New Basel Capital Accord

New Basel Capital Accord

New Basel Capital Accord

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

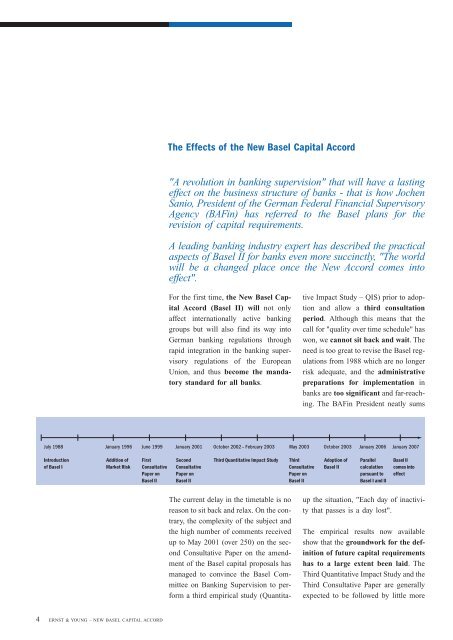

The Effects of the <strong>New</strong> <strong>Basel</strong> <strong>Capital</strong> <strong>Accord</strong>"A revolution in banking supervision" that will have a lastingeffect on the business structure of banks - that is how JochenSanio, President of the German Federal Financial SupervisoryAgency (BAFin) has referred to the <strong>Basel</strong> plans for therevision of capital requirements.A leading banking industry expert has described the practicalaspects of <strong>Basel</strong> II for banks even more succinctly, "The worldwill be a changed place once the <strong>New</strong> <strong>Accord</strong> comes intoeffect".For the first time, the <strong>New</strong> <strong>Basel</strong> <strong>Capital</strong><strong>Accord</strong> (<strong>Basel</strong> II) will not onlyaffect internationally active bankinggroups but will also find its way intoGerman banking regulations throughrapid integration in the banking supervisoryregulations of the EuropeanUnion, and thus become the mandatorystandard for all banks.The current delay in the timetable is noreason to sit back and relax. On the contrary,the complexity of the subject andthe high number of comments receivedup to May 2001 (over 250) on the secondConsultative Paper on the amendmentof the <strong>Basel</strong> capital proposals hasmanaged to convince the <strong>Basel</strong> Committeeon Banking Supervision to performa third empirical study (QuantitativeImpact Study – QIS) prior to adoptionand allow a third consultationperiod. Although this means that thecall for "quality over time schedule" haswon, we cannot sit back and wait. Theneed is too great to revise the <strong>Basel</strong> regulationsfrom 1988 which are no longerrisk adequate, and the administrativepreparations for implementation inbanks are too significant and far-reaching.The BAFin President neatly sumsJuly 1988January 1996 June 1999 January 2001 October 2002 – February 2003 May 2003 October 2003 January 2006 January 2007Introductionof <strong>Basel</strong> IAddition ofMarket RiskFirstConsultativePaper on<strong>Basel</strong> IISecondConsultativePaper on<strong>Basel</strong> IIThird Quantitative Impact StudyThirdConsultativePaper on<strong>Basel</strong> IIAdoption of<strong>Basel</strong> IIParallelcalculationpursuant to<strong>Basel</strong> I and II<strong>Basel</strong> IIcomes intoeffectup the situation, "Each day of inactivitythat passes is a day lost".The empirical results now availableshow that the groundwork for the definitionof future capital requirementshas to a large extent been laid. TheThird Quantitative Impact Study and theThird Consultative Paper are generallyexpected to be followed by little more4 ERNST & YOUNG – NEW BASEL CAPITAL ACCORD