Aurobindo Pharma - The Smart Investor

Aurobindo Pharma - The Smart Investor

Aurobindo Pharma - The Smart Investor

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Aurobindo</strong> <strong>Pharma</strong><br />

Entering the big league<br />

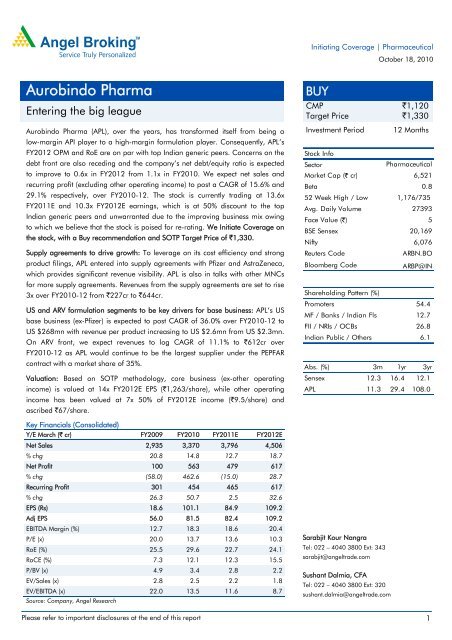

<strong>Aurobindo</strong> <strong>Pharma</strong> (APL), over the years, has transformed itself from being a<br />

low-margin API player to a high-margin formulation player. Consequently, APL’s<br />

FY2012 OPM and RoE are on par with top Indian generic peers. Concerns on the<br />

debt front are also receding and the company’s net debt/equity ratio is expected<br />

to improve to 0.6x in FY2012 from 1.1x in FY2010. We expect net sales and<br />

recurring profit (excluding other operating income) to post a CAGR of 15.6% and<br />

29.1% respectively, over FY2010-12. <strong>The</strong> stock is currently trading at 13.6x<br />

FY2011E and 10.3x FY2012E earnings, which is at 50% discount to the top<br />

Indian generic peers and unwarranted due to the improving business mix owing<br />

to which we believe that the stock is poised for re-rating. We Initiate Coverage on<br />

the stock, with a Buy recommendation and SOTP Target Price of `1,330.<br />

Supply agreements to drive growth: To leverage on its cost efficiency and strong<br />

product filings, APL entered into supply agreements with Pfizer and AstraZeneca,<br />

which provides significant revenue visibility. APL is also in talks with other MNCs<br />

for more supply agreements. Revenues from the supply agreements are set to rise<br />

3x over FY2010-12 from `227cr to `644cr.<br />

US and ARV formulation segments to be key drivers for base business: APL’s US<br />

base business (ex-Pfizer) is expected to post CAGR of 36.0% over FY2010-12 to<br />

US $268mn with revenue per product increasing to US $2.6mn from US $2.3mn.<br />

On ARV front, we expect revenues to log CAGR of 11.1% to `612cr over<br />

FY2010-12 as APL would continue to be the largest supplier under the PEPFAR<br />

contract with a market share of 35%.<br />

Valuation: Based on SOTP methodology, core business (ex-other operating<br />

income) is valued at 14x FY2012E EPS (`1,263/share), while other operating<br />

income has been valued at 7x 50% of FY2012E income (`9.5/share) and<br />

ascribed `67/share.<br />

Key Financials (Consolidated)<br />

Y/E March (` cr) FY2009 FY2010 FY2011E FY2012E<br />

Net Sales 2,935 3,370 3,796 4,506<br />

% chg 20.8 14.8 12.7 18.7<br />

Net Profit 100 563 479 617<br />

% chg (58.0) 462.6 (15.0) 28.7<br />

Recurring Profit 301 454 465 617<br />

% chg 26.3 50.7 2.5 32.6<br />

EPS (Rs) 18.6 101.1 84.9 109.2<br />

Adj EPS 56.0 81.5 82.4 109.2<br />

EBITDA Margin (%) 12.7 18.3 18.6 20.4<br />

P/E (x) 20.0 13.7 13.6 10.3<br />

RoE (%) 25.5 29.6 22.7 24.1<br />

RoCE (%) 7.3 12.1 12.3 15.5<br />

P/BV (x) 4.9 3.4 2.8 2.2<br />

EV/Sales (x) 2.8 2.5 2.2 1.8<br />

EV/EBITDA (x) 22.0 13.5 11.6 8.7<br />

Source: Company, Angel Research<br />

Initiating Coverage | <strong>Pharma</strong>ceutical<br />

October 18, 2010<br />

BUY<br />

CMP `1,120<br />

Target Price `1,330<br />

Investment Period 12 Months<br />

Stock Info<br />

Sector<br />

Market Cap (` cr)<br />

Beta<br />

52 Week High / Low<br />

Avg. Daily Volume<br />

Face Value (`)<br />

BSE Sensex<br />

Nifty<br />

Reuters Code<br />

Bloomberg Code<br />

<strong>Pharma</strong>ceutical<br />

6,521<br />

0.8<br />

1,176/735<br />

27393<br />

5<br />

20,169<br />

6,076<br />

ARBN.BO<br />

ARBP@IN<br />

Shareholding Pattern (%)<br />

Promoters 54.4<br />

MF / Banks / Indian Fls 12.7<br />

FII / NRIs / OCBs 26.8<br />

Indian Public / Others 6.1<br />

Abs. (%) 3m 1yr 3yr<br />

Sensex 12.3 16.4 12.1<br />

APL 11.3 29.4 108.0<br />

Sarabjit Kour Nangra<br />

Tel: 022 – 4040 3800 Ext: 343<br />

sarabjit@angeltrade.com<br />

Sushant Dalmia, CFA<br />

Tel: 022 – 4040 3800 Ext: 320<br />

sushant.dalmia@angeltrade.com<br />

Please refer to important disclosures at the end of this report 1

Exhibit 1: Net Sales, OPM and Recurring PAT (ex other OI) trend<br />

(` cr)<br />

5,000<br />

4,000<br />

3,000<br />

2,000<br />

1,000<br />

0<br />

1,600<br />

271<br />

2,122<br />

694<br />

1,330 1,429 1,431 1,538 1,518 1,523 1,506<br />

Source: Company, Angel Research<br />

2,430<br />

999<br />

2,935<br />

1,397<br />

1,852<br />

<strong>Aurobindo</strong> <strong>Pharma</strong> | Initiating Coverage<br />

Initiate Coverage with a Buy and Target Price of `1,330<br />

Recurring earnings (ex other OI) to post CAGR of 29.1%<br />

Net sales are estimated to log a CAGR of 15.6% to `4,506cr over FY2010-12 on<br />

back of supply agreements, the US (ex-Pfizer) and ARV formulation contracts. We<br />

expect APL’s recurring earnings (excluding other operating income) to post a<br />

CAGR of 29.1% over FY2010-12 to `506cr on the back of sales growth and OPM<br />

expansion. We estimate OPM to increase by 206bp to 20.4% during the<br />

mentioned period.<br />

2,273<br />

3,000<br />

FY2006 FY2007 FY2008 FY2009 FY2010 FY2011E FY2012E<br />

API Formulations<br />

3,370<br />

3,796<br />

4,506<br />

APL aims to clock US $2bn in FY2014<br />

APL expects to clock strong CAGR of 29.4% in top-line to US $2bn by FY2014<br />

from US $713mn in FY2010. <strong>The</strong> company expects contribution from the<br />

formulations segment to ramp up to 75% by FY2014 from current levels of 55%.<br />

Exhibit 2: APL’s revenue target<br />

(US $mn)<br />

2400<br />

2000<br />

1600<br />

1200<br />

800<br />

400<br />

0<br />

Source: Company, Angel Research<br />

Our estimates are lower than company’s long term guidance as we expect growth<br />

to be more back-ended for the company driven by US (injectables and controlled<br />

substances) and supply agreements.<br />

October 18, 2010 2<br />

(` cr)<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

67<br />

189<br />

230<br />

169<br />

304<br />

355<br />

506<br />

FY2006 FY2007 FY2008 FY2009 FY2010 FY2011E FY2012E<br />

Recurring PAT OPM<br />

713<br />

48 15<br />

328<br />

322<br />

CAGR 29.4%<br />

69.9<br />

79.7<br />

27.8<br />

11.6<br />

2,000<br />

125<br />

500<br />

875<br />

500<br />

FY2010 FY2014<br />

API Formulations Supply Agreements Injectable business<br />

25.0<br />

20.0<br />

15.0<br />

10.0<br />

5.0<br />

0.0<br />

(%)

