8-1 Solutions to Chapter 8 Net Present Value and Other Investment ...

8-1 Solutions to Chapter 8 Net Present Value and Other Investment ...

8-1 Solutions to Chapter 8 Net Present Value and Other Investment ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

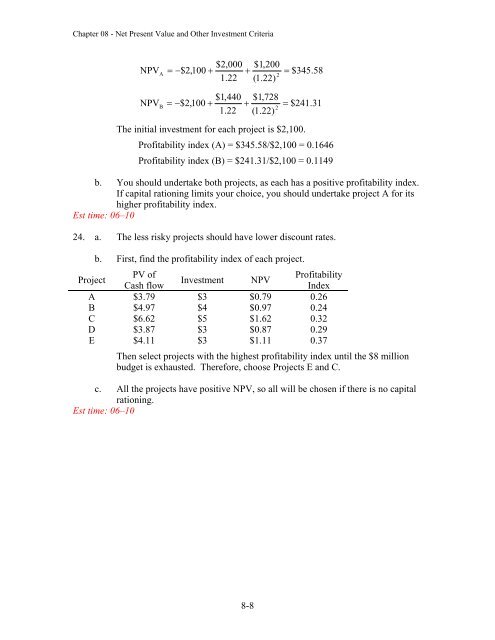

<strong>Chapter</strong> 08 - <strong>Net</strong> <strong>Present</strong> <strong>Value</strong> <strong>and</strong> <strong>Other</strong> <strong>Investment</strong> Criteria$2,000 $1,200NPVA $2,100 21.22 (1.22)$1,440 $1,728NPVB $2,100 21.22 (1.22) $345.58 $241.31The initial investment for each project is $2,100.Profitability index (A) = $345.58/$2,100 = 0.1646Profitability index (B) = $241.31/$2,100 = 0.1149b. You should undertake both projects, as each has a positive profitability index.If capital rationing limits your choice, you should undertake project A for itshigher profitability index.Est time: 06–1024. a. The less risky projects should have lower discount rates.b. First, find the profitability index of each project.ProjectPV ofProfitability<strong>Investment</strong> NPVCash flowIndexA $3.79 $3 $0.79 0.26B $4.97 $4 $0.97 0.24C $6.62 $5 $1.62 0.32D $3.87 $3 $0.87 0.29E $4.11 $3 $1.11 0.37Then select projects with the highest profitability index until the $8 millionbudget is exhausted. Therefore, choose Projects E <strong>and</strong> C.c. All the projects have positive NPV, so all will be chosen if there is no capitalrationing.Est time: 06–108-8