4600000 Shares Apple Computer, Inc. - The SWTPC Computer ...

4600000 Shares Apple Computer, Inc. - The SWTPC Computer ...

4600000 Shares Apple Computer, Inc. - The SWTPC Computer ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

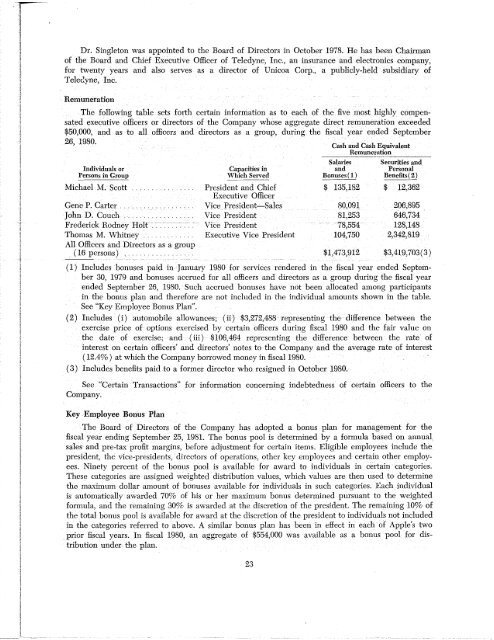

Dr. Singleton was appointed to the Board of Directors in October 1978. He has been Chairmanof the Board and Chief Executive Officer of Teledyne, <strong>Inc</strong>., an insurance and electronics company,for twenty years and also serves as a director of Unicoa Corp., a publicly-held subsidiary ofTeledyne, <strong>Inc</strong>.Remuneration<strong>The</strong> following table sets forth certain information as to each of the five most highly compensatedexecutive officers or directors of the Company whose aggregate direct remuneration exceeded$50,000, and as to all officers and directors as a group, during the fiscal year ended September26, 1980.Cash and Cash EquivalentRemunerationIndividuals orPersons in GroupMichael M. ScottGene P. Carter .......... .John D. Couch ............ .Frederick Rodney Holt-.-.. - ...... .Thomas M. Whitney ......... .All Officers and Directors as a group( 16 persons) .......... .Capacities inWhich ServedPresident and ChiefExecutive OfficerVice President-SalesVice PresidentVice PresidentExecutive Vice PresidentSalaries Securities andandPersonalBonuses(!) Benefits ( 2)$ 135,182 $ 12,36280,091 206,89581,253 646,73478,554 128,148104,750 2,342,819$1,473,912 $3,419,703(3)( 1) <strong>Inc</strong>ludes bonuses paid in January 1980 for services rendered in the fiscal year ended September30, 1979 and bonuses accrued for all officers and directors as a group during the fiscal yearended September 26, 1980. Such accrued bonuses have not been allocated among participantsin the bonus plan and therefore are not included in the individual amounts shown in the table.See ''Key Employee Bonus Plan".( 2) <strong>Inc</strong>ludes ( i) automobile allowances; ( ii) $3,272,488 representing the difference between theexercise price of options exercised by certain officers during fiscal 1980 and the fair value onthe date of exercise; and (iii) $106,464 representing the difference between the rate ofinterest on certain officers' and directors' notes to the Company and the average rate of interest( 12.4%) at which the Company borrowed money in fiscal1980.( 3) <strong>Inc</strong>ludes benefits paid to a former director who resigned in October 1980.See "Certain Transactions" for information concerning indebtedness of certain officers to theCompany.Key Employee Bonus Plan<strong>The</strong> Board of Directors of the Company has adopted a bonus plan for management for thefiscal year ending September 25, 1981. <strong>The</strong> bonus pool is determined by a formula based on annualsales and pre-tax profit margins, before adjustment for certain items. Eligible employees include thepresident, the vice-presidents, directors of operations, other key employees and certain other employees.Ninety percent of the bonus pool is available for award to individuals in certain categories.<strong>The</strong>se categories are assigned weighted distribution values, which values are then used to determinethe maximum dollar amount of bonuses available for individuals in such categories. Each individualis automatically awarded 70% of his or her maximum bonus determined pursuant to the weightedformula, and the remaining 30% is awarded at the discretion of the president. <strong>The</strong> remaining 10% ofthe total bonus pool is available for award at the discretion of the president to individuals not includedin the categories referred to above. A similar bonus plan has been in effect in each of <strong>Apple</strong>'s twoprior fiscal years. In fiscal 1980, an aggregate of $554,000 was available as a bonus pool for distributionunder the plan.23