BOARD OF APPEAL AND EQUALIZATION COUNTY OF SCOTT ...

BOARD OF APPEAL AND EQUALIZATION COUNTY OF SCOTT ...

BOARD OF APPEAL AND EQUALIZATION COUNTY OF SCOTT ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

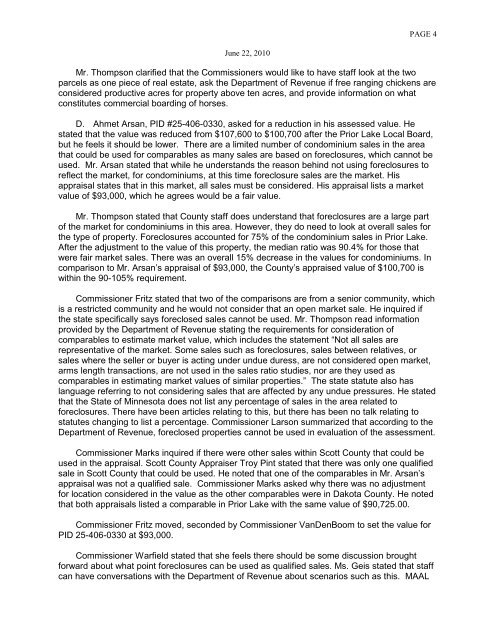

PAGE 4June 22, 2010Mr. Thompson clarified that the Commissioners would like to have staff look at the twoparcels as one piece of real estate, ask the Department of Revenue if free ranging chickens areconsidered productive acres for property above ten acres, and provide information on whatconstitutes commercial boarding of horses.D. Ahmet Arsan, PID #25-406-0330, asked for a reduction in his assessed value. Hestated that the value was reduced from $107,600 to $100,700 after the Prior Lake Local Board,but he feels it should be lower. There are a limited number of condominium sales in the areathat could be used for comparables as many sales are based on foreclosures, which cannot beused. Mr. Arsan stated that while he understands the reason behind not using foreclosures toreflect the market, for condominiums, at this time foreclosure sales are the market. Hisappraisal states that in this market, all sales must be considered. His appraisal lists a marketvalue of $93,000, which he agrees would be a fair value.Mr. Thompson stated that County staff does understand that foreclosures are a large partof the market for condominiums in this area. However, they do need to look at overall sales forthe type of property. Foreclosures accounted for 75% of the condominium sales in Prior Lake.After the adjustment to the value of this property, the median ratio was 90.4% for those thatwere fair market sales. There was an overall 15% decrease in the values for condominiums. Incomparison to Mr. Arsan’s appraisal of $93,000, the County’s appraised value of $100,700 iswithin the 90-105% requirement.Commissioner Fritz stated that two of the comparisons are from a senior community, whichis a restricted community and he would not consider that an open market sale. He inquired ifthe state specifically says foreclosed sales cannot be used. Mr. Thompson read informationprovided by the Department of Revenue stating the requirements for consideration ofcomparables to estimate market value, which includes the statement “Not all sales arerepresentative of the market. Some sales such as foreclosures, sales between relatives, orsales where the seller or buyer is acting under undue duress, are not considered open market,arms length transactions, are not used in the sales ratio studies, nor are they used ascomparables in estimating market values of similar properties.” The state statute also haslanguage referring to not considering sales that are affected by any undue pressures. He statedthat the State of Minnesota does not list any percentage of sales in the area related toforeclosures. There have been articles relating to this, but there has been no talk relating tostatutes changing to list a percentage. Commissioner Larson summarized that according to theDepartment of Revenue, foreclosed properties cannot be used in evaluation of the assessment.Commissioner Marks inquired if there were other sales within Scott County that could beused in the appraisal. Scott County Appraiser Troy Pint stated that there was only one qualifiedsale in Scott County that could be used. He noted that one of the comparables in Mr. Arsan’sappraisal was not a qualified sale. Commissioner Marks asked why there was no adjustmentfor location considered in the value as the other comparables were in Dakota County. He notedthat both appraisals listed a comparable in Prior Lake with the same value of $90,725.00.Commissioner Fritz moved, seconded by Commissioner VanDenBoom to set the value forPID 25-406-0330 at $93,000.Commissioner Warfield stated that she feels there should be some discussion broughtforward about what point foreclosures can be used as qualified sales. Ms. Geis stated that staffcan have conversations with the Department of Revenue about scenarios such as this. MAAL