NTPC - The Smart Investor - Business Standard

NTPC - The Smart Investor - Business Standard

NTPC - The Smart Investor - Business Standard

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

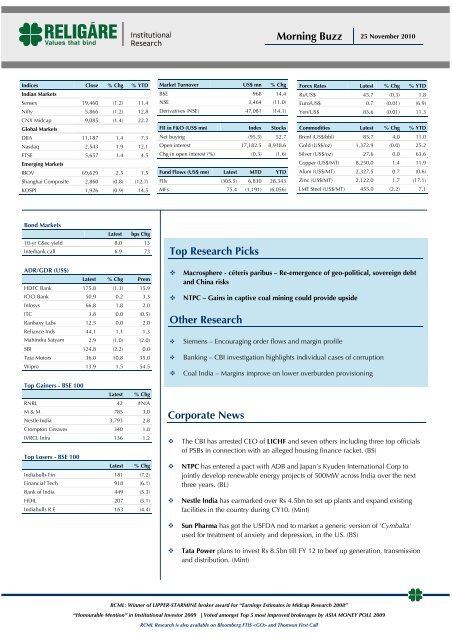

Morning Buzz 25 November 2010Indices Close % Chg % YTDIndian MarketsSensex 19,460 (1.2) 11.4Nifty 5,866 (1.2) 12.8CNX Midcap 9,085 (1.4) 22.2Global MarketsDJIA 11,187 1.4 7.3Nasdaq 2,543 1.9 12.1FTSE 5,657 1.4 4.5Emerging MarketsIBOV 69,629 2.5 1.5Shanghai Composite 2,860 (0.8) (12.7)KOSPI 1,926 (0.9) 14.5Market Turnover US$ mn % ChgBSE 968 14.4NSE 3,464 (11.0)Derivatives (NSE) 47,081 (14.1)FII in F&O (US$ mn) Index StocksNet buying (95.5) 52.7Open interest 17,182.5 8,938.6Chg in open interest (%) (0.3) (1.6)Fund Flows (US$ mn) Latest MTD YTDFIIs (305.5) 6,830 28,343MFs 75.4 (1,191) (6,056)Forex Rates Latest % Chg % YTDRs/US$ 45.7 (0.3) 1.8Euro/US$ 0.7 (0.01) (6.9)Yen/US$ 83.6 (0.01) 11.3Commodities Latest % Chg % YTDBrent (US$/bbl) 85.7 4.0 11.0Gold (US$/oz) 1,372.9 (0.0) 25.2Silver (US$/oz) 27.6 0.0 63.6Copper (US$/MT) 8,250.0 1.4 11.9Alum (US$/MT) 2,327.5 0.7 (0.6)Zinc (US$/MT) 2,122.0 1.7 (17.1)LME Steel (US$/MT) 455.0 (2.2) 7.1Bond MarketsLatest bps Chg10-yr GSec yield 8.0Interbank call 6.91373Top Research PicksADR/GDR (US$)Latest % Chg PremHDFC Bank 175.8 (1.3) 15.9ICICI Bank 50.9 0.2 3.3Infosys 66.8 1.8 2.0ITC 3.8 0.0 (0.5)Ranbaxy Labs 12.5 0.0 2.0Reliance Inds 44.1 1.1 1.3Mahindra Satyam 2.9 (1.0) (2.0)SBI 124.8 (2.2) 0.0Tata Motors 36.0 10.8 35.0Wipro 13.9 1.5 54.5Top Gainers - BSE 100Latest % ChgRNRL 42 #N/AM & M 785 3.0Nestle India 3,793 2.8Crompton Greaves 340 1.8IVRCL Infra 136 1.2Top Losers - BSE 100Latest % ChgIndiabulls Fin 181 (7.2)Financial Tech 918 (6.1)Bank of India 449 (5.3)HDIL 207 (5.1)Indiabulls R E 163 (4.4)Corporate NewsMacrosphere - cēterīs paribus – Re-emergence of geo-political, sovereign debtand China risks<strong>NTPC</strong> – Gains in captive coal mining could provide upsideOther ResearchSiemens – Encouraging order flows and margin profileBanking – CBI investigation highlights individual cases of corruptionCoal India – Margins improve on lower overburden provisioning<strong>The</strong> CBI has arrested CEO of LICHF and seven others including three top officialsof PSBs in connection with an alleged housing finance racket. (BS)<strong>NTPC</strong> has entered a pact with ADB and Japan’s Kyuden International Corp tojointly develop renewable energy projects of 500MW across India over the nextthree years. (BL)Nestle India has earmarked over Rs 4.5bn to set up plants and expand existingfacilities in the country during CY10. (Mint)Sun Pharma has got the USFDA nod to market a generic version of 'Cymbalta'used for treatment of anxiety and depression, in the US. (BS)Tata Power plans to invest Rs 8.5bn till FY 12 to beef up generation, transmissionand distribution. (Mint)RCML: Winner of LIPPER-STARMINE broker award for “Earnings Estimates in Midcap Research 2008”“Honourable Mention” in Institutional <strong>Investor</strong> 2009 | Voted amongst Top 5 most improved brokerages by ASIA MONEY POLL 2009RCML Research is also available on Bloomberg FTIS and Thomson First Call

Morning Buzz 25 November 2010Volume Shockers - BSE 100(‘000) Latest 2mth avg % ChgUnitech 30,819 27,354 112.7Power Grid 23,695 5,721 414.2IDBI Bank 13,362 8,831 151.3Suzlon Energy 10,286 18,093 56.8Mahindra Satyam 8,087 18,711 43.2Delivery Toppers - BSE 100Del % Tot Vol Days upAsian Paints 90.0 116,531 (1)Grasim 82.7 111,153 (1)Nestle India 82.1 39,079 (1)Tata Power 78.1 425,271 (1)HUL 76.0 4,763,503 2Punj Lloyd has won ~Rs 16bn of domestic and overseas contracts, including a ~Rs11bn order from IOC for the Paradip Refinery Project. (BL)<strong>The</strong> PNGRB would be inviting bids for the Surat-Paradip and Asansol-Howrah gaspipeline projects next week. (BS)Abbott India and Solvay India have jointly announced that they will merge at aswap ratio of 2:3. (ET)<strong>The</strong> government said there is no proposal to ban public sector firm BharatAluminium Company’s bauxite mining projects in Chhattisgarh. (Mint)Bangalore-based Kudremukh Iron Ore Company said it plans to set up anintegrated steel plant in Karnataka at an investment of Rs 80bn-90bn. (BS)BSE Sectoral IndicesLatest % Chg % YTDMidcap 8,004 (1.1) 19.2Smallcap 10,153 (0.6) 21.5Auto 10,116 0.1 36.1Banks 13,478 (2.9) 34.4Capital Goods 15,435 (1.2) 9.3Comm & Tech 3,632 (0.9) 10.8Con. Durables 6,521 (0.2) 72.3FMCG 3,622 0.2 29.7Healthcare 3,622 (0.3) 31.1IT 5,937 (1.1) 14.5Metals 16,211 (1.0) (6.8)Oil & Gas 10,149 (0.6) (3.1)Power 2,946 (0.9) (7.6)Realty 3,042 (2.9) (21.1)Market BreadthAdv Dec A/DNSE 509 895 0.6Sensex 5 25 0.2BSE 100 14 85 0.2BSE 200 32 167 0.2BSE 500 95 402 0.2Sensex Intraday19,90019,80019,70019,60019,50019,40019,3009:07 AM9:57 AM10:42 AM11:28 AM12:13 PM1:00 PM1:48 PM2:37 PM3:27 PMEconomic News<strong>The</strong> FMCG market in rural India is tipped to touch US$ 100bn by 2025, accordingto a study by <strong>The</strong> Nielsen Company. (BS)<strong>The</strong> two-way commerce between India and Arab Nations is expected to reachUS$ 240bn by 2014. (BS)Ministry of State for Petroleum and Natural Gas said that the decision to decontroldiesel prices has been put on hold owing to the increase in food inflation. (BS)Global NewsIreland has unveiled a four-year plan to claw back US$ 20bn using spending cutsand extra taxes. (Mint)General Motors Co plans to invest US$ 163mn at plants in Michigan and Ohio toadd engine production for the Chevrolet Cruze, the Chevy Volt and an unnamednew small car. (ET)Axiom Telecom has reached a distribution deal with BlackBerry maker ResearchIn Motion. (ET)Rolls-Royce Group PLC has won a US$ 1.2bn engine service contract fromEmirates airline. (BL)Source: BL: <strong>Business</strong> Line, BS: <strong>Business</strong> <strong>Standard</strong>, ET: Economic Times, FE: Financial Express2

Macrosphere – cēterīs paribus India Economics 25 November 2010Macrosphere – cēterīs paribusRe-emergence of geo-political, sovereign debt and China risksJust when the markets had begun to settle down and demonstrate someresilience, we received jolts from the Korean peninsula and a resurfacing of theEuropean sovereign debt crisis. <strong>The</strong> debt crisis is likely to be a risk overhang formost of 2011, and may indeed turn uglier in Q2, when Spain may be ‘put on theblock’ by the markets. In addition, we have the threat of inflation in emergingmarket economies, most importantly China. Central bank actions to tameinflation can slow the growth engines of EMs, which have so far been doublingup as the global growth engine in the post-crisis recovery.India stands apart among the EMs because of earlier emergence of the inflationrisk and the early effectiveness of RBI policy steps. However, the risk of flowsdrying out and even reversing is significant, as the vulnerability of India’sexternal accounts has increased manifold in the last few years. Domestic risksinclude the recent spate of corruption charges as well as the return of corporategovernance issues.North-South Korea exchange fire; markets singed: Asian markets crashed whilegold prices shot up as a result of the flight to safety by investors on reports of anescalation in tension between North and South Korea. <strong>The</strong> standoff is believed tobe the worst since the war on the peninsula during 1950–53, and poses asignificant geo-political risk given the US stake in the region and the relationshipbetween Washington and Pyongyang.Sovereign debt crisis endangers EU: <strong>The</strong> sovereign debt crisis has intensifiedonce again in the Eurozone, with the CDS over Ireland, Greece and Portugalreaching new highs. However, likely support from the IMF and EU calmed nervestowards the end of last week. As per estimates, Ireland might require foreignloans of over € 50bn to strengthen the country’s banks. This news flow led to afurther weakening of the euro.China hikes required reserve ratioRequired Reserve Ratio(%) CPI Inflation (R) (% YoY)20108156410250(2)0(4)Mar-06Jul-06Nov-06Mar-07Jul-07Nov-07Mar-08Jul-08Nov-08Mar-09Jul-09Nov-09Mar-10Jul-10Nov-10Source: Bloomberg, RCML Research<strong>The</strong> month that was India’s industrial production grows by 4.4% YoY;high volatility in monthly data raises concernsWPI inflation increases marginally to 8.6% YoY;expected to moderate in next few months on theback of negative base effectChina hikes its reserve requirement ratio by100bps in October along with a 50bps hike ininterest ratesUS Fed releases its monetary easing program ofUS$ 600bn; long-term rates to remain low at therisk of higher inflationNorth-South Korea exchange artillery fire; shellhits markets<strong>The</strong> month that will beToo big to save? Greece and Portugal were the warm-up acts; Spain is the mainthreat, where stakes rise several fold. Greece and Ireland hold extraordinarily highlevels of debt—totalling ~US$ 2tn—primarily carried by European banks, whoseexposure is equivalent to 20% of the Eurozone GDP. Spain and Portugal are seen asthe next vulnerable sovereign debt scares. So this adds a whole new dimension to theconcept of ‘European contagion’. A wave of sovereign defaults in these peripheralcountries would deal a serious blow to the European banking system at the very timewhen the region’s banks are yet to fully recover from their 2008–09 loan losses.Chinese inflation, escalation of tensions in Asia,sovereign debt crisis in Europe and further capitalcontrols among EMsBesides surveys and leading indicators, the focuswill also remain on Q3 GDP numbers for theIndian economy<strong>The</strong> primary challenge for US banks was exposure to bad mortgages. In June ’08, theirtotal exposure to sub-prime mortgages was US$ 2.5tn. In this context, the US$ 2tnexposure of European banks to peripheral sovereign debt may at best hamper theirability to facilitate economic recovery and at worst trigger another economic downturn.2 nd hike in two weeks for Chinese RRR: <strong>The</strong> Chinese central bank increased thereserve requirement ratio (RRR) by 50bps for the second time in two weeks, in abid to squeeze out excess cash from the economy and thus rein in inflationbefore it gets out of hand. This was the fifth such announcement this year, andtakes the RRR to 18.5% for big banks, which is a record high. <strong>The</strong> move comesafter the central bank increased interest rates in October for the first time in threeyears; we expect more rate increases before the end of the year. <strong>The</strong>announcement is likely to further incite US officials calling for an appreciation ofthe Chinese yuan against the dollar, in order to balance international trade.For further refer to our detail report release on 24November10Macro indicatorsIndicatorLatest Release(% YoY)Q1 GDP 8.8WPI Inflation 8.6Industrial Production 4.4Bank Credit 22.0Exports 21.3Imports 6.8PMI Manufacturing 57.2PMI Services 56.2Commercial Vehicles Production 21.4Compiled by RCML ResearchJay Shankar(91-22) 6766 34442jay.shankar@religare.in3

