3-1 Solutions to Chapter 3 Accounting and Finance 1. Sophie's ...

3-1 Solutions to Chapter 3 Accounting and Finance 1. Sophie's ...

3-1 Solutions to Chapter 3 Accounting and Finance 1. Sophie's ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

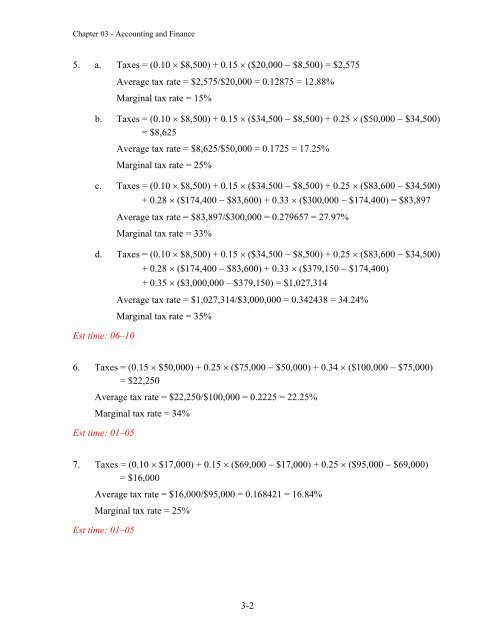

<strong>Chapter</strong> 03 - <strong>Accounting</strong> <strong>and</strong> <strong>Finance</strong>5. a. Taxes = (0.10 $8,500) + 0.15 ($20,000 $8,500) = $2,575Average tax rate = $2,575/$20,000 = 0.12875 = 12.88%Marginal tax rate = 15%b. Taxes = (0.10 $8,500) + 0.15 ($34,500 $8,500) + 0.25 ($50,000 $34,500)= $8,625Average tax rate = $8,625/$50,000 = 0.1725 = 17.25%Marginal tax rate = 25%c. Taxes = (0.10 $8,500) + 0.15 ($34,500 $8,500) + 0.25 ($83,600 $34,500)+ 0.28 ($174,400 $83,600) + 0.33 ($300,000 $174,400) = $83,897Average tax rate = $83,897/$300,000 = 0.279657 = 27.97%Marginal tax rate = 33%d. Taxes = (0.10 $8,500) + 0.15 ($34,500 $8,500) + 0.25 ($83,600 $34,500)+ 0.28 ($174,400 $83,600) + 0.33 ($379,150 $174,400)+ 0.35 ($3,000,000 – $379,150) = $1,027,314Est time: 06–10Average tax rate = $1,027,314/$3,000,000 = 0.342438 = 34.24%Marginal tax rate = 35%6. Taxes = (0.15 $50,000) + 0.25 ($75,000 $50,000) + 0.34 ($100,000 $75,000)= $22,250Average tax rate = $22,250/$100,000 = 0.2225 = 22.25%Marginal tax rate = 34%Est time: 01–057. Taxes = (0.10 $17,000) + 0.15 ($69,000 $17,000) + 0.25 ($95,000 $69,000)= $16,000Average tax rate = $16,000/$95,000 = 0.168421 = 16.84%Marginal tax rate = 25%Est time: 01–053-2