Class Descriptions - Jack Henry & Associates, Inc.

Class Descriptions - Jack Henry & Associates, Inc.

Class Descriptions - Jack Henry & Associates, Inc.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

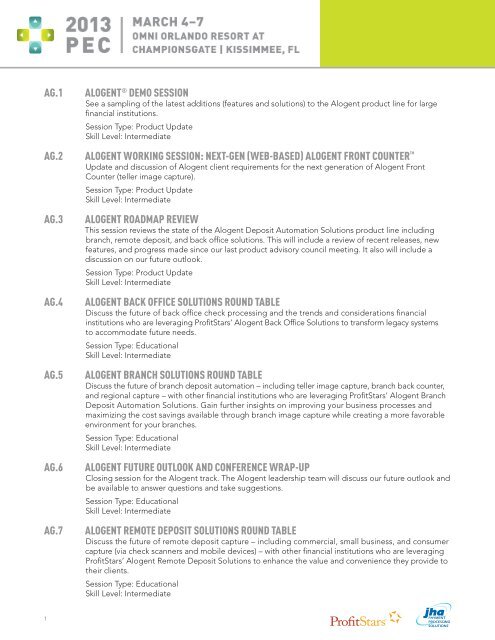

AG.1AG.2AG.3AG.4AG.5AG.6AG.7ALOGENT ® DEMO SESSIONSee a sampling of the latest additions (features and solutions) to the Alogent product line for largefinancial institutions.Session Type: Product UpdateSkill Level: IntermediateALOGENT WORKING SESSION: NEXT-GEN (WEB-BASED) ALOGENT FRONT COUNTER Update and discussion of Alogent client requirements for the next generation of Alogent FrontCounter (teller image capture).Session Type: Product UpdateSkill Level: IntermediateALOGENT ROADMAP REVIEWThis session reviews the state of the Alogent Deposit Automation Solutions product line includingbranch, remote deposit, and back office solutions. This will include a review of recent releases, newfeatures, and progress made since our last product advisory council meeting. It also will include adiscussion on our future outlook.Session Type: Product UpdateSkill Level: IntermediateALOGENT BACK OFFICE SOLUTIONS ROUND TABLEDiscuss the future of back office check processing and the trends and considerations financialinstitutions who are leveraging ProfitStars’ Alogent Back Office Solutions to transform legacy systemsto accommodate future needs.Session Type: EducationalSkill Level: IntermediateALOGENT BRANCH SOLUTIONS ROUND TABLEDiscuss the future of branch deposit automation – including teller image capture, branch back counter,and regional capture – with other financial institutions who are leveraging ProfitStars’ Alogent BranchDeposit Automation Solutions. Gain further insights on improving your business processes andmaximizing the cost savings available through branch image capture while creating a more favorableenvironment for your branches.Session Type: EducationalSkill Level: IntermediateALOGENT FUTURE OUTLOOK AND CONFERENCE WRAP-UPClosing session for the Alogent track. The Alogent leadership team will discuss our future outlook andbe available to answer questions and take suggestions.Session Type: EducationalSkill Level: IntermediateALOGENT REMOTE DEPOSIT SOLUTIONS ROUND TABLEDiscuss the future of remote deposit capture – including commercial, small business, and consumercapture (via check scanners and mobile devices) – with other financial institutions who are leveragingProfitStars’ Alogent Remote Deposit Solutions to enhance the value and convenience they provide totheir clients.Session Type: EducationalSkill Level: Intermediate1

ALL.1ALL.2ALL.3ALL.4ALL.5ALL.6CROSS-SELLING TECHNIQUESThis session will attempt to answer the question, “How do I cross-sell without sounding like a salespitch?” This session will focus on tips and tricks that will help anyone who wants to become a bettercross-seller.Session Type: EducationalSkill Level: BasicBUSINESS WRITING SKILLSIn this age of instant communications, our use of the written language has changed. This session willshow you how to adopt the writing strategies necessary to get and keep the attention of those youcommunicate with.Session Type: EducationalSkill Level: IntermediateDATA CONVERSION MERGER AND ACQUISITION INDUSTRY TRENDS AND TECHNIQUESYou’ve acquired a financial institution ... now what? This session will discuss the data conversion andarchive solution options and trends for Check Images, Document Images, COLD Reports, SignatureCards, and Statements as seen in the financial institution merger and acquisition market.Session Type: Sales Presentation/Product DemoDIVERSIFYING YOUR COMMERCIAL LOAN PORTFOLIO WHILE RECOGNIZING A HIGHER NETINTEREST MARGIN AND MINIMIZING RISKSee how alternative forms of commercial lending products can help you increase your institution’sprofitability and fee income. In addition, hear ways to tap into new commercial markets like healthcarewhile minimizing your risk with strong credit controls and real-time data. Learn to forge strongerbusiness customer relationships and gain better insight into their operations. Plus, create acompetitive edge in your marketplace by providing a needed banking service.Session Type: EducationalSkill Level: BasicDO YOU UTILIZE OUR ONLINE TOOL TO MANAGE YOUR PROFITSTARS ® RELATIONSHIP?This overview will introduce you to the For Clients site, and illustrate how to navigate its vast offerings.The For Clients site is a website that was created to provide our clients with an online tool forinteracting with all levels of the ProfitStars organization. This site is intended to be the solitarylocation to which any given user can request assistance from the support organization, finddocumentation and training materials on products, or check out new product offerings that can makeyour life easier.Session Type: EducationalSkill Level: BasicENTERPRISE CONVERSION SOLUTIONS – PROCESS FROM SALES TO COMPLETIONIf you are thinking about signing an Enterprise Conversion Solutions contract or you have recentlysigned a contract for data conversion work, then this class is a must for you! We will review the steps,risks, timelines and constraints with the entire conversion project life cycle, from the sales phase to thecompletion of the conversion, while also answering any of your technical questions along the way.Session Type: EducationalSkill Level: Basic2

ALL.7ALL.8ALL.9ALL.10HOW TO BUILD A SMALL BUSINESS STRATEGYThis session will discuss how a financial institution can put together a small business strategy thatincludes remote deposit capture, merchant processing, bill pay, check collect, and payroll cards. Learnhow these products work together to create a small business strategy to improve your current positionwith your existing small businesses as well as gain additional market share. We will provide marketingsuggestions as well as analyze additional fee income opportunities.Session Type: EducationalHOW TO ENSURE YOUR BUSINESS CONTINUITY PLAN PASSES THE REGULATORY EXAMWith the multitude and magnitude of disasters throughout the country, examiners are taking a muchharder look at the Business Continuity/Disaster Recovery (BC/DR) plans of financial institutions. Within<strong>Jack</strong> <strong>Henry</strong>, we also have BC/DR plans that are also examined by the same regulatory bodies. Throughour Centurion Disaster Recovery ® group, we have built plans for organizations and have learned indetail what the requirements are for being in compliance. Through this session, we will share with youthe key components required for your BC/DR plan to be in compliance – not only for an examination,but for an actual disaster as well.Session Type: EducationalSkill Level: BasicMEDICAL LOCKBOX 101 – A BEGINNER’S GUIDE TO PROCESSINGAn introduction to providing revenue cycle management and medical lockbox services to your hospitals,clinics, and practitioners – plus what it takes to begin, how to locate these potential customers, and whatto charge for the service.Session Type: EducationalSkill Level: BasicMEDICAL LOCKBOX CASE STUDY – SUCCESS IN A TIME OF UNCERTAINTYAn interactive case study and presentation by Los Alamos National Bank about providing revenue cyclemanagement and medical lockbox services to large area hospitals, clinics, and practitioners – andwhat it took for them to begin the process.Session Type: EducationalSkill Level: BasicALL.11 MICROSOFT ® OFFICE 365Could your bank benefit from an enterprise-class, hosted Microsoft Office suite? Microsoft Office 365opens up a world of possibilities through a reduction in hardware costs and server administration.Banks nationwide, regardless of asset size, can now benefit from the same features and functionalitythat large corporations have enjoyed for years.Session Type: Sales Presentation/Product DemoALL.12STRESS AND YOUR FIVE SENSESScreeching sirens. Glaring lights. Foul odors. Is your life a far cry from Zen-like serenity? Jolts to ourfive senses can add up to big time tension and stress! In this session, learn what stresses us, whatsoothes us, and how to recognize sensory overload!Session Type: EducationalSkill Level: Basic3

