Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

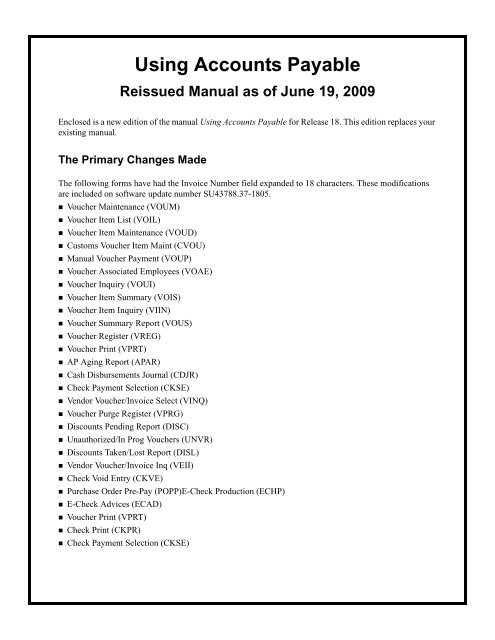

<strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>Reissued Manual as of June 19, 2009Enclosed is a new edition of the manual <strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong> for Release 18. This edition replaces yourexisting manual.The Primary Changes MadeThe following forms have had the Invoice Number field expanded to 18 characters. These modificationsare included on software update number SU43788.37-1805.• Voucher Maintenance (VOUM)• Voucher Item List (VOIL)• Voucher Item Maintenance (VOUD)• Customs Voucher Item Maint (CVOU)• Manual Voucher Payment (VOUP)• Voucher Associated Employees (VOAE)• Voucher Inquiry (VOUI)• Voucher Item Summary (VOIS)• Voucher Item Inquiry (VIIN)• Voucher Summary Report (VOUS)• Voucher Register (VREG)• Voucher Print (VPRT)• AP Aging Report (APAR)• Cash Disbursements Journal (CDJR)• Check Payment Selection (CKSE)• Vendor Voucher/Invoice Select (VINQ)• Voucher Purge Register (VPRG)• Discounts Pending Report (DISC)• Unauthorized/In Prog Vouchers (UNVR)• Discounts Taken/Lost Report (DISL)• Vendor Voucher/Invoice Inq (VEII)• Check Void Entry (CKVE)• Purchase Order Pre-Pay (POPP)E-Check Production (ECHP)• E-Check Advices (ECAD)• Voucher Print (VPRT)• Check Print (CKPR)• Check Payment Selection (CKSE)

Updating Your ManualReplace all copies of your existing manual with this new edition as it will be the basis for all future updates.

Datatel Colleague ® Finance<strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>Release 18June 19, 2009For last-minute updates and additional information about this manual, see AnswerNet page 2357.04.

<strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>© 2009 Datatel, Inc.All Rights ReservedThe information in this document is confidential and proprietary to and considered atrade secret of Datatel, Inc., and shall not be reproduced in whole or in part withoutthe written authorization of Datatel, Inc. The information in this document is subjectto change without notice.Colleague and ActiveCampus are registered trademarks of Datatel, Inc. ActiveAlumniand ActiveAdmissions are trademarks of Datatel, Inc. Other brand and productnames are trademarks or registered trademarks of their respective holders.Datatel, Inc.4375 Fair Lakes CourtFairfax, VA 22033(703) 968-9000(800) DATATELwww.datatel.com

Table of Contents19 Introduction21 About This Manual21 Who Should Read This Manual21 What This Manual Covers22 How This Manual Is Organized23 Typographical Conventions23 Conventions Used in Procedures25 Important Notices25 Alerts25 Notes26 Technical Tips27 Where to Find More Information29 Overview of Purchasing/<strong>Payable</strong>sProcessing29 In This Chapter30 Purchasing/<strong>Payable</strong>s Setup and Daily Processing32 The Purchasing and AP Process: Role of the TransactionCodes37 Statuses<strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009 5© 2009 Datatel, Inc.

Table of Contents39 Vendors41 Adding a Vendor41 In This Chapter42 Forms Used43 Before You Begin45 Understanding Vendors46 Speeding Processing and Reporting ThroughVendor-Related Information47 Vendor Terms48 Vendor Types48 Currency49 Tax Form49 Vendor Properties That Do Not Default ontoProcurement Documents51 Reporting on Vendors Through the Vendor-RelatedCodes51 Streamlining Your 1099 and T4A Tax Form Information52 Understanding Vendor Demographics52 Demographic Information: Different Roles, Same PersonRecord53 A Vendor: A Corporation or a Person?54 Person or Corporation: Differences at a Glance54 Formatted Names55 Vendor Addresses56 Vendors With One Address56 Vendors with More Than One Address58 Setting Up Multiple Addresses for a Vendor59 <strong>Using</strong> the Core Code Tables to Customize YourDemographics Options60 Vendor Demographics Forms and File Relationships60 Forms Used to Add a Vendor as a Corporation61 Forms Used to Add a Vendor as a Person62 Vendor Demographics File Relationships65 Finding Vendor Demographic Information69 Setting Up Your Vendors Prior to Going Live69 Two Methods of Setting Up Your Vendors69 Adding Demographics Information Prior to AddingVendor Information70 Adding Demographics Information at the Same Timeas Vendor Information70 After Converting Your Vendors71 About Miscellaneous Vendors6 <strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009© 2009 Datatel, Inc.

Table of Contents71 Entering Employees Who Receive Benefit Distributions asVendors72 Components of Vendor Definition73 Fields on the VEND Form78 Procedure for Adding a Person as a Vendor80 Additional Procedures82 Components of Vendor Tax Information83 Fields on the VNTX Form85 Procedure for Defining Vendor Tax Information87 Tracking Vendor Activity87 In This Chapter87 Forms Used88 Inquiring About Vendor Activity88 Finding Vendor Activity Information89 Tracking Historical Information Through Vendor ActivityInquiry90 Components of Vendor Activity Information92 Additional Notes on Vendor Activity Information93 Tracking Voucher and Invoice Information by Vendor94 Finding Vendor Voucher/Invoice Information94 Procedure for Finding Vendor Voucher Information96 Components of Summary Vendor Voucher/InvoiceInformation97 Procedure for Viewing Summary Vendor Voucher/InvoiceInformation98 Tracking Historical Information Through Vendor ActivityInquiry100 Components of Individual Voucher Information101 Additional Note on Vendor Voucher and InvoiceInformation<strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009 7© 2009 Datatel, Inc.

Table of Contents103 Vouchers105 Understanding Vouchers105 In This Chapter105 Before You Begin106 Understanding Voucher Parameters107 Voucher Approval Needed Parameter107 Vou Accepted Items Only Parameter108 Vouchering Only Accepted PO Line Items108 Vouchering Both Accepted and Unaccepted PO LineItems109 Default Voucher Done Parameter109 Understanding Voucher Status Codes109 Default Voucher Done Set to “Yes”110 Default Voucher Done Set to “No”112 Understanding Voucher Approvals112 Adding Additional Approval IDs112 Approvals Processing114 Understanding Voucher Processing114 The Voucher Maintenance (VOUM) Form115 Fields on the VOUM Form116 Required Fields on the VOUM Form117 The Voucher Item List (VOIL) Form118 Fields on the VOIL Form119 The Voucher Item Maintenance (VOUD) Form120 Fields on the VOUD Form121 Deleting Voucher Line Items122 Voucher Field Relationships (Ramification of ChangingData on VOUM)122 Default Discount Method123 Customs Vouchers123 Tax Information123 Tax Codes124 Tax Amounts124 Credit Vouchers124 Purchase Orders125 Blanket Purchase Orders125 Open Vouchering125 Limited Vouchering126 Checking the Status of BPO Line Items126 Entering GL Account Information for Blanket PurchaseOrders126 Associating Voucher Transactions with Projects8 <strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009© 2009 Datatel, Inc.

Table of Contents127 <strong>Using</strong> LookUp Shortcuts to Retrieve Vouchers131 Creating Vouchers131 In This Chapter131 Forms Used132 Entering General Voucher Information132 Before You Begin133 Procedure for Completing the VOUM Form134 Creating the Voucher from a Purchase Order134 Entering Invoice Information135 Entering/Overwriting Default Vendor Information136 Voucher Approvals137 Comments138 AP Types138 Line Items139 Voucher Done139 Reference Number140 Pay Voucher140 Associated Employees141 Entering Tax Information on the VOIL Form141 Before You Begin141 Procedure for Completing the VOIL Form145 Entering Line Item Detail on the VOUD Form145 Before You Begin145 Procedure for Completing the VOUD Form147 Trade Discounts148 Cash Discounts148 Line Item Tax Information149 GL Account Information153 Creating Vouchers for SpecificCircumstances153 In This Chapter153 Forms Used154 Creating a Voucher Without a Purchase Order155 Procedure for Creating a Voucher Without a PurchaseOrder156 Creating Vouchers for Customs Brokerage Invoices156 What is a Customs Brokerage Invoice?157 The Customs Voucher Item Maint (CVOU) Form159 The Customs Voucher GL Detail (VGLD) Form160 Procedure for Creating a Voucher for a CustomsBrokerage Invoice<strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009 9© 2009 Datatel, Inc.

