Leighton Asia News, April 2005 - Leighton Holdings

Leighton Asia News, April 2005 - Leighton Holdings

Leighton Asia News, April 2005 - Leighton Holdings

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

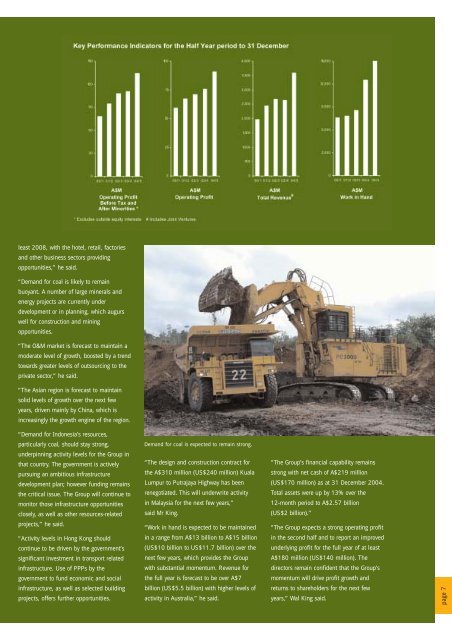

least 2008, with the hotel, retail, factoriesand other business sectors providingopportunities,” he said.“Demand for coal is likely to remainbuoyant. A number of large minerals andenergy projects are currently underdevelopment or in planning, which augurswell for construction and miningopportunities.“The O&M market is forecast to maintain amoderate level of growth, boosted by a trendtowards greater levels of outsourcing to theprivate sector,” he said.“The <strong>Asia</strong>n region is forecast to maintainsolid levels of growth over the next fewyears, driven mainly by China, which isincreasingly the growth engine of the region.“Demand for Indonesia’s resources,particularly coal, should stay strong,Demand for coal is expected to remain strong.underpinning activity levels for the Group inthat country. The government is activelypursuing an ambitious infrastructuredevelopment plan; however funding remainsthe critical issue. The Group will continue tomonitor those infrastructure opportunitiesclosely, as well as other resources-relatedprojects,” he said.“The design and construction contract forthe A$310 million (US$240 million) KualaLumpur to Putrajaya Highway has beenrenegotiated. This will underwrite activityin Malaysia for the next few years,”said Mr King.“Work in hand is expected to be maintained“The Group’s financial capability remainsstrong with net cash of A$219 million(US$170 million) as at 31 December 2004.Total assets were up by 13% over the12-month period to A$2.57 billion(US$2 billion).”“The Group expects a strong operating profit“Activity levels in Hong Kong shouldcontinue to be driven by the government’ssignificant investment in transport relatedinfrastructure. Use of PPPs by thegovernment to fund economic and socialinfrastructure, as well as selected buildingprojects, offers further opportunities.in a range from A$13 billion to A$15 billion(US$10 billion to US$11.7 billion) over thenext few years, which provides the Groupwith substantial momentum. Revenue forthe full year is forecast to be over A$7billion (US$5.5 billion) with higher levels ofactivity in Australia,” he said.in the second half and to report an improvedunderlying profit for the full year of at leastA$180 million (US$140 million). Thedirectors remain confident that the Group’smomentum will drive profit growth andreturns to shareholders for the next fewyears,” Wal King said.page 7