International Investment Group CompanyK.S.C. (Closed)Notes to the Interim Condensed Financial Statements - 31 March 2007(Unaudited)1. Incorporation of the CompanyInternational Investment Group Company is a closed Kuwaiti Shareholding Companyestablished in 1987, and registered as an investment company in the Central Bank ofKuwait. The shares of the Company were listed in the Kuwait <strong>Stock</strong> <strong>Exchange</strong> on 23November 1997.The Company’s office is domiciled at Kuwait <strong>Stock</strong> <strong>Exchange</strong> Building – fifth floor, P.O.Box 29448 Safat, 13155 - State of Kuwait.The principle activities of the Company are representing in investment activities,managing financial portfolios and investment funds for others, also real estate activity.The activities of the Company are carried out in accordance with Noble Islamic Sharieaprinciples.The annual General Assembly meeting was not held till the date of issuing these interimfinancial information. Therefore the financial statements for the year ended 31December 2006 have not been approved yet.The interim condensed financial statements were approved for issue by the Board ofDirectors on May 13, 2007.2. Basis of preparationThese interim condensed financial statements have been prepared in accordance withInternational Accounting Standard No. (34), “Interim Financial Reporting”.The interim condensed financial information does not include all information and notesthat are required for complete financial statements as per the International FinancialReporting Standards as adopted for use by the Government of Kuwait for financialinstitutions regulated by the Central Bank of Kuwait.The provision for impairment in Murabaha, Wakala and Mudarba receivables isdetermined according to Central Bank of Kuwait requirements in respect of the specificprovisions. Further, the Central Bank of Kuwait requires forming a minimum generalprovision of all Murabaha, Wakala and Mudarba receivables which is not subject tospecific provisions after disposal of some categories of guarantees that are underinstruction of Central Bank of Kuwait.Starting from 1 January 2007, the general provision perentage was decreased to 1% as aminimum for monetary financing and investment transactions and to , 0.5% as aminimum for non monetary financing and investment transctions instead of 2%.., withoutaffecting the outstanding general provision surplus as at 31 December 2006 until furtherinstructions issued from Central Bank of Kuwait.In the opinion of the management, all necessary adjustments including recordingaccruals have been included in the interim condensed financial statements for fairpresentation.The operating results for the period ended 31 March 2007 are not necessarily indicativeof the results that may be expected for the year ending 31 December 2007. For furtherinformation, you may refer to the financial statements and its related notes for the yearended 31 December 2006.5F-7