Table of Contents164 Creating Vouchers in Foreign Currencies164 Currency Conversions165 Viewing Details About the Foreign Currency Transaction165 Procedure for Creating Vouchers in Foreign Currencies167 Creating Vouchers From Recurring Vouchers168 Before You Begin169 Procedure for Creating Vouchers From RecurringVouchers170 GL Transactions for Recurring Voucher ScheduledPayments172 Creating Vouchers from a Prepaid Purchase Order177 GL Transactions for Vouchering Pre-Paid PurchaseOrders179 Outstanding Prepaids Report (POPR)180 Procedure for Creating Vouchers from a Prepaid PurchaseOrder182 Creating Vouchers to Pay Third-Party Providers of EmployeeBenefits183 Procedure for Creating Vouchers to Pay Third Parties forEmployee Benefits185 Inquiring About Vouchers185 In This Chapter185 Forms Used186 Viewing a Specific Voucher186 Understanding Voucher Inquiries187 The Voucher Inquiry (VOUI) Form188 The Voucher Item Summary (VOIS) Form189 The Voucher Item Inquiry (VIIN) Form190 Procedure for Viewing a Specific Voucher191 Viewing the Vouchers for a Specific Vendor191 Understanding the VINQ and VEEI Forms192 Understanding the VINQ Form193 Understanding the VEII Form193 Procedure for Viewing Vouchers for a Specific Vendor194 Procedure for Selecting Vouchers for Viewing196 Procedure for Viewing Selected Vouchers197 Viewing the Vouchers Paid by a Specific Check197 Before You Begin197 Procedure for Viewing the Vouchers Paid by a SpecificCheck10 <strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009© 2009 Datatel, Inc.

Table of Contents199 Printing Vouchers199 In This Chapter199 Forms Used200 Understanding Voucher Printing201 <strong>Using</strong> Range Selection Criteria201 <strong>Using</strong> Non-Range Selection Criteria202 Additional Selection Criteria203 Information Printed for Each Voucher205 Procedure for Printing Vouchers207 Sample Voucher Print209 Reporting on Vouchers209 In This Chapter210 Forms Used211 Understanding Voucher Reporting211 <strong>Using</strong> Range Selection Criteria in Voucher Reports222 <strong>Using</strong> Non-Range Selection Criteria in Voucher Reports225 Cash Disbursements Journal (CDJR)225 Understanding the Cash Disbursements Journal226 Procedure for Generating the CDJR Report228 Sample Cash Disbursement Journal Report: CheckDisbursements229 Sample Cash Disbursement Journal Report: SummaryReport231 Cash Requirements Analysis (CRAR) Report231 Understanding the Cash Requirements Analysis Report232 Procedure for Generating the CRAR Report234 Sample Cash Requirements Analysis (CRAR) Report235 Voucher Register (VREG) Report235 Understanding the Voucher Register236 Report Dates Fields236 Select Status Within Date Range238 Procedure for Generating the VREG Report241 Sample Voucher Register (VREG)242 Voucher Summary (VOUS) Report242 Understanding the Voucher Summary Report243 Procedure for Generating the VOUS Report245 Sample Voucher Summary (VOUS) Report246 AP Aging (APAR) Report246 Understanding the AP Aging Report247 Procedure for Generating the APAR Report249 Sample AP Aging (APAR) Report250 Unauthorized/ In Progress Vouchers (UNVR) Report<strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009 11© 2009 Datatel, Inc.

Table of Contents250 Understanding the Unauthorized/In Progress VouchersReport251 Procedure for Generating the UNVR Report253 Sample Unauthorized/In Progress Vouchers (UNVR)Report254 Outstanding Prepaids (POPR) Report254 Understanding the Outstanding Prepaids Report255 Procedure for Generating the POPR Report257 Sample Outstanding Prepaids (POPR) Report258 Discounts Pending (DISC) Report258 Understanding the Discounts Pending Report259 Procedure for Generating the DISC Report261 Sample Discounts Pending (DISC) Report262 Discounts Taken/Lost (DISL) Report262 Understanding the Discounts Taken/Lost Report263 Procedure for Generating the DISL Report265 Sample Discounts Taken/Lost (DISL) Report267 Paying Vouchers Manually267 In This Chapter267 Forms Used268 Understanding Voucher Payment268 Understanding Manual Voucher Payment270 Paying Vouchers With Negative Amounts271 Paying Multiple Vouchers with One Check271 Preventing Voucher Payment272 Paying a Voucher Manually272 Before You Begin272 Procedure for Manual Voucher Payment277 Voiding and Purging Vouchers277 In This Chapter277 Forms Used278 Voiding Vouchers278 Understanding Voucher Void278 Before You Begin279 Procedure for Voiding a Voucher12 <strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009© 2009 Datatel, Inc.

Table of Contents281 Purging Vouchers281 Understanding Voucher Purge281 <strong>Using</strong> the VPRG Form to Select Vouchers for Purging285 <strong>Using</strong> the VOPG Form to Purge Vouchers286 Before You Begin286 Purging Vouchers287 Procedure for Completing the Voucher Purge Register288 Procedure for Completing the Voucher Purge291 Transferring Voucher Items to FixedAssets291 In This Chapter291 Forms Used292 Before You Begin293 Understanding the FX - AP Transfer Process293 General Ledger Considerations293 Process Overview293 Step 1: Flag a Line Item for Transfer to Fixed Assets294 Step 2: Run the Fixed Assets Transfer Report (FXTR)294 Step 3: Run the Fixed Assets - AP Interface (FXAP)Process294 Step 4: Run the FX - AP Interface List (FAIL) Process295 Example of Transferring an Item into Fixed Assets295 The Purchase Order Stage296 The Proj ID Field296 The Fixed Asset Field297 The Voucher Stage298 The Transfer Process300 Illustration of the FX - AP Transfer Process301 Components of Fixed Asset Transfer from AP301 The Fixed Asset (ITM.FIXED.ASSETS.FLAG) Field301 The FXA.TRANSFER.FLAGS Validation Code Table302 The ITM.FXA.TRANSFER.STATUS Field302 The FXA.TRANSFER.STATUSES Validation Code Table302 The FXA.ITEMS File303 The FXA.BATCH File304 Selecting Fixed Assets for Transfer305 Procedure for Generating a Fixed Assets TransferReport307 Sample Fixed Assets Transfer Report308 Grouping Items for Transfer309 Procedure for Creating Batches with the FX - APInterface<strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009 13© 2009 Datatel, Inc.

Table of Contents311 Transfer Line Items to Fixed Assets313 Procedure for Creating an Asset Record for a Line Item317 <strong>Accounts</strong> Receivable Vouchers319 Understanding <strong>Accounts</strong> ReceivableVouchers319 In This Section320 In This Chapter321 Differences Between AR and AP Vouchers324 Understanding AR Vouchers324 Understanding AR Refund Vouchers324 The Voucher Credit Card Refund Flag Field325 Related Refund Vouchers327 Understanding AR Cash Advance Vouchers329 Overview of Processing AR Vouchers331 Processing AR Vouchers331 In This Chapter331 Forms Used333 Paying AR Vouchers333 Paying Credit Card Refund Vouchers333 Paying Non-Credit Card Refund Vouchers334 Paying Cash Advance Vouchers334 General Ledger Considerations334 AR Voucher Codes334 AP Type Code334 AR Type Code335 Deposit Type Code335 Cash GL Account for the Pay Method337 Posting AR Payments and Vouchers341 Paying AR Vouchers Manually342 Important Fields on the VRAP Form344 Paying Multiple AR Vouchers with One Check344 Procedure for Paying AR Vouchers Manually346 Reconciling AR Vouchers14 <strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009© 2009 Datatel, Inc.

