Interim Report 2012 - TodayIR.com

Interim Report 2012 - TodayIR.com

Interim Report 2012 - TodayIR.com

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

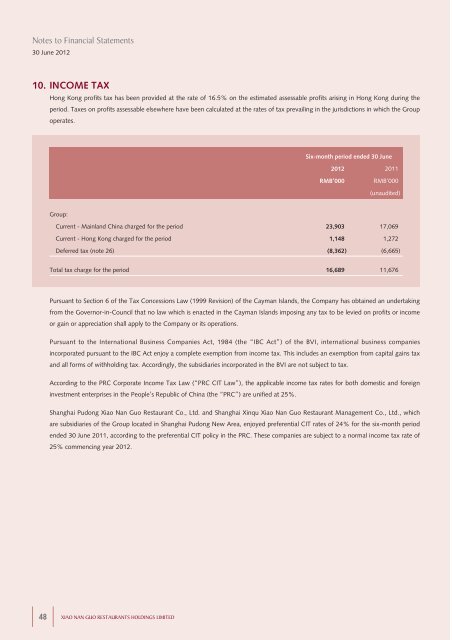

Notes to Financial Statements30 June <strong>2012</strong>10. INCOME TAXHong Kong profits tax has been provided at the rate of 16.5% on the estimated assessable profits arising in Hong Kong during theperiod. Taxes on profits assessable elsewhere have been calculated at the rates of tax prevailing in the jurisdictions in which the Groupoperates.Six-month period ended 30 June<strong>2012</strong> 2011RMB’000RMB’000(unaudited)Group:Current - Mainland China charged for the period 23,903 17,069Current - Hong Kong charged for the period 1,148 1,272Deferred tax (note 26) (8,362) (6,665)Total tax charge for the period 16,689 11,676Pursuant to Section 6 of the Tax Concessions Law (1999 Revision) of the Cayman Islands, the Company has obtained an undertakingfrom the Governor-in-Council that no law which is enacted in the Cayman Islands imposing any tax to be levied on profits or in<strong>com</strong>eor gain or appreciation shall apply to the Company or its operations.Pursuant to the International Business Companies Act, 1984 (the “IBC Act”) of the BVI, international business <strong>com</strong>paniesincorporated pursuant to the IBC Act enjoy a <strong>com</strong>plete exemption from in<strong>com</strong>e tax. This includes an exemption from capital gains taxand all forms of withholding tax. Accordingly, the subsidiaries incorporated in the BVI are not subject to tax.According to the PRC Corporate In<strong>com</strong>e Tax Law (“PRC CIT Law”), the applicable in<strong>com</strong>e tax rates for both domestic and foreigninvestment enterprises in the People’s Republic of China (the “PRC”) are unified at 25%.Shanghai Pudong Xiao Nan Guo Restaurant Co., Ltd. and Shanghai Xinqu Xiao Nan Guo Restaurant Management Co., Ltd., whichare subsidiaries of the Group located in Shanghai Pudong New Area, enjoyed preferential CIT rates of 24% for the six-month periodended 30 June 2011, according to the preferential CIT policy in the PRC. These <strong>com</strong>panies are subject to a normal in<strong>com</strong>e tax rate of25% <strong>com</strong>mencing year <strong>2012</strong>.48XIAO NAN GUO RESTAURANTS HOLDINGS LIMITED