VISA Steel Limited Annual Report 2007-08

VISA Steel Limited Annual Report 2007-08

VISA Steel Limited Annual Report 2007-08

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

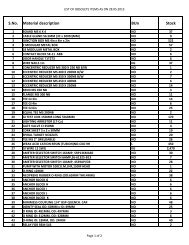

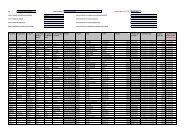

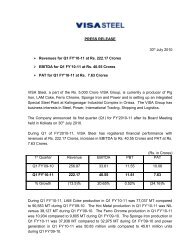

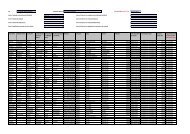

Ghotaringa Minerals <strong>Limited</strong>SCHEDULESTO THE BALANCE SHEETGhotaringa Minerals <strong>Limited</strong>SCHEDULESTO THE PROFIT AND LOSS ACCOUNTSCHEDULE : 1SHARE CAPITALAUTHORISED :10,00,000 Equity Shares of Rs.10 each 10,000,000.00 10,000,000.00ISSUED, SUBSCRIBED AND PAID UP :10,00,000 Equity Shares of Rs.10 each 10,000,000.00 10,000,000.00( Notes below)10,000,000.00 10,000,000.00NOTES :(1) Of above 1,10,000 Equity shares of Rs.10 each were allotted forconsideration other than cash pursuant to the terms of a Joint VentureAgreement for using a Prospecting Licence.(2) 8,90,000 Equity Shares of Rs 10 each are held by Visa <strong>Steel</strong> <strong>Limited</strong>(immediate holding company) and its nominees.SCHEDULE : 2CASH AND BANK BALANCESCash in hand - -Balances with Scheduled Bank :- in Current Account 983,<strong>08</strong>2.98 415,733.83- in Term deposits 3,000,000.00 5,000,000.003,983,<strong>08</strong>2.98 5,415,733.83SCHEDULE : 3OTHER CURRENT ASSETSInterest on term deposits accrued from ICICI bank 11,975.00 200,922.0011,975.00 200,922.00SCHEDULE : 4LOANS AND ADVANCESDue from a Company in which a director is a director (Note 2 Schedule 7) 469,147.00 469,147.00(Maximum amount due at anytime during the year Rs 469147, py Rs 469147)Income Tax Deducted at Source 143,059.00 78,100.00612,206.00 547,247.00SCHEDULE : 5CURRENT LIABILITIES AND PROVISIONSCURRENT LIABILITIESSundry Creditors (Note 3 on Schedule 7) 142,024.00 129,222.00PROVISIONSProvision for taxation 8,000.00 -(Rs.)As atAs at31 March 20<strong>08</strong> 31 March <strong>2007</strong>150,024.00 129,222.0SCHEDULE : 6(Rs.)<strong>2007</strong>-<strong>08</strong> 2006-07EXPENSESLegal Expenses 2,250.00 750.00Filing Fees 4,500.00 1,560.00Auditor’s Remuneration ( Note 6 on Schedule 7) 14,045.00 13,468.00Directors’ Sitting Fees (Note 7 on Schedule 7) 105,000.00 51,000.00Other Expenses 1,2<strong>08</strong>.65 5,185.05Preliminary expenses written off - -Business Promotion Expenses 44,430.00 30,000.00Car Hire Charges 10,191.00 15,539.00Printing Stationery - 7,270.00Travelling Expenses 14,566.20 24,540.00Debits Written Off - -196,190.85 149,312.05SCHEDULE : 7A. SIGNIFICANT ACCOUNTING POLICIESa. Basis of preparation of financial statementsThe financial statements have been prepared and presented under the historical cost convention on the accrualbasis of accounting and comply with the accounting standards issued by the Institute of Chartered Accountants ofIndia (ICAI) and the relevant provisions of the Companies Act, 1956 (the ‘Act’) to the extent applicable.b. Use of estimatesThe preparation of financial statements in conformity with the generally accepted accounting principles requiresmanagement to make estimates and assumptions that affect the reported amounts of income and expenses of theperiod, assets and liabilities and disclosures relating to contingent liabilities as of the date of the financial statements.Actual results could differ from those estimates. Any revision to accounting estimates is recognized prospectively infuture periods.c. Revenue recognitionThe revenue is recognized to the extent that it is probable that the economic benefits will flow to the company andthe revenue can be reliably measured. Revenue from sales of goods is recognized upon passage of title to thecustomer, which generally coincides with their delivery.Dividend income is recognized when the right to receive payment is established.Interest income is recognized using the time proportion method, based on the transactional interest rates.d. Retirement BenefitsThe Company has not started its operation and rules relating to retirement benefits have not yet become applicableto its employees. Hence, no provision has been made for the retirement benefits under AS 15.e. Fixed AssetsFixed assets are stated at original cost net of tax / duty credits availed if any, less accumulated depreciation. Costincludes pre-operative expenses and all expenses related to acquisition and installation of the concerned assets.Financing costs relating to acquisition of fixed assets are also included to the extent they relate to the period till suchassets are ready to be put to use.<strong>Annual</strong> <strong>Report</strong> <strong>2007</strong>-<strong>08</strong>117