Table of Contents347 Voiding and Purging AR Vouchers347 In This Chapter347 Forms Used348 Understanding AR Voucher Voiding349 Voiding a Single AR Voucher349 Voiding AR Refund Vouchers in a Related Group350 Procedure for Voiding AR Vouchers351 Understanding AR Voucher Purging353 Viewing and Reporting on AR Vouchers353 In This Chapter353 Forms Used354 Viewing AR Vouchers in <strong>Accounts</strong> <strong>Payable</strong>355 Viewing a Single AR Voucher355 Viewing Refund Vouchers in a Related Group357 Reporting on AR Vouchers358 AR Credit Card Refund Voucher Reports359 Checks361 Maintaining Bank Account Info for e-CheckProcessing361 In This Chapter362 Understanding Bank Account Information ande-Checks362 Storing Bank Account Information363 Capturing Address IDs on Vouchers364 Miscellaneous Addresses and Vendors364 How Colleague Determines How a Voucher Is Paid365 Address Changes After a Voucher Has Been Created365 Validating Bank Account Information for Payment bye-Check366 Components of Bank Account Information367 Prenoting Bank Account Information368 Forms Used368 Entering Bank Account Information368 The Bank Account Info Entry (BAIE) Form370 Fields on the BAIE form373 The Bank Account Info Hist (BAIH) Form373 Procedure for Entering Bank Account Information<strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009 15© 2009 Datatel, Inc.

Table of Contents375 Prenoting U.S. Bank Account Information375 The E-Check Prenote (ECPP) Form376 Fields on the ECPP Form377 Procedures for Prenoting U.S. Bank Account Information379 Batch Check Processing379 In This Chapter380 Forms Used381 Batch Check Processing Overview381 E-Check/Paper Check Workflow382 Steps at a Glance383 Understanding Voucher Selection for Payment384 Checks Form Progression384 The Check Payment Selection (CKSE) Form386 The Voucher Pay Flag Selection (VPFS) Form388 The E-Check Production (ECHP) Form390 The Check Print (CKPR) Form393 The Accept/Reprint/Restart Checks (CKRS) Form395 The Check Overflow Advices Print (CKOA) Form396 The Check Post (CKPO) Form397 Procedure for Processing Checks in Batch400 Reproducing e-Check Advices400 The E-Check Advices (ECAD) Form402 Fields on the ECAD Form403 Procedure for Reproducing e-Check Advices404 Voiding Checks405 Procedure for Voiding a Check406 Procedure for Voiding All Checks in the Current CheckRun407 Reprinting Checks in the Current Check Run407 Procedure for Reprinting Without Voiding Checks408 Procedure for Reprinting and Voiding Checks409 Reconciling Checks409 In This Chapter409 Forms Used410 Understanding Check Reconciliation412 Manual Check Reconciliation412 The Manual Check Reconciliation (RECM) Form413 Important Fields on the RECM Form415 Procedure for Manual Check Reconciliation16 <strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009© 2009 Datatel, Inc.

Table of Contents417 Batch Check Reconciliation417 The Batch Check Reconciliation (RECB) Form418 Fields on the RECB Form421 Procedure for Batch Check Reconciliation423 Electronically Reconciling Checks423 In This Chapter423 Setting Up Electronic Check Reconciliation425 Performing Electronic Check Reconciliation427 Reporting on Checks427 In This Chapter427 Forms Used428 Understanding Check Reporting428 <strong>Using</strong> Range Selection Criteria in Check Reports432 <strong>Using</strong> Non-Range Selection Criteria in Check Reports434 Generating Check Reports434 Check Register Report (CKRG)436 Sample Check Register Report439 Summary Check Register (SCKR)440 Sample Summary Check Register (SCKR)441 Reconciled Check Register (RECR)442 Sample Reconciled Check Register (RECR)443 Voided Check Register (VCRG)444 Sample Voided Check Register (VCRG)445 Purging Checks445 In This Chapter445 Forms Used446 Understanding Check Purge448 Understanding the Reconciled Check Purge Register449 Fields on the CPRG Form452 Procedure for Generating the Reconciled Check PurgeRegister455 Sample Reconciled Check Purge Register (CPRG)456 Understanding the Reconciled Check Purge Process457 Procedure for Purging Reconciled Checks<strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009 17© 2009 Datatel, Inc.

Table of Contents459 Maintaining the Financial Exports File459 In This Chapter460 Understanding the FINANCIAL.EXPORTS File460 Forms Used461 The Financial Exports Record Deletion (FERD) form461 Fields on the FERD Form462 Procedure for Maintaining the FINANCIAL.EXPORTS File463 Index18 <strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009© 2009 Datatel, Inc.

<strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>Introduction

Introduction0About This ManualWho Should Read This ManualAnyone at your institution who is responsible for the following shouldbecome familiar with the procedures and concepts presented here. This groupmay include personnel from your <strong>Accounts</strong> <strong>Payable</strong>, receiving, andprocurement departments, as well as controllers.• Setting up vendor information.• Setting up and using accounts payable approvals.• Preparing and paying vouchers for vendor invoices.• Producing accounts payable checks.What This Manual CoversThis manual provides step-by-step instructions for performing accountspayable tasks, such as check processing, using the <strong>Accounts</strong> <strong>Payable</strong> module.These instructions do not take into consideration your institution’s policiesand processes; therefore, you may need to modify the procedures provided inthis manual to incorporate the way your office performs these tasks. Whereverpossible, we indicate how your policies may have a specific impact on aparticular task and remind you to consider those policies before proceeding.<strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009 21© 2009 Datatel, Inc.

Introduction: About This ManualHow This Manual Is OrganizedTable 1: How This Manual is OrganizedPart Topic Summary1 Introduction Provides information about the organization of thismanual and how to use it to help you performaccounts payable tasks.2 Vendors Provides information and procedures for addingvendors and tracking vendor activity.3 Vouchers Provides information and procedures for creatingvouchers to pay vendor invoices. This part alsoincludes information for generating voucherreports, viewing voucher information, printing,paying, and purging vouchers.This part also provides information andprocedures for transferring items from a voucherto the Fixed Assets module, and automaticallycreating asset records for those items.4 <strong>Accounts</strong> Receivable Vouchers Provides information and procedures for viewingAR voucher information, printing, paying, andpurging AR vouchers.For information about AR credit card refundvouchers, see the <strong>Using</strong> E-Commerce manual.5 Checks Provides information and procedures forproducing accounts payable checks, andreconciling checks. This part also includesinformation for generating check reports, viewingcheck information, and purging checks.22 <strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009© 2009 Datatel, Inc.

Typographical ConventionsTypographical ConventionsThe following presentation conventions are used in this manual to help youidentify important information quickly and easily.Conventions Used in ProceduresSome special typefaces are used in this manual to clarify and standardizeinformation. Table 2 illustrates these conventions and explains theirsignificance.Table 2: Typographical Conventions Used in This ManualThis style … Indicates … For example …bold CourierText that you must typeexactly as shownType the following at the operating system prompt:cd /deptdir/mydirbold onlyBOLDUPPERCASECOURIERUPPERCASEbold,italics,CourierValues that you must selectfrom a set of possiblevaluesButtons that you must click.Menu items that you mustchoose. Note: Separatemenu items (within thepath) by a bar (|).Computer keyboard keysthat you must press.Computer keyboard keys,when included indescriptions, rather than insteps to performText that you must type,substituting your own valuefor the italicized word orwords.Select 100% from the drop-down list box for the Zoomfield.Click OK to save the data.Select Reset value from the popup menu for theCalculated Due Date field.Select Start|Settings|Control Panel.Type the following at the operating system prompt andpress ENTER:The ESC key can perform different functions, dependingon the software that you are using.Type dictname_SQL, where dictname is the name of thedictionary.<strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009 23© 2009 Datatel, Inc.

Introduction: About This ManualTable 2: Typographical Conventions Used in This Manual (cont’d)This style … Indicates … For example …regularCourierSpecific commands,operands, and requiredpunctuation characters, informats that show languagesyntax (Envision and otherlanguages) that aredescriptive and not typed.The following is the format of an inner join clause:SELECT field1, … fieldnFROM table1 JOIN table2ON table1.key = table2.keyellipsis (…)Italics, CourierItems (in syntaxes) of whichyou can provide one ormore.Text that displays on theform.SELECT field1, … fieldnThe format of an attribute declaration is as follows:type attribute_name{attachment_name:}...{attachment_name:}Re-enter the filename if File Not Found displays.24 <strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009© 2009 Datatel, Inc.

Typographical ConventionsImportant NoticesParticularly important information is emphasized in the following types ofnotices.AlertsAlerts call attention to the following:• Critical information needed to preserve the integrity of files, data, or thesystem.• Warning of imminent or potential data loss, or physical harm to users or thehardware if you fail to take or avoid a specific action.• Warning of unexpected or unpredictable results if you fail to take or avoid aspecific action.• Warning of unsupported workflows or functionality.An example is shown below.ALERT! Be extremely cautious not to delete the VOC; this willcause serious damage to your data.NotesNotes provide special additional information that you might want to know, orthat might help you perform a task.An example is shown below.Note: Colleague uses the Account Type information to determine thedefault path prompts.<strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009 25© 2009 Datatel, Inc.