ALL.13ALL.14ALL.15ALL.16ALL.17ALL.18ALL.19ALL.20THE DISASTER STRIKES – NOW WHAT?Through this disaster drill, your ability to react to a major disaster event will be tested. The objectiveof the drill is to provide a test environment where you will need to navigate your financial institutionto a successful recovery after a major disaster. You and your team will be presented with a disasterevent along with challenges throughout the drill that will alter the sequence of events and impact yourability to restore critical services to your customers/members. The drill is action-packed and highlyinteractive with some fun sprinkled in. Not only will you learn how to deal with a disaster event fromCenturion experts who have supported many clients through real disaster events, you will also learnfrom many of your peers. Buckle up and get ready to roll!Skill Level: BasicWHY WAIT?Rob Quillen, bestselling author of Why Wait?, will fill you with emotion, capture you, inspire you, andmake you realize that you have an amazing power to change another person’s life today. Rob willshare with you how a random meeting with a perfect stranger the day before 9/11 changed his lifeand how it can forever change yours.Session Type: EducationalSkill Level: BasicADVANCED LOCKBOX FEATURES – PROCESSING BEYOND THE PAPERA detailed overview on how features such as account receivable aggregation, remote scanning, anddistributive lockbox services can grow your customer service offering geography.Session Type: EducationalSkill Level: IntermediateGUEST SPEAKER / LEE WETHERINGTONLOCKBOX FEES MADE EASY – TIME TO MAKE SOME MONEYAn in-depth exploration of return on investment and monetization potential of lockbox services thatcan be offered through your financial institution.Session Type: EducationalSkill Level: IntermediateMAKING VENDOR MANAGEMENT WORKToday, the bar is being raised on vendor management by regulators. What are the benefits of aneffective due diligence program? Gain the key information you need on ProfitStars for your vendormanagement compliance and get tips on implementing an effective program at your institution.CLOSING GENERAL SESSIONTHE ONE RESOURCE YOU NEED TO PROFIT FROM SBA LENDINGDiscover how Holtmeyer & Monson makes SBA lending easy. Their comprehensive services can be aninstant profit center for your bank and includes all of the expertise needed to cover every stage of theSBA process. From loan packaging and closing, to securitization and sale and servicing, Holtmeyerand Monson has served banks and small business borrowers since 1982.Session Type: EducationalSkill Level: Basic4

ALL.21 JHADIRECT ®jhaDirect is <strong>Jack</strong> <strong>Henry</strong>’s own supply store. Learn more about pricing and availabilty of statements,forms, envelopes, printing services, scanners, marketing materials, and more.Session Type: Sales Presentation/Product DemoBMGR.1BMGR.3BMGR.4BMGR.5BMGR.6ACCOUNTS RECEIVABLE FINANCING – GOOD TO GREATHear how two successful BusinessManager ® banks with different approaches to the marketplace haveused the program to enhance their lending activities to local businesses. Since 2010, Level One Bankhas successfully found ways to lend money in the challenged southeastern Michigan market. WhileGreat Western has used the program since 1999 having funded more than $1.7 billion in receivablesacross the Midwest during that time. These banks will discuss how they use the program to expandmarket opportunities.Session Type: EducationalSkill Level: BasicACCOUNTS RECEIVABLE FINANCING – SAFETY FIRSTThis presentation will focus on three critical areas of credit control and management surrounding theBusinessManager program. Invoice verification, Credit Insurance Limits, and Lockbox Control andEnforcement will be discussed with a focus on best practices and observations from bank visits.Session Type: EducationalSkill Level: IntermediateALTERNATIVE LENDING – OPEN FORUMAs any lender knows, unfortunately not all commercial clients have the kind of credit that will allowthem to qualify for conventional bank lending. Troubled businesses often face financial challengesdue to factors they can’t always control. What is the lender to do? Say no and put the relationshipat risk? Thankfully, that is not your only choice. Today there is a strong alternative. Join this groupdiscussion on proven and successful ways to maximize your opportunities in Alternative Lending.Session Type: EducationalSkill Level: BasicFINANCING HEALTHCARE PROVIDERS – OPEN FORUMHealthcare is now a $2 trillion dollar industry and is growing at an annual rate of 6-7%. With this comesunprecedented demand, as healthcare providers are already experiencing some of the most rapidgrowth in the economy today. This kind of growth will require working capital from lenders who knowhow to administer it safely and profitably. Join this group discussion on how the BusinessManagersolution for healthcare providers utilizes a state-of-the-art valuation analysis that provides lenders withthe reimbursement knowledge to safely lend to all areas of this ripe market segment.Session Type: EducationalSkill Level: BasicHOW A BANK SUCCESSFULLY BRANDED BUSINESSMANAGERBank Independent first licensed BusinessManager in 1991 (the year that the internet was madeavailable to the public). Banking has changed a lot since then, and so has the BusinessManagerprogram. Bank Independent “relaunched” their BusinessManager program two years ago with aninnovative approach. Hear how Bank Independent has positioned BusinessManager to their lendersand their business prospects with a laser-like focus on effective and creative marketing.Session Type: EducationalSkill Level: Basic5

BMGR.7BMGR.8BMGR.9EPS.1EPS.2EPS.3RISK MANAGEMENT – OPEN FORUMJoin this group discussion on the best ways to manage the credit and operations side of theBusinessManager program. Experienced bankers share their insights and knowledge on the mosteffective methods in daily and monthly procedures while operating the program.Session Type: EducationalSkill Level: BasicWHY ACCOUNTS RECEIVABLE FINANCING IS A STRONG SOLUTION FOR BANKSAND BUSINESSES IN TODAY’S ECONOMIC AND REGULATORY ENVIRONMENTEver wondered why a stronger client would choose a structured accounts receivable program overa less monitored line? This session will open the door for new opportunities by sharing reasonsbusinesses have taken this route and improved their position as a result.Session Type: EducationalSkill Level: BasicWHY BUSINESSES CHOOSE ACCOUNTS RECEIVABLE LENDING TO FINANCE THEIRBUSINESS – OPEN FORUMStories from business owners and their lender about how the BusinessManager program has helpedtheir business grow and prosper.Session Type: EducationalACH FUNDAMENTALSThis 90-minute session will enable you to apply fundamental concepts related to ACH. This sessionwill enable you to define common ACH acronyms and distinguish payment types, identify participantsin the ACH Network and describe the flow of ACH transactions, and learn about terms and attributesrelated to ACH processing, settlement, and compliance. This session is appropriate for individualscompletely new to ACH, as well as individuals who may desire a refresher course.Session Type: EducationalSkill Level: BasicBUILD ACH REVENUE WITH ACH CLIENTACH payments are growing! Learn how your financial institution can leverage ACH Origination togenerate revenue while managing risk and meeting FFIEC compliance.Session Type: Sales Presentation/Product DemoCAN WE INNOVATE WHILE THEY REGULATE?Today’s payments landscape is marked by constant news stories about new technological advancesand creative concepts. Is it possible that the expanding regulatory climate is the catalyst for innovativeproducts designed to capture market share, replace lost fee revenue, increase profitability, and improvecustomer satisfaction? Or are these innovations driving the need for further regulation? This livelypoint-counterpoint presentation highlights thought-provoking, current examples of regulation vs.innovation that will resonate with all financial institutions.Session Type: EducationalSkill Level: Intermediate6

