Semi-Annual Reports and Accounts - Fidelity Worldwide Investment

Semi-Annual Reports and Accounts - Fidelity Worldwide Investment

Semi-Annual Reports and Accounts - Fidelity Worldwide Investment

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

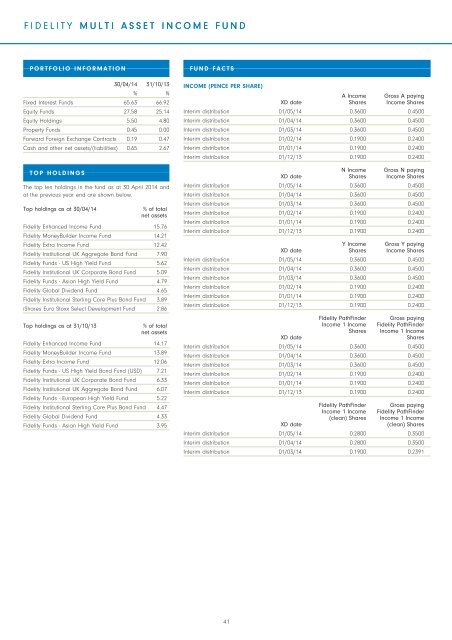

FIDELITYMULTI ASSET INCOME FUNDPORTFOLIO INFORMATION30/04/14 31/10/13% %Fixed Interest Funds 65.63 66.92Equity Funds 27.58 25.14Equity Holdings 5.50 4.80Property Funds 0.45 0.00Forward Foreign Exchange Contracts 0.19 0.47Cash <strong>and</strong> other net assets/(liabilities) 0.65 2.67TOP HOLDINGSThe top ten holdings in the fund as at 30 April 2014 <strong>and</strong>at the previous year end are shown below.Top holdings as at 30/04/14% of totalnet assets<strong>Fidelity</strong> Enhanced Income Fund 15.76<strong>Fidelity</strong> MoneyBuilder Income Fund 14.21<strong>Fidelity</strong> Extra Income Fund 12.42<strong>Fidelity</strong> Institutional UK Aggregate Bond Fund 7.90<strong>Fidelity</strong> Funds - US High Yield Fund 5.62<strong>Fidelity</strong> Institutional UK Corporate Bond Fund 5.09<strong>Fidelity</strong> Funds - Asian High Yield Fund 4.79<strong>Fidelity</strong> Global Dividend Fund 4.65<strong>Fidelity</strong> Institutional Sterling Core Plus Bond Fund 3.89iShares Euro Stoxx Select Development Fund 2.86Top holdings as at 31/10/13% of totalnet assets<strong>Fidelity</strong> Enhanced Income Fund 14.17<strong>Fidelity</strong> MoneyBuilder Income Fund 13.89<strong>Fidelity</strong> Extra Income Fund 12.06<strong>Fidelity</strong> Funds - US High Yield Bond Fund (USD) 7.21<strong>Fidelity</strong> Institutional UK Corporate Bond Fund 6.33<strong>Fidelity</strong> Institutional UK Aggregate Bond Fund 6.07<strong>Fidelity</strong> Funds - European High Yield Fund 5.22<strong>Fidelity</strong> Institutional Sterling Core Plus Bond Fund 4.47<strong>Fidelity</strong> Global Dividend Fund 4.33<strong>Fidelity</strong> Funds - Asian High Yield Fund 3.95FUND FACTSINCOME (PENCE PER SHARE)A Income Gross A payingXD date Shares Income SharesInterim distribution 01/05/14 0.3600 0.4500Interim distribution 01/04/14 0.3600 0.4500Interim distribution 01/03/14 0.3600 0.4500Interim distribution 01/02/14 0.1900 0.2400Interim distribution 01/01/14 0.1900 0.2400Interim distribution 01/12/13 0.1900 0.2400N Income Gross N payingXD date Shares Income SharesInterim distribution 01/05/14 0.3600 0.4500Interim distribution 01/04/14 0.3600 0.4500Interim distribution 01/03/14 0.3600 0.4500Interim distribution 01/02/14 0.1900 0.2400Interim distribution 01/01/14 0.1900 0.2400Interim distribution 01/12/13 0.1900 0.2400Y Income Gross Y payingXD date Shares Income SharesInterim distribution 01/05/14 0.3600 0.4500Interim distribution 01/04/14 0.3600 0.4500Interim distribution 01/03/14 0.3600 0.4500Interim distribution 01/02/14 0.1900 0.2400Interim distribution 01/01/14 0.1900 0.2400Interim distribution 01/12/13 0.1900 0.2400<strong>Fidelity</strong> PathFinder Gross payingIncome 1 Income <strong>Fidelity</strong> PathFinderShares Income 1 IncomeXD dateSharesInterim distribution 01/05/14 0.3600 0.4500Interim distribution 01/04/14 0.3600 0.4500Interim distribution 01/03/14 0.3600 0.4500Interim distribution 01/02/14 0.1900 0.2400Interim distribution 01/01/14 0.1900 0.2400Interim distribution 01/12/13 0.1900 0.2400<strong>Fidelity</strong> PathFinder Gross payingIncome 1 Income <strong>Fidelity</strong> PathFinder(clean) Shares Income 1 IncomeXD date(clean) SharesInterim distribution 01/05/14 0.2800 0.3500Interim distribution 01/04/14 0.2800 0.3500Interim distribution 01/03/14 0.1900 0.239141