Company Update Steel Authority of India - The Smart Investor

Company Update Steel Authority of India - The Smart Investor

Company Update Steel Authority of India - The Smart Investor

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

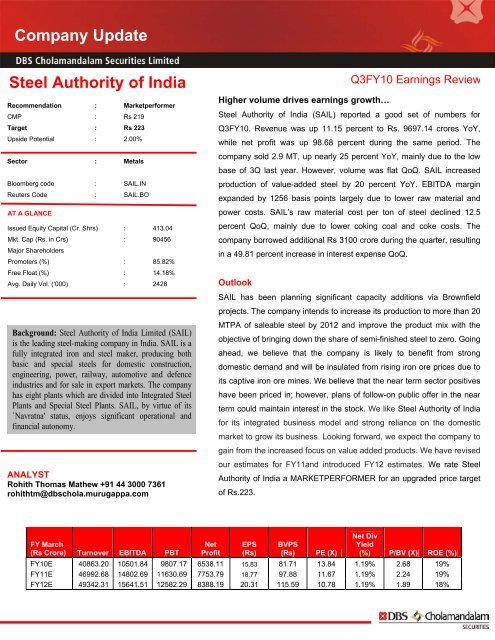

Result Summary & Comments Q3FY10Particulars (in Rs. Crs) Q3FY10 Q3FY09 YoY Q2FY10 QoQ CommentsNet Sales 9697.14 8724.35 11.15% 9943.92 -2.48%Expenses 7300.24 7664.05 -4.75% 7650.70 -4.58%HighervolumeEBITDA 2396.90 1060.30 126.06% 2293.22 4.52%Depreciation 339.04 319.39 6.15% 332.22 2.05%Other income 588.33 623.41 -5.63% 631.36 -6.82%interest 110.11 107.77 2.17% 73.50 49.81%PBT 2536.08 1256.55 101.83% 2518.86 0.68%Tax 860.53 413.21 108.25% 855.37 0.60%EOI 0.00 0.00 0.00PAT 1675.55 843.34 98.68% 1663.49 0.72%EBITDA margin 24.72% 12.15% 23.06%Tax rate 33.93% 32.88% 33.96%Net pr<strong>of</strong>it margin 17.28% 9.67% 16.73%Lower rawmaterialand powercosts