APL stock poised for re-rating<br />

<strong>Aurobindo</strong> <strong>Pharma</strong> | Initiating Coverage<br />

APL has moved up the value chain and transformed from being a<br />

low-margin API player to a high-margin formulations player. Consequently,<br />

contribution from the formulation segment to net sales is expected to increase from<br />

55% in FY2010 to 67% in FY2012. Moreover, APL’s FY2012 OPM and RoE are<br />

in-line with top Indian generic players. <strong>The</strong> debt concerns are also receding with<br />

the company’s net debt/equity ratio expected to improve to 0.6x in FY2012 from<br />

1.1x in FY2010. At current levels the stock is trading at 13.6x FY2011E and 10.3x<br />

FY2012E earnings, which is at 50% discount to the top Indian generic peers and<br />

unwarranted due to the improving business mix owing to which we believe that it is<br />

poised for re-rating.<br />

Exhibit 3: OPM and RoE comparison (FY2012)<br />

Source: Company, Angel Research. Note: Sector includes Cadila, Cipla, DRL, Lupin, Ranbaxy and<br />

Sun <strong>Pharma</strong><br />

Valuation<br />

Exhibit 4: 1-year forward PE and EV/Sales band<br />

(`)<br />

2,200<br />

2,000<br />

1,800<br />

1,600<br />

1,400<br />

1,200<br />

1,000<br />

800<br />

600<br />

400<br />

200<br />

-<br />

Source: Company, Angel Research<br />

30.0<br />

25.0<br />

20.0<br />

15.0<br />

10.0<br />

5.0<br />

0.0<br />

20x<br />

Apr-05<br />

Jul-05<br />

Oct-05<br />

Jan-06<br />

Apr-06<br />

Jul-06<br />

Oct-06<br />

Jan-07<br />

Apr-07<br />

Jul-07<br />

Oct-07<br />

Jan-08<br />

Apr-08<br />

Jul-08<br />

Oct-08<br />

Jan-09<br />

Apr-09<br />

Jul-09<br />

Oct-09<br />

Jan-10<br />

Apr-10<br />

Jul-10<br />

Oct-10<br />

On a PE basis, the stock has traded in the 2-22x one-year forward PE band, and<br />

at an average of 11x in the last five years. On the EV/Sales front, the stock has<br />

been trading in the range of 0.8-2.5x and at an average of 1.7x.<br />

15x<br />

10x<br />

5x<br />

October 18, 2010 3<br />

EV (` cr)<br />

22.0<br />

12,000<br />

10,500<br />

9,000<br />

7,500<br />

6,000<br />

4,500<br />

3,000<br />

1,500<br />

22.9<br />

20.4<br />

Sector APL<br />

OPM RoE<br />

0<br />

24.1<br />

Apr-05<br />

Jul-05<br />

Oct-05<br />

Jan-06<br />

Apr-06<br />

Jul-06<br />

Oct-06<br />

Jan-07<br />

Apr-07<br />

Jul-07<br />

Oct-07<br />

Jan-08<br />

Apr-08<br />

Jul-08<br />

Oct-08<br />

Jan-09<br />

Apr-09<br />

Jul-09<br />

Oct-09<br />

Jan-10<br />

Apr-10<br />

Jul-10<br />

Oct-10<br />

2.5x<br />

2.0x<br />

1.5x<br />

1.0x

Exhibit 6: Comparative Valuation<br />

<strong>Aurobindo</strong> <strong>Pharma</strong> | Initiating Coverage<br />

We have valued APL on a SOTP basis. <strong>The</strong> base business has been valued at 14x<br />

FY2012E core earnings (`90.2/share), which is at 33% discount (on the back of<br />

low presence in the high-margin domestic formulation business) to the top Indian<br />

generic players and fetches `1,263/share. We have assigned a higher multiple to<br />

APL’s core business compared to the multiple assigned by street and its historical<br />

average, as we believe that the concerns about higher contribution of the API<br />

business is unwarranted given that the company’s FY2012 OPM and RoE are on<br />

par with top Indian generic peers and are likely to sustain going forward.<br />

APL has also seen a substantial spurt in other operating income on the back of<br />

dossier income primarily under the Pfizer agreement and sale of dossiers in<br />

Europe. Other operating income constituted nearly 31.9% of PBT in FY2010.<br />

However, we have assigned a lower multiple as there is lack of clarity regarding<br />

the time-line of the recurring nature of the dossier income. We have valued other<br />

operating income at 7x 50% of FY2012E income (`9.5/share) and ascribed<br />

`67/share.<br />

Exhibit 5: SOTP Valuation (FY2012)<br />

Core business (`90.2/share)<br />

Other Op. income at 50% FY2012E income (`9.5/share)<br />

Total<br />

Source: Company, Angel Research<br />

Multiple<br />

(x)<br />

Per share (`)<br />

14 1,263<br />

7 67<br />

October 18, 2010 4<br />

1,330<br />

We Initiate Coverage on the stock with a Buy recommendation and SOTP Target<br />

Price of `1,330, implying an upside of 19% from current levels.<br />

Comparative Mcap (` cr) Sales (` cr) PE (x) EV/Sales (x) EV/EBITDA (x) RoE (%)<br />

FY2011E FY2012E FY2011E FY2012E FY2011E FY2012E FY2011E FY2012E FY2011E FY2012E<br />

Cadila Healthcare 14,147 4,308 5,100 22.5 17.4 3.4 2.8 17.1 13.5 34.8 34.7<br />

Cipla 26,255 5,902 6,797 23.5 19.1 4.3 3.7 21.3 17.3 17.5 18.9<br />

Dr Reddy's 26,924 8,416 9,797 27.0 20.4 3.1 2.6 16.4 13.2 25.0 25.5<br />

Lupin 18,264 5,645 6,579 22.2 17.8 3.3 2.9 17.7 14.7 31.8 31.2<br />

Ranbaxy 24,362 8,162 9,913 15.1 20.1 3.0 2.4 18.6 12.7 31.3 20.2<br />

Sun <strong>Pharma</strong> 42,252 4,830 5,581 28.5 24.1 7.8 6.6 24.0 19.8 17.1 17.7<br />

Average - 6,521 7,305 23.9 20.6 4.7 3.9 19.9 15.9 24.3 22.9<br />

<strong>Aurobindo</strong> 6,521 3,796 4,506 13.6 10.3 2.2 1.8 11.6 8.7 22.7 24.1<br />

Prem /(Disc) % to Avg - - - (43.2) (50.2) (53.7) (54.7) (42.0) (45.0) - -<br />

Source: Company, Angel Research

APL has increased its global filing<br />

dramatically from 313 in FY2008 to<br />

1,171 in FY2010<br />

Exhibit 7: API and Formulations filings<br />

1,600<br />

1,200<br />

800<br />

400<br />

0<br />

895<br />

1,126<br />

122 133 145<br />

Investment Arguments<br />

Supply agreements to drive growth<br />

Source: Company, Angel Research. Note: Other regulated markets include multiple registrations in the EU<br />

<strong>Aurobindo</strong> <strong>Pharma</strong> | Initiating Coverage<br />

On the global filings front (ANDAs and dossiers) APL has increased its filing<br />

dramatically from 313 in FY2008 to 1,171 in FY2010, as it proposes to scale up<br />

from SSP and Cephs to NPNC products. Further, the transformation from being a<br />

pure API supplier to becoming a formidable formulations player has increased its<br />

cost efficiencies, as 90% of its formulation is now backward integrated.<br />

1,412<br />

FY2008 FY2009 FY2010<br />

US Other Regulated markets<br />

In FY2010, under the Pfizer contract<br />

APL scaled up supply to 23 products to<br />

the US and clocked revenues of US<br />

$48mn<br />

185<br />

128 147 169<br />

Thus, to leverage on its cost efficiency and strong product filings, APL entered into<br />

long-term supply agreements with Pfizer (March 2009) and AstraZeneca<br />

(September 2010), which provides significant revenue visibility going ahead. <strong>The</strong><br />

company is also in discussion with other MNCs for more supply agreements.<br />

Under the Pfizer contract, APL would supply more than 100 products post full<br />

commercialisation of the contract and cover various geographies. In FY2010, APL<br />

scaled up supply with 23 products to the US and clocked revenues of US $48mn.<br />

