199Income tax paid (8,314) (5,660)Net cash from operating activities 34,299 56,539Cash flows from investing activitiesAcquisition of property, plant and equipment and intangible assets (26,448) (36,599)Changes in consolidated group (7,533)Acquisition of financial assets (252) (37,798)Proceeds from sale of fixed assets 4,540 824Translation differences 4,749 (11,303)Net cash from investing activities (17,411) (92,409)Cash flows from financing activitiesBorrowings (5,045) 39,600Long-term debt of newly consolidated companies - 4,941Acquisition of treasury shares (5,964) (3,411)Others 211 25Dividends paid (8,980) (8,655)Translation differences (183) 5,422Net cash from financing activities (19,961) 37,922Net increase (decrease) in cash and cash equivalents (3,073) 2,052Cash incorporations to the consolidated group 1,400 -Cash and cash equivalents 13,906 10,380Cash and cash equivalents at 31 December 12,233 13,906The accompanying consolidated notes form an integral part of the consolidated annual accounts.76