EPS.4EPS.5EPS.7EPS.8EPS.9EPS ENHANCEMENTS 2012: WHAT HAVE YOU DONE FOR ME LATELY?Join us for a survey of EPS enhancements added to the platform in 2012. This session will describethese new features and discuss how financial institutions and organizations can leverage them toprovide a better, more secure customer experience and improve internal processes. Enhancementscovered will include security improvements designed to strengthen a financial institution’s ability tomeet expanded FFIEC guidelines.Session Type: Product UpdateSkill Level: IntermediateEPS PRODUCT ROADMAPThe EPS platform continues to expand! We are improving existing services and exploring new ways toadd value for our clients and their customers. Join us for a preview of features and changes plannedfor 2013 and beyond.Session Type: Product UpdateMOBILE DEPOSIT WITH RDA – EVERYTHING YOU EVER WANTED TO KNOW!Now you can offer your customers the ability to make deposits on the go 24/7! Come see the powerof ProfitStars’ EPS Remote Deposit Anywhere. This web-based, check image capture, storage, andprocessing solution enables financial institutions to provide retail and small business customers theability to electronically deposit paper checks of all kinds, via Check 21, with a either a compliantsmartphone or a simple flat-bed scanner. This demonstration highlights the functionality and ease-ofuseof this industry-leading solution.Session Type: Sales Presentation/Product DemoPROTECTING YOUR CUSTOMERS WITH ACH A.L.E.R.T. AND ACH C.O.P.S.Are you doing everything you should be doing to protect your originators from threats like accounttakeover or man-in-the-middle attacks? Do you have systems in place to prevent fraudulent debitsfrom draining funds from corporate accounts? Join us for a demonstration of ACH Alert’s inbound andoriginated ACH positive pay products.Session Type: Sales Presentation/Product DemoRDC AND RDX: TAILOR YOUR RDC OFFERING TO MEET YOUR CLIENTS’ NEEDSThis session will provide an overview of Remote Deposit Complete (RDC) and Remote DepositExpress (RDX), two solutions designed to meet different customer demands. By tailoring theirremote deposit products to the needs of their client base, organizations can give their customers ormembers a choice instead of forcing them to into a “one size fits all” solution.Session Type: Sales Presentation/Product Demo7

EPS.10EPS.11EPS.12EPS.13EPS.14SMARTSIGHT : AN INDUSTRY-LEADING DASHBOARD TO MONITOR CUSTOMER ACTIVITY TOKEEP YOUR FI IN COMPLIANCEJoin us for a demo of SmartSight, ProfitStars’ new interactive dashboard that transforms data intoactionable insights. This unequalled tool makes it easy to effectively monitor data and customeractivity within EPS for strategic business and risk mitigation purposes. This essential tool helpsfinancial institutions in meeting examiner expectations; measuring and monitoring risk; and gainingglobal insight into transaction activity at the FI, business, segment, and location levels. Don’t miss thisopportunity to see how your institution can harness the power of these advanced reports!Session Type: Sales Presentation/Product DemoTHINK STRATEGICALLY – TRANSFORM RISK AND COST INTO REVENUEWhile emerging online channels create additional opportunities for fraud, technology also providesnew methods to make transactions safer. This session will explore ways financial institutions canleverage technology advances to satisfy their customers’/members’ appetite for more robust fraudprevention services. Join us to learn how to devise a strategy for using technology to meet regulatorymandates, effectively mitigate risks, support scalable, effective dispute automation, and strengthenpayments risk mitigation.Session Type: EducationalSkill Level: IntermediateWHAT ARE THEY DOING? ACH MANAGER KNOWS!Regulators are more insistent now than ever before that FIs monitor and control the ACH process. Atany given time, how can you possibly know who, what, and how much your originators are doing?Learn how ACH Manager can help you comply.Session Type: Sales Presentation/Product DemoA ROADMAP FOR ADDING NEW ACH ORIGINATORSWhether you’ve been adding new ACH originators for years or you’re only in the planning stages, thissession will provide your financial institution with valuable navigational tools and directions to create asystematic and effective process for reviewing, qualifying, approving, and adding business customers asoriginators. The first stop on the journey will be a review of an Application for ACH Origination, whichwill be provided as a sample form. Examples of topics to be reviewed at other stops include the creditreview process, exposure limits, Originator Watch List (OWL), Terminated Originator Database (TOD),and the Company Agreement for ACH Origination. The roadmap offered by this session will provideyour financial institution with an effective operations guide, as well as a sound risk management tool.Session Type: EducationalSkill Level: BasicACH CLIENT AND ACH MANAGER: NEW FEATURES YOU WON’T WANT TO MISS!EPS added exciting new features to ACH Client and ACH Manager over the last year! This session willprovide an overview of those enhancements and explain how they can be used to enhance security,improve the user experience, and simplify your own internal operations.Session Type: Product UpdateSkill Level: Intermediate8

EPS.15 BREAKING NEWS ... ACH UPDATE 2013Don’t get left behind! Make sure you stay up to date on all the breaking news and trends in theACH industry. This session is designed to provide information on the latest ACH Rules Changes(new or recently implemented), plus the latest hot topics pertaining to the payments industry. Mayinclude updates on NACHA’s rules work groups and councils. Get all the latest information on theACH Network!Session Type: EducationalSkill Level: IntermediateEPS.16 CONVERT DATA INTO KNOWLEDGE USING SMARTSIGHT ®This course will introduce you to SmartSight, an unparalleled interactive dashboard that providesactionable insights and facilitates the ability to monitor and analyze customer data. Topics will includeeffective strategies you can use to enhance business decision making, mitigate risk, and other dataanalysis techniques that will help financial institutions make the most of data and grow your ProfitStarsEPS business. Basic knowledge of Remote Deposit Capture or other EPS products is assumed.Session Type: EducationalSkill Level: BasicEPS.17EPS.18EPS.19EPS.20CPP, HPP, OR BOTH – WHAT’S THE RIGHT SOLUTION FOR MY ORGANIZATIONAND CUSTOMERS?This session will educate attendees on recent improvements to EPS’ Customer Payment Portal (CPP)and Hosted Pay Page (HPP). It will also discuss ways to use both modules to meet the needs ofdifferent customers and organizations.Session Type: Product UpdateEPS USER GROUP MEETINGThis session will provide an opportunity for the EPS user community to gather and ask questionsregarding EPS products and the current industry with both their peers and the EPS management team.Session Type: EducationalSkill Level: BasicGETTING THE MOST FROM EPS SUPPORTThis session will provide detailed information about the EPS product and current customer supportmodel. It will offer inside tips on how to get the information that you and your customers need in themost efficient and effective manner.Session Type: EducationalSkill Level: BasicMANAGING AND REPORTING ON YOUR RDA CUSTOMERSMobile remote deposit has rapidly transitioned from a luxury service offered by only the biggestfinancial institutions to the hottest new product for FIs of all sizes! This session will provide anoverview of Remote Deposit Anywhere and provide information about how your financial institutioncan manage and report on check deposit activity from flatbed scanners or mobile phones.Session Type: Product Update9

EPS.21EPS.22EPS.23EPS.24EPS.25OPPORTUNITY IN DISRUPTION: THE UPSIDE OF PAYMENTS IN FLUX“We’ll just wait to see what happens.” For many financial institutions, this is the natural responseto accelerating change, but inertia in payments is a losing proposition. Join both our Director ofPayments Strategies and Director of Strategic Insight to pinpoint actionable revenue opportunitiespresented by significant shifts in the payments ecosystem.Session Type: EducationalSkill Level: IntermediateREMOTE DEPOSIT: WHICH RD PRODUCT IS RIGHT FOR MY INSTITUTION(RDC, RDX, RDN, OR MRDC)?One remote deposit capture solution may not be enough to meet all of your customers’ diverseneeds. That’s why EPS provides multiple remote deposit modules designed to fit different marketsegments. This session will provide brief overviews of Remote Deposit Complete (RDC), RemoteDeposit Now (RDN), Remote Deposit Express (RDX), and Remote Deposit Anywhere (RDA) to helpyou better understand how to leverage your choices on a customer-by-customer basis.Session Type: EducationalSkill Level: BasicTHE PRIVACY PARADOXSavvy businesses are leveraging data to improve service and increase revenue. However, juxtaposedagainst this need to leverage data to better serve consumers is an escalating focus on protecting thatvery same consumer data. Not surprisingly, the unstoppable force of innovation is now colliding withthe immovable object of personal privacy. The energy from the resulting impact is feeding a growingfirestorm where the value of individualized service is being measured against the potential violationof the individual’s perceived right to virtual anonymity. Join us for a look at the ongoing conflict,including discussion of regulatory initiatives in the privacy landscape like the White House’s ConsumerPrivacy Bill of Rights. This session will also cover the impact of this “privacy paradox” on financialinstitutions and recommend steps for using and protecting consumer data.Session Type: EducationalSkill Level: BasicTHERE’S NO MAGIC WAND: UNDERSTANDING AND MANAGING ACH CREDIT RISKManagement of ACH credit risk is a significant responsibility and requirement for any financialinstitution that initiates entries into the ACH Network. This session will define the concept of ACHcredit risk, including the difference between risk for credit transactions and risk for debit transactions.Although there’s no magic wand you can wave to make your risk management obligations disappear,this session will identify credit monitoring and control procedures that you can develop and implementto minimize ACH credit risk. Topics to be discussed include credit ratings, exposure limits, exceptionreporting, and more. This session will also reveal the secrets behind some magic tricks which will beused in ACH risk analogies. Level: Basic.Session Type: EducationalSkill Level: BasicFRAUD PREVENTION UPDATE: NEW WAYS TO PROTECT YOUR SYSTEMS AND CUSTOMERSMore than a year after the FFIEC published its supplemental guidance, many financial institutions arestruggling to understand their responsibilities in the fight against fraud. Join us for a discussion on thestate of anti-fraud efforts and a recap of emerging protective measures available for EPS products.Session Type: EducationalSkill Level: Intermediate10