In Europe, the company expects to significantly ramp up in the current fiscal. <strong>The</strong><br />

company proposes commercialisation for the rest of the world (RoW) by FY2012.<br />

Pertinently, APL has received upfront payment under the contract boosting its cash<br />

flow. Going ahead, Pfizer is likely to add more products and cover additional<br />

geographies based on the initial response that it receives from its existing markets.<br />

October 18, 2010 5<br />

1,200<br />

1,000<br />

800<br />

600<br />

400<br />

200<br />

0<br />

838<br />

1,002<br />

FY2008 FY2009 FY2010<br />

US Other Regulated markets

Exhibit 8: Pfizer contract - Number of products<br />

Co-Exclusive<br />

Solid oral products 75<br />

Exclusive<br />

Solid oral products<br />

Sterile injectable products 11<br />

Non-Exclusive<br />

Solid oral products<br />

Sterile injectable products 1 12 12<br />

<strong>Aurobindo</strong> <strong>Pharma</strong> | Initiating Coverage<br />

US France ROEU Aus/NZ Canada RoW<br />

October 18, 2010 6<br />

34<br />

13 77 44 14 55<br />

Total 87 59 89 44 14 60<br />

Source: Company, Angel Research<br />

Under its supply agreement with AstraZeneca, APL would be supplying several<br />

solid dosage and sterile products to the emerging markets covering therapeutic<br />

segments such as anti-infective, CVS and CNS. We expect the AstraZeneca<br />

contract to contribute US $5mn in FY2012. Overall, we expect revenues from the<br />

supply agreements to increase 3x over FY2010-12 from `227cr to `644cr.<br />

Exhibit 9: Sales under supply agreements<br />

(` cr)<br />

800<br />

600<br />

400<br />

200<br />

0<br />

227<br />

Source: Company, Angel Research<br />

367<br />

23<br />

621<br />

FY2010 FY2011E FY2012E<br />

Pfizer AstraZeneca % of Sales<br />

16.0<br />

12.0<br />

8.0<br />

4.0<br />

0.0<br />

5<br />

(%)

APL’s base business (ex Pfizer) logged a<br />

CAGR of 82.3% to US $145mn over<br />

FY2006-10<br />

APL targets day-1 launches in the US<br />

and has commercialised 61 products in<br />

the US<br />

<strong>Aurobindo</strong> <strong>Pharma</strong> | Initiating Coverage<br />

US and ARV formulation segment key drivers for base business<br />

APL’s business, excluding the supply agreements, would primarily be driven by the<br />

US and the ARV segment on the formulation front. <strong>The</strong> API business is expected to<br />

be subdued as the company would be using most of the API for internal<br />

consumption.<br />

Product launches to drive business in US market<br />

APL has particularly been able to scale up its business in the US market through<br />

product introductions and the supply agreement with Pfizer. In the US, the<br />

company has seen a growth in business 16x over FY2006-10 and attained critical<br />

mass. APL’s base business (ex Pfizer) logged a CAGR of 82.3% to US $145mn<br />

over the period. Pertinently, the company scaled up supplies under the Pfizer<br />

contract in FY2010 and clocked revenues of US $48mn. APL offset the lower<br />

revenue per product (US $2.3mn) by widening its product basket (APL-61,<br />

Pfizer-23 products).<br />

Exhibit 10: US market - Performance across players (FY2010)<br />

(US $mn)<br />

400<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

374<br />

Source: Company, Angel Research.<br />

APL has commercialised 61 products in the US with the top-10 products<br />

contributing nearly 60% of its revenues in FY2010. <strong>The</strong> company primarily targets<br />

day-1 launches in the US. APL has been able to garner strong market share in<br />

highly competitive generic products such as Citalopram Hydrobromide, Paroxetine<br />

Hydrochloride, Amoxicillin, Metformin Hydrochloride and Simvastatin owing to cost<br />

advantages. APL is also witnessing strong pick up (has garnered 8% market share)<br />

in the recently launched Valacyclovir tablets. Additionally, APL recently also<br />

received approvals for the low-competition Ampicillin injections, which has a<br />

market size of more than US $100mn.<br />

October 18, 2010 7<br />

357<br />

331<br />

233<br />

193<br />

146<br />

Dr Reddy Lupin Ranbaxy Sun <strong>Pharma</strong> <strong>Aurobindo</strong> Cadila

APL expects to file 15-20 ANDAs in<br />

FY2011 and FY2012<br />

Exhibit 12: ANDA filings (FY2010)<br />

180<br />

150<br />

120<br />

90<br />

60<br />

30<br />

0<br />

82<br />

46<br />

Source: Company, Angel Research<br />

19<br />

22<br />

Exhibit 11: APL’s top products in US<br />

<strong>Aurobindo</strong> <strong>Pharma</strong> | Initiating Coverage<br />

Key Products # of players Market share (Rx, %)<br />

Citalopram Hydrobromide >15 15<br />

Paroxetine Hydrochloride >10 11<br />

Amoxicillin >10 9<br />

Metformin Hydrochloride >15 6<br />

Simvastatin >15 5<br />

Source: Industry, Angel Research; Note: Market share is for July 2010<br />

APL has also commercialised its New Jersey (NJ) facility, which it acquired from<br />

Sandoz in 2006. Through this facility APL is targeting the institutional business in<br />

the US. Pertinently, to run the institutional business in the US it is necessary to have<br />

a local production unit. APL has also begun filings of controlled substances from<br />

the unit, which is expected to contribute from FY2013 onwards.<br />

APL has been one of the aggressive filers in the US market with 169 ANDAs filed<br />

with 113 approvals received till FY2010. Among the players, APL is the third<br />

largest ANDA filer. APL has aggressively filed in the last three years and is now<br />

geared to reap benefits, even though most of the filings are for highly competitive<br />

products. APL expects to file 15-20 ANDAs in FY2011 and FY2012.<br />

169<br />

FY2007 FY2008 FY2009 FY2010 Total<br />

We expect the base business<br />

(ex-Pfizer) to grow at a CAGR of 36.0%<br />

over FY2010-12 and contribute US<br />

$268mn with revenue per product<br />

increasing to US $2.6mn<br />

Going ahead, the next three years in the US, with US $70bn going<br />

off-patent, one of the highest in history, we believe that APL is well placed to tap<br />

this opportunity. We expect the company to clock 42.0% CAGR in net sales in the<br />

US over FY2010-12 to US $388mn driven by product launches and the Pfizer<br />

contract. This contract is expected to contribute US $120mn constituting 31% of US<br />

sales. We expect the base business (ex-Pfizer) to post a CAGR of 36.0% over<br />

FY2010-12 and contribute US $268mn by FY2012 with revenue per product<br />

increasing to US $2.6mn from US $2.3mn in FY2010 as the company moves<br />

towards the high revenue generating NPNC and injectable (SSP and Cephs)<br />

products.<br />

October 18, 2010 8<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

211<br />

204<br />

169 163<br />

130<br />

113<br />

Sun <strong>Pharma</strong> Ranbaxy <strong>Aurobindo</strong> Dr Reddy Lupin Cadila

APL is one of the largest generic<br />

suppliers under the PEPFAR contracts<br />

with 35% market share<br />

Exhibit 13: US sales trend<br />

(US $mn)<br />

Source: Company, Angel Research<br />

ARV business on strong footing<br />

<strong>Aurobindo</strong> <strong>Pharma</strong> | Initiating Coverage<br />

APL derives 15% of its revenues from the ARV segment, which registered 54.9%<br />

CAGR over FY2006-10 to `495cr. This segment derives around 80% of its<br />

revenues from the President's Emergency Plan for AIDS Relief (PEPFAR) program.<br />