Introduction: About This ManualTechnical TipsTechnical tips provide details that might help power users or systemadministrators. Examples include explanations of behind-the-scenesprocessing, lists of file names, and names of validation code tables.An example is shown below.Technical Tip: The installation will default to the appropriateapplication environment.26 <strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009© 2009 Datatel, Inc.

Where to Find More InformationWhere to Find More InformationTable 3: Sources of Information for the <strong>Accounts</strong> <strong>Payable</strong> ModulePurposeDetailed information about the forms and fields in the<strong>Accounts</strong> <strong>Payable</strong> moduleOnline helpReferenceTechnical information about the <strong>Accounts</strong> <strong>Payable</strong> moduleand how it interacts with other modules in Colleague FinanceDetailed information about setting up the Purchasing and<strong>Accounts</strong> <strong>Payable</strong> modules.Instructions for performing basic functions (such as accessingforms, entering data, and accessing online help) using each ofthe available Colleague interfacesProcedures for using Colleague Finance modules thatinterface with the <strong>Accounts</strong> <strong>Payable</strong> moduleProcedures for processing 1099-MISC and T4A year-end taxinformationIn-person instruction in using the <strong>Accounts</strong> <strong>Payable</strong> moduleInformation about your terminal, your other computerequipment, and standard procedures affecting how theColleague is used at your institutionPlanning your implementation of the <strong>Accounts</strong> <strong>Payable</strong>moduleInstalling the Colleague softwareDetailed information on each Colleague subroutine, file, field,form, procedure, validation code, list specification, and batchprocessChanges and enhancements to the system since the previousreleaseKnown problems and bugsYour system administratorGetting Started with Purchasing and<strong>Accounts</strong> <strong>Payable</strong>Guide to User InterfacesGeneral Ledger Reference<strong>Using</strong> <strong>Accounts</strong> Receivable & Cash Receipts<strong>Using</strong> E-Commerce<strong>Using</strong> Fixed Assets<strong>Using</strong> Inventory<strong>Using</strong> Online Approvals in Colleague Finance<strong>Using</strong> Physical Plant<strong>Using</strong> Projects Accounting<strong>Using</strong> PurchasingU.S. Regulatory ReportingCanadian Regulatory ReportingTraining classes offered by DatatelYour system administratorDatatel’s Services ConsultantsInstallation Procedures for your Colleaguerelease level“Tech Doc Online” available on Datatel’s WebsiteRelease Highlights for your Colleaguerelease levelAnswerNet<strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009 27© 2009 Datatel, Inc.

Introduction: About This Manual28 <strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009© 2009 Datatel, Inc.

Introduction0Overview of Purchasing/<strong>Payable</strong>sProcessingIn This ChapterThis chapter discusses the procurement process as it is implemented in thePurchasing and <strong>Accounts</strong> <strong>Payable</strong> modules.The chapter is divided into the following sections:Table 4: Topics in This ChapterTopicBegins on page...Purchasing/<strong>Payable</strong>s Setup and Daily Processing 30The Purchasing and AP Process: Role of theTransaction Codes32Statuses 37<strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009 29© 2009 Datatel, Inc.

Introduction: Overview of Purchasing/<strong>Payable</strong>s ProcessingPurchasing/<strong>Payable</strong>s Setup and DailyProcessingFigure 1 illustrates the major tasks involved in setting up the Purchasing and<strong>Accounts</strong> <strong>Payable</strong> modules, followed by the major steps in purchasing andpayables processing.30 <strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009© 2009 Datatel, Inc.

Purchasing/<strong>Payable</strong>s Setup and Daily ProcessingFigure 1: Purchasing and <strong>Accounts</strong> <strong>Payable</strong> Setup and Daily ProcessingSetup:Code tablesModuleparameters& defaultsCode files*VendorsApprovals(approval classes)Daily Processing:Purchasing<strong>Accounts</strong> <strong>Payable</strong>Requisitions Purchase ordersReceivingVouchers ChecksBlanket POs* Exception: In the <strong>Accounts</strong> <strong>Payable</strong> module, the bank code file must be defined before setting parameters anddefaults, to make it possible to set up your default check print subroutines for each bank code.<strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009 31© 2009 Datatel, Inc.

Introduction: Overview of Purchasing/<strong>Payable</strong>s ProcessingThe Purchasing and AP Process: Roleof the Transaction CodesBank codes and AP types, called transaction codes, are central to theoperations of the Purchasing and <strong>Accounts</strong> <strong>Payable</strong> modules. You define atleast one bank code and one AP type before you can go live on either module.Transaction codes (AP types and bank codes) contain the informationnecessary to create and post the appropriate general ledger and encumbrancetransactions for processing purchase transactions. The relationship betweenthe transaction codes and the GL posting transactions of the purchasing andAP process is illustrated in figures 2 through 5.This example makes the following assumptions about the institution andtransaction illustrated:• There is one central AP control account• The institution is not using online requisitions; procurement begins with thepurchase order• This purchase is subject to a 4.50 percent sales tax• This purchase does not involve a foreign currency• The Discount Method parameter is set to Discounts Taken• The Distribute Tax Expense parameter is set to No32 <strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009© 2009 Datatel, Inc.

The Purchasing and AP Process: Role of the Transaction CodesFigure 2: Role of Bank Code in AP Type Definition1Bank code includes:✔ bank information✔ GL cash account2AP type code:✔ bank code linksGL cash accountto AP typeAP type code alsoincludes:✔ AP control GL account✔ discount GL account✔ tax expense GLaccount<strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009 33© 2009 Datatel, Inc.

Introduction: Overview of Purchasing/<strong>Payable</strong>s ProcessingFigure 3: Role of AP Type in Purchase Order Creation and Posting1AP type codeassociates GLaccounts withpurchase orderDetail toPOIL and POIM2Encumbrance isposted to the GLexpense accountentered on the POIMformTransactionsPurchase Order Stage:Purchases Expense Acct.10-1310-53080-01encumbrance250.0034 <strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009© 2009 Datatel, Inc.

The Purchasing and AP Process: Role of the Transaction CodesFigure 4: Role of AP Type/Bank Code in Voucher Creation1AP type code (with bank code) carriesforward from purchase order tovoucher2Voucher postings:✔ encumbrance in purchase GLexpense account relieved✔ expense posted to same accountTransactionsVoucher Stage:Purchases ExpenseAcct.10-1310-53080-01encumbrance(relieved)Purchases ExpenseAcct.10-1310-53080-01Detail to VOIL and VOUD250.00 245.003Expense posted to APcontrol GL account(from AP type code)AP Control Acct.10-0000-21001-01245.00<strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009 35© 2009 Datatel, Inc.

Introduction: Overview of Purchasing/<strong>Payable</strong>s ProcessingFigure 5: Role of AP Type/Bank Code Through Voucher in Check Creation1AP type code associates GLaccounts and bank code withvoucherTransactions2Voucher pay postings:✔ AP type code posts debit to APcontrol GL account✔ tax expense posted to taxexpense GL account✔ discount revenue posted todiscount GL accountCheck Stage:3Check amount postedto GL cash account(from bank code)AP Control Acct.10-0000-21001-01Cash Acct.10-0000-11001-01245.00 256.25Tax Expense Acct.10-0000-59040-01Discount Acct.10-0000-41000-0111.25 5.0036 <strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009© 2009 Datatel, Inc.

StatusesStatusesDuring purchasing and payables processing, each type of procurementdocument goes through a number of statuses.Table 5 illustrates the typical progression of statuses as a typical procurementtransaction goes through the steps in processing, from a requisition to a check.Note: Table 5 assumes a simple transaction, where no approvalrequirements exist, goods are ordered and received without delays,and all items are accepted as received. Thus, this example does notinclude the statuses of Not Approved, Backordered, Voided, Closed,or Cancelled.ProcessingStepCreate new requisition (unfinished)Mark requisition “Done”RequisitionStatusU(Unfinished/InProgress)O(Outstanding)PurchaseOrder StatusVoucherStatusCheckStatus- . .- . .Create purchase order (unfinished)P(PO Created)U(Unfinished/InProgress). .Mark purchase order “Done” . O(Outstanding)Receive and accept goods . A(Accepted). .. .Create voucher . I(Invoiced)U(Unfinished/InProgress).Mark voucher “Done”I(Invoiced)O(Outstanding)Print and post check . P(Paid)Reconcile check to bank statement . R(Reconciled)Table 5: Progression of Document Statuses in Typical TransactionP(Paid)R(Reconciled)O(Outstanding)R(Reconciled)<strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009 37© 2009 Datatel, Inc.