GT.1GT.2GT.3GT.4GT.5BYOD: BALANCING OPPORTUNITIES AND THREATSRound Table Discussion – Deciding to allow or not allow employees to access corporate data throughtheir personal mobile devices has become a major topic these days. This round table discussion willfocus on the risks as well as opportunities and mitigating strategies in deploying BYOD (Bring YourOwn Device). Hear what others have learned along the way or share what concerns you may have inallowing this communication channel.Session Type: EducationalSkill Level: BasicHOSTED IP TELEPHONY, UNIFIED COMMUNICATION, AND CALL CENTERSThe PBX (Private Branch Exchange) is the most common brain of a legacy phone system and supportsvoice mail, call forwarding, etc. In its time, PBX was state of the art, but today it is often limited toscale and is inflexible to grow with your institution’s requirements. Our Hosted Voice service is ahosted and managed phone system that eliminates the expensive PBX from your balance sheet,the clutter in the communications closet, offers multi-vendor support, and allows you to implementunified communication, dispersed call centers, and collaboration with ease.Session Type: Sales Presentation/Product DemoIT GENERAL DISCUSSIONThis client networking session brings together an experienced peer group of IT professionals to shareand inform on relevant information of the day. This session will provide a face-to-face exposure tothose interested in the same projects and concepts that you are experiencing. This will encompasssecurity, Virtualization, and general networking topics. Thought-provoking, lively, and educationaldiscussions are assured within this session.Session Type: EducationalSkill Level: BasicIT MANAGEMENT AS A SERVICE: DELIVER BREAKTHROUGH RESULTS FOR YOUR BUSINESSUSING THE NEXT STEP IN INFORMATION TECHNOLOGYIs your Information Technology Department maintaining or innovating? If you are like most ITDepartments today, the answer is maintaining. A recent Gartner study reported that 80% of IT resourceswere spent just keeping your network running. What if your IT Department could spend 80% of its timeinnovating instead of maintaining? Would IT be able to create more business value? In this session, wewill examine how you drive positive business outcomes using IT Management as a Service.Session Type: Sales Presentation/Product DemoLIVE HACKING AND MALWARE DEMONSTRATIONIn this session, the security experts from Gladiator Technology will but on a live hacking performance,breaking into each other’s laptops and demonstrating the methods and capabilities of modernmalware and cyber-criminals. After the demonstrations, the team will present strategies for protectionand countermeasures.Session Type: EducationalSkill Level: Basic11

GT.6STRATEGIES FOR MEETING OBJECTIVES OF THE UPDATED FFIEC AUTHENTICATION GUIDANCERound Table Discussion – Topics of conversation will focus on the updated FFIEC AuthenticationGuidance objectives. You’ll participate in sharing solutions and best practices that you and other FIsare implementing to reduce fraud today. Explore what peer institutions are doing to meet examinerexpectations for online banking risk assessments, layered security controls, customer awarenesscampaigns, and more.Session type: EducationalSkill Level: BasicGT.7 VIRTUALIZATION 101In this session, we will discuss some FAQs about Virtualization, including: What is Virtualization? Howdoes Virtualization work? What are the benefits Virtualization can offer? How secure is Virtualization?We will also discuss the basics of configuration and best practices in securing the virtual environment.Session Type: EducationalSkill Level: BasicGT.8GT.9GT.10WHAT IS NEW FOR IT – A REVIEW OF THE EVER-CHANGING LANDSCAPE OFINFORMATION TECHNOLOGYIn this session, we will discuss the new server and desktop operating systems, new features andfunctions of VMware Virtualization software, new backup solutions, new hardware, the latest indesktop and application Virtualization, as well as the rapidly growing world of BYOD (Bring Your OwnDevice) and how it can benefit FIs.Session Type: EducationalGLADIATOR ANNUAL TRAINING UPDATEThis session provides an annual update designed for Information Security Officers and IT staffregarding the latest features and functionality of Gladiator Managed Services offerings. As we addressthe basics on how a financial institution can effectively utilize our managed services solutions, we willdiscuss effective processes that we know work well for most institutions, provide instruction on newfeatures that Gladiator has added during the past year, and include a Q&A session with Gladiatorsenior management to gather input on what clients want to see in the future. In discussing ways tomaximize the effectiveness of Gladiator’s service features, we will cover topics such as: Vault trainingand procedures, research initiatives and Threat Intelligence Services, recent attack trends we haveseen and suggestions for effective mitigation strategies, plus best practices for handling advisories,alerts, and change management.Session Type: Product UpdateSkill Level: IntermediateTHE BYOD WORKPLACE – BRING YOUR OWN (MOBILE) DEVICEThe mobile device market can’t seem to settle on a single operating platform. As more employeesrely on smartphones or tablets to manage their lives and their jobs, businesses are throwing in thetowel on enforcing a single official deployment, and instead adopting a risk management approachthat incorporates employee personal devices. This session will go over vocabulary and approaches toBYOD risk management to help you make both your Compliance and Sales teams happy.Session Type: EducationalSkill Level: Basic12

GT.11GT.12IC.1IC.2IC.3THE EVER-EXPANDING ROLE OF E-BANKING; HOW TO SIMPLIFY COMPLIANCENew Online banking applications, Mobile RDC, and P2P are some of the hottest topics in the boardroom. What’s often not recognized is that successful deployment and management may require aparadigm shift in strategy. The FFIEC expects that FIs approach e-banking from the perspectiveof products/services delivered to customers versus a traditional internal-supporting technologyview. This session addresses a comprehensive approach to mitigating risk and meeting regulatoryexpectations for e-banking strategies.Session Type: EducationalSkill Level: BasicTHREAT INTELLIGENCE SERVICES – A NEW ERA OF SECURITYToday’s cyber-criminal networks are highly skilled, highly motivated, and have considerably moreresources at their disposal than the average business. They are leveraging advanced tools to generatehighly customized malware programs at a pace that is overwhelming traditional security controlssuch as anti-virus and intrusion prevention systems. As malware threats continue to evolve everyday and data thieves persist in outpacing the traditional protection methods, Gladiator is evolving itstechnology to keep pace with the ever-changing threat landscape. Attend this session to learn abouthow Gladiator’s advanced Threat Intelligence Services are leveling the playing field by providingsuperb protection from today’s most dangerous threats.Session Type: EducationalSkill Level: IntermediateIMAGECENTER OPENING SESSIONAll ImageCenter clients are encouraged to attend our opening session which will include the annualUser’s Group meeting facilitated by the User Board President, as well as operational updates andaccomplishments from this past year facilitated by the ImageCenter Director of Operations. Openboard seats will be voted on at this time, plus a review of conference tracks.Session Type: Product UpdateSkill Level: BasicLEVERAGE YOUR ATMS FOR MORE THAN DISPENSING CASHToday’s ATMs provide much more than just $20 for gas. They capture images, make payments, transferfunds, and accept deposits just to name a few. For that reason, ProfitStars has developed a solutionthat meets the need of the modern ATM portfolio. ImageCenter provides the reconciliation platformfor both deposits and payments. ATM Manager Pro ® provides a complete management tool tooversee cash, transaction cost, modeling, and unit cost. And finally, Synergy Workflow provides anautomated routing solution that continues to enhance our ATM solution set. This session will focusprimarily on processing deposits with ImageCenter. Please also stop by the Technology Showcase toview our entire ATM suite of products.Session Type: Sales Presentation/Product DemoSIMPLIFYING IMAGECENTER SECURITY SETUPThis educational session will answer your ImageCenter security related questions. How to set upsecurity groups, define user profiles, assign permissions, set global security configurations, configureWindows Domain Authentication, and generate security reports will be covered. New and existingclients are invited to attend.Session Type: EducationalSkill Level: Intermediate13

