2011 Annual Report - Cargills (Ceylon)

2011 Annual Report - Cargills (Ceylon)

2011 Annual Report - Cargills (Ceylon)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

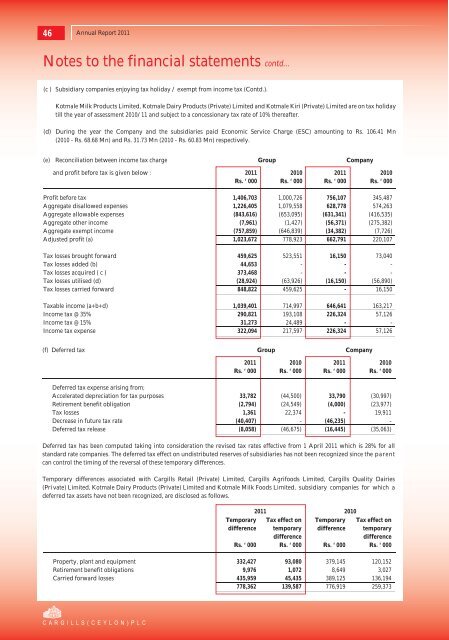

46 <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong>Notes to the financial statements contd...(c ) Subsidiary companies enjoying tax holiday / exempt from income tax (Contd.).Kotmale Milk Products Limited, Kotmale Dairy Products (Private) Limited and Kotmale Kiri (Private) Limited are on tax holidaytill the year of assessment 2010/11 and subject to a concessionary tax rate of 10% thereafter.(d) During the year the Company and the subsidiaries paid Economic Service Charge (ESC) amounting to Rs. 106.41 Mn(2010 - Rs. 68.68 Mn) and Rs. 31.73 Mn (2010 - Rs. 60.83 Mn) respectively.(e) Reconciliation between income tax charge Group Companyand profit before tax is given below : <strong>2011</strong> 2010 <strong>2011</strong> 2010Rs. ‘ 000 Rs. ‘ 000 Rs. ‘ 000 Rs. ‘ 000Profit before tax 1,406,703 1,000,726 756,107 345,487Aggregate disallowed expenses 1,226,405 1,079,558 628,778 574,263Aggregate allowable expenses (843,616) (653,095) (631,341) (416,535)Aggregate other income (7,961) (1,427) (56,371) (275,382)Aggregate exempt income (757,859) (646,839) (34,382) (7,726)Adjusted profit (a) 1,023,672 778,923 662,791 220,107Tax losses brought forward 459,625 523,551 16,150 73,040Tax losses added (b) 44,653 - - -Tax losses acquired ( c ) 373,468 - - -Tax losses utilised (d) (28,924) (63,926) (16,150) (56,890)Tax losses carried forward 848,822 459,625 - 16,150Taxable income (a+b+d) 1,039,401 714,997 646,641 163,217Income tax @ 35% 290,821 193,108 226,324 57,126Income tax @ 15% 31,273 24,489 - -Income tax expense 322,094 217,597 226,324 57,126(f) Deferred tax Group Company<strong>2011</strong> 2010 <strong>2011</strong> 2010Rs. ‘ 000 Rs. ‘ 000 Rs. ‘ 000 Rs. ‘ 000Deferred tax expense arising from;Accelerated depreciation for tax purposes 33,782 (44,500) 33,790 (30,997)Retirement benefit obligation (2,794) (24,549) (4,000) (23,977)Tax losses 1,361 22,374 - 19,911Decrease in future tax rate (40,407) - (46,235) -Deferred tax release (8,058) (46,675) (16,445) (35,063)Deferred tax has been computed taking into consideration the revised tax rates effective from 1 April <strong>2011</strong> which is 28% for allstandard rate companies. The deferred tax effect on undistributed reserves of subsidiaries has not been recognized since the parentcan control the timing of the reversal of these temporary differences.Temporary differences associated with <strong>Cargills</strong> Retail (Private) Limited, <strong>Cargills</strong> Agrifoods Limited, <strong>Cargills</strong> Quality Dairies(Pri vate) Limited, Kotmale Dairy Products (Private) Limited and Kotmale Milk Foods Limited, subsidiary companies for which adeferred tax assets have not been recognized, are disclosed as follows.<strong>2011</strong> 2010Temporary Tax effect on Temporary Tax effect ondifference temporary difference temporarydifferencedifferenceRs. ‘ 000 Rs. ‘ 000 Rs. ‘ 000 Rs. ‘ 000Property, plant and equipment 332,427 93,080 379,145 120,152Retirement benefit obligations 9,976 1,072 8,649 3,027Carried forward losses 435,959 45,435 389,125 136,194778,362 139,587 776,919 259,373