2011 Annual Report - Cargills (Ceylon)

2011 Annual Report - Cargills (Ceylon)

2011 Annual Report - Cargills (Ceylon)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

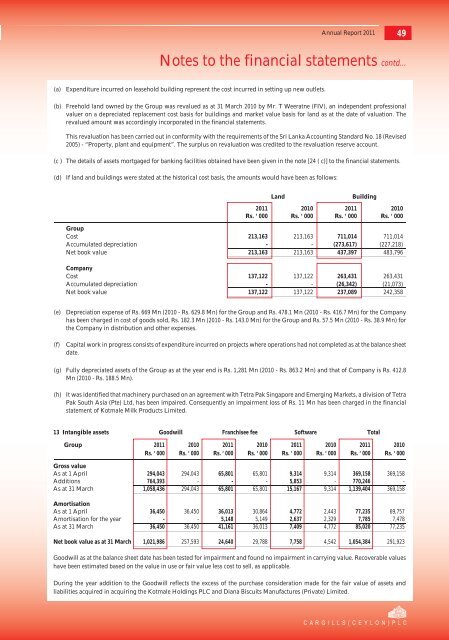

<strong>Annual</strong> <strong>Report</strong> <strong>2011</strong>49Notes to the financial statements contd...(a) Expenditure incurred on leasehold building represent the cost incurred in setting up new outlets.(b) Freehold land owned by the Group was revalued as at 31 March 2010 by Mr. T Weeratne (FIV), an independent professionalvaluer on a depreciated replacement cost basis for buildings and market value basis for land as at the date of valuation. Therevalued amount was accordingly incorporated in the financial statements.This revaluation has been carried out in conformity with the requirements of the Sri Lanka Accounting Standard No. 18 (Revised2005) - “Property, plant and equipment”. The surplus on revaluation was credited to the revaluation reserve account.(c ) The details of assets mortgaged for banking facilities obtained have been given in the note [24 ( c)] to the financial statements.(d) If land and buildings were stated at the historical cost basis, the amounts would have been as follows:LandBuilding<strong>2011</strong> 2010 <strong>2011</strong> 2010Rs. ‘ 000 Rs. ‘ 000 Rs. ‘ 000 Rs. ‘ 000GroupCost 213,163 213,163 711,014 711,014Accumulated depreciation - - (273,617) (227,218)Net book value 213,163 213,163 437,397 483,796CompanyCost 137,122 137,122 263,431 263,431Accumulated depreciation - - (26,342) (21,073)Net book value 137,122 137,122 237,089 242,358(e) Depreciation expense of Rs. 669 Mn (2010 - Rs. 629.8 Mn) for the Group and Rs. 478.1 Mn (2010 - Rs. 416.7 Mn) for the Companyhas been charged in cost of goods sold, Rs. 182.3 Mn (2010 - Rs. 143.0 Mn) for the Group and Rs. 57.5 Mn (2010 - Rs. 38.9 Mn) forthe Company in distribution and other expenses.(f)Capital work in progress consists of expenditure incurred on projects where operations had not completed as at the balance sheetdate.(g) Fully depreciated assets of the Group as at the year end is Rs. 1,281 Mn (2010 - Rs. 863.2 Mn) and that of Company is Rs. 412.8Mn (2010 - Rs. 188.5 Mn).(h) It was identified that machinery purchased on an agreement with Tetra Pak Singapore and Emerging Markets, a division of TetraPak South Asia (Pte) Ltd, has been impaired. Consequently an impairment loss of Rs. 11 Mn has been charged in the financialstatement of Kotmale Milk Products Limited.13 Intangible assets Goodwill Franchisee fee Software TotalGroup <strong>2011</strong> 2010 <strong>2011</strong> 2010 <strong>2011</strong> 2010 <strong>2011</strong> 2010Rs. ‘ 000 Rs. ‘ 000 Rs. ‘ 000 Rs. ‘ 000 Rs. ‘ 000 Rs. ‘ 000 Rs. ‘ 000 Rs. ‘ 000Gross valueAs at 1 April 294,043 294,043 65,801 65,801 9,314 9,314 369,158 369,158Additions 764,393 - - - 5,853 - 770,246 -As at 31 March 1,058,436 294,043 65,801 65,801 15,167 9,314 1,139,404 369,158AmortisationAs at 1 April 36,450 36,450 36,013 30,864 4,772 2,443 77,235 69,757Amortisation for the year - - 5,148 5,149 2,637 2,329 7,785 7,478As at 31 March 36,450 36,450 41,161 36,013 7,409 4,772 85,020 77,235Net book value as at 31 March 1,021,986 257,593 24,640 29,788 7,758 4,542 1,054,384 291,923Goodwill as at the balance sheet date has been tested for impairment and found no impairment in carrying value. Recoverable valueshave been estimated based on the value in use or fair value less cost to sell, as applicable.During the year addition to the Goodwill reflects the excess of the purchase consideration made for the fair value of assets andliabilities acquired in acquiring the Kotmale Holdings PLC and Diana Biscuits Manufactures (Private) Limited.