IC.4IC.5IC.6IC.7IC.8IC.9TRIVIAL PURSUIT: THE IMAGECENTER EDITIONDiscovering answers to ImageCenter’s most frequently asked questions is no trivial pursuit. Join usfor the ultimate game of trivia where the audience will compete in teams for semi-fabulous prizesand test their ImageCenter knowledge. All ImageCenter users are invited to participate in this funopportunity to exercise your brainpower, network with your peers, and learn valuable informationabout the ImageCenter product.Session Type: EducationalSkill Level: BasicTROUBLESHOOTING HIGH IMPACT IMAGECENTER SUPPORT CASESLet the training experts show you how to resolve some of the most frequent ImageCenter helpdeskcases. In this educational session designed for new and experienced ImageCenter users, we’ll covercommon helpdesk inquiries and provide troubleshooting tactics you can share with your operationalunits and your IT department. Please join us for one of our most highly regarded ImageCenterconference sessions.Session Type: EducationalSkill Level: IntermediateBEST PRACTICES FOR HANDLING ATM DEPOSITS USING IMAGECENTER (PANEL DISCUSSION)Come join us for an informative ImageCenter best practice session. A panel of subject matterexperts and users will discuss real-world solutions for processing and balancing Image ATM deposits.Learn how you can leverage the ImageCenter solution and these real-world techniques to reducecosts and drive efficiency in your organization. This session is a must-attend for all new and existingImageCenter ATM Deposit Processing usersSession Type: EducationalSkill Level: BasicDRIVING IMAGECENTER RELEASE INITIATIVESIn this fast-paced world of technology, it’s important to plan for what’s on the horizon. In the first halfof this session, we will review the most recent ImageCenter enhancements and introduce the changesplanned for the ImageCenter 2013 release. From there, the session turns interactive. With help fromyou, we will review and prioritize future ImageCenter roadmap items. Please join us in this importantsession, which will help drive the future of ImageCenter.Session Type: Product UpdateSkill Level: BasicMAINTAINING A HEALTHY IMAGECENTER ENVIRONMENTWhen was the last time your ImageCenter environment had a checkup? Maintaining your system iscrucial to the successful performance of your ImageCenter application. In this session, we will detailsetup, maintenance, and backup considerations to keep your environment healthy and your systemfunctioning optimally, as well as provide you with a checklist to be shared with your IT department.New and existing clients are welcome to attend.Session Type: EducationalSkill Level: IntermediateIMAGECENTER CLOSING SESSIONThis session will bring to a close the ImageCenter conference offerings. We will provide you with ourstrategic plans for the coming year, review any outstanding subjects, and give you an opportunity toshare your questions and feedback with the ImageCenter team during live Q&A. This session is opento all ImageCenter clients.14

IC.10IP.1IP.2IP.3IP.4IP.5IP.6DEFEND YOUR BANK OR CREDIT UNION AGAINST FRAUD WITH IMAGECENTER(PANEL DISCUSSION)Hear how ImageCenter’s “Five-Point Fraud” solution can reduce risk associated with check fraud.Depending on your organization’s structure, this technology can be extended to include your ATMs,tellers, mobile, payments, and other remote capture solutions. In this session, a panel of industryexperts including representation from current users will be available to answer your questions,focusing on fraud schemes, as well as tools and techniques that will reduce your risk associatedwith check fraud. Learn how to combine your internal knowledge with data from industry-leadingloss-prevention solutions like Advanced Fraud Solutions and Early Warning Systems to protectyour organization from check-related fraud. Please join this informative session, and visit us in theTechnology Showcase to get the full breadth of what “Five-Point Fraud” offers you.Session Type: EducationalSkill Level: BasicBILLSIMPLE – ELECTRONIC INVOICING FOR YOUR SMALL BUSINESS CLIENTSCome see the latest enhancements to iPay’s market-leading business payments platform. With thenew and improved BillSimple module, your small business clients will be able to create customizedpayment portals, send electronic invoices out to their customers, and receive payments online …all from one easy-to-use platform.Session Type: Sales Presentation/Product DemoFACILITATED ROUND TABLE – CONSIDERING iPAY?Is it time to consider a new bill pay platform for your institution? Join us for an iPay networking roundtable discussion for clients who don’t currently use iPay. This is an open-ended conversation whereyou can find out if iPay’s market-leading suite of bill pay solutions is a good fit for you.Session Type: Sales Presentation/Product DemoiPAY CLIENT ROUND TABLEDon’t miss this chance to share candid comments with industry peers and iPay’s leadership team.Session Type: Product UpdateSkill Level: IntermediateiPAY CONSUMER 3.0 – THE NEXT GENERATION OF BILL PAYExplore the revamped, state-of-the-art consumer bill payment solution from iPay Solutions .Session Type: Sales Presentation/Product DemoiPAY GENERAL SESSIONJoin the iPay Group President in a discussion of highlights from FY12 as well as key FY13 initiatives.Session Type: Product UpdateSkill Level: BasiciPAY SOLUTIONS’ TECHNOLOGY AND INTEGRATION ROADMAPPlease join us for a technological tour of iPay’s enhanced architectural solutioning which is facilitatinggreater integration opportunities with a variety of core and ancillary product platforms as well as witha variety of external partners. Best of all, learn what these advancements mean to you.Session Type: Product UpdateSkill Level: Intermediate15

IP.7IP.8IP.10IP.11IP.12IP.13PER.1THE iPAY DIFFERENCE – AN UPDATE ON iPAY OPERATIONS AND SUPPORTiPay’s Senior Director of Operations will provide some insight into various initiatives underway with theOperations and Support Teams. A few of the topics will include Fraud Monitoring, CommunicationTools, and Case Management.Session Type: Product UpdateSkill Level: BasicBEYOND MOBILE BANKING: THE NEW FRONTIERMobile banking traditionally featured account access, limited transfer capabilities, and locating ATMsand branches. With today’s technology, savvy users require and expect more. In this session, we willdiscuss what features and functionality will take a mobile banking application to a new frontier andshow you how iPay is incorporating them into its mobile solution.Session Type: Product UpdateSkill Level: BasicHOW IS iPAY CONTINUING TO INCORPORATE INNOVATION INTO BILL PAY?In this session, iPay will review product accomplishments in 2012 and reveal the productenhancements to unfold over 2013.Session Type: Product UpdateMINING HIDDEN TREASURE: DRIVING BILL PAY ADOPTIONMillions of customers are paying bills online – but many are still not using their FI’s site. To maximizesuccess, FIs must have a plan to drive the awareness and adoption of bill pay. Presenters will share thelatest data from industry reports and highlight the wealth of marketing resources available throughthe iPay Resource Center.Session Type: EducationalSkill Level: IntermediateTHE WORLD OF BILL PAYMENTSThink you know the differences between the four primary methods of paying bills? Do you know whichmethods are the most popular and how they are trending? Join us for an enlightening discussion.Session Type: EducationalSkill Level: BasicTHE WORLD OF BILL PRESENTMENTNo longer do consumers need to go to their biller’s site – or even to their financial institution’s bill payservice – to view their bill electronically. Bill presentment has become “the next big thing.” Please joinus to learn what all the buzz is about.Session Type: EducationalSkill Level: IntermediateADVANCED REPORTING TOOLS: UTILIZING REPORT WRITER AND REPORT CENTRALThis session will cover advanced reporting techniques within the PROFITstar ® ALM software.Attendees will learn how to customize Report Writer reports by adding color and other visuals.Attendees will also learn how to streamline the reporting process by creating report packages usingReport Central.Session Type: Product UpdateSkill Level: Intermediate16

