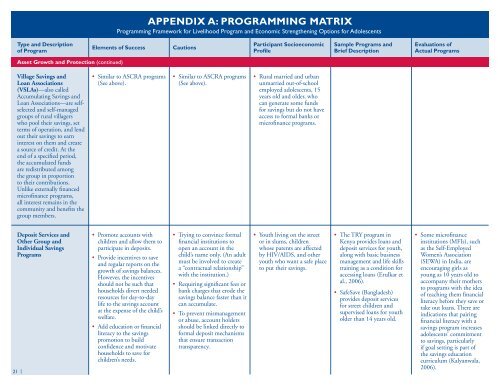

APPENDIX A: PROGRAMMING MATRIXProgramming Framework for Livelihood Program and Economic Strengthening Options for Adolescents2Type and Description Participant Socioeconomic Sample Programs and Evaluations ofElements of Success Cautions3of Program Profile Brief Description Actual ProgramsAsset Growth and Protection1Rotating Savings andCredit Associations(ROSCAs)—groups thatcollect monthly deposits,which are pooled and givento one person in the groupto use each month on arotating basis. There is noaccumulation of value orinterest paid. The advantagefor the participants is thatit is a way to access a largesum of money at one time.• Accumulating Savingsand Credit Associations(ASCRAs)—if the fundof a ROSCA is notdistributed regularlybut accumulates, it iscalled an ASCRA. Themembers save collectively.The capital is “invested”in loans to one or moremembers of the ASCRA.As they redeem the loanand pay interest, theavailable capital grows sothat more new loans canbe given to the members.• These savings groups allowthe participation of peoplewho do not fit standardmicrofinance, such as youth,as a means of building assetsfor the future, coveringperiodic expenses, andweathering economicshocks.• Ensure that the cycle ofsavings and lending inASCRAs is time-bound(usually between 6 and 12months). At the end of thisperiod, the accumulatedsavings, interest earnings,and income should bereturned to members tomaximize transparency andaccountability.• Allow each group to makeits own decisions as part ofits formation, including howgroup members will saveand lend out funds; meetingfrequency; and otherbylaws. Financial servicesmust match the needs andcapacity of the community.• Verify that groups operatesimple and transparentsystems—managed by asmall elected committee—with all activities carried outin front of members.• A key concept of a ROSCA/ASCRA is strong socialcohesion and mutualtrust. Groups must beself-selected, not externallyconvened.• Groups of youth need adultsupport only.• Loans to ROSCA/ASCRA structures fromoutside the group weakencohesion, with the qualityof repayment declining asparticipants no longer seethe funds as their own. 4• Facilitators should bemotivated to developstrong, independent, highfunctioninggroups that canmanage their own decisionsand transactions.• Unmarried and married,in-school and out of school,rural and urban boys andgirls, 15 years and older.• Group or individualsavings and deposit servicesdescribed below areprobably more appropriatein urban areas, where thereare formal banks, than eitherROSCAs or Village Savingsand Loan Associations,which function where thereare no formal financialservices available. There are,however, many examples ofurban ROSCAs.• There are many throughoutthe world; although, theseusually are not sponsoredby development projectsbut rather are formedinformally by groupsof adults. In the case ofadolescents, youth programswith an educational focusmay introduce them as acomplementary componentto financial literacy, sexeducation, or vocationaltraining as a way of teachingmoney management skills.• Worth Model (EastAfrica)—women pool theirsavings as a prerequisite totaking out a loan.• ROSCAs may not bethe ideal mechanism foraccumulating funds foreducational expenses;almost all memberswill need funds at thesame time. They may bemore useful for makingcapital investments or forpaying for non-formaleducational courses thatare not on a strict academicschedule. They also maybe useful for coveringadolescents’ personal itemsthat otherwise might besought through gifts intheir romantic/sexualrelationships.• Married girls who havelittle access to assets wouldbenefit if a ROSCA waspart of a program thatalso supported investmentin productive assets.The social dimension ofthe ROSCAs is also anadvantage for extendingsocial networks (seeexamples under the SocialCapital Formation tablebelow).20 |4If loans are made to ASCRAs, they should be to the group rather than to individuals.

APPENDIX A: PROGRAMMING MATRIXProgramming Framework for Livelihood Program and Economic Strengthening Options for Adolescents 1Type and Descriptionof ProgramElements of SuccessCautionsParticipant SocioeconomicProfile2Sample Programs and3Brief DescriptionEvaluations ofActual ProgramsAsset Growth and Protection (continued)Village Savings and • Similar to ASCRA programs • Similar to ASCRA programs • Rural married and urbanLoan Associations(VSLAs)—also calledAccumulating Savings andLoan Associations—are selfselectedand self-managedgroups of rural villagerswho pool their savings, setterms of operation, and lendout their savings to earninterest on them and createa source of credit. At theend of a specified period,the accumulated fundsare redistributed amongthe group in proportionto their contributions.Unlike externally financedmicrofinance programs,all interest remains in thecommunity and benefits thegroup members.(See above). (See above). unmarried out-of-schoolemployed adolescents, 15years old and older, whocan generate some fundsfor savings but do not haveaccess to formal banks ormicrofinance programs.Deposit Services and • Promote accounts with • Trying to convince formal • Youth living on the street • The TRY program in • Some microfinanceOther Group andchildren and allow them to financial institutions to or in slums, children Kenya provides loans and institutions (MFIs), suchIndividual Savingsparticipate in deposits. open an account in the whose parents are affected deposit services for youth, as the Self-EmployedPrograms• Provide incentives to savechild’s name only. (An adult by HIV/AIDS, and other along with basic business Women’s Associationand regular reports on themust be involved to create youth who want a safe place management and life skills (SEWA) in India, aregrowth of savings balances.a “contractual relationship” to put their savings. training as a condition for encouraging girls asHowever, the incentiveswith the institution.) accessing loans (Erulkar et young as 10 years old toshould not be such that • Requiring significant fees oral., 2006).accompany their mothershouseholds divert needed bank charges that erode theto programs with the idea• SafeSave (Bangladesh)resources for day-to-day savings balance faster than itof teaching them financialprovides deposit serviceslife to the savings account can accumulate.literacy before they save orfor street children andat the expense of the child’stake out loans. There are• To prevent mismanagement supervised loans for youthwelfare.indications that pairingor abuse, account holders older than 14 years old. financial literacy with a• Add education or financial should be linked directly to savings program increasesliteracy to the savings formal deposit mechanisms adolescents’ commitmentpromotion to build that ensure transaction to savings, particularlyconfidence and motivate transparency. if goal setting is part of21 |households to save forchildren’s needs.the savings educationcurriculum (Kalyanwala,2006).