Introduction: Overview of Purchasing/<strong>Payable</strong>s Processing38 <strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009© 2009 Datatel, Inc.

<strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>Vendors

Vendors5Adding a VendorIn This ChapterThis chapter explains how to define vendor information in the Purchasing and<strong>Accounts</strong> <strong>Payable</strong> modules, including demographics (address, name) and taxinformation associated with a vendor.The chapter is divided into the following sections:Table 6: Topics in This ChapterTopicBegins on page...Understanding Vendors 45Understanding Vendor Demographics 52Setting Up Your Vendors Prior to Going Live 69Components of Vendor Definition 72Procedure for Adding a Person as a Vendor 78Components of Vendor Tax Information 82Procedure for Defining Vendor Tax Information 85<strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009 41© 2009 Datatel, Inc.

Vendors: Adding a VendorForms UsedThe procedures discussed in this chapter require access to the followingforms:Table 7: Forms Used to Define VendorsProcedure Form MnemonicAdd a Vendor Vendor Maintenance VENDDefine Vendor TaxInformationVendor Tax InformationVNTXMaintain Demographics Information:If a Corporation: Organization Profiles ORGPAdditional Organization InfoFormatted NamesPerson AddressesAORGFNMADRIf a Person: Biographic Information BIOName and Address EntryFormatted NamesPerson AddressesNAEFNMADRNote: Two detail forms accessible from the Vendor Maintenance(VEND) form are not covered in this chapter:The Vendor History Maintenance (VENH) form displays vendoractivity, and is not used in vendor setup.The Vendor Commodities Maintenance (VNCL) form relates to vendorcommodities. Because commodity codes are considered an optionaladvanced feature of the Purchasing and <strong>Accounts</strong> <strong>Payable</strong> modules,they are not covered in this setup chapter. For general information oncommodity codes, see the Getting Started with Purchasing and<strong>Accounts</strong> <strong>Payable</strong> manual.42 <strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009© 2009 Datatel, Inc.

Before You BeginBefore You BeginBefore adding your vendors, you should:Step 1. Review concepts related to vendors and vendor demographics.See “Understanding Vendors” on page 45 and “Understanding VendorDemographics” on page 52.Step 2. Ensure that all concerned parties have had a chance to give input into theprocess of defining vendors.Coordinate with the purchasing, payables, and accounting offices to set upvendors.Step 3. If you plan to use corporation types, ensure that the CORP.TYPES code file isdefined in Colleague Core.To define corporation types, see the Getting Started with Colleague Coremanual.Step 4. Ensure that you have made any additions or modifications to all vendorrelatedcode tables in Colleague Core.• For a discussion of the Core code tables affecting vendor definition, see theGetting Started with Purchasing and <strong>Accounts</strong> <strong>Payable</strong> manual.• To define the Core code tables, see the Getting Started with Colleague Coremanual.Step 5. Ensure that all code tables have been defined in Colleague Finance.• For a discussion of Colleague Finance code table used in vendor definitionand to define the code table, see the Getting Started with Purchasing and<strong>Accounts</strong> <strong>Payable</strong> manual.Step 6. If your institution does business in any foreign currencies, ensure thatcurrency codes have been defined in the CURRENCY.CONV file.See the Getting Started with Purchasing and <strong>Accounts</strong> <strong>Payable</strong> manual.<strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009 43© 2009 Datatel, Inc.

Vendors: Adding a VendorStep 7. If you are using vendor terms codes, ensure that vendor terms have beendefined in the VENDOR.TERMS file.See the Getting Started with Purchasing and <strong>Accounts</strong> <strong>Payable</strong> manual.Step 8. If you are using vendor types, ensure that vendor types have been defined inthe VENDOR.TYPES file.See the Getting Started with Purchasing and <strong>Accounts</strong> <strong>Payable</strong> manual.Step 9. If you plan to do automated 1099-MISC processing, ensure that tax form boxcodes (BOX.CODES) have been defined in the <strong>Accounts</strong> <strong>Payable</strong> module.See the U.S. Regulatory Reporting manual, available on Datatel’s Web site.Step 10. Use the worksheets provided in the Getting Started with Purchasing and<strong>Accounts</strong> <strong>Payable</strong> manual to plan your vendor information on paper, beforeentering any information into Colleague Finance.44 <strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009© 2009 Datatel, Inc.

Understanding VendorsUnderstanding VendorsVendors are all persons, organizations, and companies to whom you makepayments from the <strong>Accounts</strong> <strong>Payable</strong> module for purchases of goods andservices, and for certain types of refunds and advances. These may include thefollowing:• Suppliers of goods and equipment.• Laborers and adjunct faculty who work as independent contractors.• In some cases, employees who receive advances or benefit distributions.You add your vendors to the Colleague database in much the same way as youadd demographic information for prospects, students, employees, and donors.The vendor setup function automatically accesses a number of CoreDemographics forms to allow entry of detailed name, address, and otheridentification information for each vendor you add.The interface with the Core Demographics forms is designed to let you keepextensive historical records on your vendors without the need to duplicateinformation. The features include the following:• Unlimited different addresses for your vendors’ separate branch locations,including address types specifically for purchase orders and checks.• Specially formatted names for different types of communications.• Identification and coding information needed for automatic 1099-MISCprocessing.• Additional name information: for individuals (persons), former name; forcorporations, other names.The vendor definition function itself also provides several options to helpstreamline your data entry and record keeping on vendors, including enteringcodes on a vendor record that will default into all line items you create onpurchasing documents you send to that vendor. The next section describesthese options in greater detail.<strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009 45© 2009 Datatel, Inc.

Vendors: Adding a VendorSpeeding Processing and Reporting ThroughVendor-Related InformationYou can set up your vendor records to provide many time-saving features forthe data entry tasks involved in using the Purchasing and <strong>Accounts</strong> <strong>Payable</strong>modules.Strictly speaking, none of the fields on the Vendor Maintenance (VEND) formare required except a vendor name. This gives you flexibility in setting upyour vendors. Keep in mind, however, that the more information you add thatis specific to each vendor, the less information will need to be added manuallyto a purchasing document each time you order goods from that vendor.The Vendor Maintenance (VEND) form contains a number of fields that,when entered on that form, will default information into the correspondingfields of a purchasing document (requisition, purchase order, or voucher)when you enter a given vendor ID on the document. 1 As a result, if you set upa given vendor’s record to include properties that are specific to that vendor(such as terms or currency), these properties will be automatically linked to allpurchasing documents on which you enter that vendor’s ID. This ensuresgreater accuracy in your daily entry of purchasing documents, and saves timeby letting you set up standard vendor information only once.Figure 6 illustrates the vendor properties on the VEND form that you can setup to default onto purchasing documents throughout your system. Each ofthese is a code file or code table that can be defined by your institution. 21. The Address, CSZ (City, State, and Zip), and Country fields also default from avendor’s record into purchasing documents when you enter the vendor’s ID.However, this information is entered on the demographics forms, not the VENDform. For more on vendor demographics, see “Understanding Vendor Demographics”on page 52.2. All the vendor properties indicated in figure 6, when linked to a vendor ID, willdefault onto requisitions, purchase orders, and vouchers. All the properties exceptTerms default onto recurring vouchers. All the properties except Tax Form defaultonto blanket purchase orders.46 <strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009© 2009 Datatel, Inc.

Understanding VendorsFigure 6: Fields on the VEND Form That Default onto Procurement DocsFields that defaultonto Purchasing/APdocumentfront sheetsFields that default ontoPurchasing/AP line itemsThe following subsections describe each of the fields you can set up to defaultinto your purchasing documents, with a brief discussion of the considerationsto keep in mind when deciding how to complete these fields on the VendorMaintenance (VEND) form.Vendor TermsWhen you enter discount terms on a purchasing document, the terms carryforward to all other purchasing documents involved in that purchase andallow Colleague to calculate your term discount for that purchase.If you have linked discount terms to a vendor’s record, the terms appearautomatically on each requisition, purchase order, and voucher you create forthat vendor. When the vendor’s invoice is received in your office, and youcreate the voucher, Colleague looks at the Invoice Date you enter on thevoucher and calculates the date by which you must pay the voucher to receivethe discount.You can enter as many vendor terms codes in a vendor’s record as you want;the first one you enter will default onto purchase documents for that vendor.Vendor terms are defined on the Vendor Terms (VTMF) form. For moreinformation see the Getting Started with Purchasing and <strong>Accounts</strong> <strong>Payable</strong>manual.<strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009 47© 2009 Datatel, Inc.