<strong>NTPC</strong> Ltd Company Update 25 November 2010ValuationWe use FCFF as the primary tool for valuation of the company. We have assumed fiveyear intermediate growth of 7.5%, and terminal growth of 5%.Fig 1 - Valuation assumptionsAll figures in Rs mnValuePresent Value of Free Cash 1,863,653Less: Net Debt (incl. Investments) 203,535Add: Mkt premium of OTSSbondsEfficiency gain from coal mining 39,218 Assumed DCF valuationEquity Value 1,699,336O/S no. of shares FY04 (mn) 8,245Per share value (Rs) 205WACC CalculationAvg. cost of debt 8.0% Marginal tax rate 16.7%Post tax cost of debt = 6.7% 10 yrs bond yield rate 8.0%Target debt:equity = 1.00 Equity risk premium 5.0%WACC = 9.5% Market rate of return 12.3%Terminal Growth (wef FY2017) 5.0%Medium Term Growth (FY13-17) 7.5%Source: RCML research5

<strong>NTPC</strong> Ltd Company Update 25 November 2010DuPont analysis(%) FY10 FY11E FY12E FY13E FY14ETax burden (Net income/PBT) 80.2 70.3 69.5 69.6 72.3Interest burden (PBT/EBIT) 99.4 105.6 101.4 97.6 95.3EBIT margin (EBIT/Revenues) 23.0 26.7 26.3 28.4 29.9Asset turnover (Revenues/Avg TA) 48.6 46.0 47.3 46.5 45.4Leverage (Avg TA/Avg equtiy) 163.0 161.2 163.4 171.6 177.1Return on equity 14.6 14.7 14.4 15.4 16.6Company profile<strong>NTPC</strong> Ltd. owns and operates power generation plants that supplypower to state electricity boards throughout India. <strong>The</strong> Company isa public sector undertaking of the Government of India and it alsoundertakes turnkey consulting projects to set up power plants.Shareholding pattern(%) Mar-10 Jun-10 Sep-10Promoters 84.5 84.5 84.5FIIs 2.6 2.6 2.9Banks & FIs 9.1 9.1 8.8Public 3.8 3.8 3.8Recommendation historyDate Event Reco price Tgt price Reco31-May-10 Initiating Coverage 201 200 Sell26-Jul-10 Results Review 202 200 Sell27-Oct-10 Results Review 205 200 Sell24-Nov-10 Company Update 179 205 BuyStock performance220210● Sell ● Buy200190180170May-10 Jun-10 Jul-10 Aug-10 Sep-10 Oct-10 Nov-107

Siemens Ltd Results Review 25 November 2010Siemens LtdEncouraging order flows and margin profileSiemens’ (SIEM) FY10 results were in line with our expectations at theconsolidated level, even as they were significantly ahead of our estimates forthe parent company (SA) driven by healthy growth in the industry andhealthcare segments. Consolidated revenues/EBITDA/PAT for FY10 were up by4.2%/25.5%/36.7% YoY to Rs 97.4bn/Rs 13.2bn/ Rs 7.6bn, while that for theparent by 11.1%/26.4%/26.5% YoY to Rs 94bn/Rs 12.9bn/ Rs 8.2bn. <strong>The</strong>implied sales and EBITDA for the parent company in Q4FY10 stood atRs 30.6bn (up 21.6% YoY) and Rs 4bn (up 62.9% YoY) respectively. SIEM’sFY10 EBITDA margin expanded 170bps to 13.8%, propelled by sharp marginimprovement in the industry segment. Order intake for the year was atRs 124bn, a growth of 41% YoY, while order backlog at FY10-end came in at~Rs 136bn, higher 32% YoY. We expect growth in order inflows and upgradesin earnings to drive up stock valuations, going ahead. Maintain BUY.Broad-based growth encouraging: SIEM’s industry and energy segments reporteda growth of 10.3% and 8.4% YoY for FY10 respectively, while the healthcaresegment saw a commendable 38.8% growth for the year. On a sub-segmentlevel, industry automation and power transmission businesses showed animpressive revenue expansion of 25% YoY and 18% YoY respectively.EBITDA margin expands 170bps: <strong>The</strong> company’s FY10 EBITDA margin increased170bps YoY to 13.8%, fuelled by sharp margin expansion in the industrysegment. Within this segment, the EBIT margin for drive technology soared by>160bps YoY to 7.9%. EBIT margin for energy segment also went up by 137bpsYoY to 15%, driven by higher margins in the fossil power generation business.Order inflows pick up: Order inflows for the year were at Rs 124bn, higher 41%YoY. Order backlog at FY10-end came in at ~Rs 136bn, up 32% YoY; this, in ourview, gives comfortable visibility on the company’s future revenue growth.Set to develop India as a global sourcing hub: Earlier in Dec ’09, SIEM hademphasised that over the next three years, it intends to undertake capacityexpansion across six product lines at an outlay of Rs 16bn in India. In our view,apart from its maintaining its leadership in certain high technology product lines,SIEM is also focusing on developing India as a global sourcing hub for valueproducts. We believe this diversification can lend an additional growth lever toSIEM’s Indian operations.Scope for further upside; maintain BUY: At our current estimates, the stocktrades at a P/E of 28.3x/23.5x for FY11E/FY12E. We restate a BUY on the stockwith a Sep ’11 target price of Rs 1,000.What’s New? Target Rating EstimatesCMP TARGET RATING RISKRs 787 Rs 1,000 BUY LOWBSE NSE BLOOMBERG500550 SIEMENS SIEM INCompany dataMarket cap (Rs mn / US$ mn) 266,238/5,319Outstanding equity shares (mn) 337Free float (%) 31.3Dividend yield (%) 0.6%52-week high/low (Rs) 857 / 4922-month average daily volume 468,615Stock performanceReturns (%) CMP 1-mth 3-mth 6-mthSiemens 787 (5.7) 10.5 17.2BSE CG 15,435 (4.0) 3.8 14.1Sensex 19,460 (3.5) 6.3 18.2P/E comparison(x)Siemens Industry40 35.13025.928.42021.123.617.9100F Y10E F Y11E F Y12EValuation matrix(x) FY10E FY11E FY12E FY13EP/E @ CMP 35.1 28.3 23.5 20.9P/E @ Target 44.5 35.9 29.9 26.5EV/EBITDA @ CMP 19.1 16.7 13.8 12.1Financial highlights(Rs mn) FY10 FY11E FY12E FY13ERevenue 97,430 117,858 145,510 165,640Growth (%) 4.2 21.0 23.5 13.8Adj net income 7,578 9,388 11,287 12,733Growth (%) 36.7 23.9 20.2 12.8FDEPS (Rs) 22.5 27.8 33.5 37.8Growth (%) 36.7 23.9 20.2 12.8Profitability and return ratios(%) FY10E FY11E FY12E FY13EEBITDA margin 13.5 12.8 12.6 12.6EBIT margin 11.8 11.2 10.9 10.8Adj PAT margin 7.8 8.0 7.8 7.7ROE 24.6 24.9 24.5 22.6ROIC 37.3 34.9 34.4 31.7ROCE 37.3 34.9 34.4 31.7Misal SinghAbhishek Raj(91-22) 6766 3466 (91-22) 6766 3485misal.singh@religare.in abhishek.raj@religare.in8

Siemens Ltd Results Review 25 November 2010Result highlightsFig 2 - Actual vs estimated performance(Rs mn) Actual Estimate % VarianceAbove estimates due to higher growthin the industry and healthcare segmentsRevenue 30,610 24,650 24.2EBITDA 4,019 3,046 31.9Adj net income 2,536 1,935 31.1FDEPS (Rs) 7.5 5.7 31.1Source: RCML ResearchFig 3 - Quarterly performance(Rs mn) Q4FY10 Q4FY09 % Chg YoY Q3FY10 % Chg QoQ Q4FY10E Variance (%)Net sales 30,610 25,180 21.6 22,464 36.3 24,650 24.2Less: Direct Cost 24,053 19,828 21.3 16,057 49.8 19,113Staff Cost 1,801 1,587 13.5 1,703 5.7 1,200Other Expenses 737 1,298 (43.2) 2,284 (67.7) 1,291Expenditure 26,591 22,712 17.1 20,044 32.7 21,603Operating profit 4,019 2,468 62.9 2,420 66.1 3,046 31.9Other income - (283) (100.0) - 3Interest (215) (205) 5.1 (181) 19.2 26Depreciation 316 213 48.3 249 26.8 244PBT 3,918 2,177 80.0 2,351 66.7 2,780Tax 1,382 814 69.8 790 75.0 845Reported PAT 2,536 1,363 86.1 1,561 62.4 1,935Adj. PAT 2,536 1,363 86.1 1,561 62.4 1,935 31.1EBITDA margin (%) 13% 10% 333 11% 236 12% 77EPS (Rs) 7.5 4.0 86.1 4.6 62.4 5.7 31.1Source: RCML Research9

