VISA Steel Limited Annual Report 2007-08

VISA Steel Limited Annual Report 2007-08

VISA Steel Limited Annual Report 2007-08

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

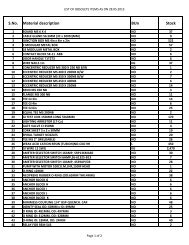

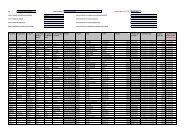

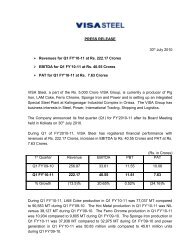

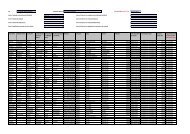

<strong>VISA</strong> <strong>Steel</strong> <strong>Limited</strong>schedulesto the CONSOLIDATED balance sheetRs. Million31 March 20<strong>08</strong> 31 March <strong>2007</strong><strong>VISA</strong> <strong>Steel</strong> <strong>Limited</strong>schedulesto the CONSOLIDATED balance sheet and Profit & loss accountRs. Million31 March 20<strong>08</strong> 31 March <strong>2007</strong>5 Inventories - At lower of Cost or Net Realisable ValueStores & Spares* 118.04 58.59Raw Materials** 1,484.62 890.58Finished Goods*** 981.65 189.71By-Products 167.94 41.49Work-in-Progress 36.14 14.752,788.39 1,195.12* Including Capital items lying in stores 76.54 35.19** Including materials in Transit - 196.41*** Including goods lying with Consignment Agents 5.65 2.046 Sundry Debtors - UnsecuredDebts Outstanding for a period exceeding six monthsConsidered Good 138.74 10.38Considered Doubtful 0.34 52.68Other debts-Considered Good 824.66 403.35963.74 466.41Less : Provision for Doubful Debts 0.34 52.68963.40 413.739 LiabilitiesSundry Creditors 4,478.69 1,759.38Advance from Customers 35.61 33.<strong>08</strong>Other Liabilities 194.53 31.79Share Refund Order Account 0.34 0.38Add : Share of Joint Venture [Refer Note 10 Schedule 16] 0.04 0.0310 Provisions4,709.21 1,824.66Leave Encashment 5.25 -Fringe Benefit Tax - 1.36[Net of Advance payment of Tax Rs Nil (<strong>2007</strong> Rs 6.64 Million)]Proposed Dividend 110.00 -Income Tax on Proposed Dividend 18.69 -133.94 1.3611 Miscellaneous Expenditure[To the extent not written off or adjusted]Share Issue Expenses 78.10 104.8878.10 104.88<strong>Annual</strong> <strong>Report</strong> <strong>2007</strong>-<strong>08</strong>7 Cash and Bank BalancesCash and Cheques in Hand 1.19 20.86Balance with Scheduled Banks in :Current Account 297.<strong>08</strong> 82.64Share Refund Order Account 0.34 0.38Fixed Deposit Account 562.34 1,629.83860.95 1,733.718 Loans and Advance - Unsecured, Considered GoodAdvances Recoverable in Cash or in kind or 794.74 371.87for value to be receivedDeposits withCustoms, Port Trust etc. 6.58 6.56Others 159.77 77.33Advance Payment of Income Tax 14.11 10.63[Net of Provision Rs. 169.33 Million (<strong>2007</strong>; Rs 85.32 Million)]Fringe Benefit Tax 0.64 -[Net of Provision Rs. 12.60 Million (<strong>2007</strong>; Rs. Nil)]Add : Share of Joint Venture [Rs. 1,364 (<strong>2007</strong>; Rs. Nil)][Refer Note 10 Schedule 16] - -975.84 466.3912 SalesSales 7,002.18 5,618.11Less : Excise Duty on sales 194.53 306.316,807.65 5,311.8013 Other IncomeInsurance Claim received 4.02 17.89Gain on Exchange Fluctuation (net) - 4.04Miscellaneous Income 16.38 45.5514 Materials20.40 67.48Raw Material ConsumedOpening Stock 890.58 527.81Add : Purchase 3,335.57 2,200.73Less : Closing stock 1,484.62 2,741.53 890.58 1,837.96Purchase of Finished Goods 2,977.38 2,280.93(Increase)/Decrease in StockOpening StockFinished Goods 189.71 548.30By-Products 41.49 12.05Work-in-Progress 14.75 1.90245.95 562.25Less : Closing StockFinished Goods 981.65 189.71By-Products 167.94 41.49Work-in-Progress 36.14 14.751,185.73 (939.78) 245.95 316.30Increase/(Decrease) in Excise Duty on Stock 67.82 (15.24)4,846.95 4,419.9597