Interim Report 2012 - TodayIR.com

Interim Report 2012 - TodayIR.com

Interim Report 2012 - TodayIR.com

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

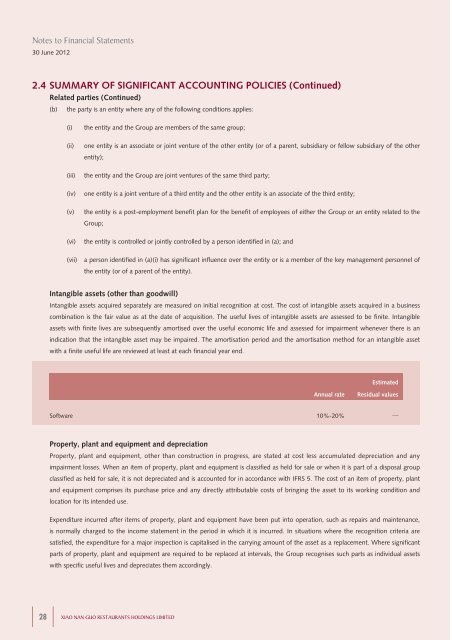

Notes to Financial Statements30 June <strong>2012</strong>2.4 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)Related parties (Continued)(b)the party is an entity where any of the following conditions applies:(i)(ii)(iii)(iv)(v)(vi)the entity and the Group are members of the same group;one entity is an associate or joint venture of the other entity (or of a parent, subsidiary or fellow subsidiary of the otherentity);the entity and the Group are joint ventures of the same third party;one entity is a joint venture of a third entity and the other entity is an associate of the third entity;the entity is a post-employment benefit plan for the benefit of employees of either the Group or an entity related to theGroup;the entity is controlled or jointly controlled by a person identified in (a); and(vii) a person identified in (a)(i) has significant influence over the entity or is a member of the key management personnel ofthe entity (or of a parent of the entity).Intangible assets (other than goodwill)Intangible assets acquired separately are measured on initial recognition at cost. The cost of intangible assets acquired in a business<strong>com</strong>bination is the fair value as at the date of acquisition. The useful lives of intangible assets are assessed to be finite. Intangibleassets with finite lives are subsequently amortised over the useful economic life and assessed for impairment whenever there is anindication that the intangible asset may be impaired. The amortisation period and the amortisation method for an intangible assetwith a finite useful life are reviewed at least at each financial year end.EstimatedAnnual rateResidual valuesSoftware 10%-20% Property, plant and equipment and depreciationProperty, plant and equipment, other than construction in progress, are stated at cost less accumulated depreciation and anyimpairment losses. When an item of property, plant and equipment is classified as held for sale or when it is part of a disposal groupclassified as held for sale, it is not depreciated and is accounted for in accordance with IFRS 5. The cost of an item of property, plantand equipment <strong>com</strong>prises its purchase price and any directly attributable costs of bringing the asset to its working condition andlocation for its intended use.Expenditure incurred after items of property, plant and equipment have been put into operation, such as repairs and maintenance,is normally charged to the in<strong>com</strong>e statement in the period in which it is incurred. In situations where the recognition criteria aresatisfied, the expenditure for a major inspection is capitalised in the carrying amount of the asset as a replacement. Where significantparts of property, plant and equipment are required to be replaced at intervals, the Group recognises such parts as individual assetswith specific useful lives and depreciates them accordingly.28XIAO NAN GUO RESTAURANTS HOLDINGS LIMITED