<strong>The</strong> US had committed funds to the tune of US $18.8bn for the PEPFAR program<br />

during FY2004-08. In FY2009, the relief was increased to US $6.6bn and<br />

maintained at US $6.7bn in FY2010. Overall expenditure on the ARV drugs<br />

increased from US $117mn in FY2005 to US $203mn in FY2008, registering a<br />

CAGR of 20%. Meanwhile, the amount spent on generic ARV increased from 9.2%<br />

in FY2005 to 76.4% in FY2008.<br />

APL is one of the largest generic suppliers under the ARV contracts with 35%<br />

market share. APL enjoys high market share as it is fully integrated in all its<br />

products apart from having a larger product basket. Overall, we expect the ARV<br />

segment to post CAGR of 11.1% over FY2010-12 to `612cr with the PEPFAR<br />

allocation for generic ARVs expected to increase.<br />

Exhibit 14: ARV sales trend<br />

(` cr)<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

700<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

13 35 58<br />

Source: Company, Angel Research<br />

October 18, 2010 9<br />

121<br />

145<br />

48<br />

192<br />

76<br />

268<br />

120<br />

FY2006 FY2007 FY2008 FY2009 FY2010 FY2011E FY2012E<br />

86<br />

122<br />

Pfizer Ex-Pfizer % of Sales<br />

404<br />

464<br />

495<br />

549<br />

612<br />

FY2006 FY2007 FY2008 FY2009 FY2010 FY2011E FY2012E<br />

ARV % of Sales<br />

50.0<br />

40.0<br />

30.0<br />

20.0<br />

10.0<br />

0.0<br />

20.0<br />

15.0<br />

10.0<br />

5.0<br />

0.0<br />

(%)<br />

(%)

We expect EU to register CAGR of<br />

around 21.0% over FY2010-12 to<br />

`348cr driven by product launches and<br />

the Pfizer contract<br />

We expect revenues from the RoW to<br />

post a CAGR of 19.1% to `294cr over<br />

FY2010-12 and expect the AstraZeneca<br />

contract to contribute Rs23cr in FY2012<br />

Europe and RoW growing at steady pace<br />

<strong>Aurobindo</strong> <strong>Pharma</strong> | Initiating Coverage<br />

In Europe, APL has been developing its presence through licensing agreements<br />

with the MNC’s and other generic players. In the UK, Netherland and Italy, APL<br />

has a direct presence. <strong>The</strong> company is now targeting newer geographies, viz.<br />

Romania, Spain, Yugoslavia and Bulgaria. During FY2006-10, the company’s EU<br />

business registered CAGR of 51.6% to `237cr.<br />

We expect EU to register CAGR of around 21.0% over FY2010-12 to `348cr<br />

driven by product launches and the Pfizer contract. We expect the Pfizer contract to<br />

scale up significantly from `2cr in FY2010 to `63cr in FY2012. Excluding Pfizer,<br />

we expect overall sales to grow by 10.0% to `285cr in FY2012.<br />

Exhibit 15: EU sales trend<br />

(` cr)<br />

45<br />

Source: Company, Angel Research<br />

Over FY2006-10, RoW registered CAGR of 26.2%. In FY2010, RoW contributed<br />

6.1% to the company’s net sales to `207cr. We expect revenues from the RoW to<br />

post a CAGR of 19.1% to `294cr over FY2010-12 and expect the AstraZeneca<br />

contract to contribute Rs23cr in FY2012.<br />

Exhibit 16: RoW sales trend<br />

(` cr)<br />

400<br />

300<br />

200<br />

100<br />

0<br />

400<br />

300<br />

200<br />

100<br />

0<br />

Source: Company, Angel Research<br />

October 18, 2010 10<br />

128<br />

201 198<br />

235<br />

2<br />

247<br />

18<br />

285<br />

FY2006 FY2007 FY2008 FY2009 FY2010 FY2011E FY2012E<br />

82<br />

288<br />

Pfizer Ex-Pfizer % of Sales<br />

158<br />

198 207 225<br />

63<br />

253<br />

23<br />

18<br />

FY2006 FY2007 FY2008 FY2009 FY2010 FY2011E FY2012E<br />

Pfizer AstraZeneca Ex-Pfizer/Astra % of Sales<br />

9.0<br />

6.0<br />

3.0<br />

0.0<br />

15.0<br />

10.0<br />

5.0<br />

0.0<br />

(%)<br />

(%)

We expect the API segment revenues to<br />

remain flat to `1,575cr over FY2010-12<br />

as the company would use most of the<br />

API for internal consumption<br />

API segment to remain subdued<br />

<strong>Aurobindo</strong> <strong>Pharma</strong> | Initiating Coverage<br />

APL is one of the largest players in the API space, which contributed around 45% to<br />

its FY2010 sales with supply of SSP (oral and sterile), Cephs (oral and sterile) and<br />

other APIs having predominant exposure in its domestic segment.<br />

APL registered a decline of 5.2% in oral (SSP and Cephs) APIs over FY2006-10 due<br />

to price volatility. <strong>The</strong> company’s API segment is vulnerable to Pen-G prices as it is<br />

the basic input for API. Hence, to protect its margins, APL shifted to sterile API<br />

products and is now also using most of the API for internal consumption.<br />

Going ahead, we expect the API segment revenues to remain flat to `1,575cr over<br />

FY2010-12 as the company would use most of the API for internal consumption.<br />

Exhibit 17: API sales break-up<br />

(` cr) FY2006 FY2007 FY2008 FY2009 FY2010 FY2011E FY2012E<br />

SSP (Oral) 586 591 673 550 449 421 391<br />

Growth (%)<br />

1.0 13.8 (18.3) (16.8) (8.0) (7.0)<br />

SSP (Sterile) - - 131 174 158 156 159<br />

Growth (%)<br />

32.2 (9.2) (1.0) 2.0<br />

Cephs (Oral) 484 643 393 422 405 417 413<br />

Growth (%)<br />

32.7 (38.8) 7.3 (4.0) 3.0 (1.0)<br />

Cephs (Sterile) - - 199 212 274 277 287<br />

Growth (%)<br />

6.6 29.5 0.9 3.7<br />

ARV & other high value 355 296 152 271 307 310 325<br />

Growth (%)<br />

(16.5) (48.8) 78.9 13.3 0.9 4.7<br />

Total 1,425 1,530 1,548 1,628 1,593 1,581 1,575<br />

Growth (%)<br />

Source: Company, Angel Research<br />

CRAMS a long term driver<br />

7.4 1.1 5.2 (1.6) (0.8) (0.4)<br />

APL launched its CRAMS division, AuroSource, to cater to the global innovators<br />

and biotech players. <strong>The</strong> division offers services across the entire product life cycle<br />

from pre-clinical to the commercial launch. APL is already in discussion with few<br />

players though we have not factored in any upsides from the business in our<br />

estimates.<br />

October 18, 2010 11

Overall contribution of the formulation<br />

segment increased from 17.0% in 2006<br />

to 55.0% in FY2010<br />

Financials<br />

<strong>Aurobindo</strong> <strong>Pharma</strong> | Initiating Coverage<br />

Top-line to register 15.6% CAGR over FY2010-12E<br />

APL recorded 20.5% CAGR in net sales during FY2006-10 to `3,370cr driven by<br />

the formulation segments. Overall contribution of the formulation segment<br />

increased from 17.0% in 2006 to 55.0% in FY2010 primarily led by the US and<br />

ARV contracts. During FY2006-10, while sales in the US posted a CAGR of 99.2%<br />

to `912cr driven by product launches and commencement of supplies to Pfizer,<br />

ARV formulation sales logged 54.9% CAGR over on the back of the contract wins<br />

under the PEPFAR project. <strong>The</strong> API segment however, recorded sluggish CAGR of<br />

3.0% as the increase in volumes was offset by lower price realisations during the<br />

period.<br />

Exhibit 18: Increasing contribution from formulations<br />

100%<br />

80%<br />

60%<br />

40%<br />

20%<br />

0%<br />

17<br />

83<br />

Source: Company, Angel Research<br />

For FY2011, we expect net sales to grow at a slower pace of 12.7% to `3,796cr<br />

due to capacity constraints (NPNC) - the new facilities at the Unit VII (SEZ) and NJ<br />

are expected to scale up gradually. We expect the formulation segment to clock<br />

22.7% yoy growth to `2,273cr, while the API segment is expected to decline by<br />