Vendors: Adding a VendorVendor TypesVendor type codes are defined by your institution. You can use them toindicate unique characteristics of a vendor that could affect the vendor’spurchasing status.Vendor types do not play a role in transaction processing, but can beextremely helpful for sorting and reporting on specific types of vendors suchas in-state, in-county, or minority business vendors. The vendor types code isa standard selection field on vendor reporting forms. On all other Purchasingand <strong>Accounts</strong> <strong>Payable</strong> module reporting forms, you can use the AdditionalSelection Criteria option or a query language.When you assign a vendor type code to a vendor, that vendor type alwaysdefaults onto requisitions, purchase orders, blanket purchase orders, vouchers,or recurring vouchers created for that vendor.Vendor types are defined on the Vendor Types (VTYF) form. For moreinformation see the Getting Started with Purchasing and <strong>Accounts</strong> <strong>Payable</strong>manual.CurrencyIf a certain vendor does business with you only in a foreign currency, you canassociate that currency with the vendor to have Colleague automaticallycalculate the correct amounts to pay the vendor (in the foreign currency) andto post your financial transaction (in your home currency).If you do deal with vendors in foreign currencies, remember that you mustdefine a special bank code and a special AP type for each foreign currency.Assigning the foreign currency code as well as the foreign currency AP type(which includes the bank code) to the vendor’s record will automate thecalculation of your financial transactions with the foreign vendor.If you assign a foreign currency code to a vendor, it is automatically linkedwith every purchasing document you create with that vendor’s ID. Thecurrency code itself appears with its description on the front form.48 <strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009© 2009 Datatel, Inc.

Understanding VendorsLine item foreign currency calculationIf you have assigned a foreign currency code to a vendor, and enter the vendorID on a purchasing document, Colleague uses that currency code toautomatically calculate the line item amounts in both the home currency andthe foreign currency, and displays both amounts, with the currency code nextto the foreign currency amount.Foreign currencies are defined on the Currency Exchange (CEXM) form. Formore information see the Getting Started with Purchasing and <strong>Accounts</strong><strong>Payable</strong> manual.Tax FormFor vendors on which you do annual income tax reporting (to the InternalRevenue Service [IRS] or Canada Customs and Revenue Agency [CCRA]),you can enter the applicable tax form on the vendor record of each of thevendors. The entry of the tax form code on their vendor records will allow youto track their income line item by line item, so that you can report on it at theend of the year.For example, you can enter “1099-MISC” on the records of all vendors onwhom you report 1099-MISC income. This code in a vendor’s record willcause Colleague to select that vendor for automatic 1099-MISC processingwhen you run that process annually.Tax forms are maintained in a code table called TAX.FORMS that is definedin Core and comes pre-defined by Datatel. You can add tax form codes to thiscode table if you need to.Another defaulting mechanism for tax forms is to set up your system so thatall the information needed for 1099 processing defaults into line items in onestep. For more information, see “Streamlining Your 1099 and T4A Tax FormInformation” on page 51.Vendor Properties That Do Not Default ontoProcurement DocumentsNeither the AP Types nor the Commodities field on the Vendor Maintenance(VEND) form defaults directly onto procurement documents. But both can beused, when associated with a vendor record, to provide important assistancein selecting and segmenting purchases from different vendors. 3<strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009 49© 2009 Datatel, Inc.

Vendors: Adding a VendorSince commodity codes are covered in another part of this book, this sectiondiscusses how linking AP types to your vendors can help you organize yourpurchasing operations and increase their efficiency.AP TypesIf you are using AP types to segment your procurement operations, either bytype of goods purchased or by branch procurement offices, assigning differentAP types to your vendor records can streamline your payables processing andhelp you segment procurement functions that need to be kept separate. Forexample, you may have a number of vendors that do business with several ofyour branch or shadow procurement offices. By entering AP types in avendor’s record, you provide a means whereby each of your differentprocurement offices can segment their own activities with that vendor fromthe procurement activities of other offices.So that each independent branch procurement office will be able to accesstheir transaction information on a given vendor individually, you can firstdefine a separate AP type for each of your branch procurement offices.Second, for any vendor that is used by more than one branch office, youwould enter each branch office’s AP type on that vendor’s record. And third,each branch office can then select the AP type (one of Colleague’s standardselection criteria) on batch processing and reporting forms, to access onlypurchasing activities with that vendor that were initiated by that branch office.For more information on how AP types help segment your branch and shadowprocurement functions, see the Getting Started with Purchasing and <strong>Accounts</strong><strong>Payable</strong> manual.In addition, if any of your vendors does business with your institution in aforeign currency, you must define a special AP type, and bank code, for thatcurrency. Then, if you enter that foreign currency AP type on the foreignvendor’s record, all requisitions, purchase orders, and vouchers created forthat vendor will be automatically associated with the proper foreign currencyand all foreign currency amounts will be calculated and posted correctly.Note: Because of the <strong>Accounts</strong> <strong>Payable</strong> module’s comprehensive taxform processing features, you do not need to designate a special APtype for your 1099 or T4A vendors. For more information, see theGetting Started with Purchasing and <strong>Accounts</strong> <strong>Payable</strong> manual.3. Linking a vendor to one or more commodity codes helps you track vendors whoare approved for certain commodities. For more detailed information on linkingvendors to commodity codes, see the Getting Started with Purchasing and<strong>Accounts</strong> <strong>Payable</strong> manual.50 <strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009© 2009 Datatel, Inc.

Understanding VendorsYou can enter as many AP types on a vendor record as you want. AP types aredefined on the AP Types (APTF) form. For more information see the GettingStarted with Purchasing and <strong>Accounts</strong> <strong>Payable</strong> manual.Reporting on Vendors Through the Vendor-RelatedCodesFive of the codes representing vendor properties are provided as standardselection criteria on vendor reporting forms. All of these codes provide waysyou can select out certain vendors and separate them for batch processing andreporting.AP Types, Terms, Vendor Types, Misc Codes, and Tax Forms are all standardselection fields on the following vendor reporting forms, all of which appearon the Vendor Maintenance (VEN) menu:• Vendor Register (VENR)• Vendor Purge Register (VNPR)• Vendor Year To Date Report (VENY)• Vendor Address List (VENA)In addition, AP Types is also a standard selection field on most batchprocessing and reporting forms in both the Purchasing and the <strong>Accounts</strong><strong>Payable</strong> modules.Streamlining Your 1099 and T4A Tax FormInformationFor vendors (or employees) on whom you must report income to your federalgovernment, you can enter the tax form name directly on the vendor record, inthe Tax Form field. This links a vendor’s record with the tax form on whichthat vendor’s income will be reported and speeds your processing of the taxforms for these vendors (or employees) at the end of the year. The tax formyou enter in the vendor record will default into all line items of eachpurchasing document you create for that vendor (you can delete them if youneed to).For more information about setting up and reporting 1099-MISC and T4Atransaction information for your vendors, see the U.S. Regulatory Reportingand Canadian Regulatory Reporting manuals available on Datatel’s web site.<strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009 51© 2009 Datatel, Inc.

Vendors: Adding a VendorUnderstanding Vendor DemographicsThis section discusses concepts related to the demographic information youmaintain about your vendors. It includes the following subsections:• Demographic Information: Different Roles, Same Person Record• A Vendor: A Corporation or a Person?• Formatted Names• Vendor Addresses• Vendor Demographics Forms and File Relationships• Finding Vendor Demographic InformationDemographic Information: Different Roles, SamePerson RecordColleague Finance treats vendors as person records that are part of yourinstitution-wide database of people. They are stored in the same databasefrom which you draw your students, employees, volunteers, donors, and allother persons and corporations with which your institution has a relationship.The following example shows how Colleague maintains cumulativeinformation on people associated with your institution but continues to needonly one person record.Stephen Jones applies for admission to your institution as a freshman. He isentered in Colleague Student as an applicant, is accepted and becomes astudent, and is entered in Colleague Student as a student. While a student hevolunteers for your institution, and is thus entered in the Human Resourcesmodule as a volunteer. After he gets his degree he continues at yourinstitution in graduate school.While he is in graduate school, he is a teaching assistant. You enter him inthe Personnel module as an employee with the position Teaching Assistant.When he gets his doctorate, he becomes an assistant professor for yourinstitution (a second position, Assistant Professor, is added to his employeerecord). After a number of years, he moves to a position with a localresearch firm, but remains an adjunct professor for your institution, andbecomes an independent contractor. This makes him a vendor, and youenter his vendor record in the Purchasing or <strong>Accounts</strong> <strong>Payable</strong> module.When Stephen Jones retires, he becomes a donor to your institution. At that52 <strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009© 2009 Datatel, Inc.

