mdg-annual-report-2013

mdg-annual-report-2013

mdg-annual-report-2013

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

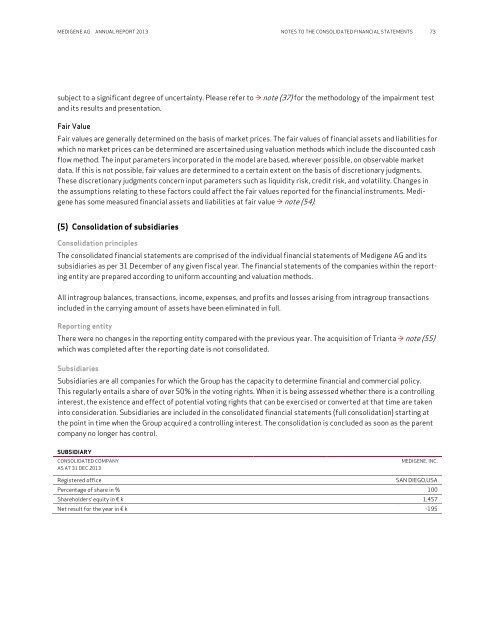

MEDIGENE AG ANNUAL REPORT <strong>2013</strong> NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS 73subject to a significant degree of uncertainty. Please refer to ≥ note (37) for the methodology of the impairment testand its results and presentation.Fair ValueFair values are generally determined on the basis of market prices. The fair values of financial assets and liabilities forwhich no market prices can be determined are ascertained using valuation methods which include the discounted cashflow method. The input parameters incorporated in the model are based, wherever possible, on observable marketdata. If this is not possible, fair values are determined to a certain extent on the basis of discretionary judgments.These discretionary judgments concern input parameters such as liquidity risk, credit risk, and volatility. Changes inthe assumptions relating to these factors could affect the fair values <strong>report</strong>ed for the financial instruments. Medigenehas some measured financial assets and liabilities at fair value ≥ note (54).(5) Consolidation of subsidiariesConsolidation principlesThe consolidated financial statements are comprised of the individual financial statements of Medigene AG and itssubsidiaries as per 31 December of any given fiscal year. The financial statements of the companies within the <strong>report</strong>ingentity are prepared according to uniform accounting and valuation methods.All intragroup balances, transactions, income, expenses, and profits and losses arising from intragroup transactionsincluded in the carrying amount of assets have been eliminated in full.Reporting entityThere were no changes in the <strong>report</strong>ing entity compared with the previous year. The acquisition of Trianta ≥ note (55)which was completed after the <strong>report</strong>ing date is not consolidated.SubsidiariesSubsidiaries are all companies for which the Group has the capacity to determine financial and commercial policy.This regularly entails a share of over 50% in the voting rights. When it is being assessed whether there is a controllinginterest, the existence and effect of potential voting rights that can be exercised or converted at that time are takeninto consideration. Subsidiaries are included in the consolidated financial statements (full consolidation) starting atthe point in time when the Group acquired a controlling interest. The consolidation is concluded as soon as the parentcompany no longer has control.SUBSIDIARYCONSOLIDATED COMPANYAS AT 31 DEC <strong>2013</strong>MEDIGENE, INC.Registered officeSAN DIEGO,USAPercentage of share in % 100Shareholders‘ equity in € k 1,457Net result for the year in € k -195