Siemens Ltd Results Review 25 November 2010Fig 4 - Segmental SnapshotYear to March Q4FY10 Q3FY10 Q2FY10 FY10 FY09Revenue mix (%)IndustryIndustry Automation 6.4% 6.1% 6.9% 6.5% 5.8%Drive Technologies 11.8% 12.6% 14.5% 13.3% 12.5%Building Technologies 5.5% 5.7% 6.4% 5.6% 5.4%Industry Solutions 10.7% 11.7% 12.5% 11.5% 12.3%Mobility 7.6% 7.1% 11.4% 9.9% 11.0%EnergyFossil power Generation 1.4% 1.0% 1.1% 1.2% 4.5%Oil & Gas 6.6% 6.7% 6.7% 6.8% 6.0%Power Transmission 31.7% 32.8% 23.9% 28.2% 26.5%Power Distribution 10.1% 7.9% 9.4% 9.2% 9.5%Healthcare 8.0% 7.7% 6.8% 7.3% 5.8%Real Estate 0.4% 0.5% 0.5% 0.5% 0.7%Revenue growth (Y-o-Y %)IndustryIndustry Automation 168% 27% -23% 25% -45%Drive Technologies -1% 34% 21% 18% 16%Building Technologies -31% 25% 658% 15% 445%Industry Solutions -21% 25% 23% 3% 1%Mobility -15% -35% 20% -1% 48%EnergyFossil power Generation -73% -66% -66% -69% 225%Oil & Gas 8% 30% 18% 25% 10%Power Transmission 100% 39% -40% 18% -13%Power Distribution 23% 4% 1% 8% 12%Healthcare 37% 69% 37% 39% -10%Real Estate -27% -18% -29% -18% 1%EBIT Margin (%)IndustryIndustry Automation 11.9% 9.3% 4.1% 9.3% 8.6%Drive Technologies 11.3% 2.2% 3.0% 7.9% 6.3%Building Technologies 7.7% 0.8% 3.1% 4.0% 3.8%Industry Solutions 8.7% 12.4% 8.2% 9.2% 9.3%Mobility 8.3% 4.2% 11.1% 8.4% -0.7%EnergyFossil power Generation 21.5% 2.0% 58.2% 30.9% 10.4%Oil & Gas 23.1% 1.2% 8.4% 13.3% 14.4%Power Transmission 15.2% 13.7% 19.8% 17.8% 16.2%Power Distribution 1.3% 6.8% 8.2% 5.6% 7.4%Healthcare 10% 7% 4% 7% 8%Real Estate -92% 80% 75% 81% 129%Source: RCML Research10

Siemens Ltd Results Review 25 November 2010Consolidated financialsProfit and Loss statementY/E March (Rs mn) FY10 FY11E FY12E FY13ERevenues 97,430 117,858 145,510 165,640Growth (%) 4.2 21.0 23.5 13.8EBITDA 13,200 15,086 18,272 20,800Growth (%) 25.5 14.3 21.1 13.8Depreciation & amortisation 1,687 1,926 2,383 2,900EBIT 11,513 13,160 15,889 17,900Growth (%) 31.1 14.3 20.7 12.7InterestOther income 577 683 751 868EBT 12,090 13,842 16,640 18,769Income taxes 4,501 4,568 5,491 6,194Effective tax rate (%) 37.2 33.0 33.0 33.0Extraordinary items - - - -Min into / inc from associates 12 (114) (139) (158)Reported net income 7,578 9,388 11,287 12,733Adjustments - - - -Adjusted net income 7,578 9,388 11,287 12,733Growth (%) 36.7 23.9 20.2 12.8Shares outstanding (mn) 337.2 337.2 337.2 337.2FDEPS (Rs) (adj) 22.5 27.8 33.5 37.8Growth (%) 36.7 23.9 20.2 12.8DPS (Rs) 5.0 5.0 5.0 5.0Cash flow statementY/E March (Rs mn) FY10E FY11E FY12E FY13ENet income + Depreciation 9,265 11,314 13,671 15,633Non-cash adjustments 1,196 - - -Changes in working capital 2,884 (2,646) (2,038) 100Cash flow from operations 13,346 8,668 11,632 15,733Capital expenditure (722) (4,378) (5,436) (5,503)Change in investments (0) - - -Other investing cash flow - - - -Cash flow from investing (722) (4,378) (5,436) (5,503)Issue of equity - - - -Issue/repay debt 2 - - -Dividends paid (11,025) (12,170) (14,461) (12,360)Other financing cash flow 9,468 10,372 12,638 10,517Change in cash & cash eq 11,070 2,492 4,373 8,386Closing cash & cash eq 25,816 28,307 32,680 41,066Economic Value Added (EVA) analysisY/E March FY10E FY11E FY12E FY13EWACC (%) 12.1 12.1 12.1 12.1ROIC (%) 37.3 34.9 34.4 31.7Invested capital (Rs mn) 33,899 41,489 50,953 61,842EVA (Rs mn) 853,494 946,524 1,135,107 1,214,688EVA spread (%) 25.18 22.81 22.28 19.64Balance sheetY/E March (Rs mn) FY10E FY11E FY12E FY13ECash and cash eq 25,816 28,307 32,680 41,066Accounts receivable 37,543 47,941 59,116 67,191Inventories 10,663 13,706 16,925 19,248Other current assets 11,152 13,113 16,455 18,867Investments 0 0 0 0Gross fixed assets 16,721 20,778 25,832 30,882Net fixed assets 9,919 12,371 15,424 18,027CWIP - - - -Intangible assetsDeferred tax assets, net - - - -Other assets (0) (0) (0) (0)Total assets 95,094 115,439 140,600 164,400Accounts payable 50,982 60,867 73,481 84,180Other current liabilitiesProvisions 10,213 13,083 16,166 18,378Debt funds 9 9 9 9Other liabilities 55 57 58 59Equity capital 674 674 674 674Reserves & surplus 33,161 40,749 50,212 61,101Shareholder's funds 33,835 41,423 50,886 61,775Total liabilities 95,094 115,439 140,600 164,400BVPS (Rs) 100.4 122.9 150.9 183.2Financial ratiosY/E March FY10E FY11E FY12E FY13EProfitability & Return ratios (%)EBITDA margin 13.5 12.8 12.6 12.6EBIT margin 11.8 11.2 10.9 10.8Net profit margin 7.8 8.0 7.8 7.7ROE 24.6 24.9 24.5 22.6ROCE 37.3 34.9 34.4 31.7Working Capital & Liquidity ratiosReceivables (days) 138 132 134 139Inventory (days) 55 53 54 56Payables (days) 241 242 235 242Current ratio (x) 1.4 1.4 1.4 1.4Quick ratio (x) 1.2 1.2 1.2 1.2Turnover & Leverage ratios (x)Gross asset turnover 5.8 6.3 6.2 5.8Total asset turnover 3.2 3.1 3.1 2.9Interest coverage ratio 19.9 22.5 24.3 23.2Adjusted debt/equity 0.0 0.0 0.0 0.0Valuation ratios (x)EV/Sales 2.6 2.1 1.7 1.5EV/EBITDA 19.0 16.6 13.7 12.1P/E 35.0 28.3 23.5 20.8P/BV 7.8 6.4 5.2 4.311

Siemens Ltd Results Review 25 November 2010Quarterly trendParticulars Q3FY09 Q4FY09 Q1FY10 Q2FY10 Q3FY10Revenue (Rs mn) 19,177 25,180 18,666 22,261 22,464YoY growth (%) 6.0 53.5 (21.7) 16.1 (10.8)QoQ growth (%) (19.5) 31.3 (25.9) 19.3 0.9EBITDA (Rs mn) 2,374 2,255 3,421 2,624 2,170EBITDA margin (%) 12.4 9.0 18.3 11.8 9.7Adj net income (Rs mn) 1,680 1,363 2,364 1,811 1,561YoY growth (%) (0.8) (39.5) 90.5 (19.7) (7.1)QoQ growth (%) (25.5) (18.9) 73.5 (23.4) (13.8)DuPont analysis(%) FY09 FY10E FY11E FY12E FY13ETax burden (Net income/PBT) 59.1 62.7 67.8 67.8 67.8Interest burden (PBT/EBIT) 106.8 105.0 105.2 104.7 104.9EBIT margin (EBIT/Revenues) 9.4 11.8 11.2 10.9 10.8Asset turnover (Revenues/Avg TA) 367.3 315.4 312.7 314.8 293.7Leverage (Avg TA/Avg equtiy) 100.6 100.2 100.2 100.1 100.1Return on equity 21.9 24.6 24.9 24.5 22.6Company profileSiemens India Ltd. has its operations in various areas: in thetransportation sector it delivers high speed trains, in the lightingsector it manufactures small light bulbs. In the healthcare sectorSiemens executes complete solutions for hospitals, for the industrysector it builds airports as well as produces contracts & for thecommunication segment it provides public network to mobiles.Shareholding pattern(%) Mar-10 Jun-10 Sep-10Promoters 55.2 55.2 55.2FIIs 4.0 4.0 4.5Banks & FIs 23.2 23.4 23.1Public 17.6 17.4 17.2Recommendation historyDate Event Reco price Tgt price Reco21-Jun-10 Initiating Coverage 731 925 Buy29-Jul-10 Results Review 721 925 Buy9-Sep-10 Company Update 707 925 Buy31-Oct-10 Company Update 818 1,000 Buy24-Nov-10 Results Review 787 1,000 BuyStock performance890● Buy840790740690640May-10 Jun-10 Jul-10 Aug-10 Sep-10 Oct-10 Nov-1012

Banking Alert 25 November 2010BankingCBI investigation highlights individual cases of corruption<strong>The</strong> Central Bureau of Investigation (CBI) has, under corruption charges,arrested a few senior employees of leading PSU banks and financial companies,namely Punjab National Bank (PNB), Bank of India (BOI), LIC Housing Finance(LICHF) and Life Insurance Corporation of India (LIC). As per CBI, thesecompanies sanctioned loans to builders without following prudential lendingnorms and took bribes in the process. In case of LICHF, CBI has arrestedMr. R.R. Nair, Director and Chief Executive, who was instrumental in turningaround the company over the last three years. Among others, the Chairman andMD of a private financial service company (name undisclosed by CBI) and aDirector of the Central Bank of India have also been arrested for facilitatingthese transactions.Details of loan developers under investigation (name or the quantum of theirloan books) have not been disclosed by CBI. We believe that credit losses forthese banks and LICHF are unlikely to be significant, as these loans generallyhave a good collateral cover. We also note that these sanctioned loans havebeen charged under bribery and not fraud (in a statement issued to theexchanges, LICHF has stated that it has followed all procedures and conducteddue diligence in approving the loans). However, we believe LICHF couldunderperform its peers in the near term due to concerns over its future growthstrategy (given that its current CEO has been arrested). For banks, stocks couldreact negatively despite the negligible earnings impact of this event. However,we remain structurally positive on the PSU banking space and believe that anyknee-jerk reaction arising from this incident should be considered as a buyingopportunity.Our top picks in the sector are State Bank of India (SBIN), Axis Bank (AXSB)among large cap banks and Dena Bank (DBNK) among mid-cap banks.LICHF could be impacted but further clarity awaited: As per media reports,LICHF’s total exposure (in the cases currently investigated by CBI) constituted~0.6% of its balance sheet (amounting to loans of ~Rs 3bn; exposure to DBRealty is Rs 1.8bn). <strong>The</strong> total credit loss is unlikely to be significant as these loansare secured. However, the stock could remain under pressure in the near termdue to uncertainty over the company’s future growth strategy. We note thatMr. R.R. Nair played a key role in turning around LICHF strongly over the lastthree years. Under his leadership, the company reported a 31% CAGR in bothadvances and PAT over FY08-FY10.After today’s correction of ~19%, the stock is trading at 2x FY12 BV and 9.3xFY12 EPS, which is not expensive in our view. We maintain our earningsestimates and rating for LICHF as of now, and will review our call afterinteracting with the management and getting more clarity on this issue.Siddharth TeliIshank Kumar(91-22) 6766 3463 (91-22) 6766 3467siddharth.teli@religare.in ishank.kumar@religare.in13

