4600000 Shares Apple Computer, Inc. - The SWTPC Computer ...

4600000 Shares Apple Computer, Inc. - The SWTPC Computer ...

4600000 Shares Apple Computer, Inc. - The SWTPC Computer ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

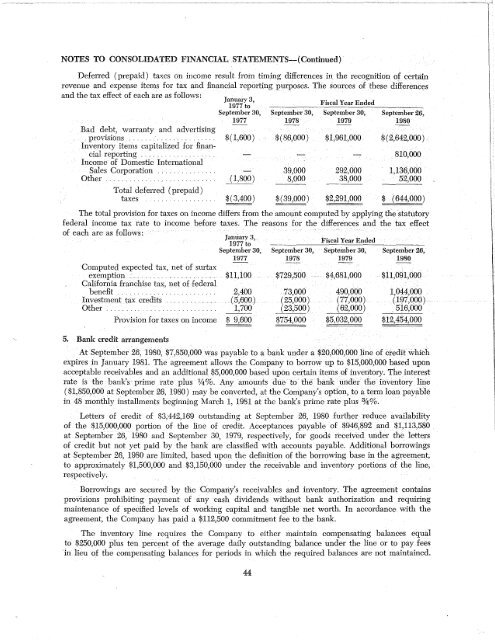

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued)Deferred (prepaid) taxes on income result from timing differences in the recognition of certainrevenue and expense items for tax and financial reporting purposes. <strong>The</strong> sources of these differencesand the tax effect of each are as follows:January 3,1977toSeptember 30,1977Bad debt, warranty and advertisingprovisions . . . . . . . . . . . . . . . . . . . . . . $ ( 1,600)Inventory items capitalized for financialreporting .....<strong>Inc</strong>ome of Domestic InternationalSales Corporation ..·........ .Other . . . . . . . . . ( 1,800)Total deferred (prepaid)taxes . . . . . . . . . $(3,400)September 30,1978$(86,000)39,0008,000$(39,000)Fiscal Year EndedSeptember 30,1979$1,961,000292,00038,000$2,291,000September 26,1980$(2,642,000)810,0001,136,00052,000$ (644,000)<strong>The</strong> total provision for taxes on income differs from the amount computed by applying the statutoryfederal income tax rate to income before taxes. <strong>The</strong> reasons for the differences and the tax effectof each are as follows:Computed expected tax, net of surtaxexemption ..................... .California franchise tax, net of federalbenefit . . . . ......... .Investment tax credits ....... .Other .............. .Provision for taxes on income5. Bank credit arrangementsJanuary 3,1977 toSeptember 30,1977$11,1002,400(5,600)1,700$ 9,600.September 30,1978$729,50073;000(25,000)(23,1500)$754,000Fiscal Year EndedSeptember 30, September 26,1979 1980$4,681,000 $11,091,000490,000 1,044,000(77,000) (197,000)(62,000) 516,000$5,032,000 $12,454,000At September 26, 1980, $7,850,000 was payable to a bank under a $20,000,000 line of credit whichexpires in January 1981. <strong>The</strong> agreement allows the Company to borrow up to $15,000,000 based uponacceptable receivables and an additional $5,000,000 based upon ceJ.tain items of inventory. <strong>The</strong> interestrate is the bank's prime rate plus 1/4%. Any amounts due to the hank under the inventory line( $1,850,000 at September 26, 1980) may be converted, at the Company's option, to a term loan payablein 48 monthly installments beginning March 1, 1981 at the bank's prime rate plus %%.Letters of credit of $3,442,169 outstanding at September 26, 1980 further reduce availabilityof the $15,000,000 portion of the line of credit. Acceptances payable of $946,892 and $1,113,580at September 26, 1980 and September 30, 1979, respectively, for goods received under the lettersof credit but not yet paid by the bank are classified with accounts payable. Additional borrowingsat September 26, 1980 are limited, based upon the definition of the borrowing base in the agreement,to approximately $1,500,000 and $3,150,000 under the receivable and inventory portions of the line,respectively.Borrowings are secured by the Company's receivables and inventory. <strong>The</strong> agreement containsproVisions prohibiting payment of any cash dividends without bank authorization and requiringmaintenance of specified levels of working capital and tangible net worth. In accordance with theagreement, the Company has paid a $112,500 commitment fee to the bank.<strong>The</strong> inventory line requires the Company to either maintain compensating balances equalto $250,000 plus ten percent of the average daily outstanding balance under the line or to pay fees~l.n lieu of the compensating balances for periods in which the required balances are not maintained.44