Understanding Vendor Demographicstime you enter his donor record in Benefactor.During this entire 30 or 40 year period, Dr. Jones has had one, and onlyone, Person record in the Colleague and Benefactor database. When youuse Person LookUp to find his record, you may see a number of codesbelow his name, all representing relationships he has had with yourinstitution over the years. His name has been added successively to theappropriate demographic subfiles, reflecting his continuing relationshipwith your institution, albeit in different capacities.Some of the same basic principles are involved in keeping the demographicrecords for a vendor. First, each vendor should have one, and only one, recordin your database. This prevents duplication and needless redundancy. Second,a vendor may have had more than one role with your institution, particularlyan individual who is an independent contractor. Third, in the case of acorporate vendor, your vendors are listed in several subfiles (CORP,CORP.FOUNDS, and VENDORS) all of which are keyed to the centralperson record in the PERSON file.One additional demographic division is used for vendors: records for a vendorthat is a person are maintained separately from records for a vendor that is acorporation or organization. The following section discusses thesedifferences.A Vendor: A Corporation or a Person?When you define a new vendor, Colleague requires you to indicate whetherthe vendor is a person or a corporation. This distinction in Colleague isimportant because different information is required to maintain the record fora corporation from that information required for maintaining the record for aperson.Note that a corporation is not necessarily an incorporated company orbusiness. In Colleague the term “Corporation” refers to any organization,foundation, company, or corporation. Essentially, a corporation is any entitywith a relationship with your institution that is not a single human being, or“Person.”<strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009 53© 2009 Datatel, Inc.

Vendors: Adding a VendorPerson or Corporation: Differences at a GlanceTo determine whether to define a vendor as a person or a corporation, you canevaluate a number of criteria, as presented in table 8. You can make these yourguiding principles in deciding whether to enter a given vendor as acorporation or a person:Table 8: Criteria That Determine if a Vendor is a Person or a CorporationCriterion Person CorporationType of tax ID number Social Security Number Employer Identification(SSN)Number (EIN) or NoneNature of organizationIndependent contractor orSole proprietorNon-personal entity1099/T4A reportability Usually 1099 reportable Usually not 1099reportableFormatted NamesA formatted name is a name that is formatted for a specific purpose. Ingeneral, you define a formatted name for a vendor if automated Colleagueprocesses (such as purchase orders, check runs, mailings, or formalcorrespondence) need to use their name in a format for which their standardcompany (or person) name is not appropriate.Colleague uses lists of name hierarchies (ordered lists) to select the propername formats to use on a specific report, check, purchase order, or otherdocument. Name hierarchies are maintained on the Name and AddressHierarchy (NAHM) form, accessed through Core Setup/Utilities. You can usethe Formatted Names (FNM) form to set up these formatted names for anyentity that has an ID in Colleague, including both corporate vendors andperson vendors.If a company uses an acronym for some purposes and spells out their name forothers, you might create a formatted name type so that the spelled out namecan be used when needed. Or, if a vendor you deal with is owned by acompany with a name different from the “DBA” name, the name you enter onyour checks to that vendor may be different from the name that is used forpurchase orders.54 <strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009© 2009 Datatel, Inc.

Understanding Vendor DemographicsFor example, General Computer Sales may be only one of several companiesowned by the same person, and you may be asked to make checks out to aname such as “JHL Enterprises, Inc.” In this example, “General ComputerSales” might be the formatted name for purchase orders, and “JHLEnterprises, Inc.” the formatted name for checks.You also might need a different name format for some of your vendors(particularly individuals and independent contractors who use their givenname in business) when you print a directory. You could enter names for adirectory listing with the format “Last First Middle.” In addition,for processing 1099-MISC forms you might want to use the formatted nametype “TN” which has been created expressly to format vendor names for thispurpose.For vendors, you normally need to define only two formatted names, one forpurchase orders and one for AP checks. Your choices for formatted names aretaken from the name types defined in the Core FORMATTED.NAME.TYPEScode table. You can change the codes in the FORMATTED.NAME.TYPEScode table if you need to add a new name format. Examples of formattedname types include:• CK — AP Check• V — Vendor (could be used for vendor reports and registers)• PO — Purchase Orders• AR — <strong>Accounts</strong> Receivable• TN — 1099 or T4A FormsWhen you create a formatted name type on the FNM form, you should enterthe exact wording of the name that should appear whenever the selectedformatted name type is used.Note: If you need to enter a formatted name that carries over to asecond line on the FNM form, enter the same formatted name type forthe second line in the window as for the first line. All occurrences of thesame name type will be used to create the name, even if they do notappear one behind the other in the formatted names listing.Vendor AddressesColleague lets you enter as few or as many addresses as you need on a vendorrecord. Many vendors will need only one address. Others, especially largecompanies, will require several addresses.<strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009 55© 2009 Datatel, Inc.

Vendors: Adding a VendorVendors With One AddressIf a vendor has only one address, and receives all purchase orders, checks, andcorrespondence at that address, you can enter that address in the vendor’srecord, and Colleague will use it for all purposes.You must assign an address type to each address you enter in a vendor’sdemographic record. For vendors with only one location, you would typicallyassign the address type “Home” (headquarters), but you are not restrictedfrom assigning any other address type to that address. The first address youenter will always become the vendor’s “preferred” address, regardless of theaddress type.Vendors with More Than One AddressIf you work with vendors for whom you need to store more than one address,you can use address types to categorize the addresses by purpose. You candesignate a special address for purchase orders and a special address forchecks.As with the Colleague name hierarchies discussed in the previous section, youcan also set up address hierarchies to cause the correct address to appear onchecks, purchase orders, or other documents. Address hierarchies, like namehierarchies, are maintained on the Core Name and Address Hierarchy(NAHM) form. The default address hierarchies delivered with Colleagueinclude all standard address types, but you can change the hierarchies if youneed to.As noted above, any address you enter in a vendor’s record must have anaddress type associated with it. When you are entering multiple addresses, thefollowing rules apply:• The first address you enter can be any address type (but “Home” isrecommended, to indicate the headquarters). This becomes the vendor’s“preferred” address.• If you enter an additional address and assign it the “PO” address type,Colleague will use this address as the default address for purchase orders(that is, this address is displayed when you enter the vendor ID on thePurchase Order Maintenance [POEM] form).• If you enter an additional address and assign it the “CK” address type,Colleague will use this address as the default address for vouchers (that is,56 <strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009© 2009 Datatel, Inc.

Understanding Vendor Demographicsthis address is displayed when you enter the vendor ID on the VoucherMaintenance [VOUM] form). This is the address used for AP checks.• If you enter other additional addresses with any other address types (such as“Additional” or “Other”), you will be able to select them when you enterthe vendor ID and detail on the Address field.• If a PO address type and a CK address type exist, Colleague will use thepreferred address for all other purposes, including registers, historicalreports, and 1099 or T4A processing.The choices for address types are defined by the Core ADREL.TYPES codetable.Table 9 gives a few examples of the results in the Purchasing and <strong>Accounts</strong><strong>Payable</strong> modules based on the number of addresses you enter on a vendor’srecord and the address types you assign.Table 9: Processing Results of Vendor Addresses with Different Address TypesAddresses/Address TypesEntered on Vendor RecordPreferredAddressThis addressbecomespreferred addressResultIn POEM FormIn VOUM FormOnly one address entered (anyaddress type)This address isdisplayed on all POscreated for the vendorThis address is displayedon all vouchers created forthe vendor• First address entered (anyaddress type)• Second address enteredwith CK (Check) addresstypeFirst addressentered becomespreferred addressPreferred address (firstaddress entered) isdisplayed on all POscreated for the vendorAddress with “CK”address type is displayedon all vouchers created forthe vendor• First address entered (anyaddress type)• Second address enteredwith PO (Purchase orders)address typeFirst addressentered becomespreferred addressAddress with “PO”address type isdisplayed on all POscreated for the vendorIf the preferred addressimmediately follows the“CK” address in the “APChecks” addresshierarchy, the preferredaddress (first addressentered) is displayed onall vouchers created forthe vendor• First address entered (anyaddress type)• Second address enteredwith CK (Checks) addresstypeFirst addressentered becomespreferred addressAddress with “PO”address type isdisplayed on all POscreated for the vendorAddress with “CK”address type is displayedon all vouchers created forthe vendor• Third address entered withPO (Purchase orders)address type<strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009 57© 2009 Datatel, Inc.