Coal India Ltd Alert 25 November 2010Coal India LtdMargins improve on lower overburden provisioningDespite a marginal 0.7% increase in production volumes, Coal India (CIL) sawits H1FY11 sales rise by 17% over last year to Rs 236bn. We believe this wasdue to (a) the company’s enhanced focus on increasing dispatches throughinventory clearance, and (b) higher realisations generated from beneficiatedcoal. In our view, CIL is likely to miss its yearly production target of 461mt andmay fall marginally short of our estimate of 447mt as well. In order to meet ourassumption and its own target, the company has to increase production by 6%and 11.6% respectively in H2FY11. CIL’s operating margin expanded to 21.4%in H1FY11 as against 16.7% in H1FY10 due to lower provisions made towardsoverburden expenditure. ECL which turned profitable in FY10 has incurred anet loss in H1FY11, whereas BCCL is showing steady improvement. <strong>The</strong> stock iscurrently trading at 9x/7.6x EV/EBITDA on FY12E/FY13E versus 5–9x/5–8x forglobal peers on CY12E/CY13E.BSE NSE BLOOMBERG533278 COALINDIA COAL INCompany dataMarket cap (Rs mn / US$ mn) 2,021,236/44,350Outstanding equity shares (mn) 6,316Free float (%) 10%Dividend yield (%)NA52-week high/low (Rs) 357/2872-month average daily volumeNATopline rises 17% in H1 despite marginally higher production: In H1FY11, CILrecorded a 17% increase in sales to Rs 236.1bn over the same year-ago period.This was despite a marginal 0.7% rise in production to 185.6mt in H1FY11. Webelieve the topline growth primarily stemmed from higher dispatches madethrough existing inventory (which lowered the coal inventory by Rs 2.2bn fromMarch ’10 levels) and the company’s enhanced focus on beneficiated coal togenerate better realisations. In our view, CIL is likely to miss its yearly productiontarget of 461mt and may fall marginally short of our estimate of 447mt as well,since it would have to increase production by 6% and 11.6% respectively inH2FY11 to meet each of these targets. (Fig-2)EBIDTA margin expands 465bps to 21.4%: CIL’s EBITDA margin for H1FY11expanded 465bps to 21.4% as against 16.7% for H1FY10. Lower provisions foroverburden expenditure (3.3% of sales in H1FY11 as against 6.7% in H1FY10)aided a 342bps increase in margins. Employee costs remained flattish and stoodat 38.6% of sales as against our estimate of 32% for FY11.Strong balance sheet to aid international acquisitions: CIL has cash of Rs 397bn inits books (Rs 6.4bn above March ’10 levels), which could be utilised to fund futureexpansion programmes. Moreover, its net worth of Rs 298bn would qualify it forinternational project bids. Considering the cash-rich balance sheet and strongoperating cash flow generation, we believe CIL would comfortably finance itscapex and overseas acquisition plans without recourse to external funding.Valuation: Global coal companies are trading in the range of 5–9x and 5–8xEV/EBITDA on CY12E and CY13E respectively. At the CMP of Rs 320, CIL istrading at 9x and 7.6x EV/EBITDA on FY12E and FY13E respectively.Financial highlights(Rs mn) FY10 FY11E FY12E FY13ERevenue 473,515 525,506 587,762 658,594Growth (%) 15.6 11.0 11.8 12.1Adj net income 98,293 114,948 137,076 163,069Growth (%) 141.9 16.9 19.2 19.0FDEPS (Rs) 15.6 18.2 21.7 25.8Growth (%) 141.9 16.9 19.2 19.0Profitability and return ratios(%) FY10 FY11E FY12E FY13EEBITDA margin 22.1 26.6 27.9 30.0EBIT margin 19.3 23.8 25.0 27.1Adj PAT margin 20.8 21.9 23.3 24.8ROE 43.8 38.2 34.5 31.5ROIC 499.2 1,066.9 240.1 186.6ROCE 38.6 34.7 32.0 29.6Suhas Harinarayanan Suman Memani Arun Aggarwal(91-22) 6766 3404 (91-22) 6766 3439 (91-22) 6766 3440suhas.hari@religare.in suman.memani@religare.in arun.aggarwal@religare.in14

Coal India Ltd Alert 25 November 2010Consolidated financialsProfit and Loss statementY/E March (Rs mn) FY10 FY11E FY12E FY13ERevenues 473,515 525,506 587,762 658,594Growth (%) 15.6 11.0 11.8 12.1EBITDA 104,724 139,989 163,725 197,373Growth (%) 297.1 33.7 17.0 20.6Depreciation & amortisation 13,295 15,030 16,790 18,726EBIT 9,460 91,429 124,959 146,935Growth (%) - 866.5 36.7 17.6Interest 1,560 1,120 1,120 1,120Other income 50,315 47,726 58,776 65,859EBT 139,648 171,565 204,591 243,386Income taxes 43,425 56,616 67,515 80,317Effective tax rate (%) 31.1 33.0 33.0 33.0Extraordinary items - - - -Min into / inc from associates - - - -Reported net income 96,223 114,948 137,076 163,069Adjustments 2,070 - - -Adjusted net income 98,293 114,948 137,076 163,069Growth (%) 141.9 16.9 19.2 19.0Shares outstanding (mn) 6,316.4 6,316.4 6,316.4 6,316.4FDEPS (Rs) (adj) 15.6 18.2 21.7 25.8Growth (%) 141.9 16.9 19.2 19.0DPS (Rs) - 4 4 4Cash flow statementY/E March (Rs mn) FY10 FY11E FY12E FY13ENet income + Depreciation 100,612 131,099 154,986 182,915Non-cash adjustments (11,869) 22,901 (18,662) (16,758)Changes in working capital 22,183 (61,316) 10,990 11,994Cash flow from operations 110,926 92,684 147,315 178,151Capital expenditure (17,573) (36,802) (46,000) (49,882)Change in investments - - - -Other investing cash flow - - - -Cash flow from investing (17,573) (36,802) (46,000) (49,882)Issue of equity (616) (4,869) - -Issue/repay debt 1,091 (1,120) (1,120) (1,120)Dividends paid - 2 0 0Other financing cash flow - (4,465) - -Change in cash & cash eq 93,828 45,431 100,195 127,149Closing cash & cash eq 390,778 436,209 536,403 663,552Economic Value Added (EVA) analysisY/E March FY10 FY11E FY12E FY13EWACC (%) 473,515 525,506 587,762 658,594ROIC (%) 15.6 11.0 11.8 12.1Invested capital (Rs mn) 98,293 114,948 137,076 163,069EVA (Rs mn) 141.9 16.9 19.2 19.0EVA spread (%) 15.6 18.2 21.7 25.8Balance sheetY/E March (Rs mn) FY10 FY11E FY12E FY13ECash and cash eq 390,778 436,209 536,403 663,552Accounts receivable 21,686 24,476 27,375 30,674Inventories 44,018 43,192 41,868 36,087Other current assets 86,762 117,424 133,772 152,976Investments 12,821 10,821 9,821 8,821Gross fixed assets 349,453 370,362 408,362 454,362Net fixed assets 120,313 130,420 151,630 178,903CWIP 22,107 38,000 46,000 49,882Intangible assets - - - -Deferred tax assets, net 9,658 - -Other assets - - - -Total assets 708,143 800,543 946,870 1,120,896Accounts payable 7,725 8,000 8,000 8,000Other current liabilities 323,704 331,561 357,996 384,302Provisions 82,396 86,177 97,075 109,878Debt funds 20,869 16,000 16,000 16,000Other liabilities 14,997 14,962 16,441 17,850Equity capital 63,164 63,164 63,164 63,164Reserves & surplus 195,289 280,679 388,194 521,702Shareholder's funds 258,453 343,843 451,358 584,866Total liabilities 708,143 800,543 946,870 1,120,896BVPS (Rs) 50.9 64.4 81.5 102.6Financial ratiosY/E March FY10 FY11E FY12E FY13EProfitability & Return ratios (%)EBITDA margin 22.1 26.6 27.9 30.0EBIT margin 19.3 23.8 25.0 27.1Net profit margin 20.8 21.9 23.3 24.8ROE 43.8 38.2 34.5 31.5ROCE 38.6 34.7 32.0 29.6Working Capital & Liquidity ratiosReceivables (days) 15 16 16 16Inventory (days) 170 168 149 121Payables (days) 35 30 28 25Current ratio (x) 1.6 1.8 2.0 2.3Quick ratio (x) 1.2 0.1 0.1 0.1Turnover & Leverage ratios (x)Gross asset turnover 1.4 1.5 1.5 1.5Total asset turnover 0.7 0.7 0.7 0.6Interest coverage ratio 58.6 111.6 131.2 159.5Adjusted debt/equity 0.1 0.1 0.0 0.0Valuation ratios (x)EV/Sales 3.2 2.9 2.6 2.3EV/EBITDA 14.3 10.7 9.2 7.6P/E 20.6 17.6 14.7 12.4P/BV 6.3 5.0 3.9 3.116

Coal India Ltd Alert 25 November 2010DuPont analysis(%) FY09 FY10 FY11E FY12E FY13ETax burden (Net income/PBT) 70.8 70.4 67.0 67.0 67.0Interest burden (PBT/EBIT) 606.6 152.7 137.3 139.2 136.2EBIT margin (EBIT/Revenues) 2.3 19.3 23.8 25.0 27.1Asset turnover (Revenues/Avg TA) 72.5 71.1 69.7 67.3 63.7Leverage (Avg TA/Avg equtiy) 311.9 296.8 250.5 219.7 199.5Return on equity 22.4 43.8 38.2 34.5 31.517

Morning Buzz 25 November 2010Events CalendarNov 25 Nov 26 Nov 27EconomyCH CPI (Sept)US FOMC MeetJN Foreign tradeJN CPIGE CPI–Quarterly Results MRF IOL Netcom, OK Play India Cethar Industries, Parekh Platinum, S & T CorporationNov 28 Nov 29 Nov 30JN Industrial ProductionEconomy – –UK Gfk Consumer confidenceUS Consumer confidenceQuarterly Results Database Finance Escorts Bajaj HindustanIN – India; GE – Germany; CH – China; JN – Japan18

