3-1 Solutions to Chapter 3 Accounting and Finance 1. Sophie's ...

3-1 Solutions to Chapter 3 Accounting and Finance 1. Sophie's ...

3-1 Solutions to Chapter 3 Accounting and Finance 1. Sophie's ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

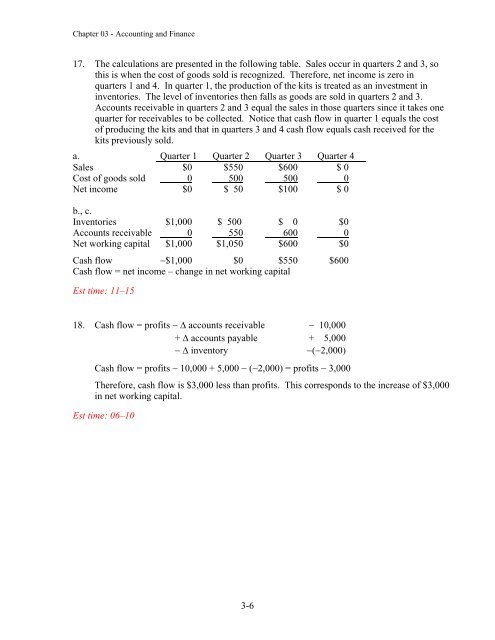

<strong>Chapter</strong> 03 - <strong>Accounting</strong> <strong>and</strong> <strong>Finance</strong>17. The calculations are presented in the following table. Sales occur in quarters 2 <strong>and</strong> 3, sothis is when the cost of goods sold is recognized. Therefore, net income is zero inquarters 1 <strong>and</strong> 4. In quarter 1, the production of the kits is treated as an investment ininven<strong>to</strong>ries. The level of inven<strong>to</strong>ries then falls as goods are sold in quarters 2 <strong>and</strong> 3.Accounts receivable in quarters 2 <strong>and</strong> 3 equal the sales in those quarters since it takes onequarter for receivables <strong>to</strong> be collected. Notice that cash flow in quarter 1 equals the cos<strong>to</strong>f producing the kits <strong>and</strong> that in quarters 3 <strong>and</strong> 4 cash flow equals cash received for thekits previously sold.a. Quarter 1 Quarter 2 Quarter 3 Quarter 4Sales $0 $550 $600 $ 0Cost of goods sold 0 500 500 0Net income $0 $ 50 $100 $ 0b., c.Inven<strong>to</strong>ries $1,000 $ 500 $ 0 $0Accounts receivable 0 550 600 0Net working capital $1,000 $1,050 $600 $0Cash flow $1,000 $0 $550 $600Cash flow = net income – change in net working capitalEst time: 11–1518. Cash flow = profits accounts receivable 10,000+ accounts payable + 5,000 inven<strong>to</strong>ry(2,000)Cash flow = profits 10,000 + 5,000 (2,000) = profits 3,000Therefore, cash flow is $3,000 less than profits. This corresponds <strong>to</strong> the increase of $3,000in net working capital.Est time: 06–103-6