PER.3PER.4PER.5PER.6PER.7CORE DEPOSIT ANALYSIS CONSIDERATIONS – BEYOND THE BASIC ASSET/LIABILITYMANAGEMENT PROBLEMThis session will address an array of balance sheet management considerations which are related tothe modeling of non-maturity deposits. Solutions to the fundamental Asset/Liability Managementproblem are often developed without consideration of other relevant balance sheet managementfunctions including budgeting/forecasting, profitability/FTP analysis, as well as strategic growth/M&Aactivity. The session will contain several examples where these non-ALM business objectives canresult in the explicit destruction of deposit value and duration. Often these events occur after marketinterest rates have risen substantially, making the cost of remediation prohibitively high. In light of thehistorically low cost of funding duration, consideration of these risks is prudent.Session Type: EducationalSkill Level: IntermediateEFFICIENT WAYS TO MODEL AND ANALYZE STRATEGIC PLANSThis session is designed to show PROFITstar ALM software clients a different way to analyze andproject strategic plans. We will demonstrate how to model various plans and be able to get instantresults and comparisons.Session Type: Product UpdateSkill Level: IntermediateKEY CLIENT IDENTIFICATION AND RETENTIONThe profitability of an organization’s top clients has never been more concentrated. Banks and creditunions often find that more than 180% of the profit comes from the top 20% of their clients. Giventhis unprecedented level of profit concentration, there are a couple of simply questions that everyorganization should ask: Do you know who your most profitability clients? And, are you activelyworking to retain their relationships?Session Type: EducationalSkill Level: BasicMARGIN MAXIMIZER INTERACTIVE – POWERFUL HOSTED SOLUTION TO BOOST LOANREVENUE AND INCREASE NET INTEREST MARGINGet to know Margin Maximizer Interactive (MMi), which takes our proven Margin Maximizer Suite ®and amplifies it to a whole new level – offering your institution a tailored solution that’s hosted, online,and at your fingertips 24/7. Additional enhancements include 11 powerful new features that offeryou improved navigation, superior customer relationship monitoring, custom filters, drag-and-dropgrouping, at-a-glance relationship summaries, and much more.Completely re-engineered using Microsoft ® Silverlight ® and hosted by Microsoft Windows Azure,Margin Maximizer Interactive utilizes a convenient cloud computing framework to make the solutionmore accessible and affordable than ever. Plus, MMi now integrates into your core system!Session Type: Sales Presentation/Product DemoPROFITABILITY ANALYSIS: WHAT ARE FIVE TAKEAWAYS FROM MY PROFITABILITY MODEL?The question that everyone has after implementing a profitability system is “Now what?” Ultimately,the success of any system is determined by how it communicates information to its user. The purposeof all managerial reports should be to provide management with information in order to make sound,informed decisions. Even though each dimensions’ focus differs, there are some common attributesin all profitability reports. In this session, we will focus on what to look for when analyzing yourprofitability reports.Session Type: EducationalSkill Level: Basic17

PER.8PER.9PER.10PER.11PER.12PER.13PER.14PROFITABILITY CHECKLIST: ARE YOU READY TO START?There are many items consider prior to beginning your organizational, product, or client profitabilityinstallation. No matter what dimension of profitability your institution is considering implementing,there are important steps to consider prior to getting started. During this session, we will explain whythese steps can go a long way in ensuring a successful implementation.Session Type: EducationalSkill Level: BasicPROFITSTARS FINANCIAL DASHBOARD – OPTIMIZER FI executives have tons of information available, but do you have a consolidation point for your keyfinancial information? Come see how the Optimizer application can aggregate information from yourPROFITstar, PROFITability ® , RPM, and Synapsys ® applications.Session Type: Sales Presentation/Product DemoUTILIZING KEY RATE TIES FOR OPTIMAL IRR MEASURESThis session is for hands-on users of the PROFITstar software and focuses on the impact of key rate tieformulas on interest rate risk calculations. Proper setup of advanced features will be discussed alongwith recommendations and ideas for more valuable IRR measures.Session Type: Product UpdateSkill Level: IntermediateWHY YOUR ORGANIZATION NEEDS PROFITABILITY ANALYTICS<strong>Inc</strong>reased competition from outside the financial services industry and more homogenous productsacross institutions has made financial management at lower levels of your organization critical. Areyou measuring profitability at key levels in your organization? Your competitors are! We will review allthree dimensions of Profitability (Branch, Product, and Client).Session Type: Sales Presentation/Product DemoASSET LIABILITY MANAGEMENT BASIC CONCEPTSThis session deals with fundamental concepts on asset/liability management. How should ALM beused at an institution? What are some of the common measurements used? How do I interpret someof the common risk metrics? Your presenter will answer all of these questions in detail. This session ismeant for members of the board of directors or ALCO whose primary responsibility does not includehands-on use of ALM software.Session Type: EducationalSkill Level: BasicHOW DO ORGANIZATIONAL, PRODUCT, AND CLIENT INFORMATION WORK TOGETHER?Having three dimensions of profitability is a powerful combination. How do these three conceptswork together to provide the most value to your organization? Key concepts need to be understoodthroughout the organization.Session Type: EducationalSkill Level: BasicHOW YOUR A/L MODEL SETUP AFFECTS FAIR VALUE RESULTSThis session is designed to better assist PROFITstar ALM software clients in understanding howdifferent model setups can affect fair value results. It will look at how decay assumptions and beta lagsaffect final results.Session Type: Product Update18

PER.15PER.16PER.17PER.18PER.19PER.20IMPLEMENTING ORGANIZATIONAL AND PRODUCT PROFITABILITYThere are many reasons why the implementation of profitability succeeds or fails at financialinstitutions today. Ultimately, this success will depend on the end users’ knowledge of the softwarepurchased to complete the task. This session is designed to assist those who are responsible forimplementing and maintaining profitability modeling within the PROFITstar software. During thissession, we will review important “how to” steps in maintaining your profitability model.Session Type: EducationalSkill Level: BasicMAINTAINING CLIENT PROFITABILITY: HOW TO GET THE MOST OUT OF YOURCLIENT PROFITABILITYHow do you get the most use from a client profitability system? Client profitability is different thanother financial reporting in your organization. To get the most value from this information, it needs tobe widely distributed and understood.Session Type: EducationalSkill Level: BasicNEW BANK CAPITAL REQUIREMENTS USING PROFITSTAR ALMBanking regulators have proposed changes to capital requirements. Final regulations should beavailable by March and implementation is required over the next several years. This session willdiscuss the new regulations as applied to community financial institutions and how the PROFITstarALM model can be used to test compliance with the new regulations. The session will discuss whatchanges an institution may need to make and how to plan for them now.Session Type: EducationalSkill Level: IntermediatePROFITABILITY THEORY: UNDERSTANDING THE BASICS OF FUNDS TRANSFER PRICINGAND ALLOCATING CAPITALOne of the important tasks of the person overseeing a profitability project is the ability tocommunicate how the systems allocations were calculated. Without this, it is hard to get buy-inif people cannot rely on the results that are reported to them. Two topics that can pose a problemare funds transfer pricing and capital allocations. During this session, we will explain the theorybehind these two topics in a way that can easily be explained to your reporting audience.Session Type: EducationalSkill Level: BasicPROFITSTAR PERFORMANCE SUITE MANAGER FORUMThis is a Q&A session with the management team of the Performance Suite of PROFITstar products(includes PROFITstar, PROFITability, RPM, Optimizer, and Margin Maximizer). Managers will presentproduct roadmaps and discuss future enhancements to the Performance Suite products.Session Type: Product UpdateREVIEWING ACCURACY OF MATURITY/REPRICING FOR MORE ADVANCED IRRThis presentation will demonstrate to hands-on users of the PROFITstar ALM software how to ensurethat proper maturity and repricing schedules are being applied to their projections and interest raterisk measures. Options for prepayment and decay assumptions will be discussed along with showingthe impact each has on IRR calculations.Session Type: Product Update19