Morning Buzz 25 November 2010Trade DataInstitutional bulk dealsScrip Client Buy/Sell Quantity Avg Price (Rs)Dhanus Tech UCO Bank S 220,000 15.5Dhanus Technologies UCO Bank S 170,964 15.5Gujarat Hotels Il&Fs Securities Services B 21,879 141.9Shetron Copthall Mauritius Investment S 244,775 43.2Talwalkar Fitness Credit Suisse (Singapore)A/C Credit Suisse (Singapore) B 161,711 282.2Source: BSE, NSEDisclosures under insider trading regulationsScrip Acquirer/Seller Buy/SellShares transacted Post-transactionQty % Qty %Aban Offshore Reji Abraham B 48,007 - 4,955,307 11.4Agro Tech Foods Itc S 1,476,793 6.1 1,333,620 5.5Anand Credit Jignesh L Shah S 10,000 - 202,886 3.4Ashco Niulab Industries Ankush A Kotwani S 500,000 0.8 163,191 0.3Dlf Gaurav Monga S 3,000 - 300 -Dlf Gaurav Monga S 3,000 - 300 -Hb Leasing & Finance Company Anju Bhasin B 1,651 0.0 291,413 2.6Hitech Plast Ramesh S Gandhi S 1,086 - 3,914 0.0Ipca Laboratories Ajit Kumar Jain B 15,000 - 66,000 0.1Ipca Laboratories Ashok Kumar B 12,500 - 50,000 0.0Ipca Laboratories Babulal Jain B 6,250 - 25,500 0.0Ipca Laboratories Jeevan Lal Nagori B 12,500 - 65,760 0.1Ipca Laboratories Murari Dutt Sharma B 12,500 - 25,000 0.0Ipca Laboratories Prakash Narayan Shanware B 12,500 - 39,465 0.0Ipca Laboratories R S Hugar B 6,250 - 12,500 0.0Ipca Laboratories V V Subba Rao B 6,250 - 12,500 0.0Ipca Laboratories Yalish Kumar Bansal B 12,500 - 50,000 0.0Ismt A K Jain B 20,000 - 2,948,940 2.0Lupin Dilip G Saoji S 1,000 - 900 -Lupin Sakti P Chakraborty S 5,000 - 110,195 -Lupin Sakti P Chakraborty S 5,000 - 110,195 0.0National Aluminium Company S K Srivastava 0 - - - -Networth Stock Broking Jupiter South Asia Investment Co - S 134,135 - 280,075 -South Asia Access FundNetworth Stock Broking<strong>The</strong> Royal Bank Of Scotland Plc As S 115,865 - 241,925 -Trustee Of Jupiter India FSks Logistics Sarvesh Kumar Shahi B 15,249 - 575,625 4.0Sonata Software Bhupati Investments & Finance S 12,262 0.0 20,933,984 19.9Voltamp Transformers Nalanda India Fund B 290,246 2.9 885,392 8.8White Diamond Industries Rameshchana P Kothari S 30,000 - 64,082 1.0Zodiac Clothing Company Ismail M Nagaria S 1,520 - 4,630 0.0Zodiac Clothing Company Kumar Subramanian S 1,581 - 1,819 0.0Source: BSE19

Sector Valuation Snapshot 25 November 2010RCML universe: Sector Valuation SnapshotMCap(Rs mn)FDEPS(Rs)FDEPS Growth(%)EBITDA Margin(%)PAT Margin(%)ROE(%)ROCE(%)Adj. Debt/EquityRatio (x)Companies CMP (Rs) Target (Rs) RecoFY11E FY12E FY11E FY12E FY11E FY12E FY11E FY12E FY11E FY12E FY11E FY12E FY11E FY12E FY11E FY12E FY11E FY12E FY11E FY12EAUTOMOBILESAshok Leyland 75 90 Buy 99,709 4.6 6.0 64.0 29.7 10.8 11.2 5.8 6.3 15.9 18.6 12.0 13.4 0.7 0.7 16.3 12.6 10.9 8.9 2.5 2.2Bajaj Auto 1,611 1,650 Hold 466,214 92.4 103.7 47.8 12.2 20.5 19.4 15.3 15.0 68.1 49.8 50.0 40.0 0.3 0.2 17.4 15.5 11.2 10.3 9.5 6.5Hero Honda 1,931 1,900 Hold 385,677 109.1 121.5 (2.6) 11.3 14.0 13.7 11.8 11.6 53.2 44.7 44.0 44.2 0.0 0.0 17.7 15.9 13.0 11.8 8.2 6.3M&M 785 820 Buy 468,112 43.0 47.8 27.4 11.3 15.0 14.5 11.1 10.6 28.6 25.8 22.1 21.0 0.3 0.3 18.3 16.4 13.9 12.3 4.8 3.9Maruti Suzuki 1,416 1,600 Hold 409,111 79.1 95.1 (8.8) 20.1 10.1 10.5 6.2 6.3 17.8 18.2 17.2 17.9 0.0 0.0 17.9 14.9 9.1 7.4 2.9 2.5Tata Motors 1,219 1,450 Buy 704,575 32.0 41.6 37.7 29.9 10.2 10.1 4.5 5.1 12.0 13.7 8.9 10.3 0.4 0.3 38.1 29.3 18.3 15.7 3.6 3.4TVS Motor 84 75 Hold 39,860 4.6 5.6 82.6 20.5 8.0 8.1 3.5 3.8 23.1 22.9 13.9 14.4 1.0 0.9 18.1 15.0 9.9 8.7 3.8 3.1Aggregate 2,573,257 - - - - 12.4 12.2 7.9 8.0 20.5 17.4 13.1 11.4 4.5 3.8AUTO ANCILLARIESAmara Raja 181 260 Buy 15,488 15.7 19.5 (19.6) 24.3 14.2 14.6 7.8 8.2 22.4 23.1 19.9 21.3 0.1 0.1 11.5 9.3 6.6 5.3 2.4 2.0Exide 161 190 Buy 136,765 7.9 9.3 24.4 18.3 23.5 23.0 14.5 14.2 26.8 25.6 26.0 25.0 0.0 0.0 20.5 17.3 12.6 10.6 4.9 4.0Mahindra Forgings 88 130 Buy 7,768 0.5 10.8 NM 2,157.1 10.5 12.2 0.2 4.0 0.5 11.2 4.2 10.0 0.8 0.6 184.3 8.2 4.0 2.7 1.0 0.9Aggregate 160,021 - - - - 18.6 18.7 9.9 10.6 19.8 15.2 10.5 8.6 3.8 3.1CAPITAL GOODSABB 842 750 Hold 178,342 22.4 26.3 33.8 17.2 7.9 9.2 4.9 5.6 16.2 16.4 24.5 24.8 - - 37.6 32.1 30.7 22.3 8.4 7.4BGR Energy 700 750 Hold 50,465 37.3 46.5 33.3 24.7 11.2 11.2 6.5 6.5 33.0 31.6 25.5 27.8 1.0 0.8 18.8 15.0 11.1 8.9 7.1 5.5BHEL 2,198 2,400 Hold 1,075,843 107.0 135.2 21.5 26.3 19.0 19.4 12.9 13.1 29.4 29.8 40.1 41.4 0.0 0.0 20.5 16.3 12.7 9.9 6.7 5.5Bajaj Electricals 250 275 Hold 24,654 15.7 19.5 33.8 23.7 10.0 10.0 5.6 5.7 27.8 27.7 39.7 41.7 0.2 0.2 15.9 12.8 9.6 7.8 5.0 4.0Crompton Greaves 340 370 Buy 217,979 13.8 15.5 58.3 12.4 14.0 13.8 9.0 8.8 31.9 29.4 35.2 31.7 0.3 0.2 24.6 21.9 17.2 15.8 16.7 11.9Cummins India 760 950 Buy 150,530 31.1 39.0 48.3 25.6 18.8 19.3 15.8 15.3 35.5 36.0 35.4 35.9 0.0 0.0 24.5 19.5 28.4 19.3 13.6 10.8Engineers India 332 400 Buy 111,762 15.5 22.1 49.9 42.2 24.9 23.8 22.1 18.7 38.8 42.6 38.8 42.6 NA NA 21.3 15.0 18.5 13.9 9.5 7.9Jyoti Structures 131 165 Buy 10,783 13.1 15.2 16.5 16.1 11.5 11.5 4.5 4.6 19.6 19.0 27.6 28.1 0.6 0.6 10.0 8.6 4.9 4.3 2.2 1.8Kalpataru Power Transmission 158 200 Hold 24,231 13.1 15.7 1.6 20.1 11.7 12.0 6.4 6.7 18.7 19.0 18.7 19.7 0.7 0.6 12.1 10.1 8.3 7.0 2.5 2.1KEC International 467 625 Buy 23,590 42.6 51.3 15.5 20.3 10.1 10.2 4.5 4.4 23.1 21.6 22.6 22.1 1.0 0.9 11.0 9.1 5.8 4.7 3.0 2.1Siemens 790 1,000 266,238 27.8 33.5 20.3 20.2 12.8 12.6 8.0 7.8 24.9 24.5 34.9 34.4 0.0 0.0 28.4 23.6 16.7 13.8 7.9 6.4Suzlon Energy 50 45 Sell 87,967 (3.4) 1.7 NM NM 5.0 8.7 - 1.1 (7.2) 3.6 1.5 5.5 1.7 1.8 - 30.0 19.5 10.1 1.1 1.2<strong>The</strong>rmax 893 900 Hold 106,371 29.7 39.3 36.8 32.1 11.5 11.5 7.3 7.5 28.3 28.6 57.1 55.3 0.0 0.0 30.0 22.7 18.4 14.2 9.9 7.8Voltas 243 300 Buy 80,471 11.3 14.4 3.7 26.8 9.0 9.2 6.9 7.2 30.2 30.4 23.7 22.7 (0.6) (0.7) 21.5 16.9 15.9 12.8 7.4 5.8Aggregate 2,409,225 - - - - 13.2 14.2 7.7 8.5 25.7 19.1 14.9 11.5 6.3 5.3P/E(x)EV/EBITDA(x)P/BV(x)20

