Interim Report 2012 - TodayIR.com

Interim Report 2012 - TodayIR.com

Interim Report 2012 - TodayIR.com

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

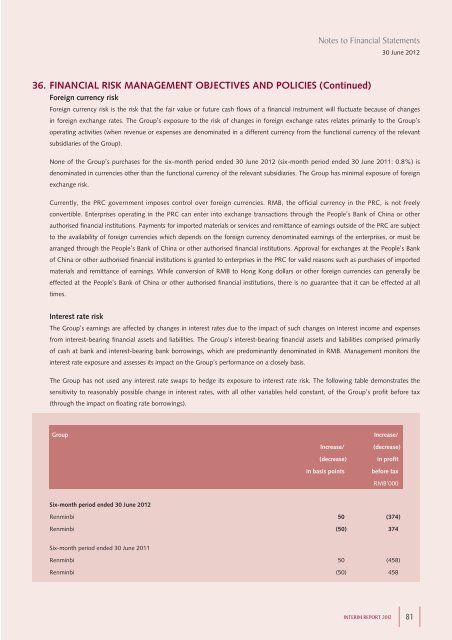

Notes to Financial Statements30 June <strong>2012</strong>36. FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (Continued)Foreign currency riskForeign currency risk is the risk that the fair value or future cash flows of a financial instrument will fluctuate because of changesin foreign exchange rates. The Group’s exposure to the risk of changes in foreign exchange rates relates primarily to the Group’soperating activities (when revenue or expenses are denominated in a different currency from the functional currency of the relevantsubsidiaries of the Group).None of the Group’s purchases for the six-month period ended 30 June <strong>2012</strong> (six-month period ended 30 June 2011: 0.8%) isdenominated in currencies other than the functional currency of the relevant subsidiaries. The Group has minimal exposure of foreignexchange risk.Currently, the PRC government imposes control over foreign currencies. RMB, the official currency in the PRC, is not freelyconvertible. Enterprises operating in the PRC can enter into exchange transactions through the People’s Bank of China or otherauthorised financial institutions. Payments for imported materials or services and remittance of earnings outside of the PRC are subjectto the availability of foreign currencies which depends on the foreign currency denominated earnings of the enterprises, or must bearranged through the People’s Bank of China or other authorised financial institutions. Approval for exchanges at the People’s Bankof China or other authorised financial institutions is granted to enterprises in the PRC for valid reasons such as purchases of importedmaterials and remittance of earnings. While conversion of RMB to Hong Kong dollars or other foreign currencies can generally beeffected at the People’s Bank of China or other authorised financial institutions, there is no guarantee that it can be effected at alltimes.Interest rate riskThe Group’s earnings are affected by changes in interest rates due to the impact of such changes on interest in<strong>com</strong>e and expensesfrom interest-bearing financial assets and liabilities. The Group’s interest-bearing financial assets and liabilities <strong>com</strong>prised primarilyof cash at bank and interest-bearing bank borrowings, which are predominantly denominated in RMB. Management monitors theinterest rate exposure and assesses its impact on the Group’s performance on a closely basis.The Group has not used any interest rate swaps to hedge its exposure to interest rate risk. The following table demonstrates thesensitivity to reasonably possible change in interest rates, with all other variables held constant, of the Group’s profit before tax(through the impact on floating rate borrowings).GroupIncrease/Increase/(decrease)in basis points(decrease)in profitbefore taxRMB’000Six-month period ended 30 June <strong>2012</strong>Renminbi 50 (374)Renminbi (50) 374Six-month period ended 30 June 2011Renminbi 50 (458)Renminbi (50) 458INTERIM REPORT <strong>2012</strong> 81