1.3% to `1,581cr.<br />

In the US region, the formulation segment is expected to clock 35.3% yoy growth<br />

to `1,234cr driven by the off-take under the Pfizer contract primarily in 2HFY2011<br />

and launch of new products (SSP and Ceph injectable products). In Europe, we<br />

expect net sales to come in at `265cr, up 11.5%, while the RoW is expected to<br />

register 8.7% yoy growth to `225cr on the back of product launches. <strong>The</strong> ARV<br />

segment is expected to clock 10.8% yoy growth to `549cr as contribution from<br />

PEPFAR contract increases.<br />

For FY2012, we expect net sales to clock strong growth of 18.7% to `4,506cr on<br />

the back of increase in capacity utilisation at its new facilities. Formulation sales<br />

are expected to register 32.0% yoy growth to `3,000cr while the API segment is<br />

expected to remain flat at `1,575cr.<br />

October 18, 2010 12<br />

33<br />

67<br />

41<br />

59<br />

48<br />

52<br />

55 60<br />

45 40<br />

FY2006 FY2007 FY2008 FY2009 FY2010 FY2011E FY2012E<br />

API Formulations<br />

67<br />

33

Overall, we expect net sales to post a<br />

CAGR of 15.6% over FY2010-12 to<br />

`4,506cr driven by the supply<br />

agreements, US (ex Pfizer) region and<br />

ARV contracts<br />

Exhibit 19: Sales break-up<br />

<strong>Aurobindo</strong> <strong>Pharma</strong> | Initiating Coverage<br />

In the US, under the Pfizer contract we expect APL to clock sales of `540cr<br />

following the increase in product launches. Further, ex-Pfizer sales in the US is<br />

expected to grow 36.3% yoy to `1,206cr and is likely to witness improvement in<br />

revenue per product. For EU we expect revenues to grow at 31.4% to `348cr,<br />

while RoW is expected to clock net sales of `294cr following commencement of<br />

supplies under the Pfizer and AstraZeneca contracts. On the ARV front, we expect<br />

growth of 11.5% in revenues to `612cr. Overall, we expect net sales to log a<br />

CAGR of 15.6% over FY2010-12 to `4,506cr driven by the supply agreements, US<br />

(ex Pfizer) region and ARV contracts.<br />

(` cr) FY2006 FY2007 FY2008 FY2009 FY2010 FY2011E FY2012E CAGR FY2010-12E<br />

Formulations 271 694 999 1,397 1,852 2,273 3,000 27.3<br />

US 58 156 236 537 912 1,234 1,746 38.3<br />

Pfizer - - - 13 225 349 540 54.9<br />

Ex-Pfizer 58 156 236 524 687 885 1,206 32.5<br />

Europe 45 128 201 198 237 265 348 21.0<br />

Pfizer - - - - 2 18 63 461.2<br />

Ex-Pfizer 45 128 201 198 235 247 285 10.0<br />

RoW 82 288 158 198 207 225 294 19.1<br />

Pfizer - - - - - - 18 -<br />

Astra - - - - - - 23 -<br />

Ex-Pfizer, Astra 82 288 158 198 207 225 253 10.6<br />

ARV 86 122 404 464 495 549 612 11.1<br />

API 1,425 1,531 1,548 1,628 1,593 1,581 1,575 (0.6)<br />

SSP 586 591 804 723 607 577 550 (4.8)<br />

Cephalosporin 484 643 592 634 679 694 700 1.5<br />

ARV & other high value 355 296 152 271 307 310 325 2.8<br />

Gross Sales 1,696 2,224 2,547 3,025 3,446 3,854 4,575 15.2<br />

Less Excise duty 95 102 117 90 76 58 69<br />

Net Sales 1,601 2,122 2,430 2,935 3,370 3,796 4,506 15.6<br />

Growth (%)<br />

Source: Company, Angel Research<br />

APL has been able to expand its OPM<br />

(excluding other OI) from 11.1% in<br />

FY2006 to 18.3% in FY2010<br />

32.6 14.5 20.8 14.8 12.7 18.7<br />

Margin expansion to be driven by increasing contribution from<br />

formulations<br />

APL has been able to expand its OPM (excluding other operating income) from<br />

11.1% in FY2006 to 18.3% in FY2010 and is now on par with the sector average<br />

in spite of higher contribution from the low-margin API segment. <strong>The</strong> company’s<br />

gross margins improved significantly by 12.1% over FY2006-10 to 47.3% on the<br />

back of increasing contribution from the high-margin formulation segment.<br />

However, the increase in gross margins was partly offset by the rise in SG&A and<br />

employee expenses, which restricted the increase in OPM by 7.2% to 18.3% in<br />

FY2010. APL increased its employee strength by 16% in FY2010 with the<br />

commencement of its new facilities and expansion at its API facilities.<br />

October 18, 2010 13

Overall, the transformation to a<br />

formulation player has benefited APL in<br />

dual ways - most of the API is now<br />

utilised for internal consumption making<br />

it cost competitive as well as insulating<br />

the company from the high price<br />

volatility witnessed in the API business<br />

<strong>Aurobindo</strong> <strong>Pharma</strong> | Initiating Coverage<br />

Going ahead, increase in contribution from formulations to 67% in FY2012 from<br />

55% in FY2010 and gradual scale up in capacity utilisation at its new facilities are<br />

likely to increase its OPM to 20.4% in FY2012 from 18.3% in FY2010.<br />

On a comparative basis, APL’s OPM would be on par with the sector average. This<br />

is on back of backward integration on the formulation front. Overall, the<br />

transformation to formulation player has benefited APL in dual ways - most of the<br />

API is now utilized for internal consumption (more than 90% of its formulation is<br />

backward integrated) thereby making it cost competitive in the formulation space<br />

as well as insulating the company from the high price volatility (seen especially<br />

between 2008-09 where gains of the formulation business was offset by price<br />

volatility on the API front) witnessed on the API business. Further, APL does not<br />

have a significant presence in the branded generic segment (including India)<br />

owing to which its expenditure for sales promotion and advertisements are on the<br />

lower side.<br />

Exhibit 20: OPM comparison (FY2012)<br />

(%)<br />

40.0<br />

30.0<br />

20.0<br />

10.0<br />

0.0<br />

33.5<br />

Sun<br />

<strong>Pharma</strong><br />

21.5 21.0 20.4 19.5 19.4<br />

Cipla Cadila<br />

Healthcare<br />

Source: Company, Angel Research. Note: Ranbaxy’s base business OPM considered.<br />

Recurring PAT (ex other OI) to increase by 29.1% CAGR over<br />

FY2010-12<br />

Recurring PAT (ex other OI) registered CAGR of 46.0% to `304cr during FY2006-<br />

10 driven by sales growth and margin expansion.<br />

Going ahead, interest expense is expected to rise as the company raises debt to<br />

repay the FCCBs (including premium) to the tune of `938cr in May 2011. We<br />

estimate interest expense to increase from `73cr to `91cr in FY2012. Depreciation<br />

cost is also expected to increase from `149cr in FY2010 to `208cr in FY2012 due<br />

to the new facilities (Unit VII (SEZ), NJ and Trident).<br />

In the last two years (FY2009 and FY2010), the company clocked other OI of<br />

`142cr and `206cr on the back of sale of dossiers to Europe and under the Pfizer<br />

contract, which has resulted in strong cash flows for the company. On a<br />

conservative basis, we expect the company to clock dossier income of `140cr both<br />

in FY2011 and FY2012 primarily from the supply agreements.<br />

October 18, 2010 14<br />

7.8<br />

APL Lupin Dr Reddy's Ranbaxy

Excluding the dossier income, recurring<br />

PAT is estimated to record strong CAGR<br />

of 29.1% to `506cr in FY2012<br />

Exhibit 21: Other operating income and Recurring PAT (ex other OI)<br />

(` cr)<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

6.4<br />

3<br />

3.4<br />

13 11<br />

3.6<br />

Source: Company, Angel Research<br />

142<br />

44.2<br />

<strong>Aurobindo</strong> <strong>Pharma</strong> | Initiating Coverage<br />

Overall, we expect recurring PAT to increase by 16.6% to `617cr assuming lower<br />

income from the sale of dossiers. Excluding the dossier income, recurring PAT is<br />

estimated to record strong CAGR of 29.1% to `506cr in FY2012.<br />

31.9<br />

30.0<br />

206<br />

22.6 17.4<br />

20.0<br />

140 140<br />

10.0<br />

FY2006 FY2008 FY2010 FY2012E<br />

Other Op Income % of PBT<br />

APL has been on aggressive capex<br />

spree in the last five years with capex of<br />

`1,721cr<br />

To address capacity constraints on the<br />

NPNC front, APL commercialised Unit<br />

VII (SEZ) in FY2010<br />

50.0<br />

40.0<br />

0.0<br />

(%)<br />

Capex spend to moderate<br />

<strong>The</strong> company has been on an aggressive capex spree in the last five years<br />

incurring capex of `1,721cr (73% of FY2010 fixed assets), which was largely spent<br />

on the formulation segment.<br />

However, capacity utilisation has been subdued especially in tablets/capsules at<br />

