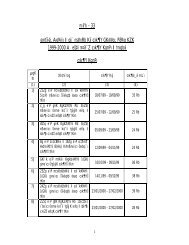

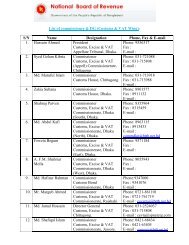

special provisions regarding baggage and goods imported or ...

special provisions regarding baggage and goods imported or ...

special provisions regarding baggage and goods imported or ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

thereof shall be deemed to be an entry f<strong>or</strong> imp<strong>or</strong>t <strong>or</strong> exp<strong>or</strong>t, as the case may be,f<strong>or</strong> the purposes of this Act.145. Rate of duty in respect of <strong>goods</strong> <strong>imp<strong>or</strong>ted</strong> <strong>or</strong> exp<strong>or</strong>ted by post.-(1) The rate of duty, if any, applicable to any <strong>goods</strong> <strong>imp<strong>or</strong>ted</strong> by post shall bethe rate in f<strong>or</strong>ce on the date on which the postal auth<strong>or</strong>ities present to theappropriate officer the declaration <strong>or</strong> label referred to in section 144 f<strong>or</strong> thepurpose of assessing the duty thereon.(2) The rate of duty, if any, applicable to any <strong>goods</strong> exp<strong>or</strong>ted by the postshall be the rate in f<strong>or</strong>ce on the date on which the exp<strong>or</strong>ter delivers such <strong>goods</strong> tothe postal auth<strong>or</strong>ities f<strong>or</strong> exp<strong>or</strong>tation.2