mdg-annual-report-2013

mdg-annual-report-2013

mdg-annual-report-2013

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

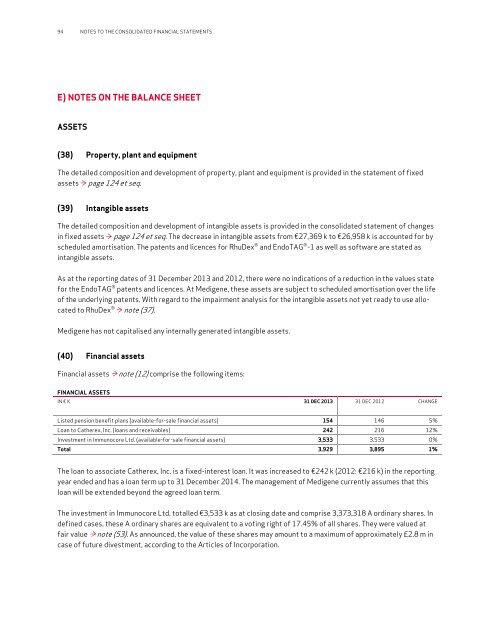

94 NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTSE) NOTES ON THE BALANCE SHEETASSETS(38) Property, plant and equipmentThe detailed composition and development of property, plant and equipment is provided in the statement of fixedassets ≥ page 124 et seq.(39) Intangible assetsThe detailed composition and development of intangible assets is provided in the consolidated statement of changesin fixed assets ≥ page 124 et seq. The decrease in intangible assets from €27,369 k to €26,958 k is accounted for byscheduled amortisation. The patents and licences for RhuDex ® and EndoTAG ® -1 as well as software are stated asintangible assets.As at the <strong>report</strong>ing dates of 31 December <strong>2013</strong> and 2012, there were no indications of a reduction in the values statefor the EndoTAG ® patents and licences. At Medigene, these assets are subject to scheduled amortisation over the lifeof the underlying patents. With regard to the impairment analysis for the intangible assets not yet ready to use allocatedto RhuDex ® ≥ note (37).Medigene has not capitalised any internally generated intangible assets.(40) Financial assetsFinancial assets ≥ note (12) comprise the following items:FINANCIAL ASSETSIN € K 31 DEC <strong>2013</strong> 31 DEC 2012 CHANGEListed pension benefit plans (available-for-sale financial assets) 154 146 5%Loan to Catherex, Inc. (loans and receivables) 242 216 12%Investment in Immunocore Ltd. (available-for-sale financial assets) 3,533 3,533 0%Total 3,929 3,895 1%The loan to associate Catherex, Inc. is a fixed-interest loan. It was increased to €242 k (2012: €216 k) in the <strong>report</strong>ingyear ended and has a loan term up to 31 December 2014. The management of Medigene currently assumes that thisloan will be extended beyond the agreed loan term.The investment in Immunocore Ltd. totalled €3,533 k as at closing date and comprise 3,373,318 A ordinary shares. Indefined cases, these A ordinary shares are equivalent to a voting right of 17.45% of all shares. They were valued atfair value ≥ note (53). As announced, the value of these shares may amount to a maximum of approximately £2.8 m incase of future divestment, according to the Articles of Incorporation.