The strengthening of the Kuwait economy was shown in October 2006, Moody’s InvestorsService upgraded the long-term foreign and domestic currency government bond ratings of Kuwaitto Aa3 with stable outlook from A2 on review for upgrade.Gross Domestic ProductThe Compound Annual Growth Rate (‘‘CAGR’’) of nominal GDP in the oil sector during thefour year period ending 2005 was 21.9 per cent. Other GCC countries have also experienced higheconomic growth rate in recent years primarily due to the oil prices. Any decline in oil prices mayslow down economic expansion.Among the other sectors, the manufacturing sector has grown at a CAGR of 26.8 per cent.during the four year period ending 2005. Other non-oil sectors which have registered good growthin recent years include financial institutions, transport, storage and communications which grew ata CAGR of 20.4 per cent. and 23.8 per cent. respectively in 2005.Principal SectorsOil and Petroleum RefiningKuwait is estimated to have over 90 billion barrels of oil reserves, the bulk of the crude oilreserves lie in the Greater Burgan field, the second largest known field in the world and thecountry’s most productive.Since 1999, oil prices have increased substantially. Kuwaiti export crude oil sold for anaverage of U.S.$25.7 per barrel in 2000, U.S.$21.3 per barrel in 2001, U.S.$23.6 per barrel in 2002,U.S.$26.9 per barrel in 2003, U.S.$32 per barrel in 2004 and U.S.$45 per barrel in the nine monthsto September 2005.While the Government is currently in a strong fiscal position, its high level of dependence onoil revenues makes it vulnerable to fluctuations in oil prices.External TradeIn addition, trade surplus for Kuwait continued its growth in 2006. For the first nine monthsof 2006, the trade surplus was KD 8.93 billion i.e. 11.7 per cent. higher than the trade surplus in2005. In 2005, the trade surplus was KD 7.99 billion registering a growth of 69.9 per cent. over theprevious year. This was a result of a growth of 55.5 per cent. in exports coupled withcomparatively lower growth of 37.2 per cent. in imports. Trade surplus represented 33.9 per cent.of the GDP in 2005, up from 26.9 per cent. in 2004. As in previous years, the growth in exports in2005 was led by oil exports. Oil exports grew by 57.4 per cent. in 2005 on account of higherprices as well as production. Kuwait, on account of its large oil exports, traditionally has a positivetrade balance. However, the quantum of the trade balance is highly dependent on oil prices andproduction levels. These factors will influence the balance of trade in coming years.Kuwait’s trade partners are primarily the United States of America, Japan, South Korea andGermany.Other SectorsIn addition to the oil and petroleum refining sector, Kuwait has strong petrochemicals,financial services, trade and exporting sectors.Public FinancesKuwaiti economy and finances have largely recovered from the Iraqi invasion of 1990. Thetotal costs resulting from the invasion and reconstruction and the military costs borne by theGovernment are estimated at more than U.S.$120 billion. The Government has repaid over U.S.$33billion in domestic and foreign debt accumulated as a result of the invasion and reconstruction ofKuwait.108

