New Basel Capital Accord

New Basel Capital Accord

New Basel Capital Accord

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

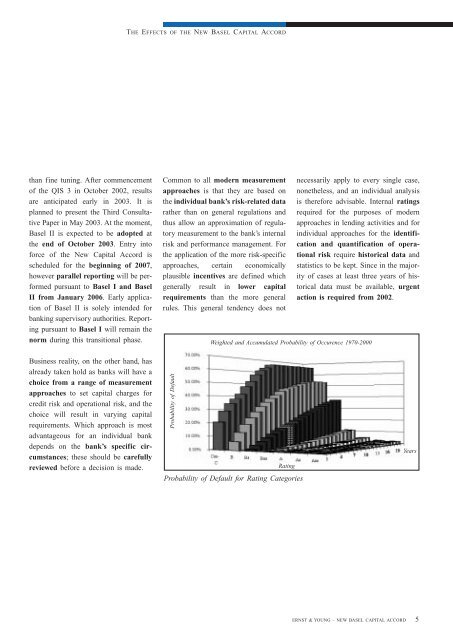

THE EFFECTS OF THE NEW BASEL CAPITAL ACCORDthan fine tuning. After commencementof the QIS 3 in October 2002, resultsare anticipated early in 2003. It isplanned to present the Third ConsultativePaper in May 2003. At the moment,<strong>Basel</strong> II is expected to be adopted atthe end of October 2003. Entry intoforce of the <strong>New</strong> <strong>Capital</strong> <strong>Accord</strong> isscheduled for the beginning of 2007,however parallel reporting will be performedpursuant to <strong>Basel</strong> I and <strong>Basel</strong>II from January 2006. Early applicationof <strong>Basel</strong> II is solely intended forbanking supervisory authorities. Reportingpursuant to <strong>Basel</strong> I will remain thenorm during this transitional phase.Common to all modern measurementapproaches is that they are based onthe individual bank’s risk-related datarather than on general regulations andthus allow an approximation of regulatorymeasurement to the bank’s internalrisk and performance management. Forthe application of the more risk-specificapproaches, certain economicallyplausible incentives are defined whichgenerally result in lower capitalrequirements than the more generalrules. This general tendency does notnecessarily apply to every single case,nonetheless, and an individual analysisis therefore advisable. Internal ratingsrequired for the purposes of modernapproaches in lending activities and forindividual approaches for the identificationand quantification of operationalrisk require historical data andstatistics to be kept. Since in the majorityof cases at least three years of historicaldata must be available, urgentaction is required from 2002.Weighted and Accumulated Probability of Occurence 1970-2000Business reality, on the other hand, hasalready taken hold as banks will have achoice from a range of measurementapproaches to set capital charges forcredit risk and operational risk, and thechoice will result in varying capitalrequirements. Which approach is mostadvantageous for an individual bankdepends on the bank’s specific circumstances;these should be carefullyreviewed before a decision is made.Probability of DefaultRatingProbability of Default for Rating CategoriesYearsERNST & YOUNG – NEW BASEL CAPITAL ACCORD5