8-1 Solutions to Chapter 8 Net Present Value and Other Investment ...

8-1 Solutions to Chapter 8 Net Present Value and Other Investment ...

8-1 Solutions to Chapter 8 Net Present Value and Other Investment ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

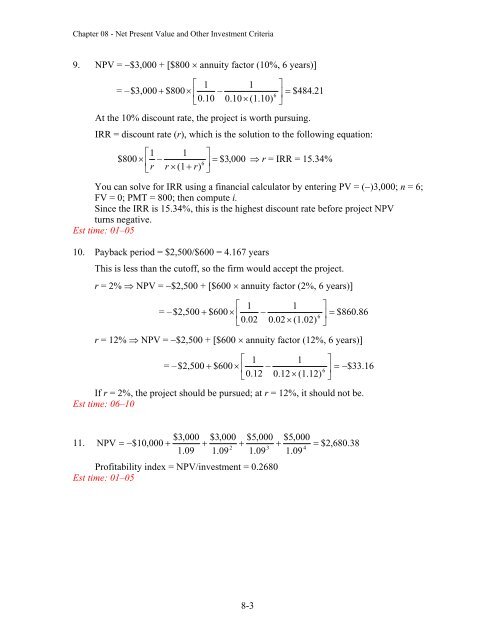

<strong>Chapter</strong> 08 - <strong>Net</strong> <strong>Present</strong> <strong>Value</strong> <strong>and</strong> <strong>Other</strong> <strong>Investment</strong> Criteria9. NPV = $3,000 + [$800 annuity fac<strong>to</strong>r (10%, 6 years)] 1 1 = – $3,000 $800 $484. 216 0.100.10(1.10) At the 10% discount rate, the project is worth pursuing.IRR = discount rate (r), which is the solution <strong>to</strong> the following equation:11 $800 $3,0006(1 ) r = IRR = 15.34%rr r You can solve for IRR using a financial calcula<strong>to</strong>r by entering PV = ()3,000; n = 6;FV = 0; PMT = 800; then compute i.Since the IRR is 15.34%, this is the highest discount rate before project NPVturns negative.Est time: 01–0510. Payback period = $2,500/$600 = 4.167 yearsThis is less than the cu<strong>to</strong>ff, so the firm would accept the project.r = 2% NPV = $2,500 + [$600 annuity fac<strong>to</strong>r (2%, 6 years)] 1 1 = – $2,500 $600 $860. 866 0.020.02(1.02) r = 12% NPV = $2,500 + [$600 annuity fac<strong>to</strong>r (12%, 6 years)] 1 1 = – $2,500 $600 $33.166 0.120.12 (1.12) If r = 2%, the project should be pursued; at r = 12%, it should not be.Est time: 06–10$3,000 $3,000 $5,000 $5,00011. NPV $10,000 $2,680. 382 341.09 1.09 1.09 1.09Profitability index = NPV/investment = 0.2680Est time: 01–058-3