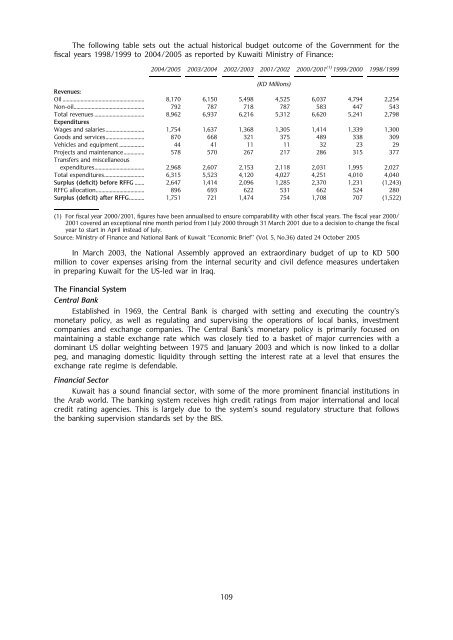

The following table sets out the actual historical budget outcome of the Government for thefiscal years 1998/1999 to 2004/2005 as reported by Kuwaiti Ministry of Finance:2004/2005 2003/2004 2002/2003 2001/2002 2000/2001 (1) 1999/2000 1998/1999(KD Millions)Revenues:Oil ........................................................... 8,170 6,150 5,498 4,525 6,037 4,794 2,254Non-oil................................................... 792 787 718 787 583 447 543Total revenues .................................... 8,962 6,937 6,216 5,312 6,620 5,241 2,798ExpendituresWages and salaries ............................ 1,754 1,637 1,368 1,305 1,414 1,339 1,300Goods and services............................ 870 668 321 375 489 338 309Vehicles and equipment .................. 44 41 11 11 32 23 29Projects and maintenance............... 578 570 267 217 286 315 377Transfers and miscellaneousexpenditures.................................... 2,968 2,607 2,153 2,118 2,031 1,995 2,027Total expenditures............................. 6,315 5,523 4,120 4,027 4,251 4,010 4,040Surplus (deficit) before RFFG ....... 2,647 1,414 2,096 1,285 2,370 1,231 (1,243)RFFG allocation................................... 896 693 622 531 662 524 280Surplus (deficit) after RFFG........... 1,751 721 1,474 754 1,708 707 (1,522)(1) For fiscal year 2000/2001, figures have been annualised to ensure comparability with other fiscal years. The fiscal year 2000/2001 covered an exceptional nine month period from I July 2000 through 31 March 2001 due to a decision to change the fiscalyear to start in April instead of July.Source: Ministry of Finance and National Bank of Kuwait ‘‘Economic Brief’’ (Vol. 5, No.36) dated 24 October 2005In March 2003, the National Assembly approved an extraordinary budget of up to KD 500million to cover expenses arising from the internal security and civil defence measures undertakenin preparing Kuwait for the US-led war in Iraq.The Financial SystemCentral BankEstablished in 1969, the Central Bank is charged with setting and executing the country’smonetary policy, as well as regulating and supervising the operations of local banks, investmentcompanies and exchange companies. The Central Bank’s monetary policy is primarily focused onmaintaining a stable exchange rate which was closely tied to a basket of major currencies with adominant US dollar weighting between 1975 and January 2003 and which is now linked to a dollarpeg, and managing domestic liquidity through setting the interest rate at a level that ensures theexchange rate regime is defendable.Financial SectorKuwait has a sound financial sector, with some of the more prominent financial institutions inthe Arab world. The banking system receives high credit ratings from major international and localcredit rating agencies. This is largely due to the system’s sound regulatory structure that followsthe banking supervision standards set by the BIS.109

- Page 2 and 3:

This Offering Circular comprises li

- Page 4 and 5:

given, and has not withdrawn, his c

- Page 6 and 7:

FORWARD LOOKING STATEMENTSSome stat

- Page 8 and 9:

STRUCTURE DIAGRAM AND CASHFLOWSThe

- Page 10 and 11:

PartiesIssuerOVERVIEW OF THE OFFERI

- Page 12 and 13:

On the exercise of the Trustee’s

- Page 14 and 15:

Periodic DistributionsRedemptionExc

- Page 16 and 17:

Redemption at the Option ofCertific

- Page 18 and 19:

Definitive Certificates evidencing

- Page 20 and 21:

Withholding TaxUse of ProceedsListi

- Page 22 and 23:

actions which could have a material

- Page 24 and 25:

The performance of IIG’s investme

- Page 26 and 27:

the insurance interests within the

- Page 28 and 29:

Certificateholders will bear the ri

- Page 30 and 31:

Enforcing foreign arbitration award

- Page 32 and 33:

1. Form, Denomination, Title and De

- Page 34 and 35:

Delegate, the Agents or any of thei

- Page 36 and 37:

4.2 Application of Proceeds from Tr

- Page 38 and 39:

In order to exercise such right, a

- Page 40 and 41:

as a result of the issue of Shares

- Page 42 and 43:

of the relevant Certificate and the

- Page 44 and 45:

(c)(d)(e)(f)(g)Relevant Share Amoun

- Page 46 and 47:

(k)(l)(m)(n)Liabilities: In exercis

- Page 48 and 49:

and, in each case, there will be no

- Page 50 and 51:

(b)Adjustment EventsSubject to Cond

- Page 52 and 53:

(vi)Where:PdTis the arithmetic aver

- Page 54 and 55:

ecome effective immediately before

- Page 56 and 57:

eplacement, the Delegate shall be e

- Page 58 and 59:

(c)where such withholding or deduct

- Page 60 and 61:

(b)mailed to them by first class pr

- Page 62 and 63: 21.2 The Issuer has in the Declarat

- Page 64 and 65: ‘‘Current Market Price’’ me

- Page 66 and 67: ‘‘Late Payment Amount’’ mea

- Page 68 and 69: aggregate Net Proceeds of Sale and

- Page 70 and 71: ‘‘Trading Day’’ means, in r

- Page 72 and 73: GLOBAL CERTIFICATEThe Global Certif

- Page 74 and 75: USE OF PROCEEDSThe proceeds of the

- Page 76 and 77: IIG - SELECTED FINANCIAL INFORMATIO

- Page 78 and 79: ecorded principally as net income f

- Page 80 and 81: Finance costsFinance costs comprise

- Page 82 and 83: its net cash used in investing acti

- Page 84 and 85: investments comprised 50 per cent.

