3-1 Solutions to Chapter 3 Accounting and Finance 1. Sophie's ...

3-1 Solutions to Chapter 3 Accounting and Finance 1. Sophie's ...

3-1 Solutions to Chapter 3 Accounting and Finance 1. Sophie's ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

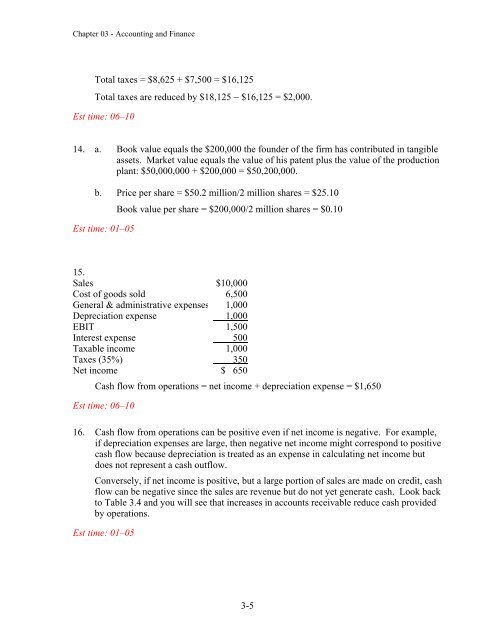

<strong>Chapter</strong> 03 - <strong>Accounting</strong> <strong>and</strong> <strong>Finance</strong>Total taxes = $8,625 + $7,500 = $16,125Total taxes are reduced by $18,125 $16,125 = $2,000.Est time: 06–1014. a. Book value equals the $200,000 the founder of the firm has contributed in tangibleassets. Market value equals the value of his patent plus the value of the productionplant: $50,000,000 + $200,000 = $50,200,000.b. Price per share = $50.2 million/2 million shares = $25.10Book value per share = $200,000/2 million shares = $0.10Est time: 01–0515.Sales $10,000Cost of goods sold 6,500General & administrative expenses 1,000Depreciation expense 1,000EBIT 1,500Interest expense 500Taxable income 1,000Taxes (35%) 350Net income $ 650Cash flow from operations = net income + depreciation expense = $1,650Est time: 06–1016. Cash flow from operations can be positive even if net income is negative. For example,if depreciation expenses are large, then negative net income might correspond <strong>to</strong> positivecash flow because depreciation is treated as an expense in calculating net income butdoes not represent a cash outflow.Conversely, if net income is positive, but a large portion of sales are made on credit, cashflow can be negative since the sales are revenue but do not yet generate cash. Look back<strong>to</strong> Table 3.4 <strong>and</strong> you will see that increases in accounts receivable reduce cash providedby operations.Est time: 01–053-5