Sector Valuation Snapshot 25 November 2010MCap(Rs mn)FDEPS(Rs)FDEPS Growth(%)EBITDA Margin(%)PAT Margin(%)ROE(%)ROCE(%)Adj. Debt/EquityRatio (x)Companies CMP (Rs) Target (Rs) RecoFY11E FY12E FY11E FY12E FY11E FY12E FY11E FY12E FY11E FY12E FY11E FY12E FY11E FY12E FY11E FY12E FY11E FY12E FY11E FY12ECEMENTACC 996 1,180 Buy 186,947 59.5 70.5 (30.4) 18.4 24.8 26.8 15.1 15.8 29.4 17.7 27.8 17.0 0.1 0.1 16.7 14.1 9.8 8.0 3.1 2.8Ambuja Cement 141 165 Buy 214,976 8.6 10.0 7.3 16.8 28.2 28.7 18.0 18.1 20.1 18.9 19.6 18.6 0.0 0.0 16.4 14.1 10.0 8.4 3.3 2.9Birla Corp 389 525 Buy 29,970 58.4 70.2 (19.3) 20.2 25.3 27.4 19.6 19.9 36.3 22.7 28.4 17.7 0.4 0.2 6.7 5.5 4.8 3.7 1.7 1.4Century Textiles 455 538 HOLD 42,308 34.9 41.3 (26.9) 18.3 16.3 18.0 7.1 7.7 17.0 17.3 9.1 9.2 1.3 1.3 13.0 11.0 5.7 4.7 2.1 1.8Grasim Industries 2,209 2,900 Buy 202,527 222.2 263.3 (33.7) 18.5 23.8 25.5 10.5 11.0 26.6 14.7 18.6 11.7 0.5 0.4 9.9 8.4 5.6 4.6 1.6 1.4India Cements 109 130 Hold 33,421 3.4 6.3 (69.4) 85.5 12.4 14.9 2.8 4.5 8.0 2.5 6.9 3.5 0.4 0.5 32.3 17.4 12.5 9.2 0.8 0.8JK Lakshmi Cement 58 94 Buy 7,060 8.6 15.1 (56.6) 75.6 19.1 23.2 7.5 10.7 26.0 10.0 15.2 6.6 0.9 1.1 6.7 3.8 6.7 4.5 0.7 0.7Mangalam Cement 139 190 Hold 3,720 29.5 34.2 (33.7) 15.9 22.7 26.0 12.8 12.6 34.9 18.9 33.9 17.0 0.0 0.4 4.7 4.1 2.5 1.8 0.4 0.3Orient Paper & Industries 57 70 Buy 11,013 7.3 9.5 (12.8) 30.7 17.0 18.3 8.3 9.5 22.5 16.9 16.1 12.1 0.7 0.6 7.8 6.0 5.2 4.2 1.4 1.2Shree Cement 2,060 2,550 Buy 71,764 124.5 159.4 (44.6) 28.1 29.1 30.7 11.7 10.7 51.4 21.3 25.0 11.9 1.1 1.0 16.5 12.9 7.2 4.9 3.9 3.2UltraTech Cement 1,126 1,260 Buy 308,638 58.4 72.7 (39.6) 24.5 21.9 23.4 10.7 11.5 28.8 16.2 21.0 12.4 0.5 0.4 19.3 15.5 9.9 8.0 3.4 2.9Aggregate 1,112,345 - - - - 22.9 24.6 11.5 12.1 14.4 11.8 7.9 6.3 2.4 2.1CONSTRUCTIONAhluwalia Contracts 161 252 Buy 10,130 16.0 19.3 23.0 20.7 11.0 10.9 5.0 4.9 33.5 29.9 25.6 24.1 0.5 0.4 10.1 8.3 4.4 3.6 2.9 2.2Hindustan Construction Co 55 73 Hold 33,632 1.8 1.9 12.9 3.9 12.3 12.2 2.5 2.2 7.0 6.9 7.5 7.7 1.9 1.8 30.4 29.3 11.7 9.7 2.1 2.0IRB Infrastructures Developers 223 287 Hold 74,084 15.0 17.5 29.2 17.1 39.6 33.1 18.2 13.7 20.2 19.6 11.7 10.7 1.9 2.1 14.9 12.7 9.0 7.0 3.0 2.5IVRCL Infrastructures 136 178 Buy 36,206 7.6 9.6 20.9 25.4 9.4 9.3 3.4 3.4 10.6 12.0 9.9 10.4 1.1 1.1 17.8 14.2 9.8 7.9 1.8 1.6Jaiprakash Associates 121 150 Buy 257,724 4.2 5.6 12.7 32.1 23.5 24.6 7.1 7.7 10.3 12.2 6.7 8.1 1.7 1.7 28.7 21.7 8.3 6.5 2.7 2.4L&T 2,017 2,330 Buy 1,225,882 73.2 90.3 32.6 23.3 13.5 13.2 8.3 8.3 28.4 27.6 12.9 13.6 1.6 1.3 27.6 22.3 18.5 15.3 5.1 4.2Nagarjuna Construction Co 134 212 Buy 34,408 9.3 10.0 17.8 7.1 10.2 10.2 4.1 3.6 10.2 10.1 8.8 8.7 1.0 1.3 14.4 13.4 9.2 7.5 1.4 1.3Patel Engineering 345 469 Buy 24,101 19.9 27.2 4.6 36.4 14.8 14.8 5.4 5.6 10.3 12.6 7.9 8.9 1.3 1.4 17.3 12.7 10.2 7.8 1.7 1.5Punj Lloyd 111 89 Sell 36,796 2.6 7.5 NM 189.0 7.2 9.5 1.0 2.2 2.8 7.8 5.1 7.5 1.2 1.4 42.8 14.8 11.6 7.1 1.2 1.1Reliance Infrastructure 933 1,390 Buy 228,513 60.6 65.8 6.9 8.7 10.7 13.0 10.2 9.0 7.5 7.3 6.9 6.9 0.6 0.7 15.4 14.2 15.8 10.6 1.0 0.9Simplex Infrastructure 421 513 Hold 20,830 28.6 34.8 11.4 21.5 10.0 10.0 2.8 2.8 13.7 14.8 7.1 7.4 1.4 1.4 14.7 12.1 6.8 5.7 1.9 1.7Aggregate 1,982,306 - - - - 13.8 14.2 7.1 7.0 23.4 19.1 13.8 10.8 2.8 2.5FMCGAsian Paints 2,604 3,000 Buy 249,655 92.7 113.1 0.7 22.0 17.4 18.0 11.6 12.1 45.7 43.9 41.4 40.3 0.1 0.1 28.1 23.0 18.5 15.3 11.4 9.0Britannia 398 450 Hold 47,571 11.0 19.8 (7.8) 79.7 4.6 6.4 2.9 4.5 43.5 66.1 16.5 25.9 2.0 1.7 36.1 20.1 26.4 15.9 14.8 12.1Colgate 876 860 Sell 119,103 32.4 35.1 4.1 8.5 22.4 21.5 19.7 18.9 129.5 129.3 128.1 128.0 0.0 0.0 27.0 24.9 22.8 21.0 33.6 30.9Dabur 94 110 Hold 164,237 3.2 4.0 13.0 24.0 18.9 19.6 14.2 15.1 50.7 47.0 42.5 40.2 0.3 0.1 29.4 23.7 22.3 18.5 12.9 9.8Emami 450 450 Sell 68,015 15.7 18.4 31.0 16.6 22.9 22.5 18.8 18.4 33.9 31.9 26.2 25.7 0.3 0.3 28.6 24.5 23.5 20.1 8.7 7.1GCPL 416 460 Hold 134,581 15.6 18.2 38.1 16.5 20.0 19.7 14.2 13.4 37.4 30.9 24.7 18.4 0.9 0.8 26.6 22.8 20.6 16.8 7.7 6.5GSK Consumer 2,313 2,200 Sell 97,286 69.0 82.3 24.6 19.4 15.7 16.2 12.6 12.6 29.2 29.1 28.4 28.4 0.0 0.0 33.5 28.1 24.5 20.0 9.0 7.5HUL 300 330 Hold 654,259 9.9 11.4 2.7 15.5 13.3 13.9 11.2 11.5 76.7 75.4 76.4 74.9 0.0 0.0 30.3 26.3 24.6 20.9 21.5 18.4ITC 174 210 Buy 1,336,006 6.2 7.6 12.6 22.2 32.1 33.7 21.5 22.6 30.6 32.2 30.4 32.0 0.0 0.0 28.0 22.9 18.6 15.2 8.0 6.9Jyothy Labs 260 305 Hold 20,980 12.3 14.2 20.3 15.2 15.7 14.7 13.5 12.7 18.6 16.1 18.4 15.9 0.0 0.0 21.2 18.4 14.9 13.0 3.1 2.8Marico 136 150 Buy 83,278 4.8 5.7 19.4 20.7 13.8 14.2 9.5 10.0 38.5 35.8 27.1 28.7 0.3 0.3 28.5 23.6 19.9 16.8 9.7 7.5Nestle 3,793 3,500 Hold 365,687 80.6 100.7 16.9 24.9 19.6 20.7 12.7 13.4 125.4 137.4 125.7 137.6 0.0 0.0 47.0 37.7 30.6 24.4 55.5 48.5Aggregate 3,340,658 20.3 21.2 14.5 15.1 30.0 24.8 21.3 17.5 11.2 9.5P/E(x)EV/EBITDA(x)P/BV(x)21

Sector Valuation Snapshot 25 November 2010Companies CMP (Rs) Target (Rs) RecoMETALSMCap(Rs mn)FDEPS(Rs)FDEPS Growth(%)EBITDA Margin(%)PAT Margin(%)ROE(%)ROCE(%)Adj. Debt/EquityRatio (x)P/E(x)EV/EBITDA(x)FY11E FY12E FY11E FY12E FY11E FY12E FY11E FY12E FY11E FY12E FY11E FY12E FY11E FY12E FY11E FY12E FY11E FY12E FY11E FY12EJSW Steel 1,203 1,050 Sell 263,456 67.9 90.2 5.5 32.7 20.0 18.4 7.0 7.1 12.8 11.8 8.7 8.8 0.7 0.6 17.7 13.3 8.7 7.2 1.5 1.3Jindal Steel & Power 644 670 Hold 601,086 56.2 68.2 44.0 21.3 34.4 17.0 37.7 38.3 40.3 34.1 23.3 20.9 0.4 0.3 11.5 9.4 7.6 6.5 3.9 2.8SAIL 179 270 Buy 737,896 21.8 25.5 33.0 17.3 27.5 29.0 18.7 18.4 24.2 23.2 17.0 16.3 0.5 0.6 8.2 7.0 5.1 4.1 1.8 1.5Tata Steel 617 780 Buy 556,305 70.9 72.4 NM 2.1 15.1 15.3 6.1 6.0 25.8 20.2 12.5 11.3 1.6 1.2 8.7 8.5 5.6 5.4 1.9 1.4Jai Balaji 254 400 Buy 16,201 12.1 42.2 142.4 249.5 13.6 22.3 3.2 10.0 7.5 22.2 8.6 15.7 177.7 137.1 21.0 6.0 9.6 5.2 1.7 1.3Aggregate 2,174,943 21.5 22.3 11.3 11.8 9.5 8.2 6.2 5.4 2.1 1.6IT SERVICESEducomp 590 700 Buy 56,326 36.6 41.8 29.9 14.2 41.0 48.3 26.8 25.1 24.6 22.7 14.2 13.8 0.8 0.6 16.1 14.1 10.5 7.3 3.5 2.9FirstSource Solutions 23 40 Buy 9,700 3.6 4.6 14.5 26.7 14.5 14.8 7.2 8.0 10.4 11.8 6.9 7.5 0.9 0.8 6.2 4.9 2.0 1.7 0.6 0.5HCL Infosystems 92 135 Hold 20,044 11.2 12.7 (18.3) 13.9 3.1 3.3 2.1 2.2 18.6 19.9 12.7 13.8 0.4 0.4 8.2 7.2 5.5 4.8 1.5 1.4HCL Tech 391 525 Buy 266,739 22.6 31.2 25.1 38.2 16.3 17.7 9.9 11.3 20.3 22.9 15.8 17.2 0.3 0.3 17.3 12.5 9.6 7.3 3.2 2.6Hexaware Technologies 87 90 Hold 12,691 8.1 9.9 (13.3) 22.8 9.4 11.1 7.3 10.4 12.3 13.9 8.3 9.9 0.1 0.1 10.8 8.8 5.4 3.9 1.0 0.9Infosys 2,996 3,200 Hold 1,719,750 121.2 145.1 11.4 19.7 33.0 32.8 24.9 24.8 26.1 26.3 51.0 53.1 0.0 0.0 24.7 20.6 18.9 15.6 6.0 5.0Infotech Enterprises 157 240 Buy 17,489 13.0 17.4 (15.7) 33.6 16.2 17.9 12.2 12.8 13.8 16.2 19.4 22.3 0.0 0.0 12.1 9.0 - - 1.6 1.4MindTree 516 625 Buy 20,634 15.4 47.3 (71.9) 207.2 9.9 17.8 3.9 10.2 8.7 23.4 8.2 21.9 0.0 0.0 33.5 10.9 21.6 10.0 2.9 2.3Mphasis 606 750 Hold 127,281 51.0 55.7 16.3 9.3 25.7 26.2 21.4 19.9 30.3 27.0 40.5 74.0 0.0 0.0 11.9 10.9 9.9 8.3 3.8 2.9NIIT 57 85 Buy 9,419 6.3 8.1 47.2 29.7 15.3 16.9 8.5 9.9 18.4 20.4 10.1 12.2 0.7 0.6 9.1 7.0 2.8 2.3 1.6 1.3NIIT Technologies 204 300 Buy 12,001 27.5 26.9 27.7 (2.1) 18.6 20.0 13.7 13.3 25.3 21.0 23.9 19.8 0.0 0.0 7.4 7.6 5.4 5.0 1.7 1.5Oracle Financial Services 2,104 2,500 Buy 176,537 123.3 143.6 33.1 16.5 39.4 41.2 33.4 34.6 19.4 18.4 19.2 17.0 0.0 0.0 17.1 14.7 14.4 12.3 3.3 2.7Patni Computers 462 600 Buy 60,533 43.9 45.7 (2.0) 4.1 19.4 20.6 17.8 15.1 12.8 13.5 20.8 21.8 0.0 0.0 10.5 10.1 8.3 7.0 1.5 1.4Persistent Systems 391 500 Buy 15,634 39.7 39.5 27.4 (0.6) 21.1 22.0 20.5 16.6 22.1 18.0 34.5 33.5 0.0 0.0 9.8 9.9 11.7 9.1 2.0 1.6Polaris Software 152 275 Buy 15,023 20.5 22.5 32.3 10.1 14.2 15.4 13.3 12.9 21.1 19.4 17.5 16.4 0.0 0.0 7.4 6.7 6.2 5.0 1.4 1.2Satyam Computer Services 67 135 Buy 79,293 7.7 10.6 470.1 38.8 18.6 20.6 15.7 16.8 22.2 24.4 19.6 21.7 0.2 0.1 8.8 6.3 5.4 3.7 1.8 1.4TCS 1,005 1,100 Hold 1,966,518 43.2 49.7 22.9 15.2 28.9 29.0 22.8 21.7 36.8 33.7 42.5 42.6 0.0 0.0 23.3 20.2 18.3 15.1 7.9 6.0Tech Mahindra 667 850 Hold 83,828 82.5 92.5 41.3 12.2 21.3 20.4 22.1 23.4 28.4 30.7 30.0 31.6 0.4 0.3 8.1 7.2 8.1 8.0 2.4 2.1Wipro 410 475 Hold 1,004,682 21.9 24.7 16.4 12.9 21.9 22.7 17.2 16.8 25.2 24.4 21.2 20.7 0.2 0.2 18.7 16.6 14.8 12.3 4.4 3.7Aggregate 5,674,120 - - - - 23.6 24.3 18.2 18.2 19.9 16.9 15.2 12.4 4.9 4.0LOGISTICSAllcargo Global Logistics 158 200 Hold 20,674 14.1 16.1 16.0 14.0 11.8 12.1 6.9 7.1 14.3 13.9 13.6 13.7 0.0 0.0 11.2 9.8 6.5 5.7 1.5 1.3Container Corp 1,277 1,500 Hold 165,943 65.5 77.1 9.3 17.8 29.1 31.1 23.0 24.4 19.2 18.4 19.2 18.4 - - 19.5 16.5 13.8 11.6 3.8 3.4Gateway Distriparks 110 135 Buy 11,857 8.0 9.6 9.4 19.8 28.5 34.4 16.6 17.3 12.3 13.3 10.8 10.1 0.2 0.2 13.7 11.5 9.0 6.5 1.2 1.1Aggregate 198,474 - - - - 22.4 24.0 16.3 17.1 17.7 15.1 11.8 9.9 3.0 2.6P/BV(x)22

