IIG Prospectus - London Stock Exchange

IIG Prospectus - London Stock Exchange

IIG Prospectus - London Stock Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

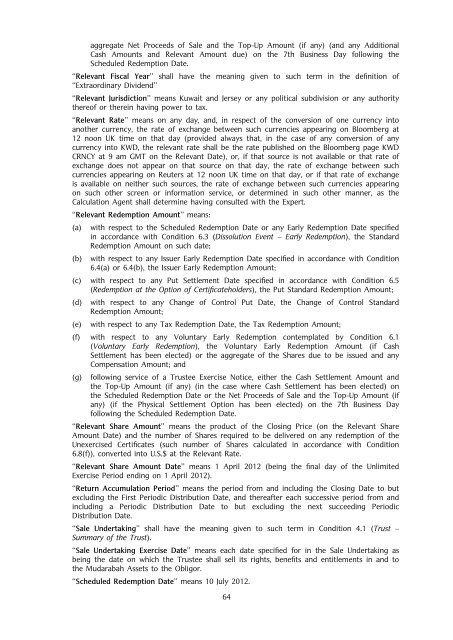

aggregate Net Proceeds of Sale and the Top-Up Amount (if any) (and any AdditionalCash Amounts and Relevant Amount due) on the 7th Business Day following theScheduled Redemption Date.‘‘Relevant Fiscal Year’’ shall have the meaning given to such term in the definition of‘‘Extraordinary Dividend’’‘‘Relevant Jurisdiction’’ means Kuwait and Jersey or any political subdivision or any authoritythereof or therein having power to tax.‘‘Relevant Rate’’ means on any day, and, in respect of the conversion of one currency intoanother currency, the rate of exchange between such currencies appearing on Bloomberg at12 noon UK time on that day (provided always that, in the case of any conversion of anycurrency into KWD, the relevant rate shall be the rate published on the Bloomberg page KWDCRNCY at 9 am GMT on the Relevant Date), or, if that source is not available or that rate ofexchange does not appear on that source on that day, the rate of exchange between suchcurrencies appearing on Reuters at 12 noon UK time on that day, or if that rate of exchangeis available on neither such sources, the rate of exchange between such currencies appearingon such other screen or information service, or determined in such other manner, as theCalculation Agent shall determine having consulted with the Expert.‘‘Relevant Redemption Amount’’ means:(a) with respect to the Scheduled Redemption Date or any Early Redemption Date specifiedin accordance with Condition 6.3 (Dissolution Event – Early Redemption), the StandardRedemption Amount on such date;(b) with respect to any Issuer Early Redemption Date specified in accordance with Condition6.4(a) or 6.4(b), the Issuer Early Redemption Amount;(c) with respect to any Put Settlement Date specified in accordance with Condition 6.5(Redemption at the Option of Certificateholders), the Put Standard Redemption Amount;(d) with respect to any Change of Control Put Date, the Change of Control StandardRedemption Amount;(e) with respect to any Tax Redemption Date, the Tax Redemption Amount;(f) with respect to any Voluntary Early Redemption contemplated by Condition 6.1(Voluntary Early Redemption), the Voluntary Early Redemption Amount (if CashSettlement has been elected) or the aggregate of the Shares due to be issued and anyCompensation Amount; and(g) following service of a Trustee Exercise Notice, either the Cash Settlement Amount andthe Top-Up Amount (if any) (in the case where Cash Settlement has been elected) onthe Scheduled Redemption Date or the Net Proceeds of Sale and the Top-Up Amount (ifany) (if the Physical Settlement Option has been elected) on the 7th Business Dayfollowing the Scheduled Redemption Date.‘‘Relevant Share Amount’’ means the product of the Closing Price (on the Relevant ShareAmount Date) and the number of Shares required to be delivered on any redemption of theUnexercised Certificates (such number of Shares calculated in accordance with Condition6.8(f)), converted into U.S.$ at the Relevant Rate.‘‘Relevant Share Amount Date’’ means 1 April 2012 (being the final day of the UnlimitedExercise Period ending on 1 April 2012).‘‘Return Accumulation Period’’ means the period from and including the Closing Date to butexcluding the First Periodic Distribution Date, and thereafter each successive period from andincluding a Periodic Distribution Date to but excluding the next succeeding PeriodicDistribution Date.‘‘Sale Undertaking’’ shall have the meaning given to such term in Condition 4.1 (Trust –Summary of the Trust).‘‘Sale Undertaking Exercise Date’’ means each date specified for in the Sale Undertaking asbeing the date on which the Trustee shall sell its rights, benefits and entitlements in and tothe Mudarabah Assets to the Obligor.‘‘Scheduled Redemption Date’’ means 10 July 2012.64