2011 Annual Report - Cargills (Ceylon)

2011 Annual Report - Cargills (Ceylon)

2011 Annual Report - Cargills (Ceylon)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

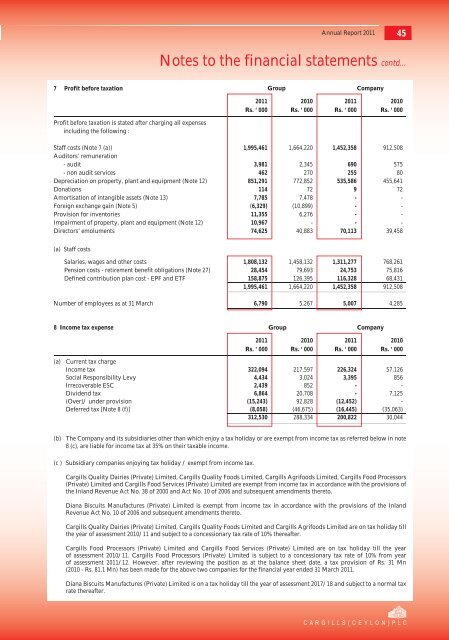

<strong>Annual</strong> <strong>Report</strong> <strong>2011</strong>45Notes to the financial statements contd...7 Profit before taxationGroupCompany<strong>2011</strong> 2010 <strong>2011</strong> 2010Rs. ‘ 000 Rs. ‘ 000 Rs. ‘ 000 Rs. ‘ 000Profit before taxation is stated after charging all expensesincluding the following :Staff costs (Note 7 (a)) 1,995,461 1,664,220 1,452,358 912,508Auditors’ remuneration- audit 3,981 2,345 690 575- non audit services 462 270 255 80Depreciation on property, plant and equipment (Note 12) 851,291 772,852 535,586 455,641Donations 114 72 9 72Amortisation of intangible assets (Note 13) 7,785 7,478 - -Foreign exchange gain (Note 5) (6,329) (10,899) - -Provision for inventories 11,355 6,276 - -Impairment of property, plant and equipment (Note 12) 10,967 - - -Directors’ emoluments 74,625 40,883 70,113 39,458(a) Staff costsSalaries, wages and other costs 1,808,132 1,458,132 1,311,277 768,261Pension costs - retirement benefit obligations (Note 27) 28,454 79,693 24,753 75,816Defined contribution plan cost - EPF and ETF 158,875 126,395 116,328 68,4311,995,461 1,664,220 1,452,358 912,508Number of employees as at 31 March 6,790 5,267 5,007 4,2858 Income tax expense Group Company<strong>2011</strong> 2010 <strong>2011</strong> 2010Rs. ‘ 000 Rs. ‘ 000 Rs. ‘ 000 Rs. ‘ 000(a) Current tax chargeIncome tax 322,094 217,597 226,324 57,126Social Responsibility Levy 4,434 3,024 3,395 856Irrecoverable ESC 2,439 852 - -Dividend tax 6,864 20,708 - 7,125(Over)/ under provision (15,243) 92,828 (12,452) -Deferred tax [Note 8 (f)] (8,058) (46,675) (16,445) (35,063)312,530 288,334 200,822 30,044(b) The Company and its subsidiaries other than which enjoy a tax holiday or are exempt from income tax as referred below in note8 (c), are liable for income tax at 35% on their taxable income.(c ) Subsidiary companies enjoying tax holiday / exempt from income tax.<strong>Cargills</strong> Quality Dairies (Private) Limited, <strong>Cargills</strong> Quality Foods Limited, <strong>Cargills</strong> Agrifoods Limited, <strong>Cargills</strong> Food Processors(Private) Limited and <strong>Cargills</strong> Food Services (Private) Limited are exempt from income tax in accordance with the provisions ofthe Inland Revenue Act No. 38 of 2000 and Act No. 10 of 2006 and subsequent amendments thereto.Diana Biscuits Manufactures (Private) Limited is exempt from income tax in accordance with the provisions of the InlandRevenue Act No. 10 of 2006 and subsequent amendments thereto.<strong>Cargills</strong> Quality Dairies (Private) Limited, <strong>Cargills</strong> Quality Foods Limited and <strong>Cargills</strong> Agrifoods Limited are on tax holiday tillthe year of assessment 2010/11 and subject to a concessionary tax rate of 10% thereafter.<strong>Cargills</strong> Food Processors (Private) Limited and <strong>Cargills</strong> Food Services (Private) Limited are on tax holiday till the yearof assessment 2010/11. <strong>Cargills</strong> Food Processors (Private) Limited is subject to a concessionary tax rate of 10% from yearof assessment <strong>2011</strong>/12. However, after reviewing the position as at the balance sheet date, a tax provision of Rs. 31 Mn(2010 - Rs. 81.1 Mn) has been made for the above two companies for the financial year ended 31 March <strong>2011</strong>.Diana Biscuits Manufactures (Private) Limited is on a tax holiday till the year of assessment 2017/18 and subject to a normal taxrate thereafter.