46% in FY2010 primarily due to lower utilisation at the Unit VIB (Cephs) and Unit<br />

XII (SSP). However, going ahead, we expect the utilisation to increase at these<br />

facilities on the back of injectable product launches in the US and pick up in<br />

volume under the supply agreements.<br />

Exhibit 22: Formulation facilities<br />

Units Product Capacity Utilisation (%)<br />

Unit VIB Cephs oral & sterile < 25<br />

Unit XII SSP oral and sterile 85<br />

Unit VII (SEZ) NPNC Newly commenced<br />

USA NJ NPNC Newly commenced<br />

Trident Injectables (NPNC) To commence in 2HFY2012<br />

Source: Company, Angel Research<br />

Further, to address the capacity constraint in Unit III (NPNC), APL built a facility<br />

near Hyderabad (Unit VII SEZ) in FY2010. APL spent around `250cr to set up this<br />

facility, which is spread across 10 acres of the total 75 acres land. <strong>The</strong> unit has<br />

the capacity to produce to 1,000mn tablets and 100mn capsules per month, which<br />

has almost doubled the company’s tablets/capsules production. <strong>The</strong> company<br />

expects the unit to meet the increasing demand in the regulated markets and<br />

emerging markets.<br />

October 18, 2010 15<br />

(` cr)<br />

600<br />

400<br />

200<br />

0<br />

67<br />

189<br />

230<br />

169<br />

304<br />

355<br />

506<br />

FY2006 FY2007 FY2008 FY2009 FY2010 FY2011E FY2012E<br />

Recurring PAT

Exhibit 24: Debt levels, FCF and Capex<br />

(` cr)<br />

2,500<br />

2,000<br />

1,500<br />

1,000<br />

500<br />

0<br />

1,373<br />

2,078<br />

1,908<br />

Source: Company, Angel Research<br />

2,333<br />

2,155<br />

2,004<br />

<strong>Aurobindo</strong> <strong>Pharma</strong> | Initiating Coverage<br />

APL has also commercialised its NJ facility, which it acquired from Sandoz in<br />

2006. Through this facility APL is targeting the institutional business in the US. It is<br />

necessary to have a local production unit to run the institutional business. APL has<br />

begun filings of controlled substances from the unit, which is expected to contribute<br />

from FY2013 onwards. Overall, we expect Unit VII SEZ and the NJ facility to scale<br />

up and witness ramp up in capacity utilisation in FY2012 driven by supply<br />

agreements, US and ARV segment leading to an improvement in margins.<br />

Thus, with most of the facilities in place, we expect APL to incur moderate capex of<br />

`568cr over the next two years.<br />

Debt concerns receding<br />

In view of APL’s aggressive capex, its net debt/equity increased to 1.8x in FY2009,<br />

which was much higher than the industry average of 0.4x. However, in FY2010,<br />

with overall improvement in business profitability (OPM expansion), the company’s<br />

net debt/equity improved to 1.1x. Going ahead, in FY2012, we expect net<br />

debt/equity to further improve to 0.6x on the back of debt repayments, decline in<br />

capex and improvement in profitability.<br />

APL has outstanding FCCB of US $139.2mn repayable in May 2011 with the<br />

conversion price at 25-43% premium over the current price. We expect APL to<br />

repay its outstanding FCCBs through internal accruals and debt resulting in outflow<br />

of `938cr.<br />

Exhibit 23: FCCB details<br />

Maturity Date<br />

Issued<br />

(US$ mn)<br />

Converted/<br />

Bought back<br />

O/s US<br />

$mn<br />

October 18, 2010 16<br />

YTM<br />

(%)<br />

Exch Rate<br />

(`/US $)<br />

Amt Payable<br />

(` cr)<br />

Breakeven<br />

price (`)<br />

August 8, 2010 60.0 60.0 - 40.0 - - -<br />

May 10, 2011 150.0 43.8 106.2 46.3 46.0 715 1,615<br />

May 17, 2011 50.0 17.0 33.0 46.9 46.0 223 1,406<br />

Total 260.0 120.8 139.2<br />

Source: Company, Angel Research<br />

1,766<br />

FY2006 FY2008 FY2010 FY2012E<br />

Debt Net Debt Equity<br />

2.0<br />

1.6<br />

1.2<br />

0.8<br />

0.4<br />

0.0<br />

(x)<br />

(` cr)<br />

600<br />

450<br />

300<br />

150<br />

0<br />

(150)<br />

(300)<br />

(450)<br />

(237)<br />

253<br />

(326)<br />

345<br />

(48)<br />

244<br />

(343)<br />

479<br />

29<br />

400<br />

938<br />

288 280<br />

247<br />

198<br />

FY2006 FY2007 FY2008 FY2009 FY2010 FY2011E FY2012E<br />

FCF Capex

Concerns<br />

<strong>Aurobindo</strong> <strong>Pharma</strong> | Initiating Coverage<br />

� Delay in ramp up of supply agreements: APL is expected to receive 14.3% of<br />

its FY2012 revenues from the supply agreements (Pfizer and AstraZeneca).<br />

Hence, any delay in ramp up of the supply agreements would pose a<br />

downside risk to our estimates.<br />

� Forex risks: Exports constitute 61% of the company revenues. <strong>The</strong>refore, any<br />

significant appreciation in the rupee could adversely affect the company's<br />

margins. However, more than 80% of the company’s debt is foreign currency<br />

denominated providing a natural hedge against currency volatility.<br />

� High price volatility in the API business: Higher-than-anticipated price erosion<br />

in the company's generic API business, could impact its profitability. In<br />

FY2008-09, OPMs were flat in spite of higher contribution from the<br />

high-margin formulation business as the gains were offset by the price<br />

volatility in the API business. However, with formulation contribution to net<br />

sales increasing to 67% in FY2012 and reducing dependence on Pen-G<br />

related APIs, which should cushion the company’s margins going ahead.<br />

October 18, 2010 17

Company Background<br />

<strong>Aurobindo</strong> <strong>Pharma</strong> | Initiating Coverage<br />

APL, one of the largest API manufacturers in Asia, was incorporated in 1989 by P V<br />

Ramaprasad Reddy and K Nityananda Reddy. APL is now present across the value<br />

chain from intermediates, API and formulations supported by a strong R&D team.<br />

APL has commercialised over 200 APIs and 300 formulation products till date.<br />

Over the years, the company has developed its presence in key therapeutic areas<br />

such as SSPs, Cephs, Anti-virals, CNS, CVS, gastroenterology, pain management,<br />

etc. Being an integrated player, the company enjoys an edge over competition.<br />

<strong>The</strong> company has 15 manufacturing facilities across the globe approved by the US<br />

