mdg-annual-report-2013

mdg-annual-report-2013

mdg-annual-report-2013

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

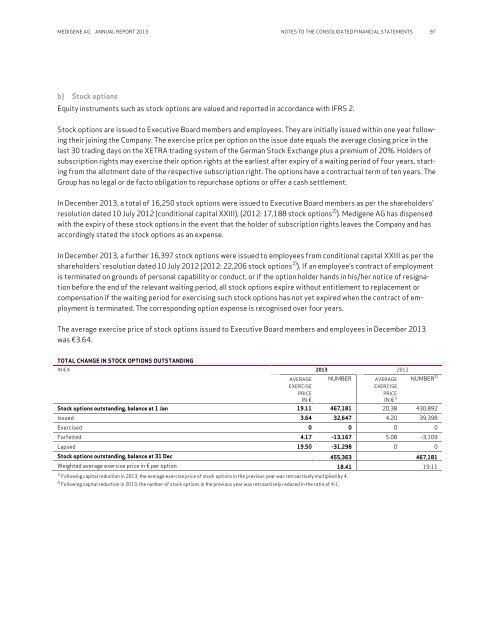

MEDIGENE AG ANNUAL REPORT <strong>2013</strong> NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS 97b) Stock optionsEquity instruments such as stock options are valued and <strong>report</strong>ed in accordance with IFRS 2.Stock options are issued to Executive Board members and employees. They are initially issued within one year followingtheir joining the Company. The exercise price per option on the issue date equals the average closing price in thelast 30 trading days on the XETRA trading system of the German Stock Exchange plus a premium of 20%. Holders ofsubscription rights may exercise their option rights at the earliest after expiry of a waiting period of four years, startingfrom the allotment date of the respective subscription right. The options have a contractual term of ten years. TheGroup has no legal or de facto obligation to repurchase options or offer a cash settlement.In December <strong>2013</strong>, a total of 16,250 stock options were issued to Executive Board members as per the shareholders’resolution dated 10 July 2012 (conditional capital XXIII), (2012: 17,188 stock options 2) ). Medigene AG has dispensedwith the expiry of these stock options in the event that the holder of subscription rights leaves the Company and hasaccordingly stated the stock options as an expense.In December <strong>2013</strong>, a further 16,397 stock options were issued to employees from conditional capital XXIII as per theshareholders’ resolution dated 10 July 2012 (2012: 22,206 stock options 2) ). If an employee’s contract of employmentis terminated on grounds of personal capability or conduct, or if the option holder hands in his/her notice of resignationbefore the end of the relevant waiting period, all stock options expire without entitlement to replacement orcompensation if the waiting period for exercising such stock options has not yet expired when the contract of employmentis terminated. The corresponding option expense is recognised over four years.The average exercise price of stock options issued to Executive Board members and employees in December <strong>2013</strong>was €3.64.TOTAL CHANGE IN STOCK OPTIONS OUTSTANDINGIN € K <strong>2013</strong> 2012AVERAGE NUMBERAVERAGEIN €IN € 1)EXERCISEPRICEEXERCISEPRICEStock options outstanding, balance at 1 Jan 19.11 467,181 20.38 430,892Issued 3.64 32,647 4.20 39,398Exercised 0 0 0 0Forfeited 4.17 -13,167 5.08 -3,109Lapsed 19.50 -31,298 0 0Stock options outstanding, balance at 31 Dec 455,363 467,181Weighted average exercise price in € per option 18.41 19.111) Following capital reduction in <strong>2013</strong>, the average exercise price of stock options in the previous year was retroactively multiplied by 4.2)Following capital reduction in <strong>2013</strong>, the number of stock options in the previous year was retroactively reduced in the ratio of 4:1.