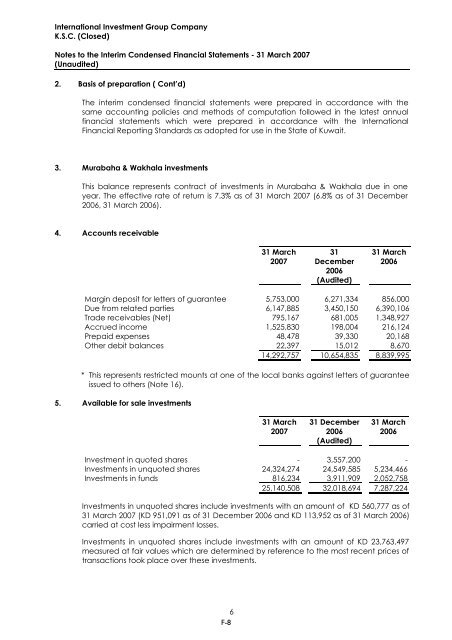

International Investment Group CompanyK.S.C. (Closed)Notes to the Interim Condensed Financial Statements - 31 March 2007(Unaudited)2. Basis of preparation ( Cont’d)The interim condensed financial statements were prepared in accordance with thesame accounting policies and methods of computation followed in the latest annualfinancial statements which were prepared in accordance with the InternationalFinancial Reporting Standards as adopted for use in the State of Kuwait.3. Murabaha & Wakhala investmentsThis balance represents contract of investments in Murabaha & Wakhala due in oneyear. The effective rate of return is 7.3% as of 31 March 2007 (6.8% as of 31 December2006, 31 March 2006).4. Accounts receivable31 March200731December2006(Audited)31 March2006Margin deposit for letters of guarantee 5,753,000 6,271,334 856,000Due from related parties 6,147,885 3,450,150 6,390,106Trade receivables (Net) 795,167 681,005 1,348,927Accrued income 1,525,830 198,004 216,124Prepaid expenses 48,478 39,330 20,168Other debit balances 22,397 15,012 8,67014,292,757 10,654,835 8,839,995* This represents restricted mounts at one of the local banks against letters of guaranteeissued to others (Note 16).5. Available for sale investments31 March200731 December2006(Audited)31 March2006Investment in quoted shares - 3,557,200 -Investments in unquoted shares 24,324,274 24,549,585 5,234,466Investments in funds 816,234 3,911,909 2,052,75825,140,508 32,018,694 7,287,224Investments in unquoted shares include investments with an amount of KD 560,777 as of31 March 2007 (KD 951,091 as of 31 December 2006 and KD 113,952 as of 31 March 2006)carried at cost less impairment losses.Investments in unquoted shares include investments with an amount of KD 23,763,497measured at fair values which are determined by reference to the most recent prices oftransactions took place over these investments.6F-8

- Page 2 and 3:

This Offering Circular comprises li

- Page 4 and 5:

given, and has not withdrawn, his c

- Page 6 and 7:

FORWARD LOOKING STATEMENTSSome stat

- Page 8 and 9:

STRUCTURE DIAGRAM AND CASHFLOWSThe

- Page 10 and 11:

PartiesIssuerOVERVIEW OF THE OFFERI

- Page 12 and 13:

On the exercise of the Trustee’s

- Page 14 and 15:

Periodic DistributionsRedemptionExc

- Page 16 and 17:

Redemption at the Option ofCertific

- Page 18 and 19:

Definitive Certificates evidencing

- Page 20 and 21:

Withholding TaxUse of ProceedsListi

- Page 22 and 23:

actions which could have a material

- Page 24 and 25:

The performance of IIG’s investme

- Page 26 and 27:

the insurance interests within the

- Page 28 and 29:

Certificateholders will bear the ri

- Page 30 and 31:

Enforcing foreign arbitration award

- Page 32 and 33:

1. Form, Denomination, Title and De

- Page 34 and 35:

Delegate, the Agents or any of thei

- Page 36 and 37:

4.2 Application of Proceeds from Tr

- Page 38 and 39:

In order to exercise such right, a

- Page 40 and 41:

as a result of the issue of Shares

- Page 42 and 43:

of the relevant Certificate and the

- Page 44 and 45:

(c)(d)(e)(f)(g)Relevant Share Amoun

- Page 46 and 47:

(k)(l)(m)(n)Liabilities: In exercis

- Page 48 and 49:

and, in each case, there will be no

- Page 50 and 51:

(b)Adjustment EventsSubject to Cond

- Page 52 and 53:

(vi)Where:PdTis the arithmetic aver

- Page 54 and 55:

ecome effective immediately before

- Page 56 and 57:

eplacement, the Delegate shall be e

- Page 58 and 59:

(c)where such withholding or deduct

- Page 60 and 61:

(b)mailed to them by first class pr

- Page 62 and 63:

21.2 The Issuer has in the Declarat

- Page 64 and 65:

‘‘Current Market Price’’ me

- Page 66 and 67:

‘‘Late Payment Amount’’ mea

- Page 68 and 69:

aggregate Net Proceeds of Sale and

- Page 70 and 71:

‘‘Trading Day’’ means, in r

- Page 72 and 73:

GLOBAL CERTIFICATEThe Global Certif

- Page 74 and 75:

USE OF PROCEEDSThe proceeds of the

- Page 76 and 77:

IIG - SELECTED FINANCIAL INFORMATIO

- Page 78 and 79:

ecorded principally as net income f

- Page 80 and 81:

Finance costsFinance costs comprise

- Page 82 and 83:

its net cash used in investing acti

- Page 84 and 85:

investments comprised 50 per cent.

