New Basel Capital Accord

New Basel Capital Accord

New Basel Capital Accord

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

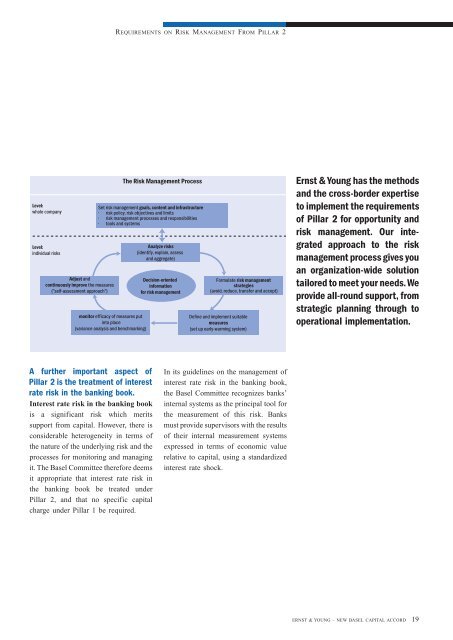

REQUIREMENTS ON RISK MANAGEMENT FROM PILLAR 2Level:whole companyLevel:individual risksAdjust andcontinuously improve the measures("self-assessment approach")The Risk Management ProcessSet risk management goals, content and infrastructure• risk policy, risk objectives and limits• risk management processes and responsibilities• tools and systemsmonitor efficacy of measures putinto place(variance analysis and benchmarking)Analyze risks(identify, explain, assessand aggregate)Decision-orientedinformationfor risk managementFormulate risk managementstrategies(avoid, reduce, transfer and accept)Define and implement suitablemeasures(set up early-warming system)Ernst & Young has the methodsand the cross-border expertiseto implement the requirementsof Pillar 2 for opportunity andrisk management. Our integratedapproach to the riskmanagement process gives youan organization-wide solutiontailored to meet your needs. Weprovide all-round support, fromstrategic planning through tooperational implementation.A further important aspect ofPillar 2 is the treatment of interestrate risk in the banking book.Interest rate risk in the banking bookis a significant risk which meritssupport from capital. However, there isconsiderable heterogeneity in terms ofthe nature of the underlying risk and theprocesses for monitoring and managingit. The <strong>Basel</strong> Committee therefore deemsit appropriate that interest rate risk inthe banking book be treated underPillar 2, and that no specific capitalcharge under Pillar 1 be required.In its guidelines on the management ofinterest rate risk in the banking book,the <strong>Basel</strong> Committee recognizes banks’internal systems as the principal tool forthe measurement of this risk. Banksmust provide supervisors with the resultsof their internal measurement systemsexpressed in terms of economic valuerelative to capital, using a standardizedinterest rate shock.ERNST & YOUNG – NEW BASEL CAPITAL ACCORD19