2011 Annual Report - Cargills (Ceylon)

2011 Annual Report - Cargills (Ceylon)

2011 Annual Report - Cargills (Ceylon)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

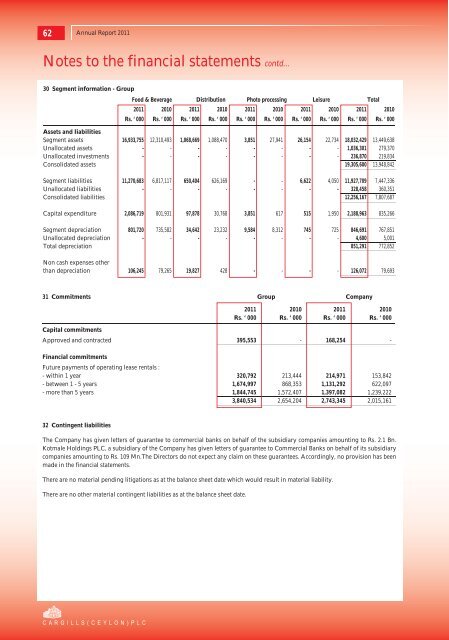

62 <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong>Notes to the financial statements contd...30 Segment information - GroupFood & Beverage Distribution Photo processing Leisure Total<strong>2011</strong> 2010 <strong>2011</strong> 2010 <strong>2011</strong> 2010 <strong>2011</strong> 2010 <strong>2011</strong> 2010Rs. ‘ 000 Rs. ‘ 000 Rs. ‘ 000 Rs. ‘ 000 Rs. ‘ 000 Rs. ‘ 000 Rs. ‘ 000 Rs. ‘ 000 Rs. ‘ 000 Rs. ‘ 000Assets and liabilitiesSegment assets 16,933,755 12,310,493 1,068,669 1,088,470 3,851 27,941 26,154 22,734 18,032,429 13,449,638Unallocated assets - - - - - - - - 1,036,301 279,370Unallocated investments - - - - - - - - 236,870 219,834Consolidated assets 19,305,600 13,948,842Segment liabilities 11,270,683 6,817,117 650,404 626,169 - - 6,622 4,050 11,927,709 7,447,336Unallocated liabilities - - - - - - - - 328,458 360,351Consolidated liabilities 12,256,167 7,807,687Capital expenditure 2,086,719 801,931 97,878 30,768 3,851 617 515 1,950 2,188,963 835,266Segment depreciation 801,720 735,582 34,642 23,232 9,584 8,312 745 725 846,691 767,851Unallocated depreciation - - - - - - - - 4,600 5,001Total depreciation 851,291 772,852Non cash expenses otherthan depreciation 106,245 79,265 19,827 428 - - - - 126,072 79,69331 Commitments Group Company<strong>2011</strong> 2010 <strong>2011</strong> 2010Rs. ‘ 000 Rs. ‘ 000 Rs. ‘ 000 Rs. ‘ 000Capital commitmentsApproved and contracted 395,553 - 168,254 -Financial commitmentsFuture payments of operating lease rentals :- within 1 year 320,792 213,444 214,971 153,842- between 1 - 5 years 1,674,997 868,353 1,131,292 622,097- more than 5 years 1,844,745 1,572,407 1,397,082 1,239,2223,840,534 2,654,204 2,743,345 2,015,16132 Contingent liabilitiesThe Company has given letters of guarantee to commercial banks on behalf of the subsidiary companies amounting to Rs. 2.1 Bn.Kotmale Holdings PLC, a subsidiary of the Company has given letters of guarantee to Commercial Banks on behalf of its subsidiarycompanies amounting to Rs. 109 Mn.The Directors do not expect any claim on these guarantees. Accordingly, no provision has beenmade in the financial statements.There are no material pending litigations as at the balance sheet date which would result in material liability.There are no other material contingent liabilities as at the balance sheet date.