PER.21PPS.1PPS.2PPS.3PPS.4PPS.5PPS.6PPS.7PPS.8PPS.9WHAT AREAS OF YOUR ALM SOFTWARE ARE EXAMINERS MOST INTERESTED IN?This session is designed to help clients better prepare for the regulatory scrutiny of their PROFITstarALM software. We will provide clients a checklist for reviewing their model on a regular basis and alsofeature a checklist of documentation to provide to examiners.Session Type: Product UpdateATM AND BRANCH TRANSFORMATIONAt airport check-ins, car rentals, and various retailers, consumers are using self-service with minimalemployee assistance. Is the public ready for assisted self-service in financial institutions?Session Type: Sales Presentation/Product DemoCARDTRONICSIs dealing with your ATMs too much of a chore? Discover how Cardtronics can help manage yourATM business.Session Type: Sales Presentation/Product DemoFRAUD IS ALWAYS CHANGING: REVIEW THE AVAILABLE TOOLSWe’ll cover authorization restrictions, BIN/account limits, smsGuardian , CAMS alerts, and more.Session Type: EducationalMERCHANT PROCESSING AND SMALL BUSINESSLearn how to combine merchant processing and remote deposit capture to grow small businessaccounts. We’ll discuss challenges and solutions.PPS OFFERS REAL VALUE WITH ATM, DEBIT, AND CREDIT PROCESSINGGet the technology you need and the service you deserve. The session will cover all JHA PaymentProcessing Solutions ® (PPS) services and the real value difference.Session Type: Sales Presentation/Product DemoPREPAID CARDS – THE PROCESS AND BENEFITSWhat benefits can you expect from prepaid cards? This session will explain the type of cards available,the income opportunity, and program implementation.Session Type: Sales Presentation/Product DemoATM BEST PRACTICESHow you can fine-tune ATM procedures and optimize efficiencies? Do you find it difficult to keep upwith changing regulations and compliance issues? This session may be just what you’re looking for!Session Type: EducationalCHIP CARD WORKSHOP FOR PPS CLIENTSPPS clients only. What would it take to get your credit union ready for chip cards? Join this workshopand we’ll help you plan your process.Session Type: EducationalDATA NAVIGATOR TRAINING: YOUR SOLUTION TO CHARGEBACKSThis demonstration will show you how to input chargeback information. This will be useful whether20

PPS handles your chargebacks, or if you manage them yourself.Session Type: EducationalPPS.10PPS.11PPS.12PPS.13PPS.14PPS.15PPS.16PPS.17PPS.19EIGHTH ANNUAL CARD ISSUERS’ SAFETY SCORECARDDon’t miss this one! Research shows that more alerts lead to quicker detection time and lower fraud costs.Session Type: EducationalEMV: WHAT IT IS AND HOW IT WILL AFFECT YOUOberthur Technologies will review some EMV basics, the EMV marketplace, and technical details youought to know.Session Type: Product UpdateEXTRA AWARDS ® : MERCHANT-FUNDED COMPONENTPPS is planning to integrate merchant-funded awards into its Extra Awards platform. Discover how thisservice will encourage card use.Session Type: Product UpdateFRAUD TOOLS WORKSHOPJoin us to review fraud reports and tools, and to discover how to best align them to your needs.Participation is required to get full benefit and understanding from this session.Session Type: EducationalINTEGRATING PPS PROCESSING AND SYMITAR’S CARD MODULEFor Symitar ® FIs only: Discover how we can combine these services for a dynamic solution.Session Type: EducationalPPS CHARGEBACK HANDLING: LET US HELP YOUWhat is the current status of chargeback regulations? What are the most common disputes and howare they handled? A representative of the JHA Payment Processing Solutions professional chargebackteam will fill you in and explain how the PPS chargeback service works.Session Type: EducationalVISA ® AND THE FUTURE OF COMMERCEV.me is Visa’s mobile wallet solution. This session will discuss the mobile wallet and review Visa’s visionfor the future of commerce.Session Type: EducationalVISA/MC BALANCING AND BALANCING REPORTSJoin us and get a better understanding of balancing and what reports to use.Session Type: EducationalVISA CHARGEBACK/BASIC TRACK (INCLUDES ALL CONFERENCE SESSIONS AND EXHIBITS)This class provides a detailed overview of the entire dispute process. There will be an in-depth reviewof the chargeback reason codes. The class will be guided through the dispute process using examples21

of cardholder letters. Review will be done from both the issuer and acquirer side. Examples will alsoguide attendees through the compliance and arbitration process. It is recommended that attendeeshave less than one year of experience handling disputes.PPS.20PPS.21PPS.22SN.1SN.2SN.3VISA CHARGEBACK/BASIC TRACK ($395 – CHARGEBACK ONLY PART I/IIMONDAY/TUESDAY ONLY)This class provides a detailed overview of the entire dispute process. There will be an in-depth reviewof the chargeback reason codes. The class will be guided through the dispute process using examplesof cardholder letters. Review will be done from both the issuer and acquirer side. Examples will alsoguide attendees through the compliance and arbitration process. It is recommended that attendeeshave less than one year of experience handling disputes.VISA CHARGEBACK/ADVANCED TRACK (INCLUDES ALL CONFERENCE SESSIONSAND EXHIBITS)This class provides in-depth, hands-on training for the handling of the entire dispute process. Therewill be a comprehensive review of any changes in reason codes as well as updates to changes indispute regulations. The remainder of the class will focus on hands-on handling of disputes. It isrecommended that attendees have a minimum of one year of experience handling disputes.VISA CHARGEBACK/ADVANCED ($395 – PART I/II MONDAY/TUESDAY ONLY)This class provides in-depth, hands-on training for the handling of the entire dispute process. Therewill be a comprehensive review of any changes in reason codes as well as updates to changes indispute regulations. The remainder of the class will focus on hands-on handling of disputes. It isrecommended that attendees have a minimum of one year of experience handling disputes.DATA BASICSThis session is a crazy quilt of critical information! Examine Synapsys jargon (what exactly are SalePlanand Profit_History?). We’ll review the impact of database structure decisions (what does an additionalservice flag do compared with an additional service account record?). We’ll also view Dbload reports –and more.Session Type: EducationalSkill Level: BasicDID YOU KNOW?A consistently most-popular session, we’ll cover specifics about new Synapsys R11 features andfeatures you might have missed but will definitely want to consider. The session will also include newClean Query Script options in Configuration Utility. You will not want to miss this information-filledsession! Q&A time at the end of the will be invaluable for those questions you’ve been wanting to ask.Session Type: EducationalSkill Level: IntermediateNINE PROVEN STEPS TO CREATE A RELATIONSHIP-DRIVEN CULTUREDo many of your employees resist selling? Do your customers or members give you their transactionbusiness but go to your competitors for financial advice and other needs? Do they consider you afinancial partner or “just another errand”? Here’s what you’ll learn in this idea-packed and energizing22

session: discover the three most important emotive drivers that stir your customers or members toaction; rate your current relationship process and identify areas to improve; learn what it takes toprofile and manage a relationship; understand how to stop the product pitching and get staff buy-into building relationships; receive a nine-step proven plan, avoid the common pitfalls and most of all,maximize your ROI in Synapsys!Session Type: EducationalSkill Level: IntermediateSN.4SN.5SN.6SN.7SN.8ON-BOARDING INDIRECT LENDING CLIENTSLearn from one organization’s successful efforts to build a solid relationship with borrowers whoprobably don’t think of themselves as members of the organization. See how Synapsys MarketingManager is used to identify target clients and deliver leads to the call center team. Also, learn howthe team documents client contact on the Campaign Activity. Review management reports AND studysuccess statistics. You can grow relationships with indirect loan clients.Session Type: EducationalSkill Level: IntermediateREADY, SET, GO – PREPARING FOR THE SYNAPSYS R11 UPGRADEPlan now for the newest version of Synapsys. This session will cover how one organization preparedfor their Release 11 upgrade. We’ll also see how new Synapsys features support the bank’s sales-andserviceculture.Session Type: EducationalSkill Level: BasicPROACTIVE BRANCH ASSOCIATES AND MANAGERS USE MY CLIENTSWe hear consistently that “it’s five times less costly to grow relationships with current clients thanto develop new relationships with non-client prospects.” Synapsys Release 11 adds dramatic newoptions for users to manage and analyze the My Clients view. In this session, we’ll work as branchassociates, lenders, and branch managers to develop the best lists for proactive client contact. Then,we’ll move to Synapsys Marketing Manager to review what additional work Marketing can do togenerate product leads and calling lists … and post them directly to each associate’s My Inbox list.Session Type: EducationalSkill Level: BasicBANKING CORE SYSTEM INTEGRATION WITH SYNAPSYSWe’ll look at integration between Synapsys and Vertex first to lay the groundwork for excellent serviceand sales at the teller line. See the new tools available to tellers – right on the Vertex screen. Plan nowto expand how your tellers work to grow client relationships. For personal bankers and lenders, we’llreview Synapsys integration with SilverLake, CIF 20/20 ® , and Core Director ® . Plan for easy introductionof right-click movement from Synapsys to the core system.Session Type: EducationalSkill Level: IntermediateBEST PRACTICES OF TOP PERFORMING SALES MANAGERSJust like Olympic coaches committed to helping their athlete(s) win a gold medal, committed salesmanagers can make a significant difference in the performance of their team. Your relationshipmanagers, financial service reps, and calling officers need motivated and talented sales managers to23