- Page 86 and 87:

new company, for example Ajal Finan

- Page 88 and 89:

IIG also intends in the next few ye

- Page 90 and 91:

IIG has entered into a number of cu

- Page 92 and 93: the productivity of oil and gas wel

- Page 94 and 95: CompetitionIIG expects that First K

- Page 96 and 97: indirectly, 70 per cent. of the sha

- Page 98 and 99: * distribution of borrowings, claim

- Page 100 and 101: * Chairman and Managing Director of

- Page 102 and 103: Name Title AgeYear firststarted wit

- Page 104 and 105: SHAREHOLDERSIIG has been a publicly

- Page 106 and 107: Shareholders holding at least 25 pe

- Page 108 and 109: The table below sets forth the repo

- Page 110 and 111: There are no other outstanding secu

- Page 112 and 113: The strengthening of the Kuwait eco

- Page 114 and 115: THE TRUST ASSETSPursuant to the Dec

- Page 116 and 117: in each case, there will be no rest

- Page 118 and 119: with the covenant relating to the L

- Page 120 and 121: ‘‘Independent Appraiser’’ m

- Page 122 and 123: ‘‘Total Consolidated Contingent

- Page 124 and 125: For these purposes:‘‘Material S

- Page 126 and 127: TAXATIONThe following is a general

- Page 128 and 129: CLEARANCE AND SETTLEMENTThe informa

- Page 130 and 131: SUBSCRIPTION AND SALEBarclays Bank

- Page 132 and 133: exempt offer under sub-paragraph (3

- Page 134 and 135: GENERAL INFORMATION1. Application h

- Page 136 and 137: APPENDIX - FINANCIAL STATEMENTSFina

- Page 138 and 139: International Investment Group Comp

- Page 140 and 141: International Investment Group Comp

- Page 144 and 145: International Investment Group Comp

- Page 146 and 147: International Investment Group Comp

- Page 148 and 149: International Investment Group Comp

- Page 150 and 151: F-15

- Page 152 and 153: International Investment Group Comp

- Page 154 and 155: International Investment Group Comp

- Page 156 and 157: International Investment Group Comp

- Page 158 and 159: International Investment Group Comp

- Page 160 and 161: International Investment Group Comp

- Page 162 and 163: International Investment Group Comp

- Page 164 and 165: International Investment Group Comp

- Page 166 and 167: International Investment Group Comp

- Page 168 and 169: International Investment Group Comp

- Page 170 and 171: 166Independent Auditior’s ReportF

- Page 172 and 173: 188International Investment Group K

- Page 174 and 175: EXHIBIT DINTERNATIONAL INVESTMENT G

- Page 176 and 177: EXHIBIT CINTERNATIONAL INVESTMENT G

- Page 178 and 179: -2-As per the revised IAS 39, unrea

- Page 180 and 181: -4-Gains or losses arising from tra

- Page 182 and 183: -6-n) Treasury sharesTreasury share

- Page 184 and 185: -8-5. Murabaha receivables2005KD200

- Page 186 and 187: -10-Compensation to key management

- Page 188 and 189: -12-During the year, the company ha

- Page 190 and 191: -14-19. Treasury sharesThe Company

- Page 192 and 193:

-16-29. Fiduciary assetsThe Company

- Page 194 and 195:

-18-iii)Mudaraba receivables and ot

- Page 196 and 197:

-20-32. ZakatAccording to State of

- Page 198 and 199:

F-63

- Page 200 and 201:

F-65

- Page 202 and 203:

F-67

- Page 204 and 205:

F-69

- Page 206 and 207:

F-71

- Page 208 and 209:

F-73

- Page 210 and 211:

F-75

- Page 212 and 213:

F-77

- Page 214 and 215:

F-79

- Page 216 and 217:

F-81

- Page 218 and 219:

F-83

- Page 220 and 221:

THE ISSUER AND TRUSTEEIIG Funding L