Vendors: Adding a VendorSetting Up Multiple Addresses for a VendorColleague’s design offers flexibility in storing your vendor addresses, bykeeping address records in a subsidiary address file, called ADDRESS, that islinked to your vendors’ person or corporation records. Any given corporationor person record stores the key to each ADDRESS record that exists for thatvendor. The key is linked to a record in the ADDRESS file, where eachaddress you enter for your vendors is actually stored.This section provides some notes to remember about setting up additionaladdresses for vendors. Since the form flow and steps for a person vendordiffer slightly from those for a corporate vendor, the two types of vendorrecords are presented separately.Entering multiple addresses for a vendor who is a person. When you addaddresses for a vendor who is a person, note the following (more detailedprocedural information is provided in <strong>Using</strong> Demographics):• When you access the ADR form as a detail form from the Demographicsfield on the Vendor Maintenance (VEND) form, the Address Resolutionform appears just before the ADR form, to let you select, from theResolution list, the address you want to view or change.• The first address displayed on the Address Resolution form is the“preferred,” or default, address, and is used in all cases where no specificother address is specified. It can be any address type.• If you want to add an address for one of your vendors, you enter “A” to(A)dd on the Address Resolution form, and a blank ADR form appears,ready for entering a new address record.• Note that even if a vendor has only one address on its record, you mightstill be presented with the Address Resolution form. This is to give you theoption of adding a new address (using the “(A)dd” option on the Resolutionform) for this vendor.Entering multiple addresses for a vendor who is a corporation. When youadd addresses for a vendor who is a corporation, note the following:• When you access the ORGP form as a detail form from the Demographicsfield on the Vendor Maintenance (VEND) form, the Address Resolution58 <strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009© 2009 Datatel, Inc.

Understanding Vendor Demographicsform appears just before the ORGP form, to let you select, from theResolution list, the address you want to view or change.• You can also add addresses for a corporate vendor on the ADR form (eventhough it is not available as a detail form for corporations from the VENDform), by entering the mnemonic at any menu prompt.• The first address displayed on the Address Resolution form is the“preferred,” or default, address, and is used in all cases where no specificother address is specified. It can be any address type.• If you want to add an address for one of your vendors, you enter “A” to(A)dd on the Address Resolution form, and the ORGP form appears withall the address fields blank, ready for entering a new address record.• Note that even if a vendor has only one address on its record, you mightstill be presented with the Address Resolution form. This is to give you theoption of adding a new address (using the “(A)dd” option on the Resolutionform) for this vendor.<strong>Using</strong> the Core Code Tables to Customize YourDemographics OptionsA number of Core code tables can be useful in setting up your vendor recordsto suit your institution’s needs. If you want to be able to specify certaincharacteristics of vendors that are not listed in the Core code tables asprovided by Datatel, several of them can be modified as needed for your site.The following partial list outlines some Core code tables you can modify asneeded to help you track your vendor information more effectively:• ADDRESS.ROUTE.CODES. These are routing codes used for sortingand targeting mass mail. Each code consists of a superset of zip codes (suchas all zip codes in a major metropolitan area). You can set up different routecodes as needed.• ADREL.TYPES. These codes are for different types of addresses forvendors in your database. You can add your own codes for address typesother than the standard home, purchase orders, and check address typecodes.• FORMATTED.NAME.TYPES. These codes list formats in which aperson’s or corporation’s name would need to appear for different uses. Youcan set up your own name types if you need to automatically print names indifferent formats.• PERSON.ORIGIN.CODES. These define how an individual’s record wasacquired by your institution (mailing list, reference, or contact). You can<strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009 59© 2009 Datatel, Inc.

Vendors: Adding a Vendoradd other origins for vendors, such as Yellow Pages, advertisement,referral, or sales call.• PHONE.TYPES. You can enter codes for types of phone numbers thatmay appear on a vendor’s record; for example, home, business, 800, direct,fax, car, or a second branch location. You can enter multiple phone types oneach address record.• SOURCES. These codes are for all people and corporations in yourdatabase, and indicate a given type of relationship to your institution (forexample, alumni, trustees, staff). You can add other types of relationshipssuch as vendor.For more on changing these or other Core code tables, see the Getting Startedwith Purchasing and <strong>Accounts</strong> <strong>Payable</strong> manual, or consult online help foryour module. For information on using the Validation Codes (VAL) form, seethe Getting Started with Purchasing and <strong>Accounts</strong> <strong>Payable</strong> manual.Vendor Demographics Forms and File RelationshipsColleague provides different demographics forms for maintaining informationon persons and on corporations. Although the forms for adding vendordemographic information are actually Core forms, you can access themdirectly from the Purchasing and <strong>Accounts</strong> <strong>Payable</strong> modules.From the Demographics field on the Vendor Maintenance (VEND) form, youcan detail to one of several other forms. Only the forms pertinent to the typeof vendor you are working with, corporation or person, are available.This subsection describes the Demographics forms available from the VENDform.Forms Used to Add a Vendor as a CorporationThe following Core forms are available from the Demographics field on theVEND form for adding demographic information for a vendor that is acorporation:• Organization Profiles (ORGP). Displays name information includingmailing and sort names, identification number, and one address record at atime for the selected corporation (address information includes address typeand phone number and type)• Additional Organization Info (AORG). Displays information describingthe organization, and identification numbers for tax and federal60 <strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009© 2009 Datatel, Inc.

Understanding Vendor Demographicsidentification purposes, as well as space to enter names formatted indifferent ways for different uses (for example, a PO name for a vendormight use an acronym, while a check name for the same vendor would spellout the full name of the firm)• Formatted Names (FNM). A full form allowing entry of multipleformatted names (the formatted names field on the AORG form displaysthe same information as this form — with the difference that this formdisplays more names)If you want to add addresses for a corporation you can use either the ORGPform (if you enter “A” to Add in the Address Resolution form that isdisplayed) or the standard Demographics address form, the Person Addresses(ADR) form. Although the ADR form is not on the Demographics minimenufor corporations, it can be accessed from any menu prompt in the Purchasingand <strong>Accounts</strong> <strong>Payable</strong> modules. For more on multiple addresses for acorporation, see “Vendor Addresses” on page 55.Forms Used to Add a Vendor as a PersonThe following Core forms can be accessed from the Demographics field onthe VEND form for adding demographic information for a vendor that is aperson:• Name and Address Entry (NAE). Displays information on name, address,and mailing rules• Biographic Information (BIO). Displays some of the same information asthe NAE form, but focuses on history information, such as preferred name,marital status, and citizenship• Person Addresses (ADR). Displays one address record at a time for theselected person (you can store unlimited addresses for a person); if morethan one address has been entered on the person’s record an AddressResolution form appears just prior to the NAE form, where you select theaddress you want to view• Formatted Names (FNM). A full form allowing entry of multipleformatted namesDetailed procedures for using the Name and Address Entry (NAE) and PersonAddresses (ADR) forms are covered in the <strong>Using</strong> Demographics manual. Formore information on the Formatted Names (FNM) and BiographicInformation (BIO) forms, see the <strong>Using</strong> Demographics manual.<strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009 61© 2009 Datatel, Inc.

Vendors: Adding a VendorTable 10 provides a quick summary of differences in Colleague’s handling ofperson and corporation vendor demographic informationTable 10: Differences in Colleague’s Handling of Person and Corporate VendorsProcedure Person CorporationDefault indexing method (namesearch using LookUp)Entering demographicinformationPartial name indexingName and Address Entry (NAE)Soundex indexingOrganization Profiles (ORGP)Entering additional addresses Person Addresses (ADR) Person Addresses (ADR)Entering formatted names Formatted Names (FNM) Formatted Names (FNM)Entering additional information Biographic Information (BIO) Additional Organization Info (AORG)Files updated by adding thistype of vendorVENDORS, PERSON, ADDRESSVENDORS, PERSON,CORP.FOUNDS, ADDRESSVendor Demographics File RelationshipsColleague stores the demographic records for your vendors in accordancewith the following file relationships:• All vendors in your system have a record in the PERSON file.• Each vendor also has a record in the VENDORS file, which is a subset ofthe PERSON file• In addition, vendors that are corporations have a record in theCORP.FOUNDS file.• Both individual and corporate vendors also have one or more records in theADDRESS file. Multiple addresses for a vendor are keyed to the vendor’srecord in the PERSON file.Figure 7 illustrates the differences in how Colleague handles a vendor recordbased on whether you add the record as a person or a corporation. Note thatthe CORP.FOUNDS file and the VENDORS file are both subsets of thePERSON file.62 <strong>Using</strong> <strong>Accounts</strong> <strong>Payable</strong>, June 19, 2009© 2009 Datatel, Inc.