LIVELIHOOD OPTIONS FOR GIRLS: - Health Policy Initiative

LIVELIHOOD OPTIONS FOR GIRLS: - Health Policy Initiative

LIVELIHOOD OPTIONS FOR GIRLS: - Health Policy Initiative

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

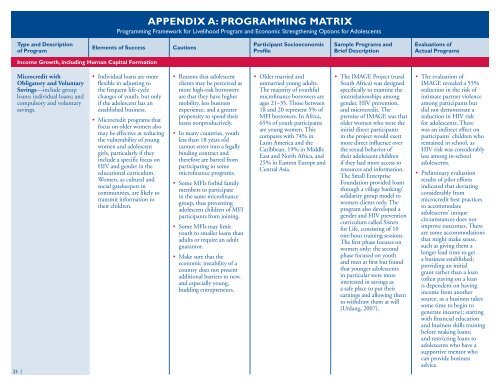

APPENDIX A: PROGRAMMING MATRIXProgramming Framework for Livelihood Program and Economic Strengthening Options for Adolescents 1Type and Descriptionof ProgramElements of SuccessCautionsParticipant SocioeconomicProfile2Sample Programs and3Brief DescriptionEvaluations ofActual ProgramsIncome Growth, including Human Capital FormationMicrocredit withObligatory and VoluntarySavings—include grouploans; individual loans; andcompulsory and voluntarysavings.23 |• Individual loans are moreflexible in adjusting tothe frequent life-cyclechanges of youth, but onlyif the adolescent has anestablished business.• Microcredit programs thatfocus on older women alsomay be effective at reducingthe vulnerability of youngwomen and adolescentgirls, particularly if theyinclude a specific focus onHIV and gender in theeducational curriculum.Women, as cultural andsocial gatekeepers incommunities, are likely totransmit information totheir children.• Reasons that adolescentclients may be perceived asmore high-risk borrowersare that they have highermobility, less businessexperience, and a greaterpropensity to spend theirloans nonproductively.• In many countries, youthless than 18 years oldcannot enter into a legallybinding contract andtherefore are barred fromparticipating in somemicrofinance programs.• Some MFIs forbid familymembers to participatein the same microfinancegroup, thus preventingadolescent children of MFIparticipants from joining.• Some MFIs may limityouth to smaller loans thanadults or require an adultguarantor.• Make sure that theeconomic instability of acountry does not presentadditional barriers to new,and especially young,budding entrepreneurs.• Older married andunmarried young adults.The majority of youthfulmicrofinance borrowers areages 21–35. Those between18 and 20 represent 5% ofMFI borrowers. In Africa,65% of youth participantsare young women. Thiscompares with 74% inLatin America and theCaribbean, 19% in MiddleEast and North Africa, and25% in Eastern Europe andCentral Asia.• The IMAGE Project (ruralSouth Africa) was designedspecifically to examine theinterrelationships amonggender, HIV prevention,and microcredit. Thepremise of IMAGE was thatolder women who were theinitial direct participantsin the project would exertmore direct influence overthe sexual behavior oftheir adolescent childrenif they had more access toresources and information.The Small EnterpriseFoundation provided loansthrough a village banking/solidarity group model towomen clients only. Theprogram also developed agender and HIV preventioncurriculum called Sistersfor Life, consisting of 10one-hour training sessions.The first phase focuses onwomen only; the secondphase focused on youthand men at first but foundthat younger adolescentsin particular were moreinterested in savings asa safe place to put theirearnings and allowing themto withdraw them at will(Urdang, 2007).• The evaluation ofIMAGE revealed a 55%reduction in the risk ofintimate partner violenceamong participants butdid not demonstrate areduction in HIV riskfor adolescents. Therewas an indirect effect onparticipants’ children whoremained in school, asHIV risk was considerablyless among in-schooladolescents.• Preliminary evaluationresults of pilot effortsindicated that deviatingconsiderably frommicrocredit best practicesto accommodateadolescents’ uniquecircumstances does notimprove outcomes. Thereare some accommodationsthat might make sense,such as giving them alonger lead time to geta business established;providing an initialgrant rather than a loan(often paying on a loanis dependent on havingincome from anothersource, as a business takessome time to begin togenerate income); startingwith financial educationand business skills trainingbefore making loans;and restricting loans toadolescents who have asupportive mentor whocan provide businessadvice.