Resume - PDF - Webprofile.info

Resume - PDF - Webprofile.info

Resume - PDF - Webprofile.info

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

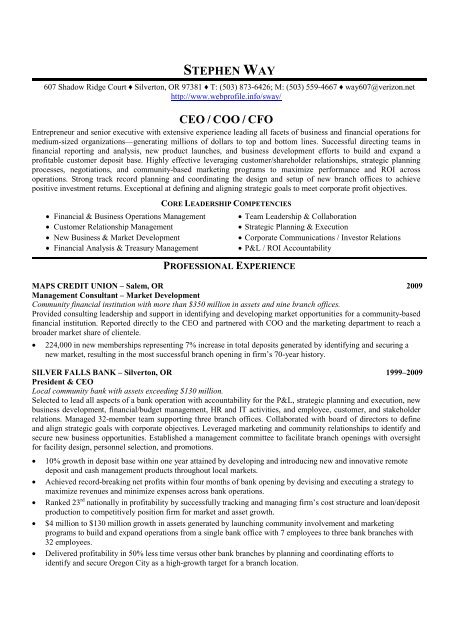

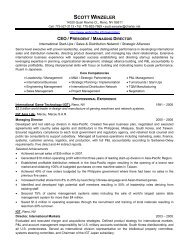

STEPHEN WAY607 Shadow Ridge Court ♦ Silverton, OR 97381 ♦ T: (503) 873-6426; M: (503) 559-4667 ♦ way607@verizon.nethttp://www.webprofile.<strong>info</strong>/sway/CEO / COO / CFOEntrepreneur and senior executive with extensive experience leading all facets of business and financial operations formedium-sized organizations—generating millions of dollars to top and bottom lines. Successful directing teams infinancial reporting and analysis, new product launches, and business development efforts to build and expand aprofitable customer deposit base. Highly effective leveraging customer/shareholder relationships, strategic planningprocesses, negotiations, and community-based marketing programs to maximize performance and ROI acrossoperations. Strong track record planning and coordinating the design and setup of new branch offices to achievepositive investment returns. Exceptional at defining and aligning strategic goals to meet corporate profit objectives. Financial & Business Operations Management Customer Relationship Management New Business & Market Development Financial Analysis & Treasury ManagementCORE LEADERSHIP COMPETENCIESPROFESSIONAL EXPERIENCE Team Leadership & Collaboration Strategic Planning & Execution Corporate Communications / Investor Relations P&L / ROI AccountabilityMAPS CREDIT UNION – Salem, OR 2009Management Consultant – Market DevelopmentCommunity financial institution with more than $350 million in assets and nine branch offices.Provided consulting leadership and support in identifying and developing market opportunities for a community-basedfinancial institution. Reported directly to the CEO and partnered with COO and the marketing department to reach abroader market share of clientele.224,000 in new memberships representing 7% increase in total deposits generated by identifying and securing anew market, resulting in the most successful branch opening in firm’s 70-year history.SILVER FALLS BANK – Silverton, OR 1999–2009President & CEOLocal community bank with assets exceeding $130 million.Selected to lead all aspects of a bank operation with accountability for the P&L, strategic planning and execution, newbusiness development, financial/budget management, HR and IT activities, and employee, customer, and stakeholderrelations. Managed 32-member team supporting three branch offices. Collaborated with board of directors to defineand align strategic goals with corporate objectives. Leveraged marketing and community relationships to identify andsecure new business opportunities. Established a management committee to facilitate branch openings with oversightfor facility design, personnel selection, and promotions.10% growth in deposit base within one year attained by developing and introducing new and innovative remotedeposit and cash management products throughout local markets.Achieved record-breaking net profits within four months of bank opening by devising and executing a strategy tomaximize revenues and minimize expenses across bank operations.Ranked 23 rd nationally in profitability by successfully tracking and managing firm’s cost structure and loan/depositproduction to competitively position firm for market and asset growth.$4 million to $130 million growth in assets generated by launching community involvement and marketingprograms to build and expand operations from a single bank office with 7 employees to three bank branches with32 employees.Delivered profitability in 50% less time versus other bank branches by planning and coordinating efforts toidentify and secure Oregon City as a high-growth target for a branch location.

STEPHEN WAY, Professional Experience…Continued Page 2 of 2Selected Achievements Continued…Generated significant increase in lease income to more than offset depreciation expense by overseeing theconceptual design and build-out of a new city branch facility that boosted branch profitability in 50% less time.$1 million average balance for a key account secured by introducing a remote deposit system to assist a propertymanagement firm in expediting the collection of account funds.Improved staff performance and shareholder value by initiating a successful launch of an online proxy votingsystem.Successfully retained a profitable banking relationship by creating and aligning a new loan product with termsoutside of normal product offerings to accommodate customer financing needs.Consistently ranked high in national profitability by leading efforts to establish a comprehensive, bottoms-upstrategic planning process with buy-in from key stakeholders to track and measure plan performance against actualresults.BANK OF SALEM – Salem, OR 1990–1999Executive VP & CFOLocal bank serving Salem, Portland, and Tigard communities with assets exceeding $175 million.Led day-to-day bank operations with oversight for the P&L, financial/budget reporting, investment portfolioperformance, interest rate risk management, and financial audits/examinations. Partnered with CEO and board ofdirectors to design and implement annual strategic plan. Managed and trained 30 employees that included 10 directreports. Identified and negotiated a cost-effective solution to quickly convert an existing system to an outsourced dataprocessor in response to a system termination due to Y2K.$10,000+ saved annually by leading an in-house initiative to develop and align investor collateral materials(annual reports/proxy materials) with industry best practices.Consistently ranked in top 10% of peer group for ROI performance by tracking and managing total returns andyield curve positions for an investment portfolio.Accomplished one of the lowest efficiency ratios in the industry versus a high 60% efficiency ratio on average formost nationwide banks by developing and implementing effective cost management processes and tools acrossoperations.50% improvement in reporting accuracy and productivity achieved by designing a financial reporting tool thatwent above and beyond financial reporting requirements of federal regulators.FAMILY FEDERAL SAVINGS & LOAN ASSOCIATION – Dallas, OR 1983–1990President / CEO (1989 – 1990) ; EVP / CFO (1985 – 1989)Community-based financial institution.Oversaw operations for community bank with responsibility for eight branch offices, $150 million in assets, and 50+employees. Provided financial management for a securities and liquidity portfolio. Implemented an asset/liabilitymanagement system. Reported and reviewed monthly financial results with directors, identifying opportunities forprofit improvement.10% reduction in operating costs with four-fold increase in mortgage originations generated within six months byrevamping antiquated loan underwriting criteria without compromising credit standards and pricing requirements.20% cut in overhead costs garnered by successfully negotiating the profitable sale of three unprofitable branches.$50 million investment in government securities garnered by presenting a plan to board of directors to use andmanage excess funds for investment in a government securities portfolio.Previous Position: Controller (1983–1985)EDUCATIONM.B.A. (Finance Emphasis), Willamette University—Atkinson School of Management, Salem, ORB.A. in Political Science (Pre-law), Washington State University, Pullman, WA607 Shadow Ridge Court ♦ Silverton, OR 97381 ♦ T: (503) 873-6426; M: (503) 559-4667 ♦ way607@verizon.net