Sector Valuation Snapshot 25 November 2010MCap(Rs mn)FDEPS(Rs)FDEPS Growth(%)EBITDA Margin(%)PAT Margin(%)ROE(%)ROCE(%)Adj. Debt/EquityRatio (x)Companies CMP (Rs) Target (Rs) RecoFY11E FY12E FY11E FY12E FY11E FY12E FY11E FY12E FY11E FY12E FY11E FY12E FY11E FY12E FY11E FY12E FY11E FY12E FY11E FY12EOIL & GASBPCL 701 910 BUY 253,274 (19.8) 38.3 (146.4) (293.7) 0.8 2.6 - 1.1 (5.8) 11.9 (0.8) 9.3 0.9 0.8 - 18.3 28.9 10.0 2.2 2.1Cairn India 318 285 SELL 603,222 25.9 34.7 378.8 33.8 75.2 73.3 52.7 56.8 14.0 16.7 16.2 19.5 (0.1) (0.1) 12.3 9.2 8.1 6.7 1.6 1.4GAIL India 485 540 BUY 615,656 27.7 36.3 11.7 31.4 21.3 26.3 12.6 15.4 19.5 22.3 22.2 23.8 0.5 0.5 17.5 13.4 10.2 7.7 3.2 2.8GSPL 112 125 HOLD 63,176 7.1 7.2 (3.8) 2.4 94.0 94.0 37.4 36.1 27.3 21.6 26.5 22.8 0.6 0.6 15.9 15.5 7.4 7.0 4.8 4.8HPCL 434 660 BUY 146,863 50.3 61.8 31.0 22.9 2.9 3.5 1.4 1.8 14.1 15.8 10.2 12.7 0.8 0.7 8.6 7.0 7.6 6.8 1.2 1.1IGL 320 330 HOLD 44,793 18.2 21.3 18.1 17.4 28.9 27.1 15.6 13.9 27.8 26.9 37.5 33.9 14.8 20.9 17.6 15.0 9.6 7.7 4.5 3.7IOC 362 550 BUY 879,283 35.3 39.8 (20.1) 12.8 4.7 5.6 3.2 3.7 15.0 15.4 13.7 15.8 0.6 0.5 10.3 9.1 9.4 8.1 1.5 1.4Oil India 1,400 1,450 SELL 336,612 120.3 119.1 10.8 (1.0) 52.8 51.3 35.8 35.5 19.7 17.2 29.8 26.1 (0.6) (0.7) 11.6 11.8 6.5 6.7 2.1 1.9ONGC 1,247 1,510 BUY 2,668,137 118.0 113.6 29.7 (3.7) 46.1 47.2 22.5 22.7 22.9 19.3 34.9 32.4 3.8 3.8 10.6 11.0 4.8 5.0 2.2 2.0Petronet LNG 116 165 BUY 86,850 7.7 9.8 42.2 27.7 9.7 9.9 4.6 5.0 21.4 23.5 19.8 20.0 0.9 0.9 15.1 11.8 8.5 7.1 3.0 2.6Reliance Industries 996 1,210 HOLD 3,259,455 65.1 74.9 33.9 15.1 16.0 19.2 8.2 10.3 14.1 14.4 14.4 15.8 0.2 0.0 15.3 13.3 9.1 8.3 2.1 1.8Aggregate 8,957,321 - - - - 13.6 15.5 7.2 8.5 13.0 11.5 7.5 6.9 2.0 1.8PHARMCEUTICALSBiocon 393 550 Buy 78,660 18.3 20.3 22.5 10.7 20.0 20.2 13.2 13.0 18.3 19.3 14.6 16.1 0.3 0.2 21.5 19.4 15.0 13.3 4.5 3.9Cadila Healthcare 780 770 Hold 159,673 30.9 38.5 20.8 24.9 20.5 21.0 14.4 15.2 36.5 33.6 22.8 24.6 0.7 0.4 25.3 20.2 19.0 15.6 9.8 7.5Cipla 341 370 Hold 273,555 13.2 15.6 1.0 18.1 23.8 24.2 16.9 17.4 20.5 16.7 19.1 16.7 0.0 0.0 25.8 21.8 18.8 16.2 4.6 4.0Dishman Pharmaceuticals 142 192 Hold 11,475 10.6 15.2 (6.4) 43.7 21.2 24.3 9.0 11.3 12.3 10.5 8.7 8.3 1.0 1.0 13.4 9.4 9.3 7.0 1.5 1.3Dr Reddy's Labs 1,781 1,870 Buy 301,286 66.6 102.9 0.5 54.4 18.2 24.2 15.3 19.4 23.3 20.6 17.1 16.6 0.3 0.2 26.7 17.3 23.2 14.4 7.0 5.7GlaxoSmithKline Pharmaceuticals 2,209 2,160 Hold 187,067 69.8 82.0 18.1 17.6 36.6 36.7 26.8 26.8 29.8 30.6 29.7 30.5 0.0 0.0 31.7 26.9 21.2 18.0 10.5 9.0Glenmark Pharmaceuticals 352 390 Buy 94,972 18.0 23.4 37.2 30.1 27.6 27.7 16.2 17.6 16.7 17.7 12.9 14.2 0.7 0.5 19.6 15.0 13.4 11.1 4.0 3.3Jubilant Organosys 303 330 Hold 48,150 21.5 26.9 7.9 25.1 17.3 18.3 9.2 10.2 11.2 10.9 8.8 9.0 0.7 0.6 14.1 11.3 11.5 9.5 2.1 1.9Lupin 487 510 Buy 217,001 19.6 23.0 28.4 17.4 20.1 19.8 15.5 15.3 39.4 36.3 24.6 26.2 0.6 0.3 24.9 21.2 20.1 17.1 10.7 7.9Piramal Healthcare 456 480 Sell 95,216 28.5 34.5 25.4 21.0 21.7 21.9 14.4 15.4 31.4 29.7 23.3 25.1 0.4 0.2 16.0 13.2 12.0 10.5 4.5 3.5Sun Pharmaceutical Industries 2,273 2,210 Hold 468,256 97.7 109.2 41.1 11.8 37.3 35.0 34.3 31.8 19.7 24.1 19.2 22.9 0.0 0.1 23.3 20.8 20.6 18.2 6.2 5.1Aggregate 1,935,312 - - - - 23.7 24.7 17.6 18.4 23.5 19.1 18.2 14.9 6.0 4.9POWERAdani Power 139 130 Sell 302,153 6.6 19.6 744.2 196.3 63.9 67.9 56.5 51.6 21.9 47.7 10.0 20.7 1.0 1.7 21.0 7.1 20.8 6.0 4.1 2.8Lanco Infratech 65 85 Buy 156,387 3.6 2.8 94.4 (24.3) 26.4 25.9 6.2 3.6 23.6 14.8 (72.2) (156.9) 4.4 4.2 17.8 23.6 8.7 6.7 3.8 3.2<strong>NTPC</strong> 178 200 Sell 1,468,930 12.4 13.4 17.3 7.9 35.1 35.0 20.9 20.0 15.7 15.5 22.4 15.5 0.5 0.5 14.3 13.3 9.9 8.8 2.2 2.0Reliance Power 168 140 Sell 471,394 5.1 4.6 78.5 (8.8) 57.2 52.1 55.4 41.3 7.7 5.9 4.9 3.2 1.3 2.0 33.0 36.2 34.0 30.6 2.4 2.2Tata Power 1,289 1,250 Hold 305,936 75.5 101.0 16.2 33.7 22.5 25.0 9.0 10.2 15.0 18.3 6.8 7.6 1.1 1.2 17.1 12.8 6.8 5.2 2.1 2.1Jindal Steel & Power 644 670 Hold 601,086 56.2 68.2 44.0 21.3 34.4 17.0 37.7 38.3 40.3 34.1 23.3 20.9 0.4 0.3 11.5 9.4 7.6 6.5 3.9 2.8Aggregate 3,305,886 - - - - 35.6 37.0 20.5 20.7 15.8 12.7 10.3 8.1 2.6 2.2P/E(x)EV/EBITDA(x)P/BV(x)23

