30 Sep 2011

30 Sep 2011

30 Sep 2011

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

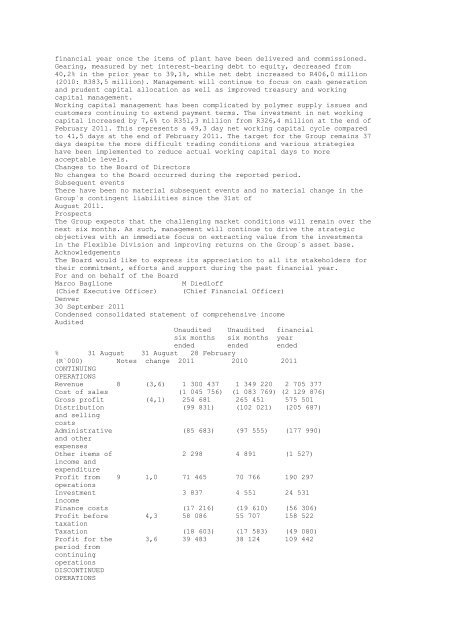

financial year once the items of plant have been delivered and commissioned.Gearing, measured by net interest-bearing debt to equity, decreased from40,2% in the prior year to 39,1%, while net debt increased to R406,0 million(2010: R383,5 million). Management will continue to focus on cash generationand prudent capital allocation as well as improved treasury and workingcapital management.Working capital management has been complicated by polymer supply issues andcustomers continuing to extend payment terms. The investment in net workingcapital increased by 7,6% to R351,3 million from R326,4 million at the end ofFebruary <strong>2011</strong>. This represents a 49,3 day net working capital cycle comparedto 41,5 days at the end of February <strong>2011</strong>. The target for the Group remains 37days despite the more difficult trading conditions and various strategieshave been implemented to reduce actual working capital days to moreacceptable levels.Changes to the Board of DirectorsNo changes to the Board occurred during the reported period.Subsequent eventsThere have been no material subsequent events and no material change in theGroup`s contingent liabilities since the 31st ofAugust <strong>2011</strong>.ProspectsThe Group expects that the challenging market conditions will remain over thenext six months. As such, management will continue to drive the strategicobjectives with an immediate focus on extracting value from the investmentsin the Flexible Division and improving returns on the Group`s asset base.AcknowledgementsThe Board would like to express its appreciation to all its stakeholders fortheir commitment, efforts and support during the past financial year.For and on behalf of the BoardMarco BaglioneM Diedloff(Chief Executive Officer) (Chief Financial Officer)Denver<strong>30</strong> <strong>Sep</strong>tember <strong>2011</strong>Condensed consolidated statement of comprehensive incomeAuditedUnaudited Unaudited financialsix months six months yearended ended ended% 31 August 31 August 28 February(R`000) Notes change <strong>2011</strong> 2010 <strong>2011</strong>CONTINUINGOPERATIONSRevenue 8 (3,6) 1 <strong>30</strong>0 437 1 349 220 2 705 377Cost of sales (1 045 756) (1 083 769) (2 129 876)Gross profit (4,1) 254 681 265 451 575 501Distribution (99 831) (102 021) (205 687)and sellingcostsAdministrative (85 683) (97 555) (177 990)and otherexpensesOther items of 2 298 4 891 (1 527)income andexpenditureProfit from 9 1,0 71 465 70 766 190 297operationsInvestment 3 837 4 551 24 531incomeFinance costs (17 216) (19 610) (56 <strong>30</strong>6)Profit before 4,3 58 086 55 707 158 522taxationTaxation (18 603) (17 583) (49 080)Profit for the 3,6 39 483 38 124 109 442period fromcontinuingoperationsDISCONTINUEDOPERATIONS