DBS Cholamandalam Securites LimitedMember: BSE, NSE, MSERegd. Office: Dare House, 2 (Old # 234) N.S.C. Bose Road, Chennai – 600 001.Website : www.choladbsdirect.comE-mail id - customercare@dbschola.murugappa.comTo open Trading Account SMS CDWM TA to 55050AHMEDABADBANGALORECHANDIGARHCHENNAICOIMBATOREDELHIHYDERABADJAMSHEDPURKOLKATAMUMBAIPATNAPUNERANCHITRIVANDRAMCHENNAIEAST & WESTNORTHSOUTHLOCATIONBEM PHONE NUMBERS E-MAIL IDMr.Mehul M Min 079 - 64500318/19 mehulmm@dbschola.murugappa.comMr. Sajesh M080-41503340 - 44 / 41503353sajeshm@dbschola.murugappa.comMr. Krishna Kumar R Mkrishnakumarrm@dbschola.murugappa.comMr. Vishal Arora 0172 - 26248051 vishalarora@dbschola.murugappa.comMr. Baskaran S 044 - 26198919/16 baskarans@dbschola.murugappa.comMr. Rangarajan 044- 26192020 sundaresanm@dbschola.murugappa.comMr. Mohan V N 0422- 4292041/4204620 mohanvn@dbschola.murugappa.comMr. Kunal kaushish 011- 66134224/25 kunalkaushish@dbshcola.murugappa.comMr. Anupum Periwal 040- 64550572/77 anupamp@dbschola.murugappa.comMr.ASLN Murthy 040-32978355 murthyasln@dbschola.murugappa.comMr. Srinivasa Reddy D V 040- 23316567/68 srinivasardv@dbschola.murugappa.comMr. Amit Kumar Mahto 0657 - 2320098/177 amitkumarm@dbschola.murugappa.comMr. Kumar Gauravkumargaurav@dbschola.murugappa.com033- 44103638/3639Mr.Subhrodeep Chatterjeesubhrodeepc@dbschola.murugappa.comMr. Navneet Kedia 022- 66156591 navneetk@dbschola.murugappa.comMs Shweta Shantaram Padhey 022- 66574000 shwetasp@dbschola.murugappa.comMs. Sheetal Bheda 022 -22153610 sheetalbheda@dbschola.murugappa.comMr.Sanjay Kumar 0612 -2500008 sanjaykumarr@dbschola.murugappa.comMr. Amol 020 - 30264811/12 sujitag@dbschola.murugappa.comMr. Sanjiv Kumar 0651 - 6453496 sanjivkumar@dbschola.murugappa.comMr. Suresh KM0471-3075225 / 224sureshkm@dbschola.muruagappa.comREGIONAL EQUITY MANAGERMr. Lakshmanan T S P 9840019701 lakshmanantsp@dbschola.murugappa.comMr. Ananthanarayan 9930103070 ananthanarayanj@dbschola.murugapa.comMr. Ajay Kumar Minocha 9838074353 ajaykm@dbschola.murugappa.comMr. Shankar P V 9840494132 shankarpv@dbschola.murugappa.comRESEARCHMr. Sandip RaichuraHead <strong>of</strong> Equities 044-25307216 raichuraS@dbschola.murugappa.comMr. Radhakrishnan.RManager Research / Technicals 044-25307353 radhakrishnanR@dbschola.murugappa.comMr. Alagappan AFinancial Services 044-25307363 alagappana@choladbs.murugappa.comMr. Balajee Tirupati Infrastructure 044-25307364 balajeet@dbschola.murugappa.comMr. Kumar Rahul Chauhan Sugar, Capital Goods 044-25307364 kumarrc@dbschola.murugappa.comMr. Rohith Thomas MathewMetals, Mining, Cement 044-25307363 rohithtm@dbschola.murugappa.comMr. Ramasubramaniam PTelecom, Capital Goods 044-25307360 ramasubramanianp@dbschola.murugappa.comMs. Sheetal AggarwalInformation Technology 044-25307365 sheetala@dbschola.murugappa.comMr. Sathyajith NMutal Fund Analyst 044-25307225 sathyajithn@dbschola.murugappa.comCOMPLIANCEMr Guruswamy Raj Manager-Compliance guruswamyrg@dbschola.murugappa.comDISCLAIMER:<strong>The</strong> research analyst who is primarily responsible for this report certifies that: (1) all <strong>of</strong> the views expressed in this report accurately reflect his or her personal opinions about any and all <strong>of</strong> thesubject securities or issuers; and (2) no part <strong>of</strong> any <strong>of</strong> the research analyst's compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed inthis report. This report has been prepared on the basis <strong>of</strong> information that is already available in publicly accessible media or developed through analysis <strong>of</strong> DBS Cholamandalam SecuritiesLimited. DBS Cholamandalam Securities Limited makes every effort to use reliable, comprehensive information, but we make no representation that it is accurate or complete<strong>The</strong> views expressed are those <strong>of</strong> the analyst and the <strong>Company</strong> may or may not subscribe to all the views expressed therein DBS Cholamandalam Securities Limited reserves the right to makemodifications and alterations to this statement as may be required from time to time without any prior approval. DBS Cholamandalam Securities Limited, its affiliates, directors andemployees may from time to time, effect or have effected an own account transaction in or deal as agent in or for the securities mentioned in this report. <strong>The</strong> recipient should take this intoaccount before interpreting the report.This report is for private circulation and for information purposes only. It does not provide individually tailor-made investment advice and has been prepared without regard to any specificinvestment objectives, financial situation, or any particular needs <strong>of</strong> any <strong>of</strong> the persons who receive it. All investors may not find the securities discussed in this report to be suitable. DBSCholamandalam Securities Limited recommends that investors independently evaluate particular investments and strategies. <strong>Investor</strong>s should seek the advice <strong>of</strong> a financial advisor with regardto the appropriateness <strong>of</strong> investing in any securities / investment strategies recommended in this report. <strong>The</strong> appropriateness <strong>of</strong> a particular investment or strategy will depend on aninvestor’s individual preference. Past performance is not necessarily a guide to future performance. Estimates <strong>of</strong> future prospects are based on assumptions that may not be realized. . Republicationor redistribution in any form, in whole or in part, is prohibited.STOCK RATING: Outperformer: > 20% upside over the next 12 months; Marketperformer: trade within a +/-20% range over the next 12 months; Underperformer: > 20% downside overthe next 12 months.