FDA and other regulators. APL has presence in more than 100 countries and<br />

derives more than 60% of its revenues from exports.<br />

Exhibit 25: Facilities<br />

Formulations<br />

Unit Products<br />

Unit III Multi-purpose non-Betalactums Oral<br />

Unit VII (SEZ) Non-Betallactums Oral<br />

USA NJ Non-Betallactums Oral<br />

Unit VIB Cephalosporins (Oral & Sterile)<br />

Unit XII Semi-synthetic penicillins (SSP) oral and sterile<br />

API<br />

Units Products<br />

Unit I CVS, CNS, Anti-allergic<br />

Unit IA Cephalosporins (Non-Sterile)<br />

Unit V Semi-synthetic penicillins (sterile and Non sterile)<br />

Unit VIA Cephalosporins (Sterile)<br />

Unit VIII<br />

Gastro enterologicals,<br />

Anti-retroviral<br />

Unit XIB Anti-retroviral<br />

Source: Company, Angel Research<br />

October 18, 2010 18

Profit & Loss Statement (Consolidated)<br />

<strong>Aurobindo</strong> <strong>Pharma</strong> | Initiating Coverage<br />

Y/E March (` cr) FY2007 FY2008 FY2009 FY2010 FY2011E FY2012E<br />

Net Sales 2,122 2,430 2,935 3,370 3,796 4,506<br />

Other operating income 13 11 142 206 140 140<br />

Total operating income 2,135 2,441 3,077 3,575 3,936 4,646<br />

% chg 670.9 14.3 26.1 16.2 10.1 18.0<br />

Total Expenditure 1,821 2,089 2,561 2,752 3,089 3,588<br />

Net Raw Materials 1,300 1,412 1,680 1,777 1,932 2,178<br />

Other Mfg costs 206 267 301 338 406 473<br />

Personnel 150 193 244 327 414 533<br />

Other 164 217 336 310 336 403<br />

EBITDA 301 341 374 617 707 919<br />

% chg 70.2 13.2 9.6 65.1 14.6 29.9<br />

(% of Net Sales) 14.2 14.0 12.7 18.3 18.6 20.4<br />

Depreciation& Amortisation 100 100 128 149 187 208<br />

EBIT 202 241 246 468 520 710<br />

% chg 284.4 19.3 2.3 90.0 11.2 36.5<br />

(% of Net Sales) 9.5 9.9 8.4 13.9 13.7 15.8<br />

Interest & other Charges 86 69 93 73 74 91<br />

Other Income 77 110 27 44 34 43<br />

(% of PBT) 37.5 37.6 - 6.9 5.5 5.3<br />

Share in profit of Associates - 0.0 0.0 - - -<br />

Recurring PBT 206 292 323 645 620 802<br />

% chg 170.7 41.8 10.5 100.0 (3.8) 29.4<br />

Extraordinary Expense/(Inc.) - - 201.0 (109.5) (13.9) -<br />

PBT (reported) 206 292 122 754 634 802<br />

Tax 4.4 53.6 21.4 191.4 155.0 185.7<br />

(% of PBT) 2.1 18.4 17.6 25.4 24.4 23.1<br />

PAT (reported) 201 238 100 563 479 617<br />

Less: Minority interest (MI) 1 (0) - (0) - -<br />

PAT after MI (reported) 200 239 100 563 479 617<br />

ADJ. PAT 200 239 301 454 465 617<br />

% chg 292.7 19.1 26.3 50.7 2.5 32.6<br />

(% of Net Sales) 9.4 9.8 3.4 16.7 12.6 13.7<br />

Basic EPS (`) 37.7 44.4 18.6 101.1 84.9 109.2<br />

Adj Fully Diluted EPS (`) 37.7 44.4 56.0 81.5 82.4 109.2<br />

% chg 409.2 17.8 26.3 45.4 1.1 32.6<br />

October 18, 2010 19

Balance Sheet (Consolidated)<br />

<strong>Aurobindo</strong> <strong>Pharma</strong> | Initiating Coverage<br />

Y/E March (` cr) FY2007 FY2008 FY2009 FY2010 FY2011E FY2012E<br />

SOURCES OF FUNDS<br />

Equity Share Capital 27 27 27 28 28 28<br />

Share Application Money - - - - - -<br />

Reserves& Surplus 859 1,097 1,214 1,801 2,248 2,821<br />

Shareholders’ Funds 886 1,124 1,241 1,829 2,276 2,849<br />

Minority Interest 4 3 3 4 4 4<br />

Total Loans 2,078 1,908 2,333 2,155 2,004 1,766<br />

Deferred Tax Liability 68 73 77 91 116 133<br />

Total Liabilities 3,036 3,109 3,654 4,079 4,400 4,753<br />

APPLICATION OF FUNDS<br />

Gross Block 1,414 1,601 1,869 2,312 2,850 3,280<br />

Less: Acc. Depreciation 316 418 575 697 884 1,092<br />

Net Block 1,099 1,184 1,294 1,615 1,966 2,188<br />

Capital Work-in-Progress 219 278 536 570 320 170<br />

Goodwill 54 53 105 96 96 96<br />

Investments 0 60 0 0 0 0<br />

Current Assets 2,135 2,059 2,289 2,506 2,882 3,384<br />

Cash 582 283 128 73 151 68<br />

Loans & Advances 272 316 394 375 562 640<br />

Other 1,281 1,460 1,767 2,058 2,169 2,676<br />

Current liabilities 471 526 570 708 864 1,085<br />

Net Current Assets 1,664 1,534 1,719 1,798 2,018 2,299<br />

Mis. Exp. not written off - - - - - -<br />

Total Assets 3,036 3,109 3,654 4,079 4,400 4,753<br />

October 18, 2010 20

Cash Flow Statement (Consolidated)<br />

<strong>Aurobindo</strong> <strong>Pharma</strong> | Initiating Coverage<br />

Y/E March (` cr) FY2007 FY2008 FY2009 FY2010 FY2011E FY2012E<br />

Profit before tax 206 292 73 752 620 802<br />

Depreciation 100 100 128 149 187 208<br />

(Inc)/Dec in Working Capital (267) (91) (334) (261) (142) (364)<br />

Less: Other income (83) (49) (180) 44 34 43<br />

Direct taxes paid (23) (46) (30) (153) (130) (169)<br />

Cash Flow from Operations 99 305 16 443 501 435<br />

(Inc.)/Dec. in Fixed Assets (345) (244) (479) (400) (288) (280)<br />

(Inc.)/Dec. in Investments (205) 113 48 (9) - -<br />

Other income (83) (49) (180) 44 34 43<br />

Cash Flow from Investing (633) (181) (611) (365) (254) (237)<br />

Issue of Equity 3 2 - 5 0 -<br />

Inc./(Dec.) in loans 791 (141) 287 (1) (137) (238)<br />

Dividend Paid (Incl. Tax) (9) (16) (39) (29) (33) (43)<br />

Others 130 (268) 193 (109) - -<br />

Cash Flow from Financing 915 (423) 440 (132) (169) (281)<br />

Inc./(Dec.) in Cash 381 (300) (155) (54) 78 (83)<br />

Opening Cash balances 202 582 283 128 73 151<br />

Closing Cash balances 582 283 128 73 151 68<br />

October 18, 2010 21

Key Ratios<br />

<strong>Aurobindo</strong> <strong>Pharma</strong> | Initiating Coverage<br />

Y/E March FY2007 FY2008 FY2009 FY2010 FY2011E FY2012E<br />

Valuation Ratio (x)<br />

P/E (on FDEPS) 29.7 25.2 20.0 13.7 13.6 10.3<br />

P/CEPS 19.9 17.8 26.4 8.8 9.5 7.7<br />

P/BV 6.7 5.4 4.9 3.4 2.8 2.2<br />

Dividend yield (%) 0.2 0.3 0.4 0.4 0.4 0.6<br />

EV/Sales 3.5 3.1 2.8 2.5 2.2 1.8<br />

EV/EBITDA 24.8 22.4 22.0 13.5 11.6 8.7<br />

EV / Total Assets 2.5 2.5 2.3 2.0 1.9 1.7<br />

Per Share Data (`)<br />

EPS (Basic) 37.7 44.4 18.6 101.1 84.9 109.2<br />

EPS (fully diluted) 37.7 44.4 56.0 81.5 82.4 109.2<br />

Cash EPS 56.2 63.0 42.4 127.9 118.0 146.1<br />

DPS 2.5 3.3 4.5 5.0 4.9 6.6<br />

Book Value 166.1 209.1 230.9 328.3 403.1 504.7<br />

Dupont Analysis<br />

EBIT margin 9.5 9.9 8.4 13.9 13.7 15.8<br />

Tax retention ratio 97.9 81.6 82.4 74.6 75.6 76.9<br />

Asset turnover (x) 1.0 0.9 1.0 0.9 1.0 1.0<br />

ROIC (Post-tax) 8.9 7.5 6.7 9.8 9.9 12.6<br />

Cost of Debt (Post Tax) 4.9 2.8 3.6 2.4 2.7 3.7<br />

Leverage (x) 0.9 1.6 1.6 1.5 1.0 0.7<br />

Operating ROE 12.7 14.7 11.7 20.6 16.9 18.9<br />

Returns (%)<br />

ROCE (Pre-tax) 7.7 7.8 7.3 12.1 12.3 15.5<br />

Angel ROIC (Pre-tax) 10.1 10.3 9.2 15.0 14.5 17.2<br />

ROE 23.5 23.7 25.5 29.6 22.7 24.1<br />

Turnover ratios (x)<br />

Asset Turnover (Gross Block) 1.6 1.6 1.8 1.7 1.5 1.5<br />

Inventory / Sales (days) 96 108 99 101 102 98<br />

Receivables (days) 103 97 92 94 94 92<br />

Payables (days) 81 78 70 74 70 67<br />

WC cycle (ex-cash) (days) 203 174 169 169 167 161<br />

Solvency ratios (x)<br />

