Aurobindo Pharma - The Smart Investor

Aurobindo Pharma - The Smart Investor

Aurobindo Pharma - The Smart Investor

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

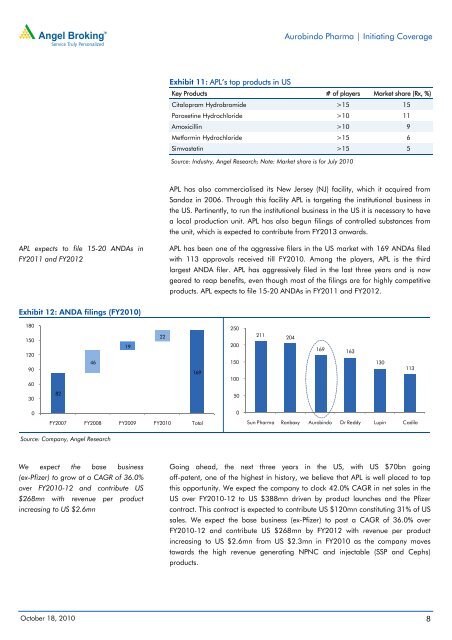

APL expects to file 15-20 ANDAs in<br />

FY2011 and FY2012<br />

Exhibit 12: ANDA filings (FY2010)<br />

180<br />

150<br />

120<br />

90<br />

60<br />

30<br />

0<br />

82<br />

46<br />

Source: Company, Angel Research<br />

19<br />

22<br />

Exhibit 11: APL’s top products in US<br />

<strong>Aurobindo</strong> <strong>Pharma</strong> | Initiating Coverage<br />

Key Products # of players Market share (Rx, %)<br />

Citalopram Hydrobromide >15 15<br />

Paroxetine Hydrochloride >10 11<br />

Amoxicillin >10 9<br />

Metformin Hydrochloride >15 6<br />

Simvastatin >15 5<br />

Source: Industry, Angel Research; Note: Market share is for July 2010<br />

APL has also commercialised its New Jersey (NJ) facility, which it acquired from<br />

Sandoz in 2006. Through this facility APL is targeting the institutional business in<br />

the US. Pertinently, to run the institutional business in the US it is necessary to have<br />

a local production unit. APL has also begun filings of controlled substances from<br />

the unit, which is expected to contribute from FY2013 onwards.<br />

APL has been one of the aggressive filers in the US market with 169 ANDAs filed<br />

with 113 approvals received till FY2010. Among the players, APL is the third<br />

largest ANDA filer. APL has aggressively filed in the last three years and is now<br />

geared to reap benefits, even though most of the filings are for highly competitive<br />

products. APL expects to file 15-20 ANDAs in FY2011 and FY2012.<br />

169<br />

FY2007 FY2008 FY2009 FY2010 Total<br />

We expect the base business<br />

(ex-Pfizer) to grow at a CAGR of 36.0%<br />

over FY2010-12 and contribute US<br />

$268mn with revenue per product<br />

increasing to US $2.6mn<br />

Going ahead, the next three years in the US, with US $70bn going<br />

off-patent, one of the highest in history, we believe that APL is well placed to tap<br />

this opportunity. We expect the company to clock 42.0% CAGR in net sales in the<br />

US over FY2010-12 to US $388mn driven by product launches and the Pfizer<br />

contract. This contract is expected to contribute US $120mn constituting 31% of US<br />

sales. We expect the base business (ex-Pfizer) to post a CAGR of 36.0% over<br />

FY2010-12 and contribute US $268mn by FY2012 with revenue per product<br />

increasing to US $2.6mn from US $2.3mn in FY2010 as the company moves<br />

towards the high revenue generating NPNC and injectable (SSP and Cephs)<br />

products.<br />

October 18, 2010 8<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

211<br />

204<br />

169 163<br />

130<br />

113<br />

Sun <strong>Pharma</strong> Ranbaxy <strong>Aurobindo</strong> Dr Reddy Lupin Cadila