- Page 86 and 87: new company, for example Ajal Finan

- Page 88 and 89: IIG also intends in the next few ye

- Page 90 and 91: IIG has entered into a number of cu

- Page 92 and 93: the productivity of oil and gas wel

- Page 94 and 95: CompetitionIIG expects that First K

- Page 96 and 97: indirectly, 70 per cent. of the sha

- Page 98 and 99: * distribution of borrowings, claim

- Page 100 and 101: * Chairman and Managing Director of

- Page 102 and 103: Name Title AgeYear firststarted wit

- Page 104 and 105: SHAREHOLDERSIIG has been a publicly

- Page 106 and 107: Shareholders holding at least 25 pe

- Page 108 and 109: The table below sets forth the repo

- Page 110 and 111: There are no other outstanding secu

- Page 114 and 115: THE TRUST ASSETSPursuant to the Dec

- Page 116 and 117: in each case, there will be no rest

- Page 118 and 119: with the covenant relating to the L

- Page 120 and 121: ‘‘Independent Appraiser’’ m

- Page 122 and 123: ‘‘Total Consolidated Contingent

- Page 124 and 125: For these purposes:‘‘Material S

- Page 126 and 127: TAXATIONThe following is a general

- Page 128 and 129: CLEARANCE AND SETTLEMENTThe informa

- Page 130 and 131: SUBSCRIPTION AND SALEBarclays Bank

- Page 132 and 133: exempt offer under sub-paragraph (3

- Page 134 and 135: GENERAL INFORMATION1. Application h

- Page 136 and 137: APPENDIX - FINANCIAL STATEMENTSFina

- Page 138 and 139: International Investment Group Comp

- Page 140 and 141: International Investment Group Comp

- Page 142 and 143: International Investment Group Comp

- Page 144 and 145: International Investment Group Comp

- Page 146 and 147: International Investment Group Comp

- Page 148 and 149: International Investment Group Comp

- Page 150 and 151: F-15

- Page 152 and 153: International Investment Group Comp

- Page 154 and 155: International Investment Group Comp

- Page 156 and 157: International Investment Group Comp

- Page 158 and 159: International Investment Group Comp

- Page 160 and 161: International Investment Group Comp

- Page 162 and 163:

International Investment Group Comp

- Page 164 and 165:

International Investment Group Comp

- Page 166 and 167:

International Investment Group Comp

- Page 168 and 169:

International Investment Group Comp

- Page 170 and 171:

166Independent Auditior’s ReportF

- Page 172 and 173:

188International Investment Group K

- Page 174 and 175:

EXHIBIT DINTERNATIONAL INVESTMENT G

- Page 176 and 177:

EXHIBIT CINTERNATIONAL INVESTMENT G

- Page 178 and 179:

-2-As per the revised IAS 39, unrea

- Page 180 and 181:

-4-Gains or losses arising from tra

- Page 182 and 183:

-6-n) Treasury sharesTreasury share

- Page 184 and 185:

-8-5. Murabaha receivables2005KD200

- Page 186 and 187:

-10-Compensation to key management

- Page 188 and 189:

-12-During the year, the company ha

- Page 190 and 191:

-14-19. Treasury sharesThe Company

- Page 192 and 193:

-16-29. Fiduciary assetsThe Company

- Page 194 and 195:

-18-iii)Mudaraba receivables and ot

- Page 196 and 197:

-20-32. ZakatAccording to State of

- Page 198 and 199:

F-63

- Page 200 and 201:

F-65

- Page 202 and 203:

F-67

- Page 204 and 205:

F-69

- Page 206 and 207:

F-71

- Page 208 and 209:

F-73

- Page 210 and 211:

F-75

- Page 212 and 213:

F-77

- Page 214 and 215:

F-79

- Page 216 and 217:

F-81

- Page 218 and 219:

F-83

- Page 220 and 221:

THE ISSUER AND TRUSTEEIIG Funding L