encourage and raise their performance. Unfortunately, most managers just focus on reaching monthlynumbers and neglect to develop their people. In this idea-packed session, you’ll discover the topactivities that guarantee results, the six key strategies used by Olympic coaches to raise performance,the power of observing staff, pre-call planning (and coaching) with Synapsys reports, and much more!You’ll leave armed with tools to kick your relationship process into high gear.Session Type: EducationalSkill Level: IntermediateSN.9SN.10SN.11SN.12SN.13SN.14GREAT IDEAS WORKSHOPSynapsys trainers have identified all sorts of great ideas through their work with long-term clients.Come to this session to pick up tips and tidbits to help you re-examine Config settings, day-to-dayprocesses, and training strategies. Take great ideas and a handy worksheet away from the session!Session Type: EducationalSkill Level: IntermediateINCENTIVE COMPENSATIONThis session overviews incentive compensation plan design, introduction to management and staff,Synapsys setup, and on-going process management. We’ll look at missteps as well as successes alongthe way. We’ll compare pre-Synapsys processes with how things work for front-line associates and for theincentive compensation manager now that Synapsys is doing much of the tracking and calculation work.Session Type: EducationalSkill Level: IntermediateIT’S A SNAP! TO BUILD CLIENT RELATIONSHIPS USING SYNAPSYSEnjoy this session as you take away fresh ideas on how one of our clients used Synapsys to take theirsales culture to the next level. Our featured credit union has experienced impressive growth each ofthe last three years. They have grown new member relationships while also creating deeper, strongerrelationships with existing members. They had a good sales culture before adding Synapsys to thetool belt … Synapsys helped take it to the next level!Session Type: EducationalSkill Level: IntermediateMANAGING CUSTOMERS IN THE SWEET SPOTUse sweet-spot research to identify very-best clients and almost-very-best clients. Develop marketingplans to move clients from almost-best to absolutely-best. Also, we’ll cover how to develop marketingcampaigns and electronic next-best-product postings to Synapsys and the core system.Session Type: EducationalSkill Level: IntermediateMANAGING THE ON-BOARDING PROCESS WITH NEW SYNAPSYS ENHANCEMENTSIn this session, you will receive examples of on-boarding strategies for your organization. Exciting newfeatures will be taught regarding configuration utility settings on how to manage your on boardingprocess. We will finish this session demonstrating our new tiered tickler options.Session Type: EducationalSkill Level: IntermediateSYNAPSYS STRATEGIES ROUND TABLEJoin us for the Synapsys Strategies Round Table and share ideas about how to get more out of yourSynapsys system. This session is a great way to get to know other Synapsys users and gain exposure24

to some best practices. Representatives from the Synapsys team will help moderate the round table.Session Type: EducationalSkill Level: IntermediateSN.15SYN.1SYN.2SYN.3SYN.4SYN.5TACKLING YOUR CHALLENGES ROUND TABLEThis is an opportunity for credit unions to discuss their biggest challenges related to sales, service,and marketing efforts. Come prepared to discuss these challenges with your peers and resources fromthe Episys ® and Synapsys teams.Session Type: EducationalSkill Level: IntermediateeSIGNATURE REGULATION WORKSHOPJoin us for an important update on the electronic and digital signing regulations from one of theleading experts in the industry. This session is a must-attend for all new and existing customers thathave an interest in utilizing Synergy eSign as their signing ceremony solution. Bring your eSignaturecompliance/regulatory questions with you. This is a three-hour, pre-conference workshop.JHA ENTERPRISE WORKFLOW – BUSINESS PROCESS MANAGEMENTJHA Enterprise Workflow is a brand new JHA workflow solution. Come and learn what this excitingnew product has to offer! In this session, we will review the JHA Enterprise Workflow solution featuresand provide a brief product demonstration. This session is a must-attend for all new and existingSynergy clients who have interest in leveraging Workflow to automate their ECM business processes.Session Type: Product UpdateSkill Level: BasicSYNERGY CAPTURE BEST PRACTICESAre you looking for innovative ways to streamline your Synergy Document Capture processes? If so,then this session is for you! Come and learn about Synergy Capture best practices from one of ourSynergy Professional Service experts. In this session, you learn how you can leverage several SynergyCapture technologies – including AutoImport, Batch Document Recognition (BDR), Auto DocumentRecognition (ADR), eSign, XML processing, and Kofax – to help streamline your Synergy Capture backoffice processes. This session is a must-attend for all new and existing Synergy Document clients.Session Type: Product UpdateSkill Level: BasicSYNERGY CLIENT NETWORKINGCome join us for an interactive client exchange of end-user experiences with the Synergy productsuite. Whether you are new to Synergy or a seasoned pro, you won’t want to miss this customernetworking session. Come share your Synergy user experience, ask questions and learn how otherorganizations benefit from Synergy.Session Type: Product UpdateSkill Level: BasicSYNERGY r2013 PRODUCT UPDATECome join us for an important update on our latest Synergy release, r2013. This session will include a25

ief demo of some of the hot new Synergy 2013 features and enhancements as well as a sneak peekinto our Synergy product roadmap.Session Type: Product UpdateSkill Level: BasicSYN.6SYN.7SYN.8SYN.9SYN.10SYN.11SYNERGY SOFTWARE OVERVIEW AND DEMOCome join us for a Synergy product overview where you will see a demonstration of key Synergyproduct functionalities such as search and retrieval, working with documents, distribution, and capture(including advanced capture capabilities), and more. This session is intended for both new andexisting Synergy customers who are interested in learning more about all Synergy has to offer.Session Type: Sales Presentation/Product DemoLEVERAGING SYNERGY DOCUMENT TRACKING IN YOUR LOAN DEPARTMENTDo you have interest in archiving your loan documents in Synergy? Are you unsure whether all yournecessary loan documents have been successfully archived into Synergy for compliance? If so, thenthis is a session you don’t want to miss! We’ll walk you through some real-world use cases thatdemonstrate how you can leverage Synergy Document Tracking in your loan area. You’ll also get anopportunity to see a dashboard of audit reports that are available.Session Type: EducationalSYNERGY – GETTING THE MOST OUT OF YOUR SOLUTIONAre you interested in discovering some new tips that will help you drive more efficiency with yourSynergy solution? If so, then this sessions for you! The Synergy experts have compiled the top Synergytips every organization must know. Whether you are new to Synergy or a long-time user, you will findsomething in this session to take back home and improve your organization’s efficiency.Session Type: EducationalSYNERGY eSIGN PRODUCT UPDATESynergy eSign continues to be one of our hottest new Synergy modules. Come join us for animportant product update on Synergy eSign and learn about all the exciting new Synergy eSignfeatures and enhancements. This session is a must-attend for all new and existing Synergy clients.Session Type: Product UpdateSkill Level: BasicSYNERGY EXECUTIVE PANEL Q&AThis closing session will include an open forum Q&A discussion with Synergy management on anySynergy topic of interest. Come join us for an interactive discussion and make sure you get all yourquestions answered before you leave the conference.Session Type: Product UpdateSYNERGY PANEL DISCUSSIONRepresentatives from key industries will discuss how Synergy can make your company moreefficient. Synergy panelists will share their experience with vendor selection, implementation, andbest practices. Come learn how these organizations have increased productivity and gained moreefficiency with Synergy.Session Type: Product UpdateSYN.12 SYNERGY RETENTION 101Come join us for a basic training session on Synergy Retention from one of our Synergy University26

Training experts. In this session, you will learn how to create business rules to automatically purgearchived information from Synergy, and you’ll also receive some best practice tips on retention. Thisis a must-attend session for all new and existing Synergy clients that have an interest in leveragingSynergy Retention for compliance.Session Type: EducationalSYN.13WHEEL OF SYNERGYWheel of Synergy is a fun, interactive game where contestants will be competing in teams for prizes.By spinning the wheel and completing the puzzle, you will learn many capabilities the Synergyproduct has to offer. This is also a great way to network with other Synergy customers. We lookforward seeing you there!Session Type: Product Update27