Net debt to equity 1.7 1.4 1.8 1.1 0.8 0.6<br />

Net debt to EBITDA 5.0 4.8 5.9 3.4 2.6 1.8<br />

Interest Coverage (EBIT / Int.) 2.3 3.5 2.6 6.4 7.0 7.8<br />

October 18, 2010 22

<strong>Aurobindo</strong> <strong>Pharma</strong> | Initiating Coverage<br />

Research Team Tel: 022 - 4040 3800 E-mail: research@angeltrade.com Website: www.angeltrade.com<br />

DISCLAIMER<br />

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment<br />

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make<br />

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies<br />

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and<br />

risks of such an investment.<br />

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make<br />

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. <strong>The</strong> views contained in this<br />

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.<br />

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and<br />

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's<br />

fundamentals.<br />

<strong>The</strong> information in this document has been printed on the basis of publicly available information, internal data and other reliable<br />

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this<br />

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way<br />

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.<br />

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,<br />

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While<br />

Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory,<br />

compliance, or other reasons that prevent us from doing so.<br />

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,<br />

redistributed or passed on, directly or indirectly.<br />

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or<br />

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in<br />

the past.<br />

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in<br />

connection with the use of this information.<br />

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please<br />

refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and<br />

its affiliates may have investment positions in the stocks recommended in this report.<br />

Disclosure of Interest Statement <strong>Aurobindo</strong> <strong>Pharma</strong><br />

1. Analyst ownership of the stock No<br />

2. Angel and its Group companies ownership of the stock No<br />

3. Angel and its Group companies' Directors ownership of the stock No<br />

4. Broking relationship with company covered No<br />

Note: We have not considered any Exposure below Rs 1 lakh for Angel, its Group companies and Directors.<br />

Ratings (Returns): Buy (> 15%) Accumulate (5% to 15%) Neutral (-5 to 5%)<br />

Reduce (-5% to 15%) Sell (< -15%)<br />

October 18, 2010 23

<strong>Aurobindo</strong> <strong>Pharma</strong> | Initiating Coverage<br />

Address: Acme Plaza, ‘A’ Wing, 3rd Floor, M.V. Road, Opp. Sangam Cinema, Andheri (E), Mumbai - 400 059.<br />

Research Team<br />

Tel: (022) 3952 4568 / 4040 3800<br />

Fundamental:<br />

Sarabjit Kour Nangra VP-Research, <strong>Pharma</strong>ceutical sarabjit@angeltrade.com<br />

Vaibhav Agrawal VP-Research, Banking vaibhav.agrawal@angeltrade.com<br />

Vaishali Jajoo Automobile vaishali.jajoo@angeltrade.com<br />

Shailesh Kanani Infrastructure, Real Estate shailesh.kanani@angeltrade.com<br />

Anand Shah FMCG, Media anand.shah@angeltrade.com<br />

Deepak Pareek Oil & Gas deepak.pareek@angeltrade.com<br />

Sushant Dalmia, CFA <strong>Pharma</strong>ceutical sushant.dalmia@angeltrade.com<br />

Rupesh Sankhe Cement, Power rupeshd.sankhe@angeltrade.com<br />

Param Desai Real Estate, Logistics, Shipping paramv.desai@angeltrade.com<br />

Sageraj Bariya Fertiliser, Mid-cap sageraj.bariya@angeltrade.com<br />

Paresh Jain Metals & Mining pareshn.jain@angeltrade.com<br />

Amit Rane Banking amitn.rane@angeltrade.com<br />

John Perinchery Capital Goods john.perinchery@angeltrade.com<br />

Srishti Anand IT, Telecom srishti.anand@angeltrade.com<br />

Jai Sharda Mid-cap jai.sharda@angeltrade.com<br />

Sharan Lillaney Mid-cap sharanb.lillaney@angeltrade.com<br />

Naitik Mody Mid-cap naitiky.mody@angelbroking.com<br />

Amit Vora Research Associate (Oil & Gas) amit.vora@angeltrade.com<br />

V Srinivasan Research Associate (Cement, Power) v.srinivasan@angeltrade.com<br />

Mihir Salot Research Associate (Logistics, Shipping) mihirr.salot@angeltrade.com<br />

Chitrangda Kapur Research Associate (FMCG, Media) chitrangdar.kapur@angeltrade.com<br />

Vibha Salvi Research Associate (IT, Telecom) vibhas.salvi@angeltrade.com<br />

Pooja Jain Research Associate (Metals & Mining) pooja.j@angeltrade.com<br />

Yaresh Kothari Research Associate (Automobile) yareshb.kothari@angeltrade.com<br />

Shrinivas Bhutda Research Associate (Banking) shrinivas.bhutda@angeltrade.com<br />

Sreekanth P.V.S Research Associate (FMCG, Media) sreekanth.s@angeltrade.com<br />

Hemang Thaker Research Associate (Capital Goods) hemang.thaker@angeltrade.com<br />

Nitin Arora Research Associate (Infra, Real Estate) nitin.arora@angeltrade.com<br />

Technicals:<br />

Shardul Kulkarni Sr. Technical Analyst shardul.kulkarni@angeltrade.com<br />

Mileen Vasudeo<br />

Derivatives:<br />

Technical Analyst vasudeo.kamalakant@angeltrade.com<br />

Siddarth Bhamre Head - Derivatives siddarth.bhamre@angeltrade.com<br />

Jaya Agarwal Derivative Analyst jaya.agarwal@angeltrade.com<br />

Institutional Sales Team:<br />

Mayuresh Joshi VP - Institutional Sales mayuresh.joshi@angeltrade.com<br />

Abhimanyu Sofat AVP - Institutional Sales abhimanyu.sofat@angeltrade.com<br />

Nitesh Jalan Sr. Manager niteshk.jalan@angeltrade.com<br />

Pranav Modi Sr. Manager pranavs.modi@angeltrade.com<br />

Sandeep Jangir Sr. Manager sandeepp.jangir@angeltrade.com<br />

Ganesh Iyer Sr. Manager ganeshb.Iyer@angeltrade.com<br />

Jay Harsora Sr. Dealer jayr.harsora@angeltrade.com<br />

Meenakshi Chavan Dealer meenakshis.chavan@angeltrade.com<br />

Gaurang Tisani Dealer gaurangp.tisani@angeltrade.com<br />

Production Team:<br />

Bharathi Shetty Research Editor bharathi.shetty@angeltrade.com<br />

Simran Kaur Research Editor simran.kaur@angeltrade.com<br />

Bharat Patil Production bharat.patil@angeltrade.com<br />

Dilip Patel Production dilipm.patel@angeltrade.com<br />

Angel Broking Ltd: BSE Sebi Regn No : INB 010996539 / CDSL Regn No: IN - DP - CDSL - 234 - 2004 / PMS Regn Code: PM/INP000001546 Angel Securities Ltd:BSE: INB010994639/INF010994639 NSE: INB230994635/INF230994635 Membership numbers: BSE 028/NSE:09946<br />

Angel Capital & Debt Market Ltd: INB 231279838 / NSE FNO: INF 231279838 / NSE Member code -12798 Angel Commodities Broking (P) Ltd: MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX : Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302<br />

October 18, 2010 24