Sector Valuation Snapshot 25 November 2010Companies CMP (Rs) Target (Rs) RecoREAL ESTATEMCap(Rs mn)FDEPS(Rs)FDEPS Growth(%)EBITDA Margin(%)PAT Margin(%)ROE(%)ROCE(%)Adj. Debt/EquityRatio (x)P/E(x)EV/EBITDA(x)FY11E FY12E FY11E FY12E FY11E FY12E FY11E FY12E FY11E FY12E FY11E FY12E FY11E FY12E FY11E FY12E FY11E FY12E FY11E FY12EAnant Raj Industries 121 170 Buy 35,707 7.8 9.4 (3.3) 19.6 47.5 31.8 45.2 28.5 6.4 7.3 6.0 6.5 0.1 0.1 15.5 12.9 13.0 10.2 1.0 0.9DLF 304 335 Hold 516,116 15.1 17.1 40.6 13.7 47.3 44.9 25.7 23.3 10.7 12.6 7.0 8.6 0.7 0.7 20.2 17.8 14.2 11.9 2.0 1.9Godrej Properties 668 520 Hold 46,632 22.4 57.4 27.5 155.9 45.9 48.5 39.2 39.9 17.8 35.6 9.8 21.8 0.8 0.6 29.7 11.6 28.8 10.8 5.0 3.6HDIL 207 270 Buy 85,740 17.9 38.3 19.3 113.3 43.9 52.3 31.6 38.2 9.2 15.9 6.9 12.7 0.4 0.3 11.5 5.4 12.0 5.6 0.9 0.7Indiabulls Real Estate 163 230 Buy 65,371 10.3 10.5 NA 2.3 37.8 34.1 29.6 24.3 3.5 3.5 3.5 3.3 0.2 0.3 15.9 15.5 9.4 8.4 0.6 0.5Orbit Corp 88 150 Hold 9,452 17.1 20.9 (16.0) 22.1 32.0 32.0 13.9 15.3 10.3 11.6 8.6 9.1 1.0 0.8 5.1 4.2 8.2 7.3 1.0 0.9Peninsula Land 55 75 Sell 15,412 8.2 7.2 (18.4) (11.9) 44.4 50.8 33.5 38.7 16.2 12.7 12.5 9.8 0.3 0.3 6.7 7.6 5.7 6.6 1.0 0.9Phoenix Mills 219 250 Buy 31,692 5.2 18.3 27.6 252.9 75.5 82.9 34.7 45.5 4.7 15.2 3.6 10.3 0.5 0.6 42.3 12.0 22.2 7.5 2.0 1.7Puravankara Projects 107 130 Buy 22,772 7.1 7.2 4.0 1.5 30.3 23.3 25.1 21.8 9.8 9.2 6.2 5.9 0.6 0.6 15.1 14.8 16.8 18.7 1.4 1.3Unitech 67 100 Buy 168,800 3.7 5.2 29.9 41.0 35.8 37.0 23.3 25.6 9.4 11.6 6.1 7.8 0.6 0.5 18.2 12.9 17.8 13.4 1.9 1.6Aggregate 997,694 - - - - 43.3 43.7 26.9 27.3 17.9 13.0 14.3 10.4 1.5 1.4SUGARBajaj Hindusthan 116 107 Hold 22,207 15.7 5.3 400.2 (66.0) 18.8 15.4 6.7 3.0 12.1 3.6 8.3 4.2 0.8 0.4 7.4 21.7 5.7 9.1 0.8 0.8Balrampur Chini 77 77 Hold 20,108 9.7 11.0 8.9 14.1 23.1 19.5 12.3 12.2 20.2 20.7 14.6 16.9 0.5 0.2 8.0 7.0 6.4 6.6 1.6 1.4Dhampur Sugar 68 80 Hold 3,218 39.9 18.2 274.8 (54.5) 23.4 19.6 12.1 7.7 35.5 12.8 21.0 10.7 0.8 0.5 1.7 3.7 2.4 4.0 0.4 0.4Aggregate 45,533 - - - - 20.8 17.5 9.3 6.9 6.0 9.4 5.1 7.1 1.0 0.9TELECOMBharti Airtel 332 400 Buy 1,260,020 18.2 23.5 (22.9) 28.8 34.9 36.5 11.3 12.0 15.3 17.0 8.7 8.6 1.3 1.1 18.2 14.1 8.5 6.7 2.6 2.2Idea Cellular 70 95 Buy 230,093 2.9 3.4 (6.6) 19.7 25.8 28.3 6.1 6.0 8.0 8.8 5.8 7.1 1.0 0.9 24.4 20.4 7.3 5.5 2.0 1.7MTNL 56 50 Sell 35,060 (14.8) (14.4) NM NM - - - - (10.3) (11.1) (8.9) (9.5) 0.3 0.3 - - - - 0.4 0.5Onmobile Global 265 450 Buy 15,559 12.1 18.2 61.5 50.6 22.5 27.4 13.0 15.6 9.2 12.4 7.7 11.2 0.0 0.0 22.0 14.6 10.7 7.0 1.9 1.7Reliance Communications 144 190 Buy 296,498 7.4 11.1 (65.9) 50.6 31.9 34.1 7.3 9.7 4.0 5.8 3.5 4.5 0.8 0.7 19.5 13.0 7.2 5.9 0.7 0.7Tata Communications 279 400 Buy 79,472 (26.1) (21.6) NM NM 11.0 12.5 - - (17.9) (17.6) 3.3 3.2 2.1 2.6 - - 11.6 9.1 2.1 2.5Spice Mobility 138 130 Buy 10,311 13.1 24.0 39.1 82.8 9.9 10.4 7.0 9.6 53.5 55.7 47.1 42.1 0.0 0.0 10.5 5.8 6.5 4.7 4.4 2.5Aggregate 1,927,013 - - - - 29.0 31.1 6.8 8.1 24.3 17.2 8.4 6.6 1.7 1.5OTHERSSintex Industries 215 490 Buy 58,611 30.2 37.4 25.2 24.1 16.4 16.8 10.1 10.4 19.0 19.3 10.1 11.6 0.4 0.3 7.1 5.7 8.8 7.1 2.4 2.0P/BV(x)24

Morning Buzz 25 November 2010RCML ResearchAnalyst Sector Email ID Office TelephoneManoj Singla(Managing Director & Co-head Research)Suhas Harinarayanan(Managing Director & Co-head Research)IT, Telecom manoj.singla@religare.in (91-22) 6766 3401Capital Goods, Real Estate, Power suhas.hari@religare.in (91-22) 6766 3404Kaushal Maroo Automobiles kaushal.maroo@religare.in (91-22) 6766 3457Keyur Vora Automobiles vora.keyur@religare.in (91-22) 6766 3456Siddharth Teli Banking & Financial Services siddharth.teli@religare.in (91-22) 6766 3463Ishank Kumar Banking & Financial Services ishank.kumar@religare.in (91-22) 6766 3467Nikhil Rungta Banking & Financial Services nikhil.rungta@religare.in (91-22) 6766 3451Misal Singh Capital Goods misal.singh@religare.in (91-22) 6766 3466Abhishek Raj Capital Goods abhishek.raj@religare.in (91-22) 6766 3485Mihir Jhaveri Cement mihir.jhaveri@religare.in (91-22) 6766 3459Vaibhav Jain Construction, Infrastructure jain.vaibhav@religare.in (91-22) 6766 3464Hardik Shah Construction, Infrastructure hardik.shah@religare.in (91-22) 6766 3465Jay Shankar Economy jay.shankar@religare.in (91-22) 6766 3442Vallabh Kulkarni Economy vallabh.kulkarni@religare.in (91-22) 6766 3438Varun Lohchab FMCG varun.lohchab@religare.in (91-22) 6766 3458Gaurang Kakkad FMCG gaurang.kakkad@religare.in (91-22) 6766 3470Bandish Mehta FMCG bandish.mehta@religare.in (91-22) 6766 3471Rumit Dugar IT, Telecom rumit.dugar@religare.in (91-22) 6766 3444Udit Garg IT, Telecom udit.garg@religare.in (91-22) 6766 3445Anuj Bagri IT, Telecom anuj.bagri@religare.in (91-22) 6766 3443Amit Agarwal Metals amit.ag@religare.in (91-22) 6766 3449Ballabh Modani Oil & Gas ballabh.modani@religare.in (91-22) 6766 3436Nitin Tiwari Oil & Gas nitin.tiwari@religare.in (91-22) 6766 3437Vikas Sonawale Pharmaceuticals vikas.sonawale@religare.in (91-22) 6766 3447Vineet Agrawal Pharmaceuticals vineet.agrawal@religare.in (91-22) 6766 3448Sumit Maniyar Power sumit.maniyar@religare.in (91-22) 6766 3461Suman Memani Real Estate suman.memani@religare.in (91-22) 6766 3439Arun Aggarwal Real Estate arun.aggarwal@religare.in (91-22) 6766 3440Ankur Periwal Retail, Logistics, Sugar ankur.periwal@religare.in (91-22) 6766 3469Aseem Gupta Mid Caps aseem.gupta@religare.in (91-22) 6766 3450Dr Tirthankar Patnaik Strategy tirthankar.patnaik@religare.in (91-22) 6766 3446Prasad Shahane Strategy prasad.shahane@religare.in (91-22) 6766 345526

Coverage ProfileBy recommendationBy market cap (US$)(%)6058(%)806940200339Buy Hold Sell6040200292> $1bn $200mn - $1bn < $200mnRecommendation interpretationRecommendationExpected absolute returns (%) over 12 monthsBuy More than 15%Hold Between 15% and –5%Sell Less than –5%Recommendation structure changed with effect from March 1, 2009Expected absolute returns are based on share price at market close unless otherwise stated. Stock recommendations are based on absolute upside (downside) and have a12-month horizon. Our target price represents the fair value of the stock based upon the analyst’s discretion. We note that future price fluctuations could lead to a temporarymismatch between upside/downside for a stock and our recommendation.Religare Capital Markets Ltd4 th Floor, GYS Infinity, Paranjpe ‘B’ Scheme, Subhash Road, Vile Parle (E), Mumbai 400 057.DisclaimerThis document is NOT addressed to or intended for distribution to retail clients (as defined by the FSA).This document is issued by Religare Capital Markets plc (“RCM”) in the UK, which is authorised and regulated by the Financial Services Authority in connection with its UKdistribution. RCM is a member of the London Stock Exchange.This material should not be construed as an offer or recommendation to buy or sell or solicitation of any offer to buy any security or other financial instrument, nor shall it, orthe fact of its distribution, form the basis of, or be relied upon in connection with, any contract relating to such action or any other matter. <strong>The</strong> material in this report is basedon information that we consider reliable and accurate at, and share prices are given as at close of business on, the date of this report but we do not warrant or represent(expressly or impliedly) that it is accurate, complete, not misleading or as to its fitness for the purpose intended and it should not be relied upon as such. Any opinionexpressed (including estimates and forecasts) is given as of the date of this report and may be subject to change without notice.RCM, and any of its connected or affiliated companies or their directors or employees, may have a position in any of the securities or may have provided corporate financeadvice, other investment services in relation to any of the securities or related investments referred to in this document. Our asset management area, our proprietary tradingdesks and investing businesses may make investment decisions that are inconsistent with the recommendations or views expressed in this briefing note.RCM accepts no liability whatsoever for any direct, indirect or consequential loss or damage of any kind arising out of the use of or reliance upon all or any of this materialhowsoever arising. <strong>Investor</strong>s should make their own investment decisions based upon their own financial objectives and financial resources and it should be noted thatinvestment involves risk, including the risk of capital loss.This document is confidential and is supplied to you for information purposes only. It may not (directly or indirectly) be reproduced, further distributed to any person orpublished, in whole or in part, for any purpose whatsoever. Neither this document, nor any copy of it, may be taken or transmitted into the United States, Canada, Australia,Ireland, South Africa or Japan or into any jurisdiction where it would be unlawful to do so. Any failure to comply with this restriction may constitute a violation of relevantlocal securities laws. If you have received this document in error please telephone Nicholas Malins-Smith on +44 (0) 20 7382 4479.