mdg-annual-report-2013

mdg-annual-report-2013

mdg-annual-report-2013

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

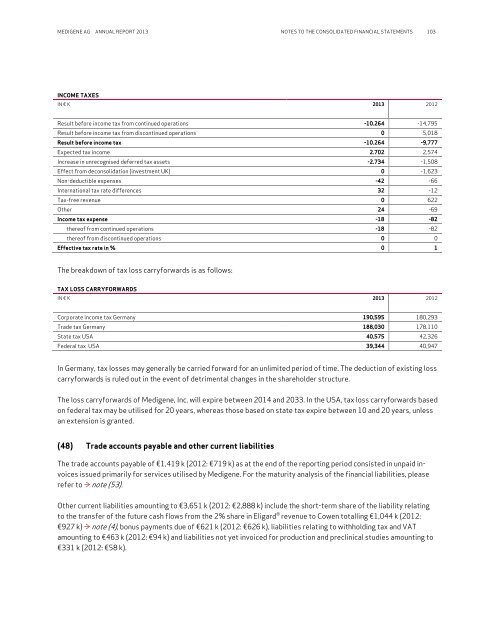

MEDIGENE AG ANNUAL REPORT <strong>2013</strong> NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS 103INCOME TAXESIN € K <strong>2013</strong> 2012Result before income tax from continued operations -10.264 -14,795Result before income tax from discontinued operations 0 5,018Result before income tax -10.264 -9,777Expected tax income 2.702 2,574Increase in unrecognised deferred tax assets -2.734 -1,508Effect from deconsolidation (investment UK) 0 -1,623Non-deductible expenses -42 -66International tax rate differences 32 -12Tax-free revenue 0 622Other 24 -69Income tax expense -18 -82thereof from continued operations -18 -82thereof from discontinued operations 0 0Effective tax rate in % 0 1The breakdown of tax loss carryforwards is as follows:TAX LOSS CARRYFORWARDSIN € K <strong>2013</strong> 2012Corporate income tax Germany 190,595 180,293Trade tax Germany 188,030 178,110State tax USA 40,575 42,326Federal tax USA 39,344 40,947In Germany, tax losses may generally be carried forward for an unlimited period of time. The deduction of existing losscarryforwards is ruled out in the event of detrimental changes in the shareholder structure.The loss carryforwards of Medigene, Inc. will expire between 2014 and 2033. In the USA, tax loss carryforwards basedon federal tax may be utilised for 20 years, whereas those based on state tax expire between 10 and 20 years, unlessan extension is granted.(48) Trade accounts payable and other current liabilitiesThe trade accounts payable of €1,419 k (2012: €719 k) as at the end of the <strong>report</strong>ing period consisted in unpaid invoicesissued primarily for services utilised by Medigene. For the maturity analysis of the financial liabilities, pleaserefer to ≥ note (53).Other current liabilities amounting to €3,651 k (2012: €2,888 k) include the short-term share of the liability relatingto the transfer of the future cash flows from the 2% share in Eligard ® revenue to Cowen totalling €1,044 k (2012:€927 k) ≥ note (4), bonus payments due of €621 k (2012: €626 k), liabilities relating to withholding tax and VATamounting to €463 k (2012: €94 k) and liabilities not yet invoiced for production and preclinical studies amounting to€331 k (2012: €58 k).